Enlarge image

01

0000000000111111111122222222223333333333444444444455555555556666666666777777777788888

1234567890123456789012345678901234567890123456789012345678901234567890123456789012345

Enclosure

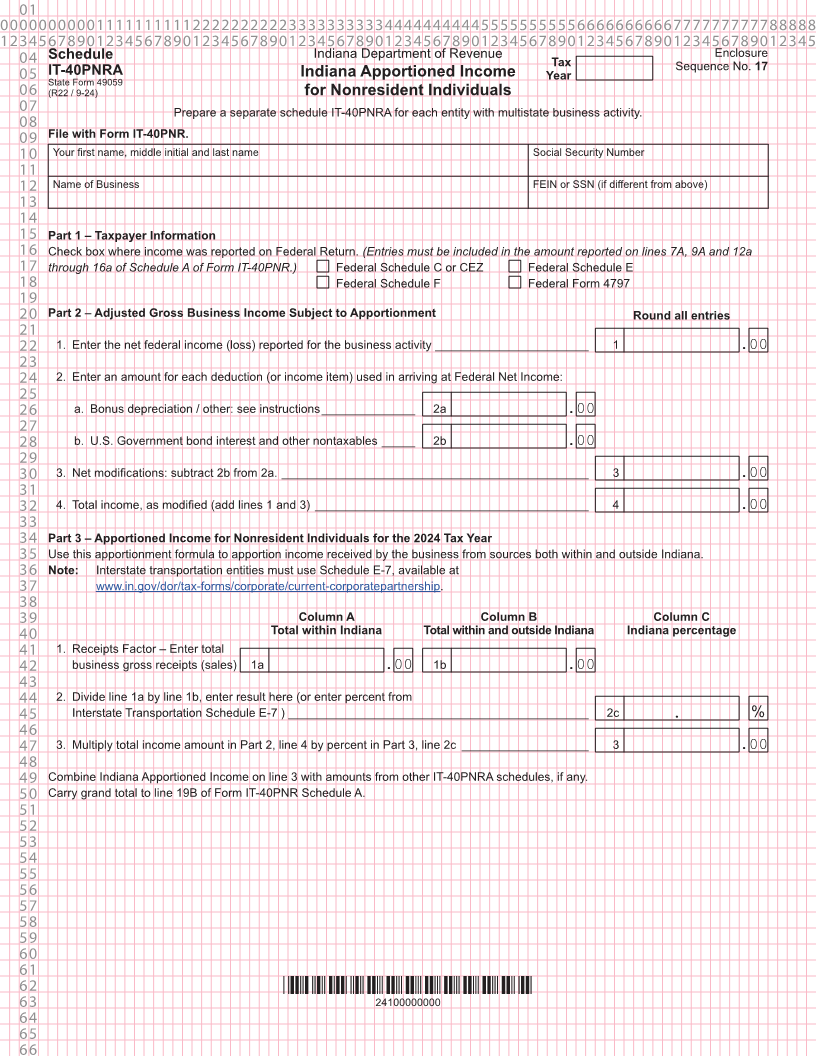

04 Schedule Indiana Department of Revenue Tax Sequence No. 17

05 IT-40PNRA Indiana Apportioned Income Year

State Form 49059

06 (R22 / 9-24) for Nonresident Individuals

07 Prepare a separate schedule IT-40PNRA for each entity with multistate business activity.

08

09 File with Form IT-40PNR.

10 Your first name, middle initial and last name Social Security Number

11

12 Name of Business FEIN or SSN (if different from above)

13

14

15 Part 1 – Taxpayer Information

16 Check box where income was reported on Federal Return. (Entries must be included in the amount reported on lines 7A, 9A and 12a

17 through 16a of Schedule A of Form IT-40PNR.) Federal Schedule C or CEZ Federal Schedule E

18 Federal Schedule F Federal Form 4797

19

20 Part 2 – Adjusted Gross Business Income Subject to Apportionment Round all entries

21

22 1. Enter the net federal income (loss) reported for the business activity _______________________ 1 .00

23

24 2. Enter an amount for each deduction (or income item) used in arriving at Federal Net Income:

25

26 a. Bonus depreciation / other: see instructions ______________ 2a .00

27

28 b. U.S. Government bond interest and other nontaxables _____ 2b .00

29

30 3. Net modifications: subtract 2b from 2a. ______________________________________________ 3 .00

31

32 4. Total income, as modified (add lines 1 and 3) _________________________________________ 4 .00

33

34 Part 3 – Apportioned Income for Nonresident Individuals for the 2024 Tax Year

35 Use this apportionment formula to apportion income received by the business from sources both within and outside Indiana.

36 Note: Interstate transportation entities must use Schedule E-7, available at

37 www.in.gov/dor/tax-forms/corporate/current-corporatepartnership.

38

39 Column A Column B Column C

40 Total within Indiana Total within and outside Indiana Indiana percentage

41 1. Receipts Factor – Enter total

42 business gross receipts (sales) 1a .00 1b .00

43

44 2. Divide line 1a by line 1b, enter result here (or enter percent from

45 Interstate Transportation Schedule E-7 ) _____________________________________________ 2c . %

46

47 3. Multiply total income amount in Part 2, line 4 by percent in Part 3, line 2c ___________________ 3 .00

48

49 Combine Indiana Apportioned Income on line 3 with amounts from other IT-40PNRA schedules, if any.

50 Carry grand total to line 19B of Form IT-40PNR Schedule A.

51

52

53

54

55

56

57

58

59

60

61

62 *24100000000*

63 24100000000

64

65

66