Enlarge image

01

0000000000111111111122222222223333333333444444444455555555556666666666777777777788888

1234567890123456789012345678901234567890123456789012345678901234567890123456789012345

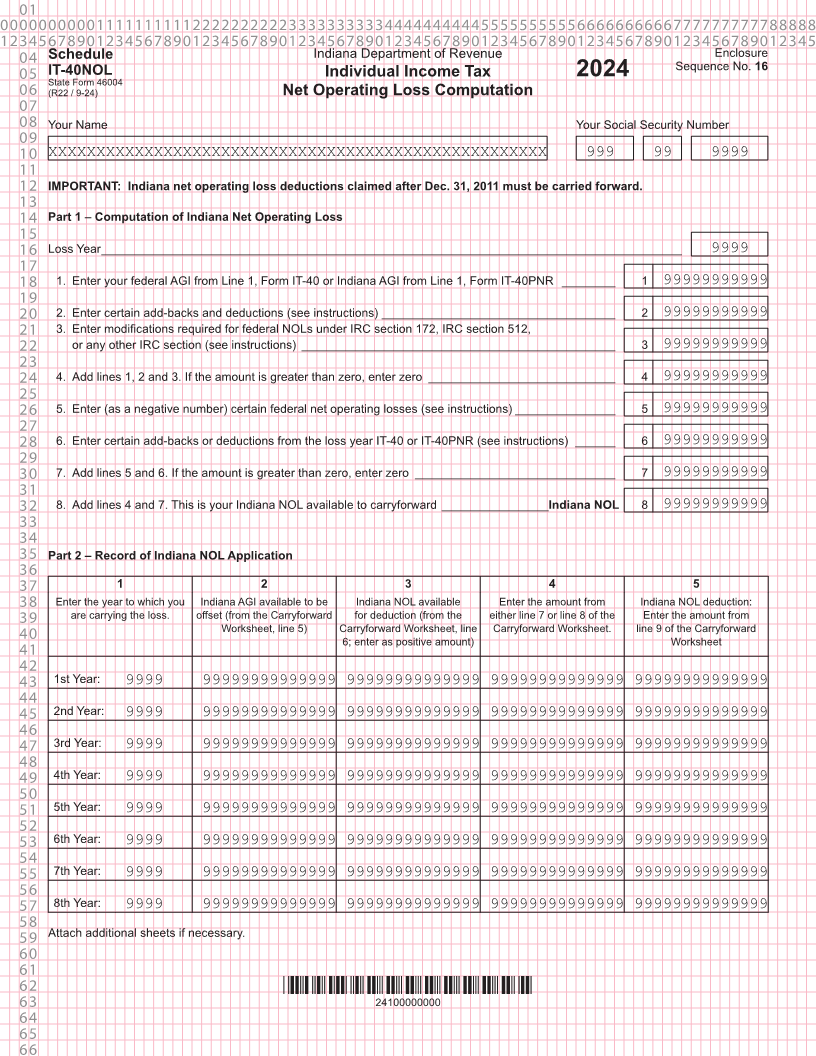

04 Schedule Indiana Department of Revenue Enclosure

Sequence No. 16

05 IT-40NOL Individual Income Tax 2024

State Form 46004

06 (R22 / 9-24) Net Operating Loss Computation

07

08 Your Name Your Social Security Number

09

10 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 999 99 9999

11

12 IMPORTANT: Indiana net operating loss deductions claimed after Dec. 31, 2011 must be carried forward.

13

14 Part 1 – Computation of Indiana Net Operating Loss

15

16 Loss Year _______________________________________________________________________________________ 9999

17

18 1. Enter your federal AGI from Line 1, Form IT-40 or Indiana AGI from Line 1, Form IT-40PNR ________ 1 99999999999

19

20 2. Enter certain add-backs and deductions (see instructions) ___________________________________ 2 99999999999

21 3. Enter modifications required for federal NOLs under IRC section 172, IRC section 512,

22 or any other IRC section (see instructions) _______________________________________________ 3 99999999999

23

24 4. Add lines 1, 2 and 3. If the amount is greater than zero, enter zero ____________________________ 4 99999999999

25

26 5. Enter (as a negative number) certain federal net operating losses (see instructions) _______________ 5 99999999999

27

28 6. Enter certain add-backs or deductions from the loss year IT-40 or IT-40PNR (see instructions) ______ 6 99999999999

29

30 7. Add lines 5 and 6. If the amount is greater than zero, enter zero ______________________________ 7 99999999999

31

32 8. Add lines 4 and 7. This is your Indiana NOL available to carryforward ________________Indiana NOL 8 99999999999

33

34

35 Part 2 – Record of Indiana NOL Application

36

37 1 2 3 4 5

38 Enter the year to which you Indiana AGI available to be Indiana NOL available Enter the amount from Indiana NOL deduction:

39 are carrying the loss. offset (from the Carryforward for deduction (from the either line 7 or line 8 of the Enter the amount from

Worksheet, line 5) Carryforward Worksheet, line Carryforward Worksheet. line 9 of the Carryforward

40 6; enter as positive amount) Worksheet

41

42

43 1st Year: 9999 99999999999999 99999999999999 99999999999999 99999999999999

44

45 2nd Year: 9999 99999999999999 99999999999999 99999999999999 99999999999999

46

47 3rd Year: 9999 99999999999999 99999999999999 99999999999999 99999999999999

48

49 4th Year: 9999 99999999999999 99999999999999 99999999999999 99999999999999

50

51 5th Year: 9999 99999999999999 99999999999999 99999999999999 99999999999999

52

53 6th Year: 9999 99999999999999 99999999999999 99999999999999 99999999999999

54

55 7th Year: 9999 99999999999999 99999999999999 99999999999999 99999999999999

56

57 8th Year: 9999 99999999999999 99999999999999 99999999999999 99999999999999

58

59 Attach additional sheets if necessary.

60

61

62 *24100000000*

63 24100000000

64

65

66