Enlarge image

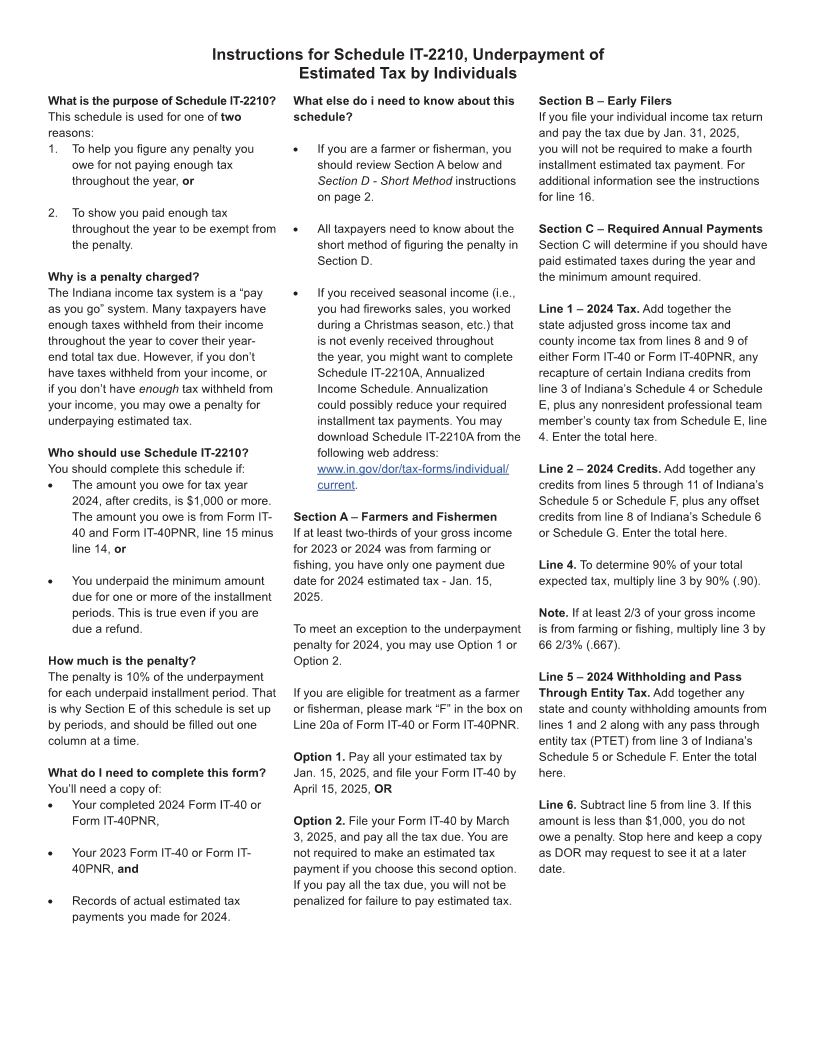

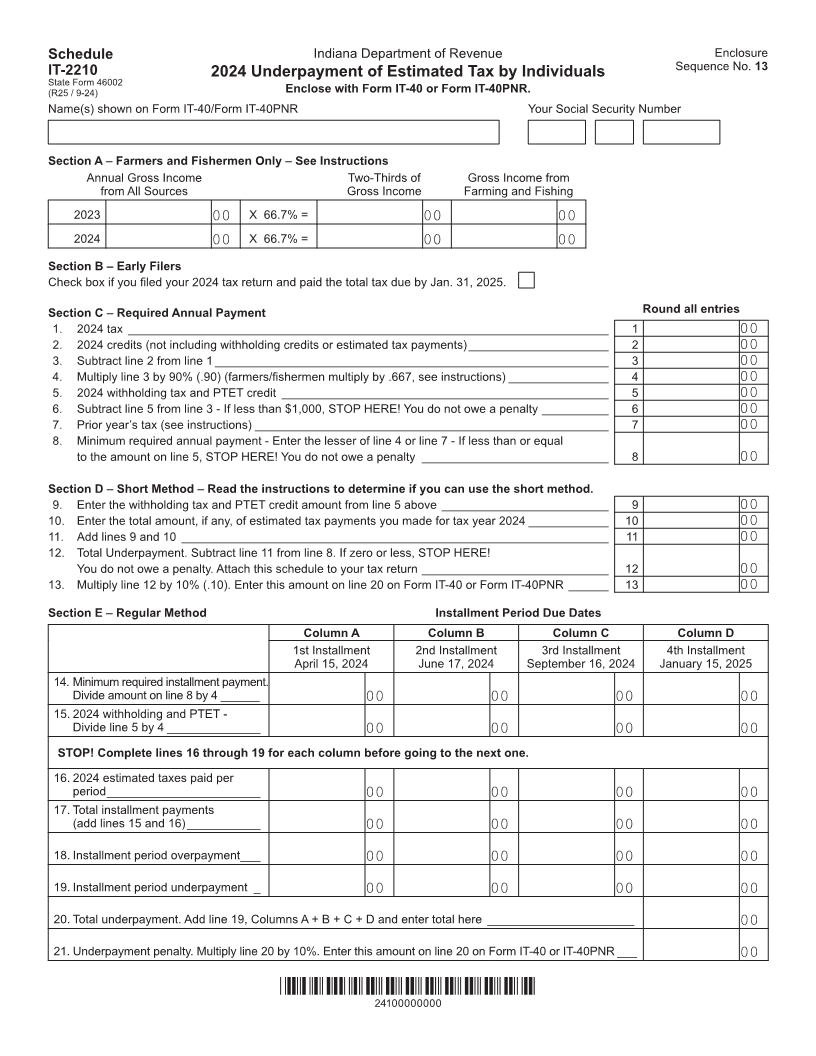

Schedule Indiana Department of Revenue Enclosure

IT-2210 2024 Underpayment of Estimated Tax by Individuals Sequence No. 13

State Form 46002

(R25 / 9-24) Enclose with Form IT-40 or Form IT-40PNR.

Name(s) shown on Form IT-40/Form IT-40PNR Your Social Security Number

Section A – Farmers and Fishermen Only – See Instructions

Annual Gross Income Two-Thirds of Gross Income from

from All Sources Gross Income Farming and Fishing

2023 00 X 66.7% = 00 00

2024 00 X 66.7% = 00 00

Section B – Early Filers

Check box if you filed your 2024 tax return and paid the total tax due by Jan. 31, 2025.

Section C – Required Annual Payment Round all entries

1. 2024 tax ________________________________________________________________________ 1 00

2. 2024 credits (not including withholding credits or estimated tax payments) _____________________ 2 00

3. Subtract line 2 from line 1 ___________________________________________________________ 3 00

4. Multiply line 3 by 90% (.90) (farmers/fishermen multiply by .667, see instructions) _______________ 4 00

5. 2024 withholding tax and PTET credit _________________________________________________ 5 00

6. Subtract line 5 from line 3 - If less than $1,000, STOP HERE! You do not owe a penalty __________ 6 00

7. Prior year’s tax (see instructions) _____________________________________________________ 7 00

8. Minimum required annual payment - Enter the lesser of line 4 or line 7 - If less than or equal

to the amount on line 5, STOP HERE! You do not owe a penalty ____________________________ 8 00

Section D – Short Method – Read the instructions to determine if you can use the short method.

9. Enter the withholding tax and PTET credit amount from line 5 above _________________________ 9 00

10. Enter the total amount, if any, of estimated tax payments you made for tax year 2024 ____________ 10 00

11. Add lines 9 and 10 ________________________________________________________________ 11 00

12. Total Underpayment. Subtract line 11 from line 8. If zero or less, STOP HERE!

You do not owe a penalty. Attach this schedule to your tax return ____________________________ 12 00

13. Multiply line 12 by 10% (.10). Enter this amount on line 20 on Form IT-40 or Form IT-40PNR ______ 13 00

Section E – Regular Method Installment Period Due Dates

Column A Column B Column C Column D

1st Installment 2nd Installment 3rd Installment 4th Installment

April 15, 2024 June 17, 2024 September 16, 2024 January 15, 2025

14. Minimum required installment payment.

Divide amount on line 8 by 4 ______ 00 00 00 00

15. 2024 withholding and PTET -

Divide line 5 by 4 ______________ 00 00 00 00

STOP! Complete lines 16 through 19 for each column before going to the next one.

16. 2024 estimated taxes paid per

period _______________________ 00 00 00 00

17. Total installment payments

(add lines 15 and 16) ___________ 00 00 00 00

18. Installment period overpayment ___ 00 00 00 00

19. Installment period underpayment _ 00 00 00 00

20. Total underpayment. Add line 19, Columns A + B + C + D and enter total here ______________________ 00

21. Underpayment penalty. Multiply line 20 by 10%. Enter this amount on line 20 on Form IT-40 or IT-40PNR ___ 00

*24100000000*

24100000000