Enlarge image

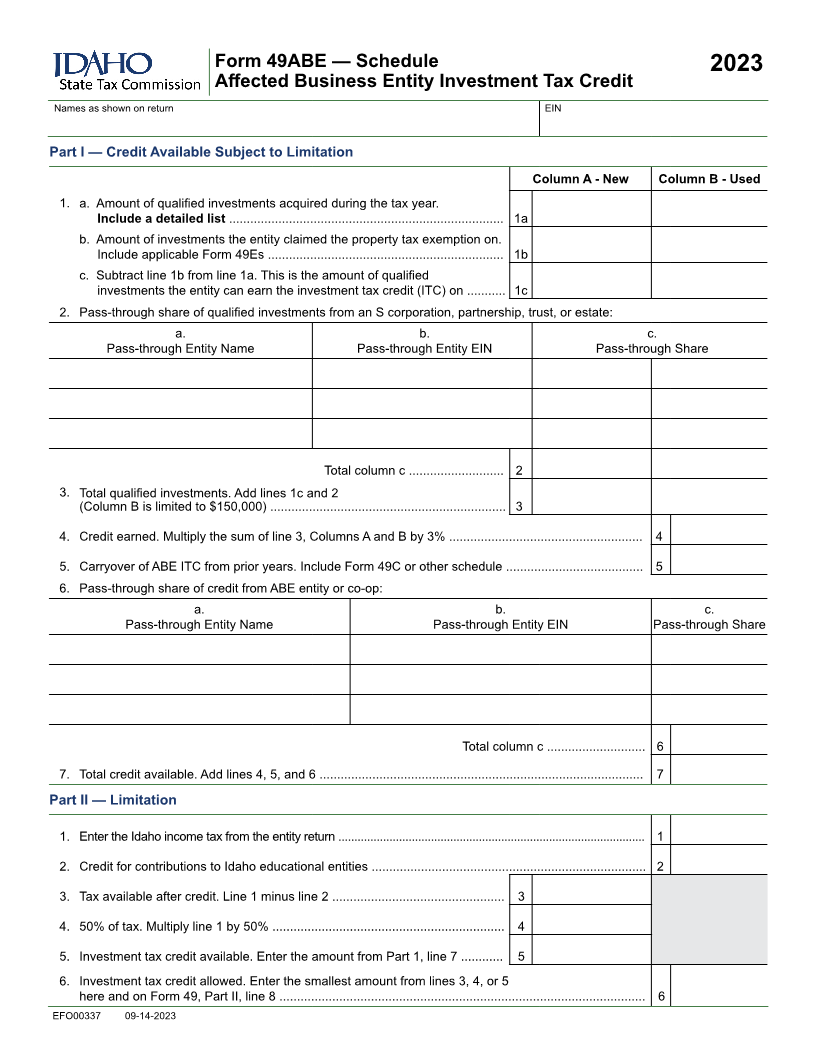

Form 49ABE — Schedule 2023

Affected Business Entity Investment Tax Credit

Names as shown on return EIN

Part I — Credit Available Subject to Limitation

Column A - New Column B - Used

1. a. Amount of qualified investments acquired during the tax year.

Include a detailed list .............................................................................. 1 a

b. Amount of investments the entity claimed the property tax exemption on.

Include applicable Form 49Es ................................................................... 1b

c. Subtract line 1b from line 1a. This is the amount of qualified

investments the entity can earn the investment tax credit (ITC) on ........... 1c

2. Pass-through share of qualified investments from an S corporation, partnership, trust, or estate:

a. b. c.

Pass-through Entity Name Pass-through Entity EIN Pass-through Share

Total column c ........................... 2

3. Total qualified investments. Add lines 1c and 2

(Column B is limited to $150,000) ................................................................... 3

4. Credit earned. Multiply the sum of line 3, Columns A and B by 3% ....................................................... 4

5. Carryover of ABE ITC from prior years. Include Form 49C or other schedule ....................................... 5

6. Pass-through share of credit from ABE entity or co-op:

a. b. c.

Pass-through Entity Name Pass-through Entity EIN Pass-through Share

Total column c ............................ 6

7. Total credit available. Add lines 4, 5, and 6 ............................................................................................ 7

Part II — Limitation

1. Enter the Idaho income tax from the entity return ................................................................................................ 1

2. Credit for contributions to Idaho educational entities .............................................................................. 2

3. Tax available after credit. Line 1 minus line 2 ................................................. 3

4. 50% of tax. Multiply line 1 by 50% .................................................................. 4

5. Investment tax credit available. Enter the amount from Part 1, line 7 ............ 5

6. Investment tax credit allowed. Enter the smallest amount from lines 3, 4, or 5

here and on Form 49, Part II, line 8 ........................................................................................................ 6

EFO00337 09-14-2023