Enlarge image

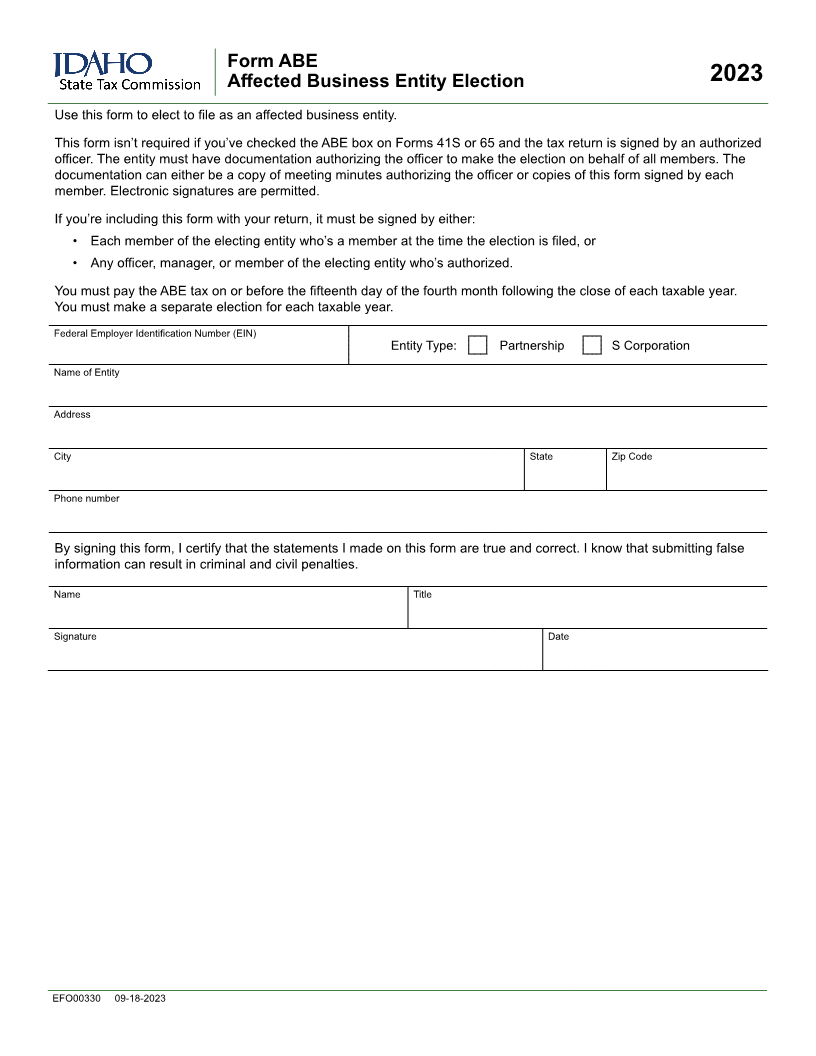

Form ABE

Affected Business Entity Election 2023

Use this form to elect to file as an affected business entity.

This form isn’t required if you’ve checked the ABE box on Forms 41S or 65 and the tax return is signed by an authorized

officer. The entity must have documentation authorizing the officer to make the election on behalf of all members. The

documentation can either be a copy of meeting minutes authorizing the officer or copies of this form signed by each

member. Electronic signatures are permitted.

If you’re including this form with your return, it must be signed by either:

• Each member of the electing entity who’s a member at the time the election is filed, or

• Any officer, manager, or member of the electing entity who’s authorized.

You must pay the ABE tax on or before the fifteenth day of the fourth month following the close of each taxable year.

You must make a separate election for each taxable year.

Federal Employer Identification Number (EIN)

Entity Type: Partnership S Corporation

Name of Entity

Address

City State Zip Code

Phone number

By signing this form, I certify that the statements I made on this form are true and correct. I know that submitting false

information can result in criminal and civil penalties.

Name Title

Signature Date

EFO00330 09-18-2023