Enlarge image

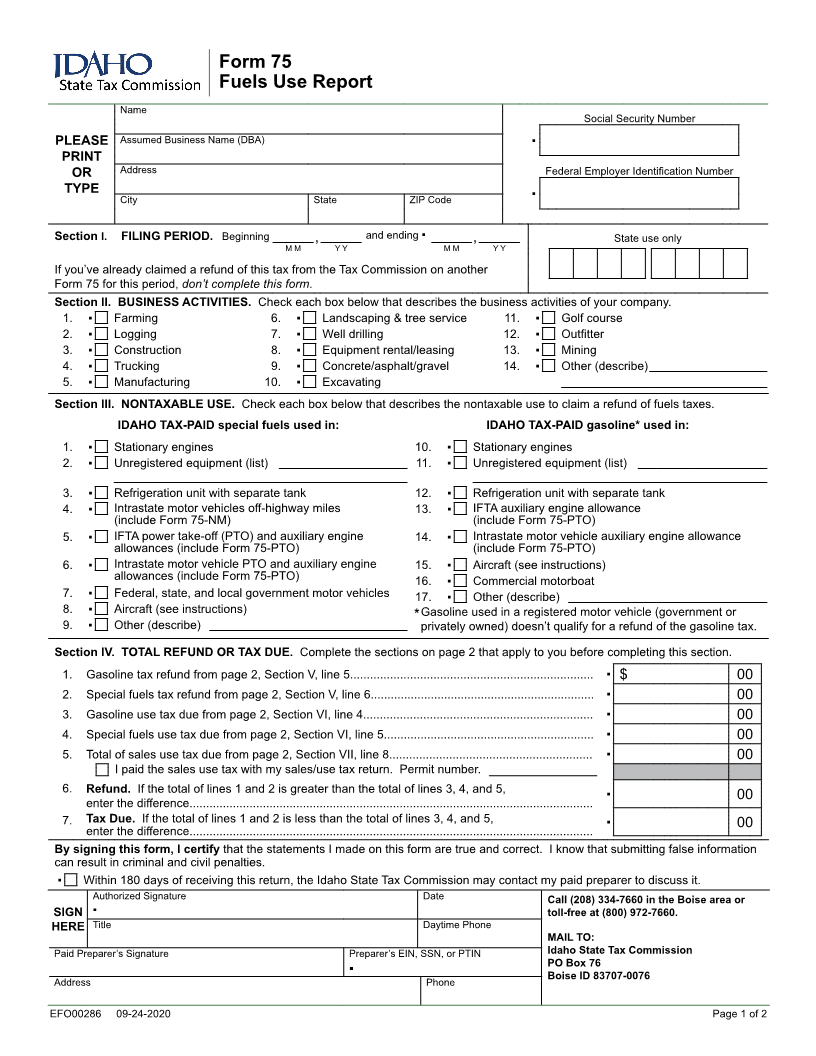

Form 75

Fuels Use Report

Name

Social Security Number

PLEASE Assumed Business Name (DBA) ▪

PRINT

OR Address Federal Employer Identification Number

TYPE City State ZIP Code ▪

Section I. FILING PERIOD. Beginning , and ending ▪ , State use only

M M Y Y M M Y Y

If you’ve already claimed a refund of this tax from the Tax Commission on another

Form 75 for this period, don’t complete this form.

Section II. BUSINESS ACTIVITIES. Check each box below that describes the business activities of your company.

1. ▪ Farming 6. ▪ Landscaping & tree service 11. ▪ Golf course

2. ▪ Logging 7. ▪ Well drilling 12. ▪ Outfitter

3. ▪ Construction 8. ▪ Equipment rental/leasing 13. ▪ Mining

4. ▪ Trucking 9. ▪ Concrete/asphalt/gravel 14. ▪ Other (describe)

5. ▪ Manufacturing 10. ▪ Excavating

Section III. NONTAXABLE USE. Check each box below that describes the nontaxable use to claim a refund of fuels taxes.

IDAHO TAX-PAID special fuels used in: IDAHO TAX-PAID gasoline* used in:

1. ▪ Stationary engines 10. ▪ Stationary engines

2. ▪ Unregistered equipment (list) 11. ▪ Unregistered equipment (list)

3. ▪ Refrigeration unit with separate tank 12. ▪ Refrigeration unit with separate tank

4. ▪ Intrastate motor vehicles off-highway miles 13. ▪ IFTA auxiliary engine allowance

(include Form 75-NM) (include Form 75-PTO)

5. ▪ IFTA power take-off (PTO) and auxiliary engine 14. ▪ Intrastate motor vehicle auxiliary engine allowance

allowances (include Form 75-PTO) (include Form 75-PTO)

6. ▪ Intrastate motor vehicle PTO and auxiliary engine 15. ▪ Aircraft (see instructions)

allowances (include Form 75-PTO) 16. ▪ Commercial motorboat

7. ▪ Federal, state, and local government motor vehicles 17. ▪ Other (describe)

8. ▪ Aircraft (see instructions) * Gasoline used in a registered motor vehicle (government or

9. ▪ Other (describe) privately owned) doesn’t qualify for a refund of the gasoline tax.

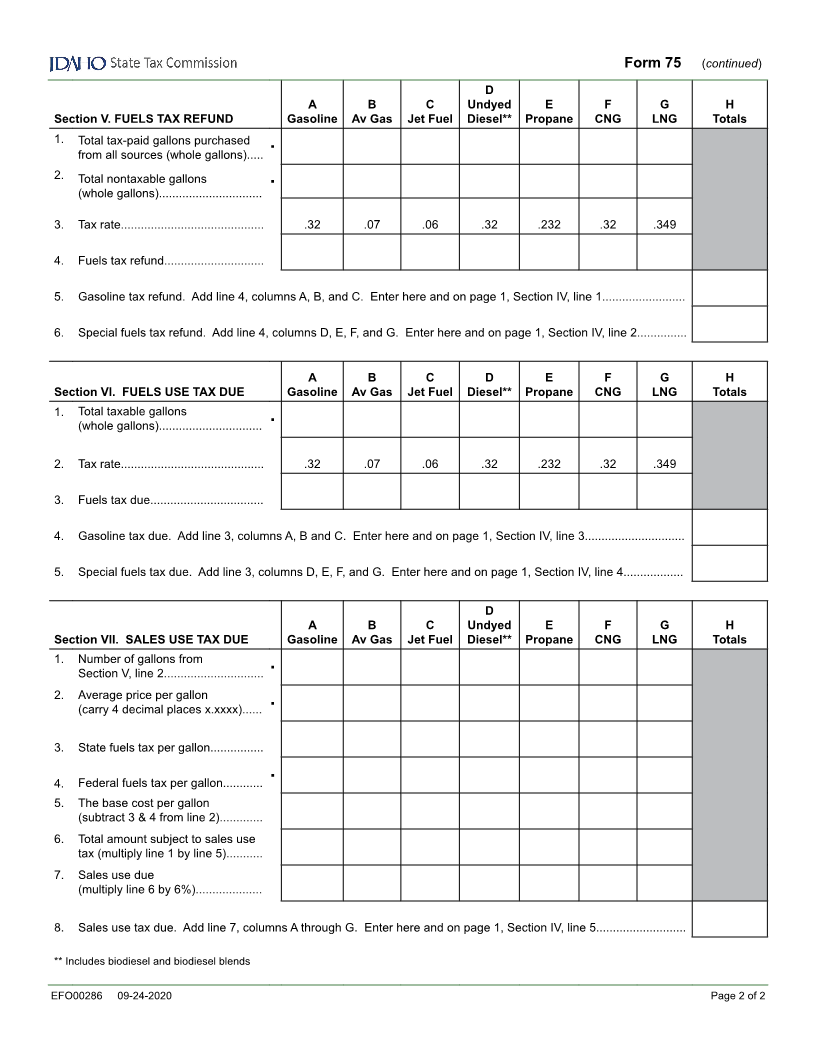

Section IV. TOTAL REFUND OR TAX DUE. Complete the sections on page 2 that apply to you before completing this section.

1. Gasoline tax refund from page 2, Section V, line 5......................................................................... ▪ $ 00

2. Special fuels tax refund from page 2, Section V, line 6................................................................... ▪ 00

3. Gasoline use tax due from page 2, Section VI, line 4..................................................................... ▪ 00

4. Special fuels use tax due from page 2, Section VI, line 5............................................................... ▪ 00

5. Total of sales use tax due from page 2, Section VII, line 8............................................................. ▪ 00

I paid the sales use tax with my sales/use tax return. Permit number.

6. Refund. If the total of lines 1 and 2 is greater than the total of lines 3, 4, and 5, ▪ 00

enter the difference.........................................................................................................................

7. Tax Due. If the total of lines 1 and 2 is less than the total of lines 3, 4, and 5, ▪ 00

enter the difference.........................................................................................................................

By signing this form, I certify that the statements I made on this form are true and correct. I know that submitting false information

can result in criminal and civil penalties.

▪ Within 180 days of receiving this return, the Idaho State Tax Commission may contact my paid preparer to discuss it.

Authorized Signature Date Call (208) 334-7660 in the Boise area or

SIGN ▪ toll-free at (800) 972-7660.

HERE Title Daytime Phone

MAIL TO:

Paid Preparer’s Signature Preparer’s EIN, SSN, or PTIN Idaho State Tax Commission

PO Box 76

▪ Boise ID 83707-0076

Address Phone

EFO00286 09-24-2020 Page 1 of 2