Enlarge image

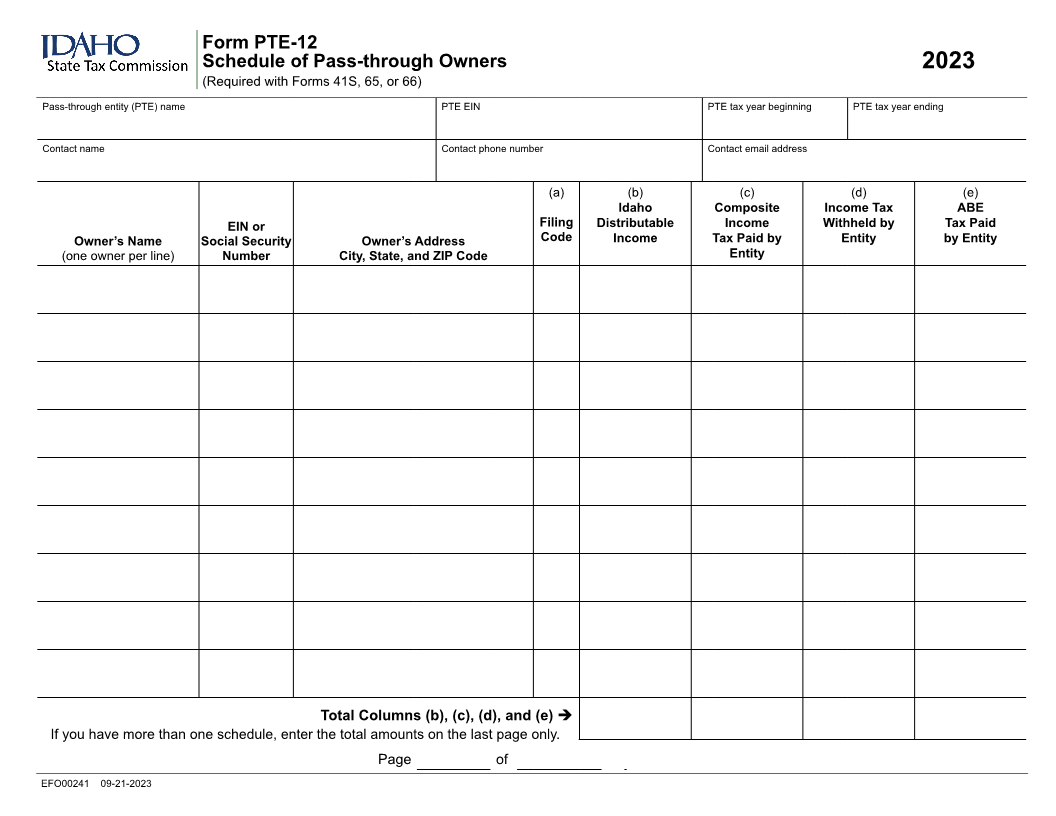

Form PTE-12

Schedule of Pass-through Owners 2023

(Required with Forms 41S, 65, or 66)

Pass-through entity (PTE) name PTE EIN PTE tax year beginning PTE tax year ending

Contact name Contact phone number Contact email address

(a) (b) (c) (d) (e)

Idaho Composite Income Tax ABE

EIN or Filing Distributable Income Withheld by Tax Paid

Owner’s Name Social Security Owner’s Address Code Income Tax Paid by Entity by Entity

(one owner per line) Number City, State, and ZIP Code Entity

Total Columns (b), (c), (d), and (e)

If you have more than one schedule, enter the total amounts on the last page only.

Page of

EFO00241 09-21-2023