Enlarge image

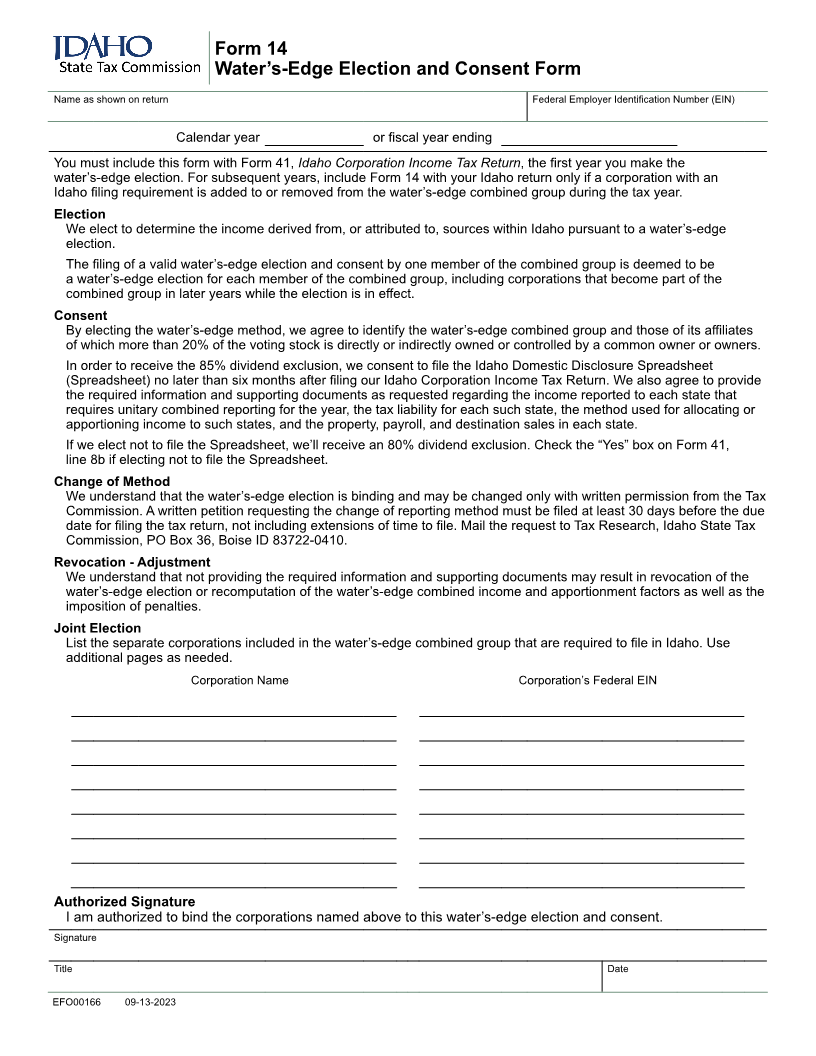

Form 14

Water’s-Edge Election and Consent Form

Name as shown on return Federal Employer Identification Number (EIN)

Calendar year or fiscal year ending

You must include this form with Form 41, Idaho Corporation Income Tax Return, the first year you make the

water’s-edge election. For subsequent years, include Form 14 with your Idaho return only if a corporation with an

Idaho filing requirement is added to or removed from the water’s-edge combined group during the tax year.

Election

We elect to determine the income derived from, or attributed to, sources within Idaho pursuant to a water’s-edge

election.

The filing of a valid water’s-edge election and consent by one member of the combined group is deemed to be

a water’s-edge election for each member of the combined group, including corporations that become part of the

combined group in later years while the election is in effect.

Consent

By electing the water’s-edge method, we agree to identify the water’s-edge combined group and those of its affiliates

of which more than 20% of the voting stock is directly or indirectly owned or controlled by a common owner or owners.

In order to receive the 85% dividend exclusion, we consent to file the Idaho Domestic Disclosure Spreadsheet

(Spreadsheet) no later than six months after filing our Idaho Corporation Income Tax Return. We also agree to provide

the required information and supporting documents as requested regarding the income reported to each state that

requires unitary combined reporting for the year, the tax liability for each such state, the method used for allocating or

apportioning income to such states, and the property, payroll, and destination sales in each state.

If we elect not to file the Spreadsheet, we’ll receive an 80% dividend exclusion. Check the “Yes” box on Form 41,

line 8b if electing not to file the Spreadsheet.

Change of Method

We understand that the water’s-edge election is binding and may be changed only with written permission from the Tax

Commission. A written petition requesting the change of reporting method must be filed at least 30 days before the due

date for filing the tax return, not including extensions of time to file. Mail the request to Tax Research, Idaho State Tax

Commission, PO Box 36, Boise ID 83722-0410.

Revocation - Adjustment

We understand that not providing the required information and supporting documents may result in revocation of the

water’s-edge election or recomputation of the water’s-edge combined income and apportionment factors as well as the

imposition of penalties.

Joint Election

List the separate corporations included in the water’s-edge combined group that are required to file in Idaho. Use

additional pages as needed.

Corporation Name Corporation’s Federal EIN

Authorized Signature

I am authorized to bind the corporations named above to this water’s-edge election and consent.

Signature

Title Date

EFO00166 09-13-2023