Enlarge image

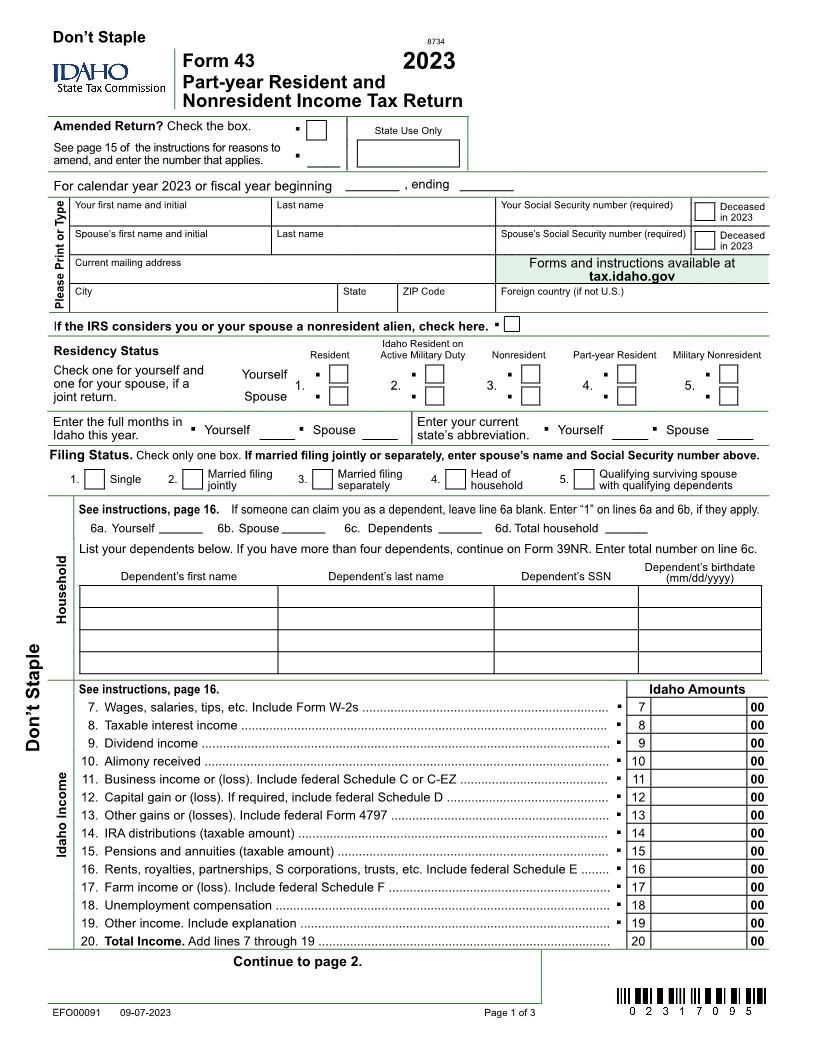

Don’t Staple 8734

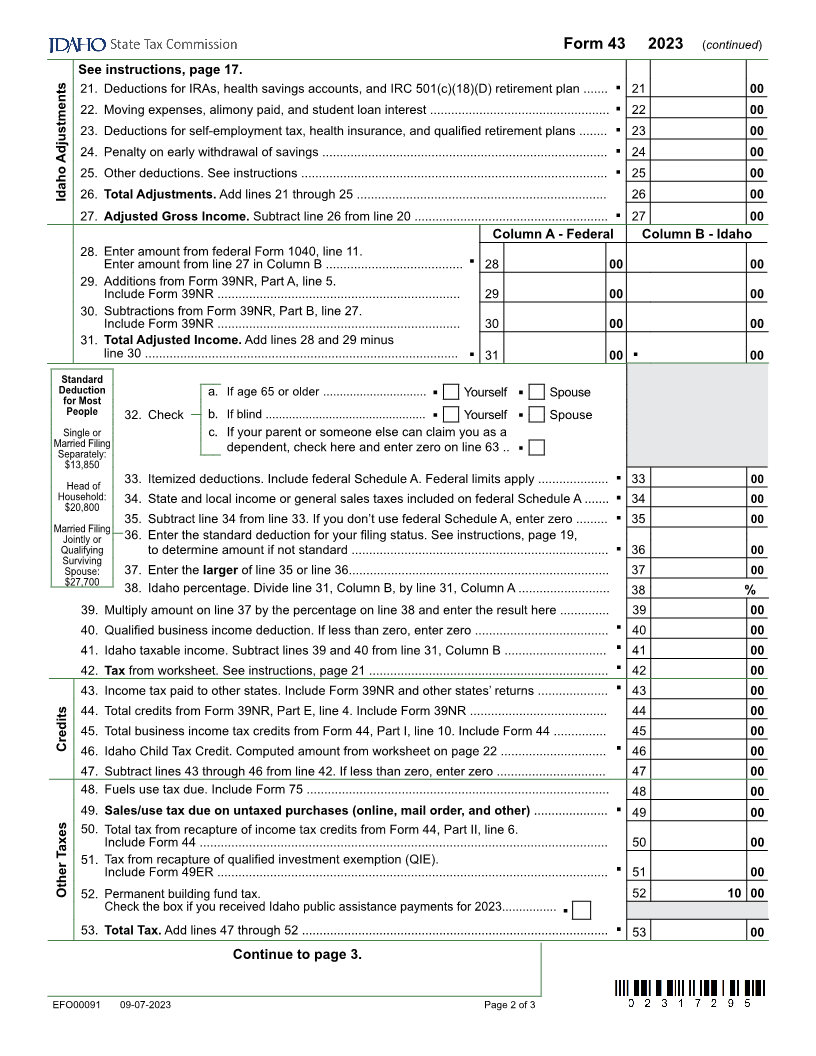

Form 43 2023

Part-year Resident and

Nonresident Income Tax Return

Amended Return? Check the box. ▪ State Use Only

See page 15 of the instructions for reasons to

amend, and enter the number that applies. ▪

For calendar year 2023 or fiscal year beginning , ending

Your first name and initial Last name Your Social Security number (required) Deceased

in 2023

Spouse’s first name and initial Last name Spouse’s Social Security number (required) Deceased

in 2023

Current mailing address Forms and instructions available at

tax.idaho.gov

City State ZIP Code Foreign country (if not U.S.)

Please Print or Type

If the IRS considers you or your spouse a nonresident alien, check here. ▪

Idaho Resident on

Residency Status Resident Active Military Duty Nonresident Part-year Resident Military Nonresident

Check one for yourself and Yourself ▪ ▪ ▪ ▪ ▪

one for your spouse, if a 1. 2. 3. 4. 5.

joint return. Spouse ▪ ▪ ▪ ▪ ▪

Enter the full months in Enter your current

Idaho this year. ▪ Yourself ▪ Spouse state’s abbreviation. ▪ Yourself ▪ Spouse

Filing Status. Check only one box. If married filing jointly or separately, enter spouse’s name and Social Security number above.

1. Single 2. Married filing 3. Married filing 4. Head of 5. Qualifying surviving spouse

jointly separately household with qualifying dependents

See instructions, page 16. If someone can claim you as a dependent, leave line 6a blank. Enter “1” on lines 6a and 6b, if they apply.

6a. Yourself 6b. Spouse 6c. Dependents 6d. Total household

List your dependents below. If you have more than four dependents, continue on Form 39NR. Enter total number on line 6c.

Dependent’s birthdate

Dependent’s first name Dependent’s last name Dependent’s SSN (mm/dd/yyyy)

Household

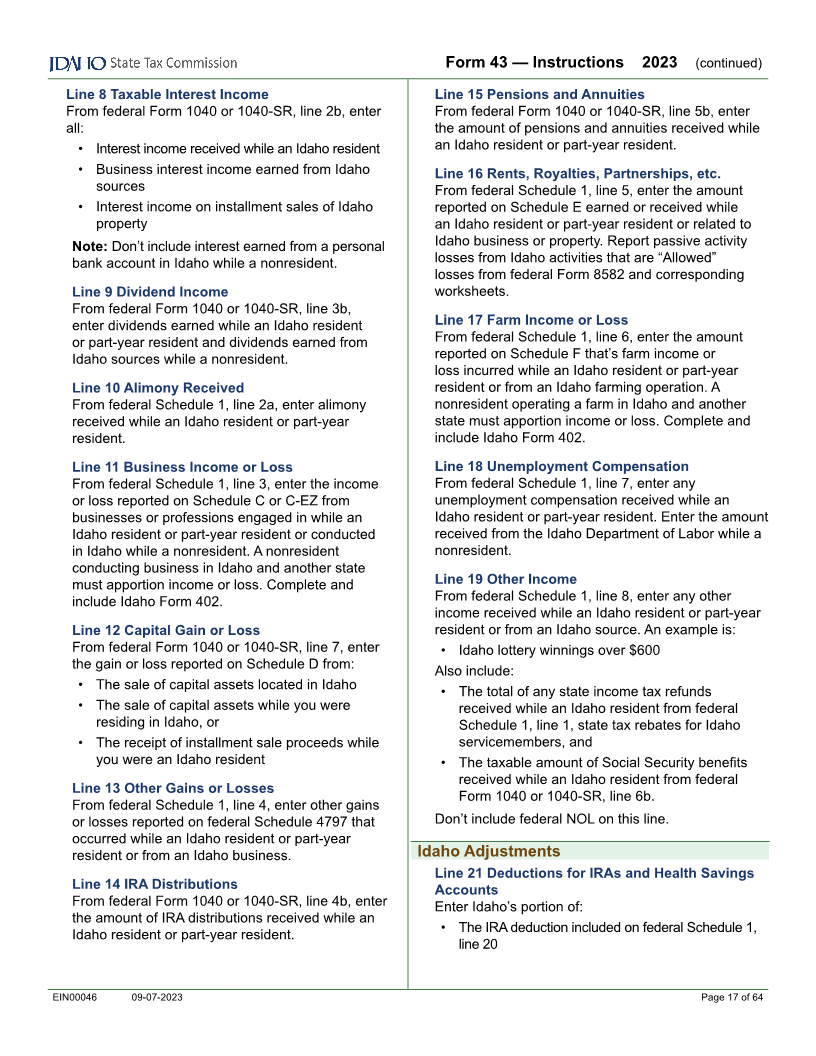

See instructions, page 16. Idaho Amounts

7 . Wages, salaries, tips, etc. Include Form W-2s ...................................................................... ▪ 7 00

8 . Taxable interest income ........................................................................................................ ▪ 8 00

Don’t Staple 9 . Dividend income .................................................................................................................... ▪ 9 00

10 . Alimony received ................................................................................................................... ▪ 10 00

11 . Business income or (loss). Include federal Schedule C or C-EZ .......................................... ▪ 11 00

12 . Capital gain or (loss). If required, include federal Schedule D .............................................. ▪ 12 00

13 . Other gains or (losses). Include federal Form 4797 .............................................................. ▪ 13 00

14 . IRA distributions (taxable amount) ........................................................................................ ▪ 14 00

Idaho Income 15 . Pensions and annuities (taxable amount) ............................................................................. ▪ 15 00

16 . Rents, royalties, partnerships, S corporations, trusts, etc. Include federal Schedule E ........ ▪ 16 00

17 . Farm income or (loss). Include federal Schedule F ............................................................... ▪ 17 00

18 . Unemployment compensation ............................................................................................... ▪ 18 00

19 . Other income. Include explanation ........................................................................................ ▪ 19 00

20 . Total Income. Add lines 7 through 19 ................................................................................... 20 00

Continue to page 2.

EFO00091 09-07-2023 Page 1 of 3