Enlarge image

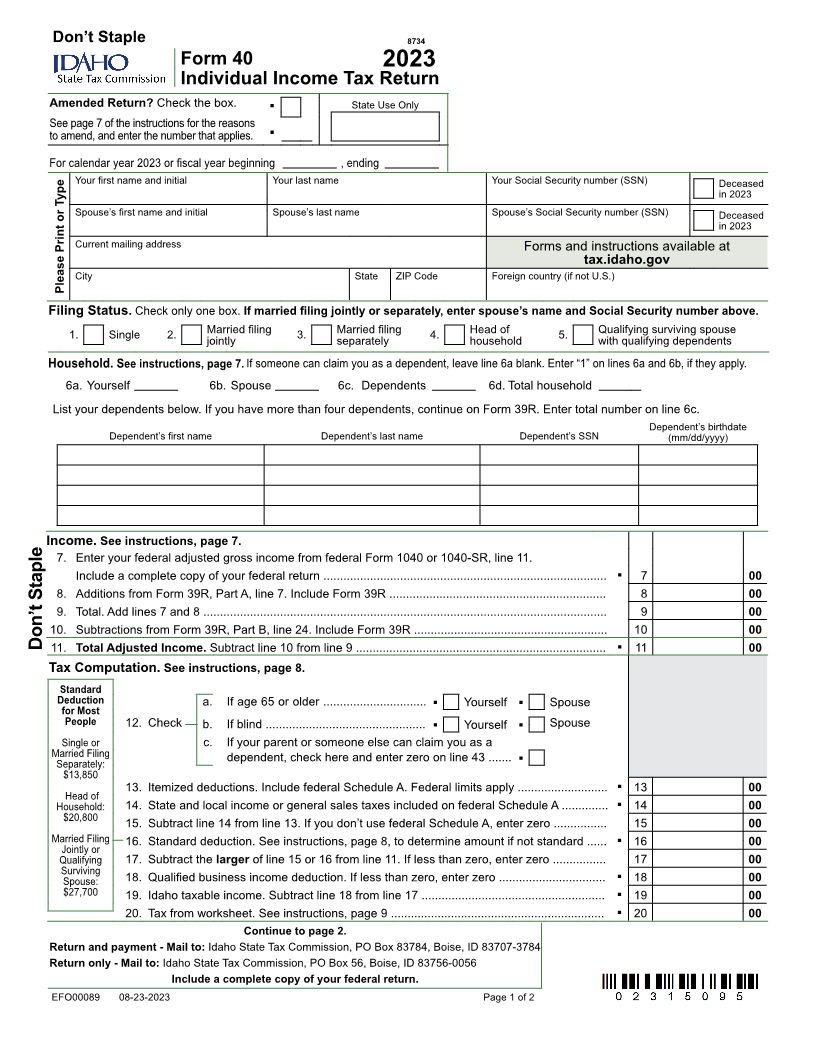

Don’t Staple 8734

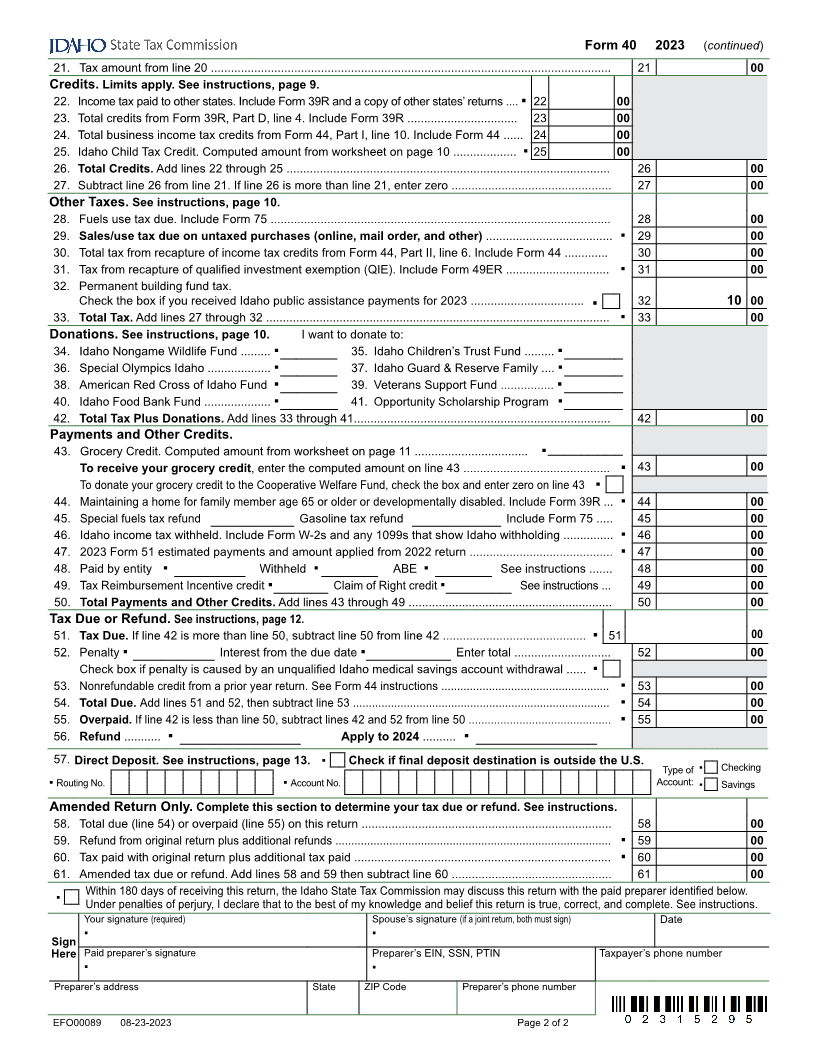

Form 40 2023

Individual Income Tax Return

Amended Return? Check the box. ▪ State Use Only

See page 7 of the instructions for the reasons

to amend, and enter the number that applies. ▪

For calendar year 2023 or fiscal year beginning , ending

Your first name and initial Your last name Your Social Security number (SSN) Deceased

in 2023

Spouse’s first name and initial Spouse’s last name Spouse’s Social Security number (SSN) Deceased

in 2023

Current mailing address Forms and instructions available at

tax.idaho.gov

City State ZIP Code Foreign country (if not U.S.)

Please Print or Type

Filing Status. Check only one box. If married filing jointly or separately, enter spouse’s name and Social Security number above.

1. Single 2. Married filing 3. Married filing 4. Head of 5. Qualifying surviving spouse

jointly separately household with qualifying dependents

Household. See instructions, page 7. If someone can claim you as a dependent, leave line 6a blank. Enter “1” on lines 6a and 6b, if they apply.

6a. Yourself 6b. Spouse 6c. Dependents 6d. Total household

List your dependents below. If you have more than four dependents, continue on Form 39R. Enter total number on line 6c.

Dependent’s birthdate

Dependent’s first name Dependent’s last name Dependent’s SSN (mm/dd/yyyy)

Income. See instructions, page 7.

7. Enter your federal adjusted gross income from federal Form 1040 or 1040-SR, line 11.

Include a complete copy of your federal return ..................................................................................... ▪ 7 00

8. Additions from Form 39R, Part A, line 7. Include Form 39R ................................................................. 8 00

9. Total. Add lines 7 and 8 ......................................................................................................................... 9 00

10. Subtractions from Form 39R, Part B, line 24. Include Form 39R .......................................................... 10 00

Don’t Staple 11. Total Adjusted Income. Subtract line 10 from line 9 ........................................................................... ▪ 11 00

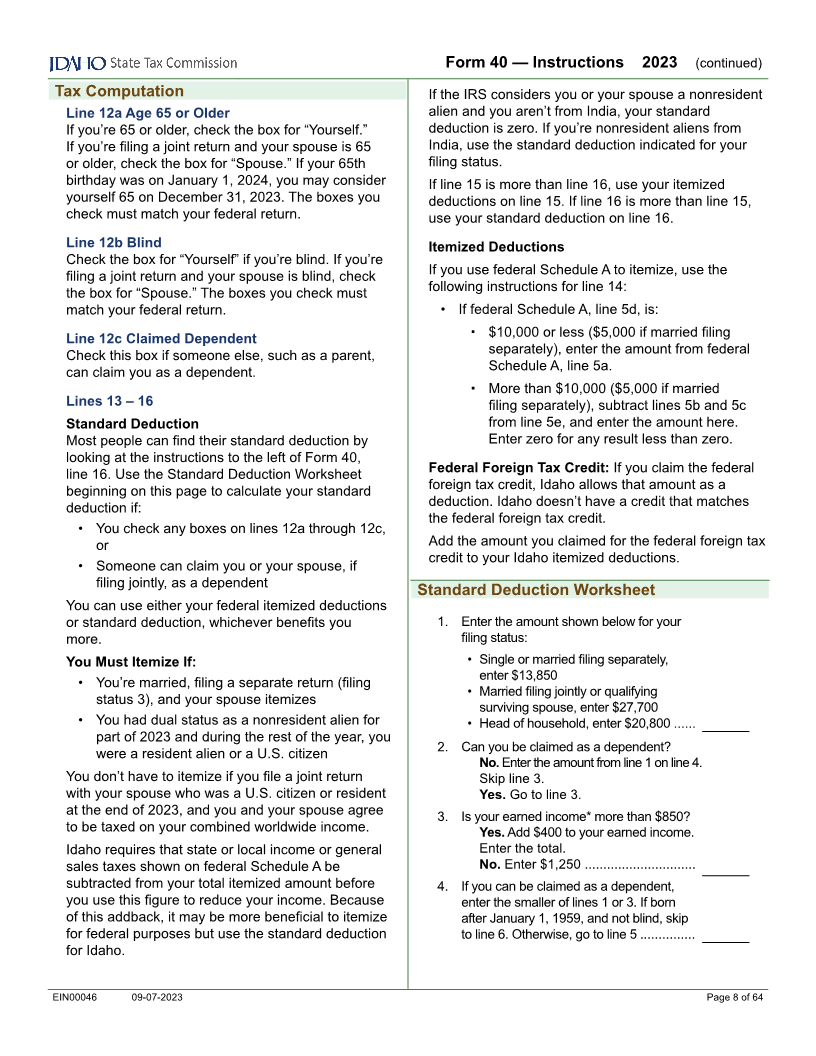

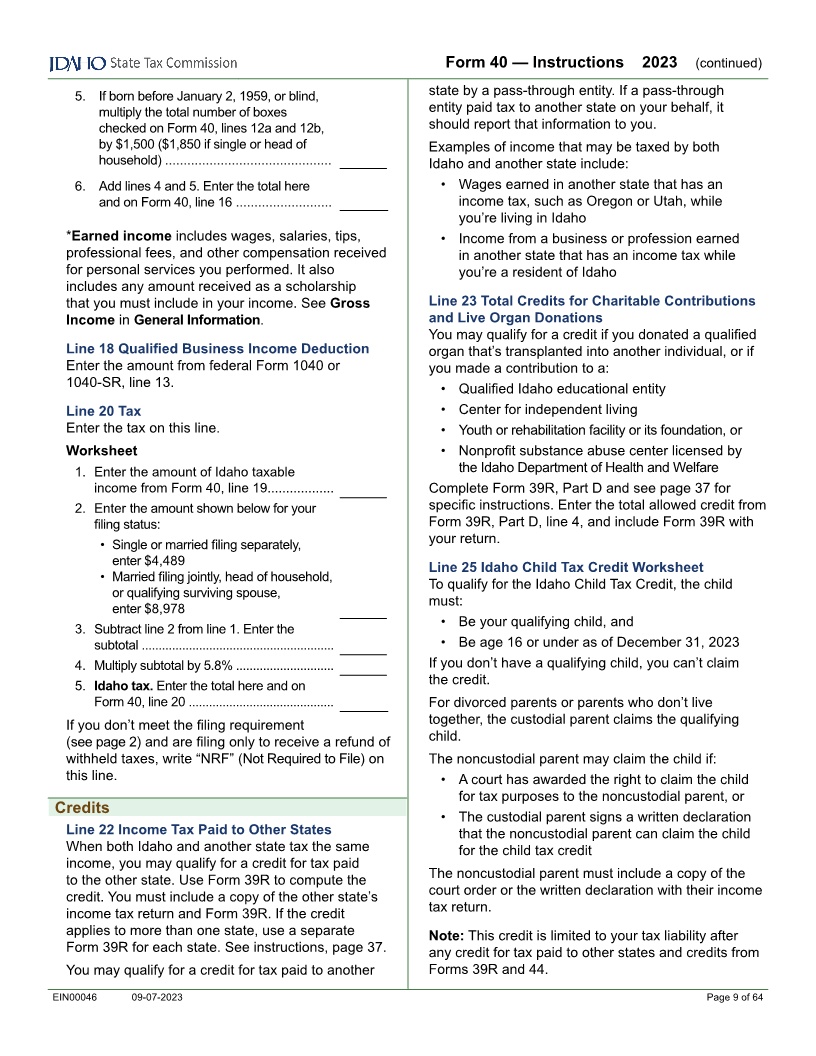

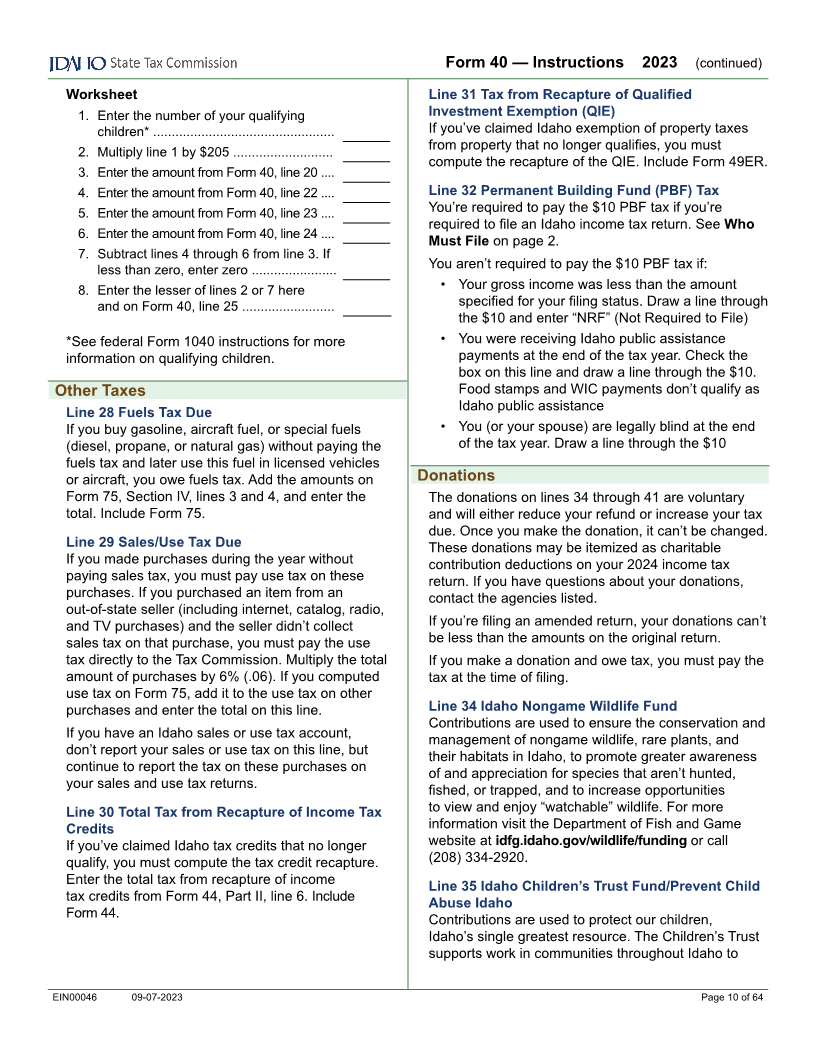

Tax Computation. See instructions, page 8.

Standard

Deduction a. If age 65 or older ............................... ▪ Yourself ▪ Spouse

for Most

People 12. Check b. If blind ................................................ ▪ Yourself ▪ Spouse

Single or c. If your parent or someone else can claim you as a

Married Filing dependent, check here and enter zero on line 43 ....... ▪

Separately:

$13,850

13. Itemized deductions. Include federal Schedule A. Federal limits apply ........................... ▪ 13 00

Head of

Household: 14. State and local income or general sales taxes included on federal Schedule A .............. ▪ 14 00

$20,800

15. Subtract line 14 from line 13. If you don’t use federal Schedule A, enter zero ................ 15 00

Married Filing 16. Standard deduction. See instructions, page 8, to determine amount if not standard ...... ▪ 16 00

Jointly or

Qualifying 17. Subtract the larger of line 15 or 16 from line 11. If less than zero, enter zero ................ 17 00

Surviving

Spouse: 18. Qualified business income deduction. If less than zero, enter zero ................................ ▪ 18 00

$27,700 19. Idaho taxable income. Subtract line 18 from line 17 ....................................................... ▪ 19 00

20. Tax from worksheet. See instructions, page 9 ................................................................ ▪ 20 00

Continue to page 2.

Return and payment - Mail to: Idaho State Tax Commission, PO Box 83784, Boise, ID 83707-3784

Return only - Mail to: Idaho State Tax Commission, PO Box 56, Boise, ID 83756-0056

Include a complete copy of your federal return.

EFO00089 08-23-2023 Page 1 of 2