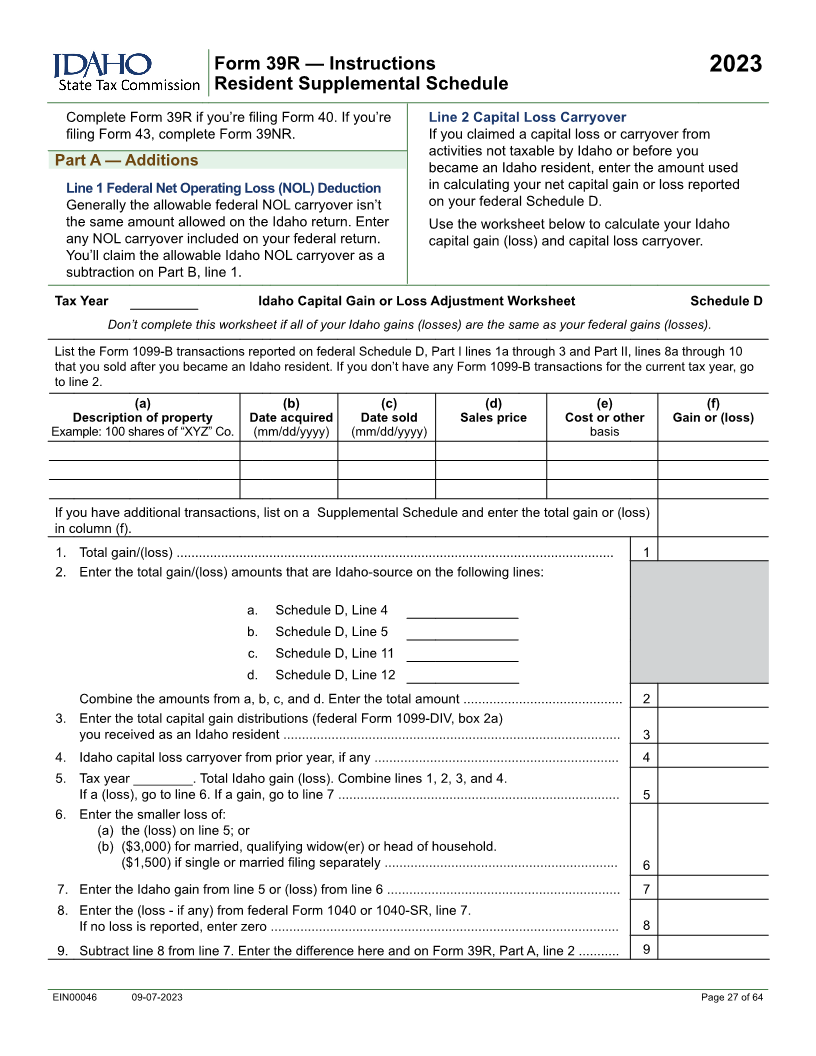

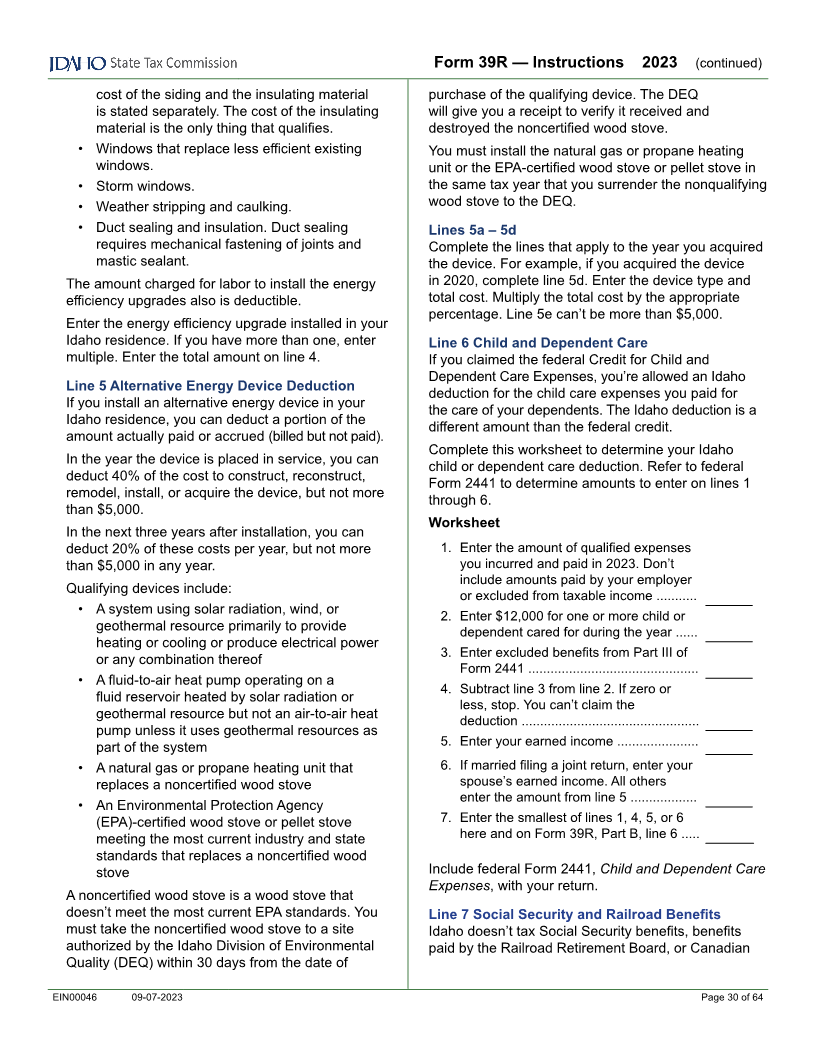

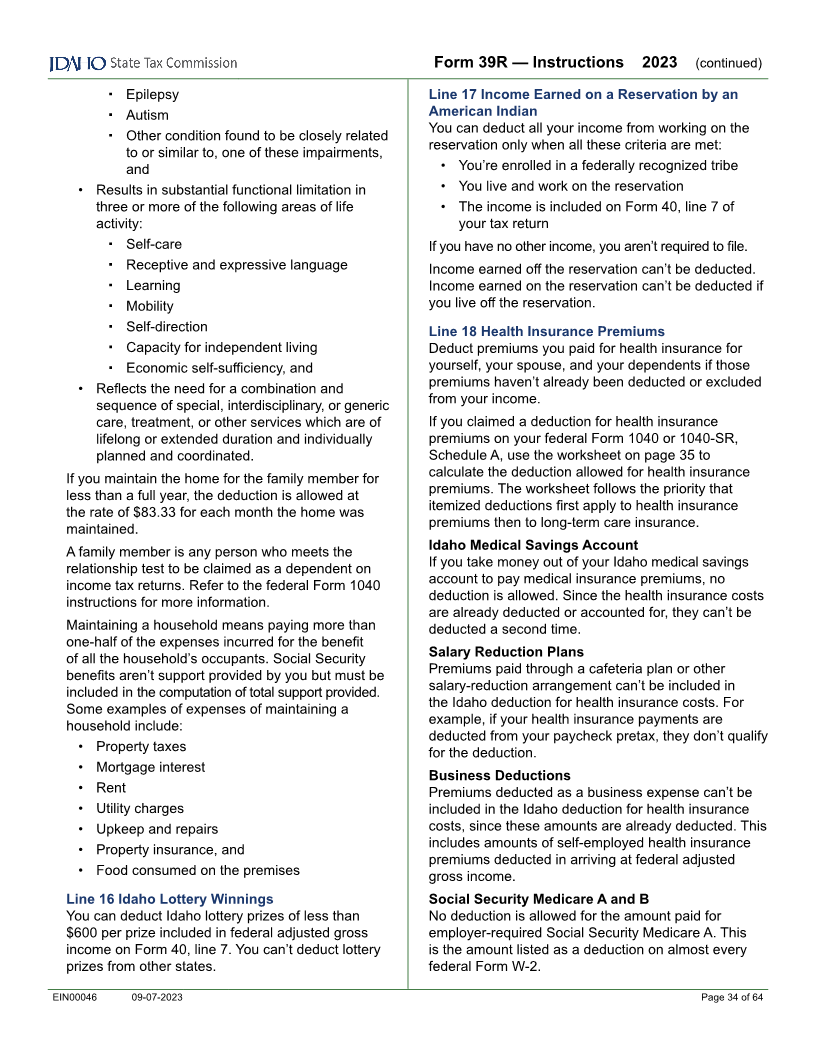

Enlarge image

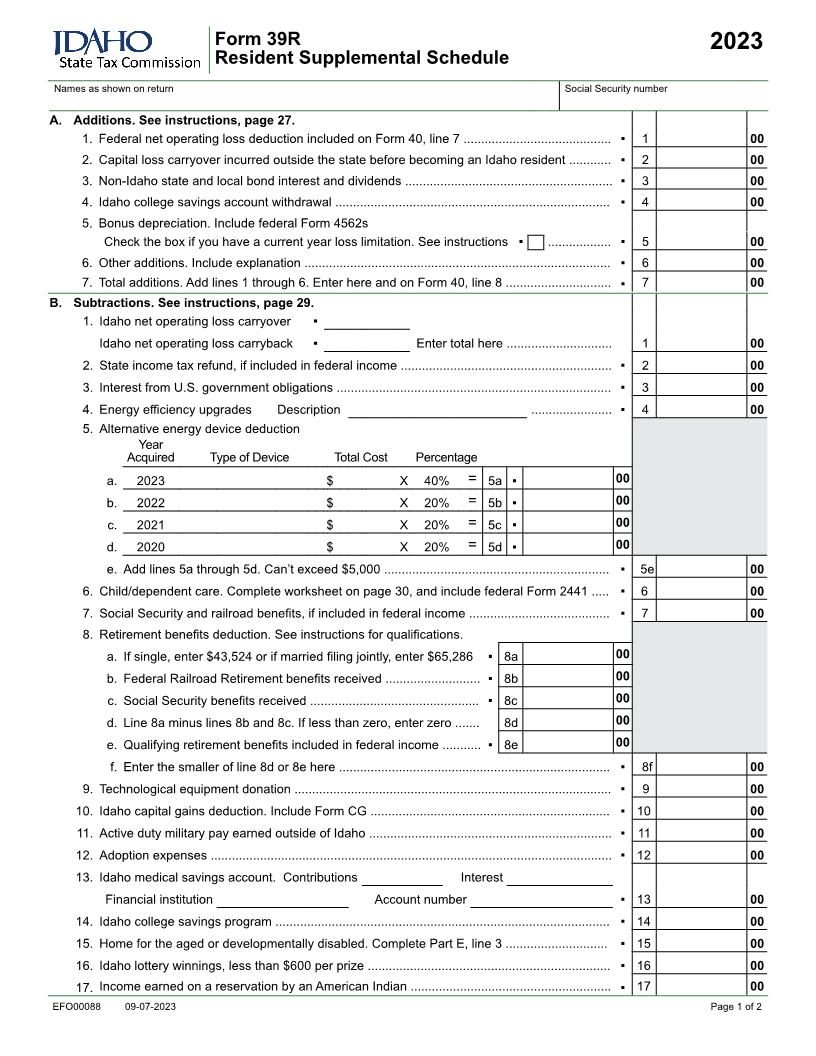

Form 39R 2023

Resident Supplemental Schedule

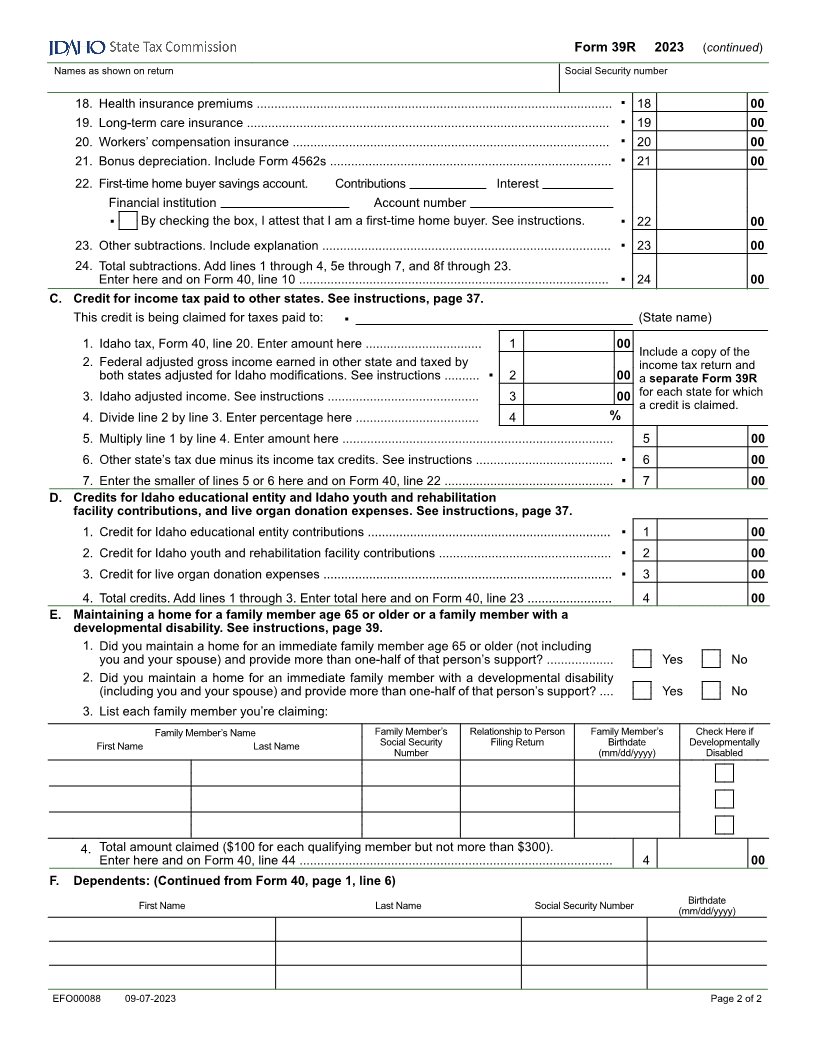

Names as shown on return Social Security number

A. Additions. See instructions, page 27.

1. Federal net operating loss deduction included on Form 40, line 7 .......................................... ▪ 1 00

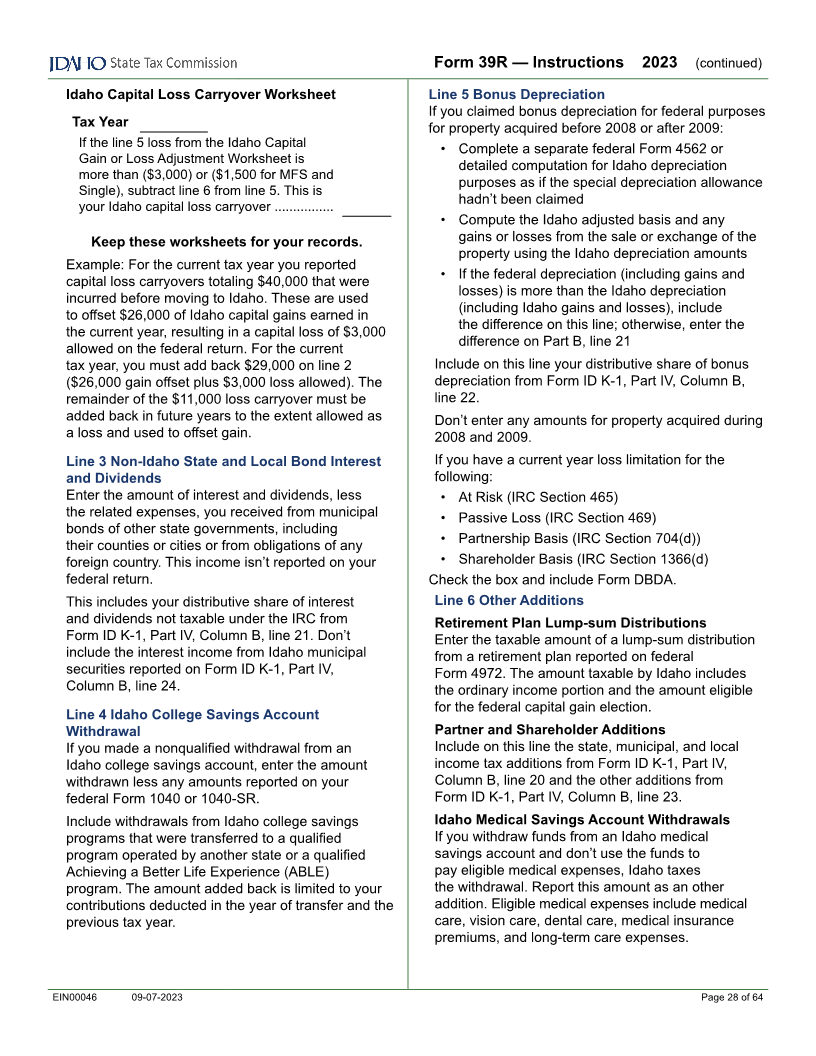

2. Capital loss carryover incurred outside the state before becoming an Idaho resident ............ ▪ 2 00

3. Non-Idaho state and local bond interest and dividends ........................................................... ▪ 3 00

4. Idaho college savings account withdrawal .............................................................................. ▪ 4 00

5. Bonus depreciation. Include federal Form 4562s

Check the box if you have a current year loss limitation. See instructions ▪ .................. ▪ 5 00

6. Other additions. Include explanation ....................................................................................... ▪ 6 00

7. Total additions. Add lines 1 through 6. Enter here and on Form 40, line 8 .............................. ▪ 7 00

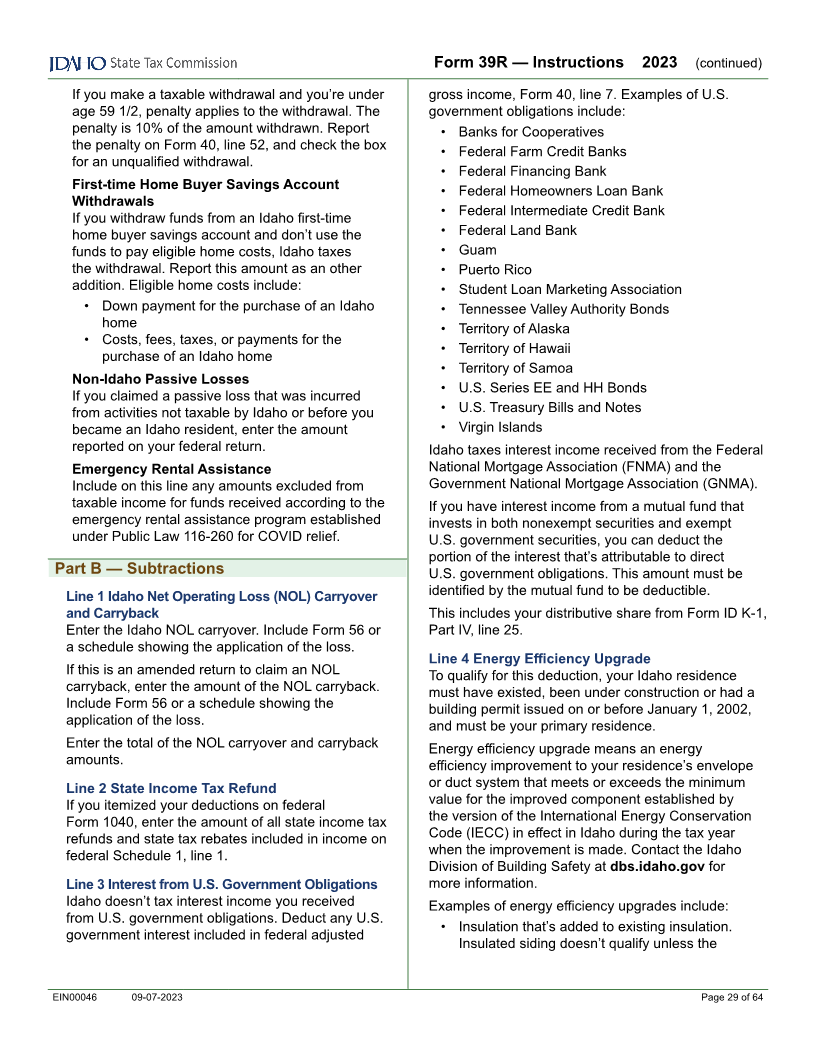

B. Subtractions. See instructions, page 29.

1. Idaho net operating loss carryover ▪

Idaho net operating loss carryback ▪ Enter total here .............................. 1 00

2. State income tax refund, if included in federal income ............................................................ ▪ 2 00

3. Interest from U.S. government obligations .............................................................................. ▪ 3 00

4. Energy efficiency upgrades Description ....................... ▪ 4 00

5. Alternative energy device deduction

Year

Acquired Type of Device Total Cost Percentage

a. 2023 $ X 40% = 5a ▪ 00

b. 2022 $ X 20% = 5b ▪ 00

c. 2021 $ X 20% = 5c ▪ 00

d. 2020 $ X 20% = 5d ▪ 00

e. Add lines 5a through 5d. Can’t exceed $5,000 ................................................................ ▪ 5e 00

6. Child/dependent care. Complete worksheet on page 30, and include federal Form 2441 ..... ▪ 6 00

7. Social Security and railroad benefits, if included in federal income ........................................ ▪ 7 00

8. Retirement benefits deduction. See instructions for qualifications.

a. If single, enter $43,524 or if married filing jointly, enter $65,286 ▪ 8a 00

b. Federal Railroad Retirement benefits received ........................... ▪ 8b 00

c. Social Security benefits received ................................................ ▪ 8c 00

d. Line 8a minus lines 8b and 8c. If less than zero, enter zero ....... 8d 00

e. Qualifying retirement benefits included in federal income ........... ▪ 8e 00

f. Enter the smaller of line 8d or 8e here ............................................................................. ▪ 8f 00

9. Technological equipment donation .......................................................................................... ▪ 9 00

10. Idaho capital gains deduction. Include Form CG .................................................................... ▪ 10 00

11. Active duty military pay earned outside of Idaho ..................................................................... ▪ 11 00

12. Adoption expenses .................................................................................................................. ▪ 12 00

13. Idaho medical savings account. Contributions Interest

Financial institution Account number ▪ 13 00

14. Idaho college savings program ............................................................................................... ▪ 14 00

15. Home for the aged or developmentally disabled. Complete Part E, line 3 ............................. ▪ 15 00

16. Idaho lottery winnings, less than $600 per prize ..................................................................... ▪ 16 00

17. Income earned on a reservation by an American Indian ......................................................... ▪ 17 00

EFO00088 09-07-2023 Page 1 of 2