- 4 -

Enlarge image

|

Form 56 — Instructions

Net Operating Loss Schedule 2023

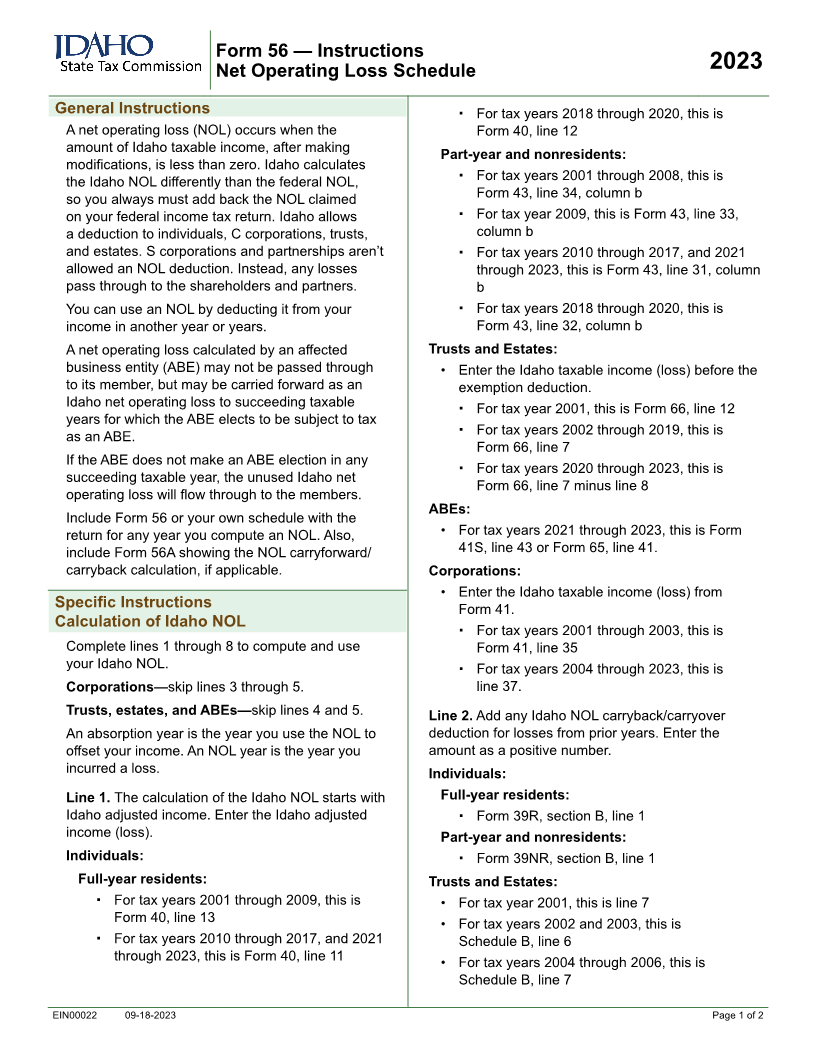

General Instructions For tax years 2018 through 2020, this is

A net operating loss (NOL) occurs when the Form 40, line 12

amount of Idaho taxable income, after making

Part-year and nonresidents:

modifications, is less than zero. Idaho calculates

For tax years 2001 through 2008, this is

the Idaho NOL differently than the federal NOL,

so you always must add back the NOL claimed Form 43, line 34, column b

on your federal income tax return. Idaho allows For tax year 2009, this is Form 43, line 33,

a deduction to individuals, C corporations, trusts, column b

and estates. S corporations and partnerships aren’t For tax years 2010 through 2017, and 2021

allowed an NOL deduction. Instead, any losses through 2023, this is Form 43, line 31, column

pass through to the shareholders and partners. b

You can use an NOL by deducting it from your For tax years 2018 through 2020, this is

income in another year or years. Form 43, line 32, column b

A net operating loss calculated by an affected Trusts and Estates:

business entity (ABE) may not be passed through • Enter the Idaho taxable income (loss) before the

to its member, but may be carried forward as an exemption deduction.

Idaho net operating loss to succeeding taxable For tax year 2001, this is Form 66, line 12

years for which the ABE elects to be subject to tax

For tax years 2002 through 2019, this is

as an ABE.

Form 66, line 7

If the ABE does not make an ABE election in any

For tax years 2020 through 2023, this is

succeeding taxable year, the unused Idaho net

Form 66, line 7 minus line 8

operating loss will flow through to the members.

ABEs:

Include Form 56 or your own schedule with the

return for any year you compute an NOL. Also, • For tax years 2021 through 2023, this is Form

include Form 56A showing the NOL carryforward/ 41S, line 43 or Form 65, line 41.

carryback calculation, if applicable. Corporations:

• Enter the Idaho taxable income (loss) from

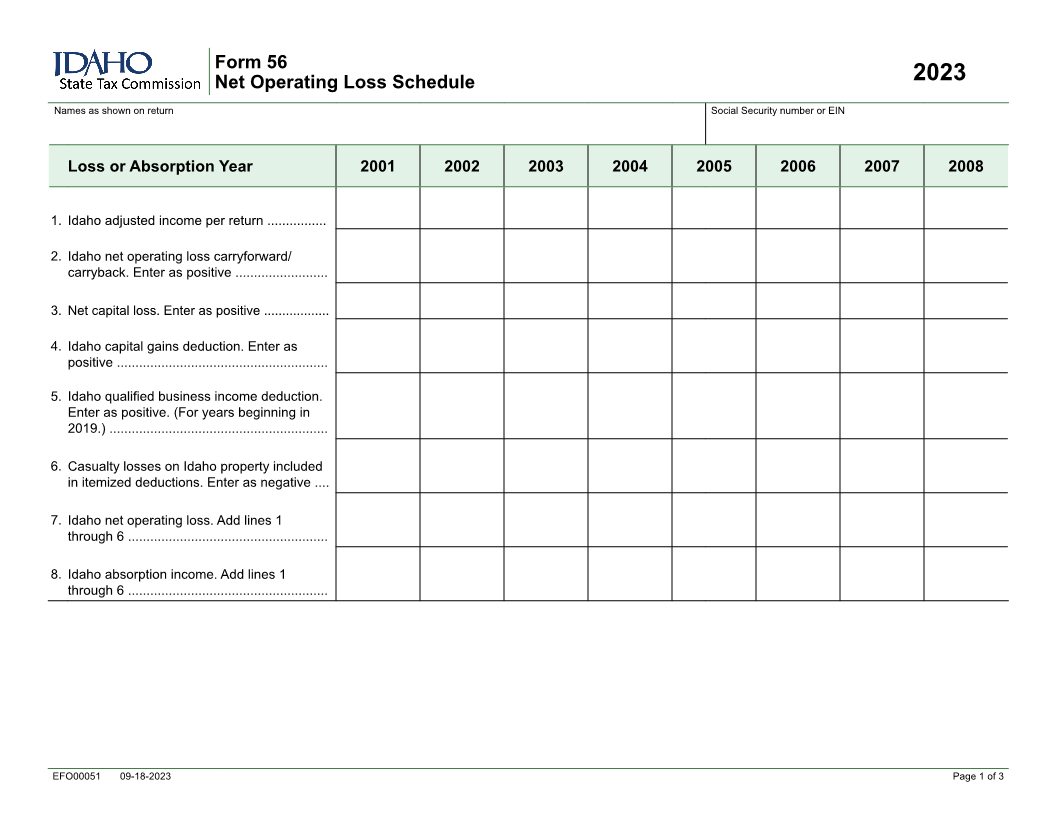

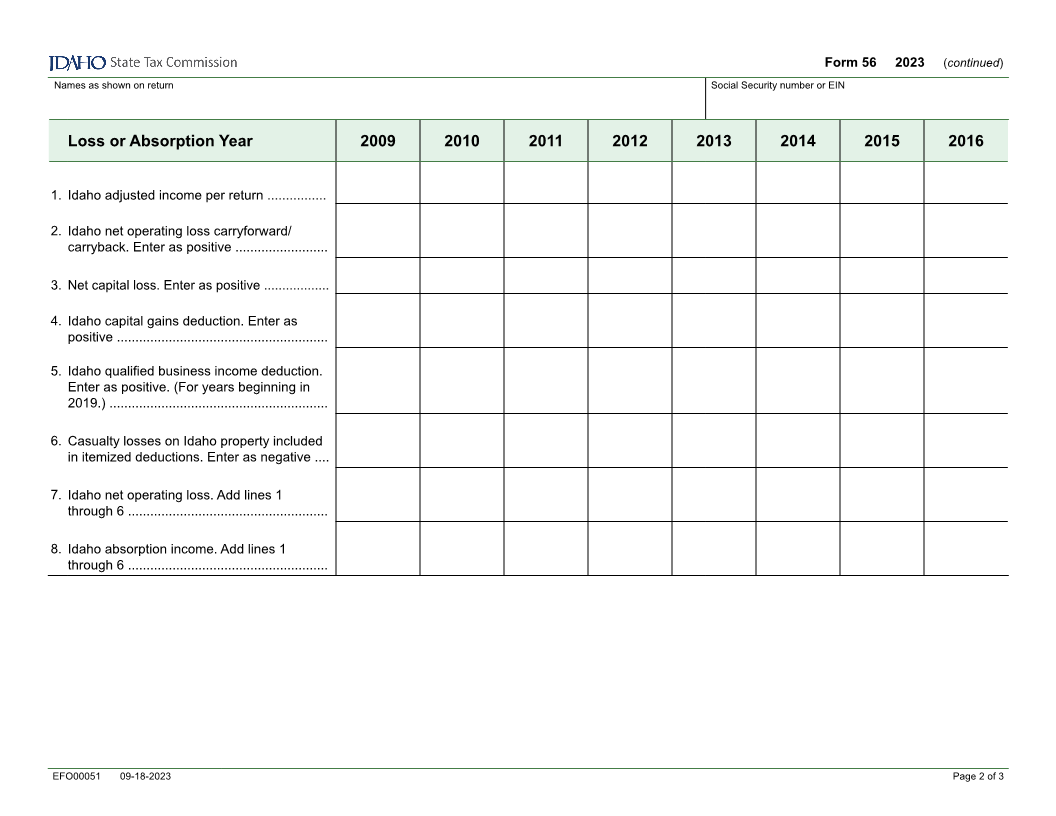

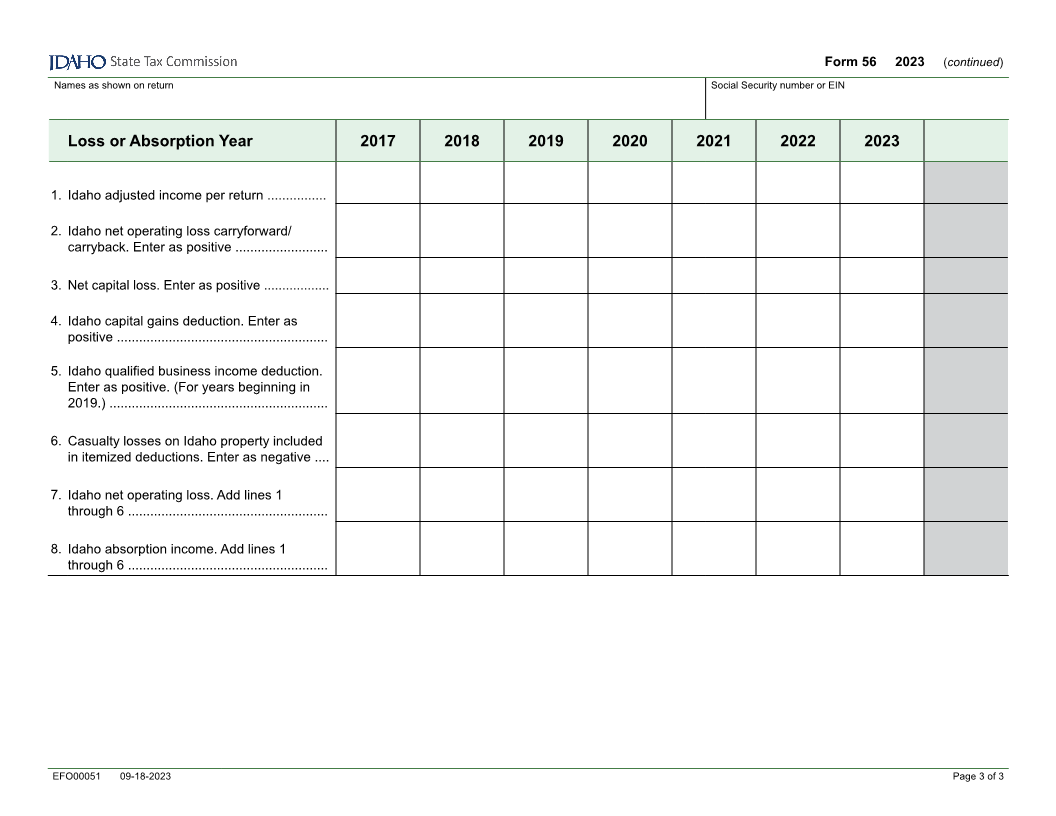

Specific Instructions Form 41.

Calculation of Idaho NOL For tax years 2001 through 2003, this is

Complete lines 1 through 8 to compute and use Form 41, line 35

your Idaho NOL. For tax years 2004 through 2023, this is

Corporations—skip lines 3 through 5. line 37.

Trusts, estates, and ABEs—skip lines 4 and 5. Line 2. Add any Idaho NOL carryback/carryover

An absorption year is the year you use the NOL to deduction for losses from prior years. Enter the

offset your income. An NOL year is the year you amount as a positive number.

incurred a loss. Individuals:

Line 1. The calculation of the Idaho NOL starts with Full-year residents:

Idaho adjusted income. Enter the Idaho adjusted Form 39R, section B, line 1

income (loss). Part-year and nonresidents:

Individuals: Form 39NR, section B, line 1

Full-year residents: Trusts and Estates:

For tax years 2001 through 2009, this is • For tax year 2001, this is line 7

Form 40, line 13 • For tax years 2002 and 2003, this is

For tax years 2010 through 2017, and 2021 Schedule B, line 6

through 2023, this is Form 40, line 11 • For tax years 2004 through 2006, this is

Schedule B, line 7

EIN00022 09-18-2023 Page 1 of 2

|