Enlarge image

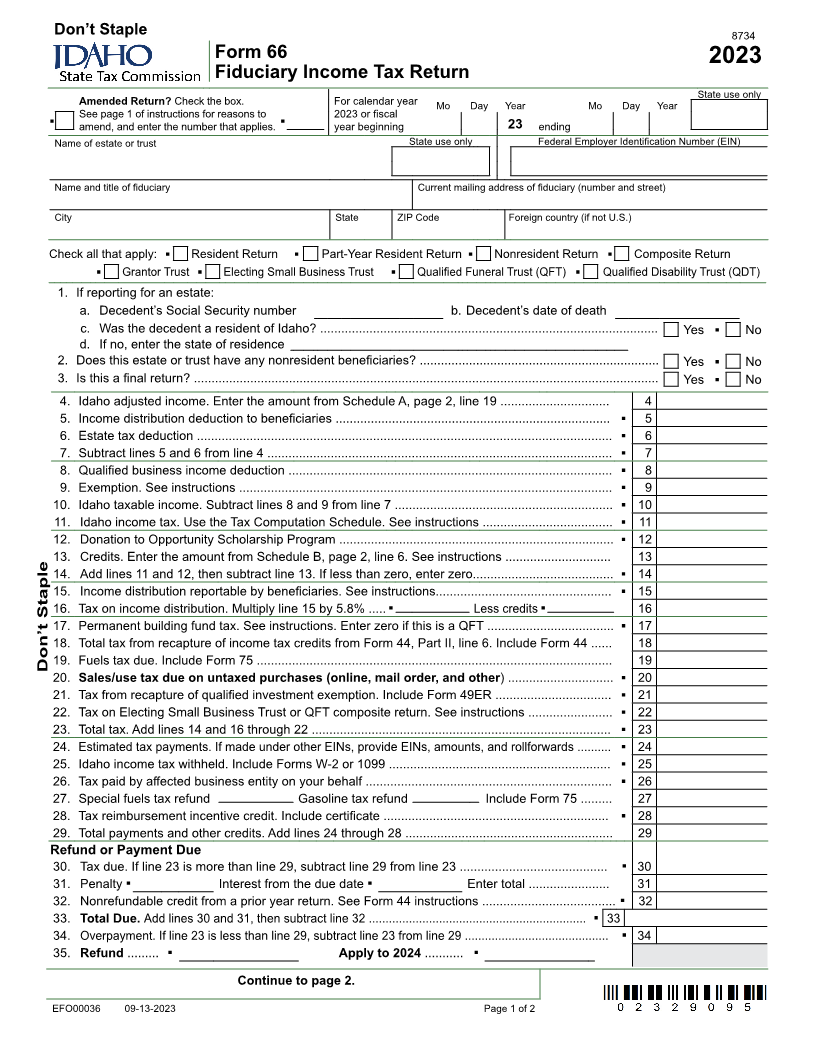

Don’t Staple 8734

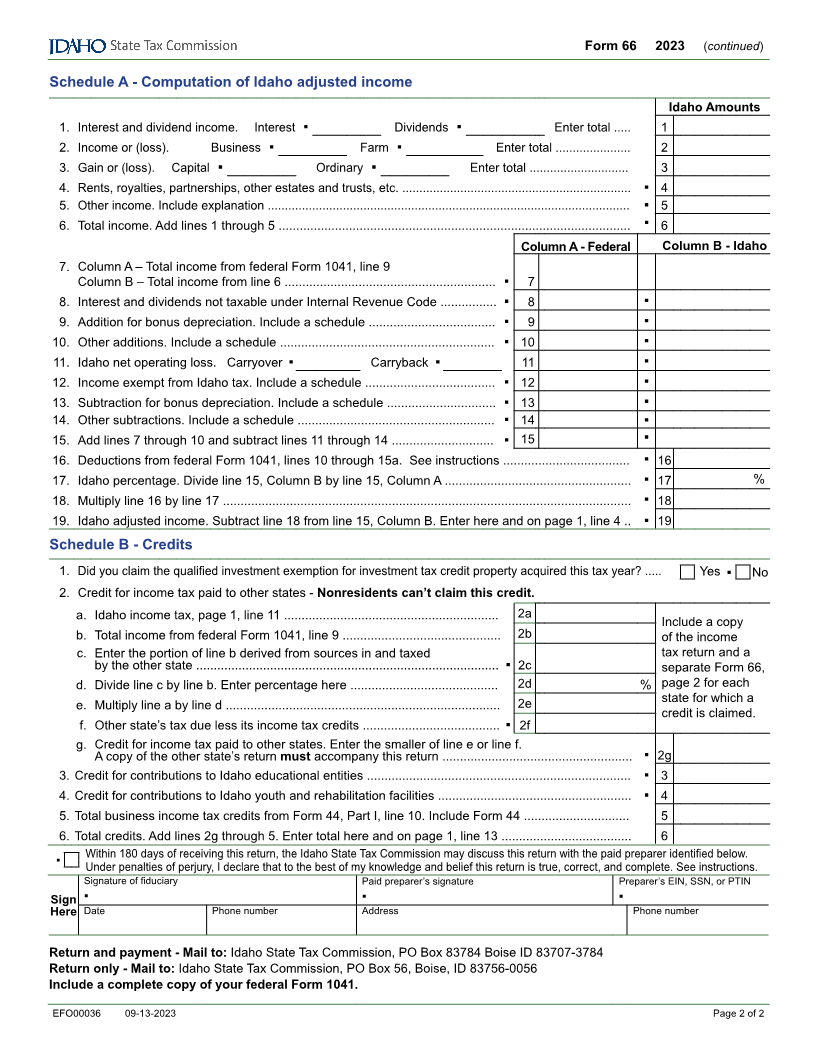

Form 66

2023

Fiduciary Income Tax Return

State use only

Amended Return? Check the box. For calendar year Mo Day Year Mo Day Year

See page 1 of instructions for reasons to 2023 or fiscal

▪ amend, and enter the number that applies. ▪ year beginning 23 ending

Name of estate or trust State use only Federal Employer Identification Number (EIN)

Name and title of fiduciary Current mailing address of fiduciary (number and street)

City State ZIP Code Foreign country (if not U.S.)

Check all that apply: ▪ Resident Return ▪ Part-Year Resident Return ▪ Nonresident Return ▪ Composite Return

▪ Grantor Trust ▪ Electing Small Business Trust ▪ Qualified Funeral Trust (QFT) ▪ Qualified Disability Trust (QDT)

1. If reporting for an estate:

a. Decedent’s Social Security number b. Decedent’s date of death

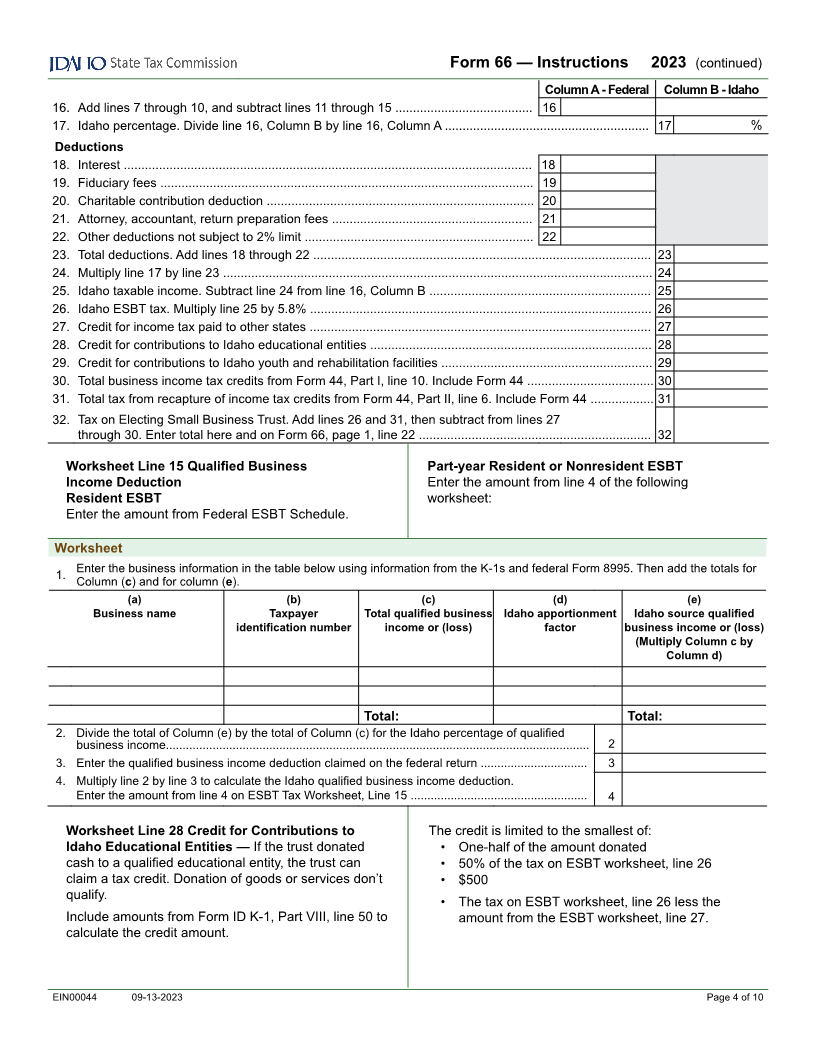

c. Was the decedent a resident of Idaho? ................................................................................................ Yes ▪ No

d. If no, enter the state of residence

2. Does this estate or trust have any nonresident beneficiaries? .................................................................... Yes ▪ No

3. Is this a final return? .................................................................................................................................... Yes ▪ No

4. Idaho adjusted income. Enter the amount from Schedule A, page 2, line 19 ............................... 4

5. Income distribution deduction to beneficiaries .............................................................................. ▪ 5

6. Estate tax deduction ...................................................................................................................... ▪ 6

7. Subtract lines 5 and 6 from line 4 .................................................................................................. ▪ 7

8. Qualified business income deduction ............................................................................................ ▪ 8

9. Exemption. See instructions .......................................................................................................... ▪ 9

10. Idaho taxable income. Subtract lines 8 and 9 from line 7 .............................................................. ▪ 10

11. Idaho income tax. Use the Tax Computation Schedule. See instructions ..................................... ▪ 11

12. Donation to Opportunity Scholarship Program .............................................................................. ▪ 12

13. Credits. Enter the amount from Schedule B, page 2, line 6. See instructions .............................. 13

14. Add lines 11 and 12, then subtract line 13. If less than zero, enter zero........................................ ▪ 14

15. Income distribution reportable by beneficiaries. See instructions.................................................. ▪ 15

16. Tax on income distribution. Multiply line 15 by 5.8% ..... ▪ Less credits▪ 16

17. Permanent building fund tax. See instructions. Enter zero if this is a QFT .................................... ▪ 17

18. Total tax from recapture of income tax credits from Form 44, Part II, line 6. Include Form 44 ...... 18

Don’t19. FuelsStapletax due. Include Form 75 ..................................................................................................... 19

20. Sales/use tax due on untaxed purchases (online, mail order, and other) .............................. ▪ 20

21. Tax from recapture of qualified investment exemption. Include Form 49ER ................................. ▪ 21

22. Tax on Electing Small Business Trust or QFT composite return. See instructions ........................ ▪ 22

23. Total tax. Add lines 14 and 16 through 22 ..................................................................................... ▪ 23

24. Estimated tax payments. If made under other EINs, provide EINs, amounts, and rollforwards .......... ▪ 24

25. Idaho income tax withheld. Include Forms W-2 or 1099 ............................................................... ▪ 25

26. Tax paid by affected business entity on your behalf ...................................................................... ▪ 26

27. Special fuels tax refund Gasoline tax refund Include Form 75 ......... 27

28. Tax reimbursement incentive credit. Include certificate ................................................................ ▪ 28

29. Total payments and other credits. Add lines 24 through 28 ........................................................... 29

Refund or Payment Due

30. Tax due. If line 23 is more than line 29, subtract line 29 from line 23 .......................................... ▪ 30

31. Penalty ▪ Interest from the due date ▪ Enter total ....................... 31

32. Nonrefundable credit from a prior year return. See Form 44 instructions ...................................... ▪ 32

33. Total Due. Add lines 30 and 31, then subtract line 32 ................................................................. ▪ 33

34. Overpayment. If line 23 is less than line 29, subtract line 23 from line 29 ........................................... ▪ 34

35. Refund ......... ▪ Apply to 2024 ........... ▪

Continue to page 2.

EFO00036 09-13-2023 Page 1 of 2