Enlarge image

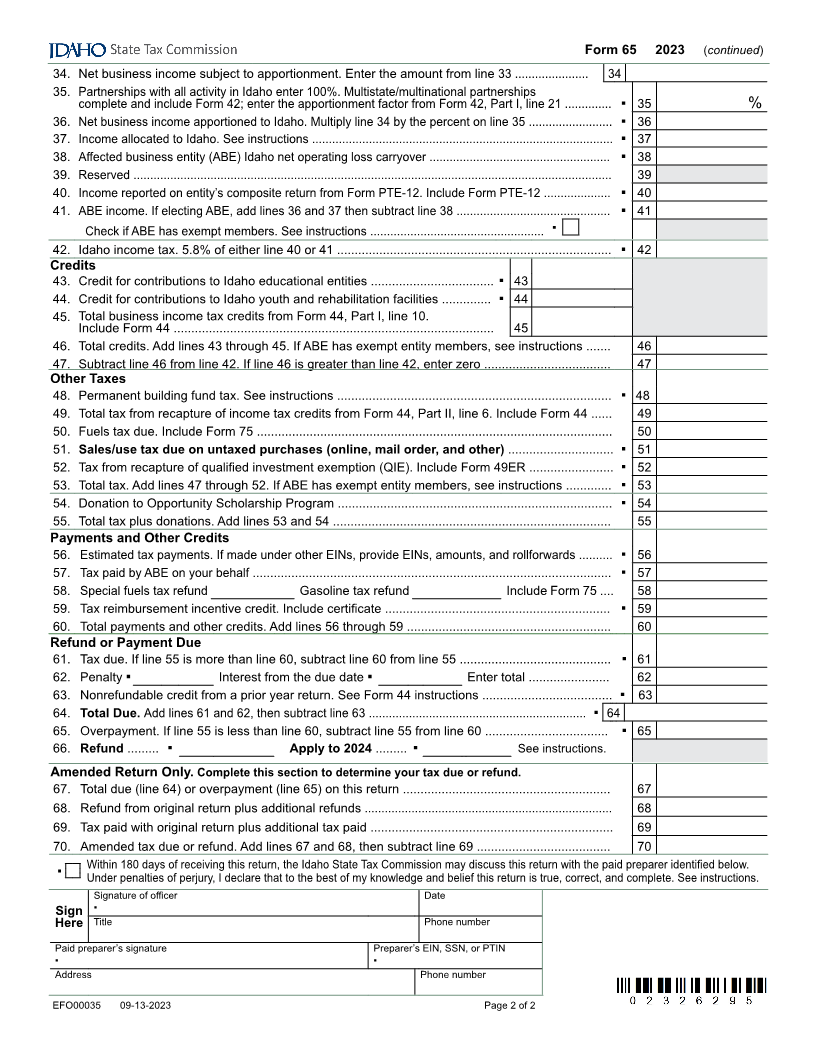

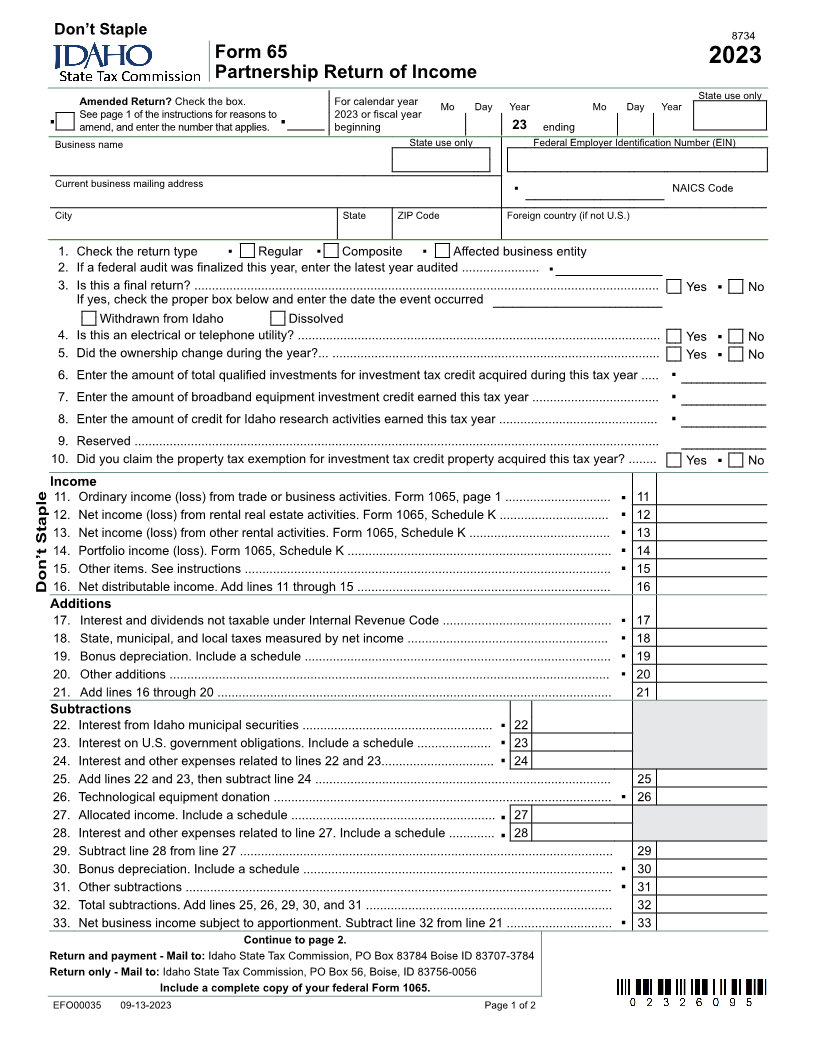

Don’t Staple 8734

Form 65

2023

Partnership Return of Income

Amended Return? Check the box. For calendar year State use only

Mo Day Year Mo Day Year

See page 1 of the instructions for reasons to 2023 or fiscal year

▪ amend, and enter the number that applies. ▪ beginning 23 ending

Business name State use only Federal Employer Identification Number (EIN)

Current business mailing address NAICS Code

▪

City State ZIP Code Foreign country (if not U.S.)

1. Check the return type ▪ Regular ▪ Composite ▪ Affected business entity

2. If a federal audit was finalized this year, enter the latest year audited ...................... ▪

3. Is this a final return? .................................................................................................................................... Yes ▪ No

If yes, check the proper box below and enter the date the event occurred

Withdrawn from Idaho Dissolved

4. Is this an electrical or telephone utility? ....................................................................................................... Yes ▪ No

5. Did the ownership change during the year?... ............................................................................................. Yes ▪ No

6. Enter the amount of total qualified investments for investment tax credit acquired during this tax year ..... ▪

7. Enter the amount of broadband equipment investment credit earned this tax year .................................... ▪

8. Enter the amount of credit for Idaho research activities earned this tax year ............................................. ▪

9. Reserved .....................................................................................................................................................

10. Did you claim the property tax exemption for investment tax credit property acquired this tax year? ........ Yes ▪ No

Income

11. Ordinary income (loss) from trade or business activities. Form 1065, page 1 .............................. ▪ 11

12. Net income (loss) from rental real estate activities. Form 1065, Schedule K ............................... ▪ 12

13. Net income (loss) from other rental activities. Form 1065, Schedule K ........................................ ▪ 13

14. Portfolio income (loss). Form 1065, Schedule K ........................................................................... ▪ 14

15. Other items. See instructions ........................................................................................................ ▪ 15

Don’t Staple 16. Net distributable income. Add lines 11 through 15 ........................................................................ 16

Additions

17. Interest and dividends not taxable under Internal Revenue Code ................................................ ▪ 17

18. State, municipal, and local taxes measured by net income ......................................................... ▪ 18

19. Bonus depreciation. Include a schedule ....................................................................................... ▪ 19

20. Other additions ............................................................................................................................. ▪ 20

21. Add lines 16 through 20 ................................................................................................................ 21

Subtractions

22. Interest from Idaho municipal securities ...................................................... ▪ 22

23. Interest on U.S. government obligations. Include a schedule ..................... ▪ 23

24. Interest and other expenses related to lines 22 and 23................................ ▪ 24

25. Add lines 22 and 23, then subtract line 24 .................................................................................... 25

26. Technological equipment donation ................................................................................................ ▪ 26

27. Allocated income. Include a schedule .......................................................... ▪ 27

28. Interest and other expenses related to line 27. Include a schedule ............. ▪ 28

29. Subtract line 28 from line 27 .......................................................................................................... 29

30. Bonus depreciation. Include a schedule ........................................................................................ ▪ 30

31. Other subtractions ......................................................................................................................... ▪ 31

32. Total subtractions. Add lines 25, 26, 29, 30, and 31 ...................................................................... 32

33. Net business income subject to apportionment. Subtract line 32 from line 21 .............................. ▪ 33

Continue to page 2.

Return and payment - Mail to: Idaho State Tax Commission, PO Box 83784 Boise ID 83707-3784

Return only - Mail to: Idaho State Tax Commission, PO Box 56, Boise, ID 83756-0056

Include a complete copy of your federal Form 1065.

EFO00035 09-13-2023 Page 1 of 2