Enlarge image

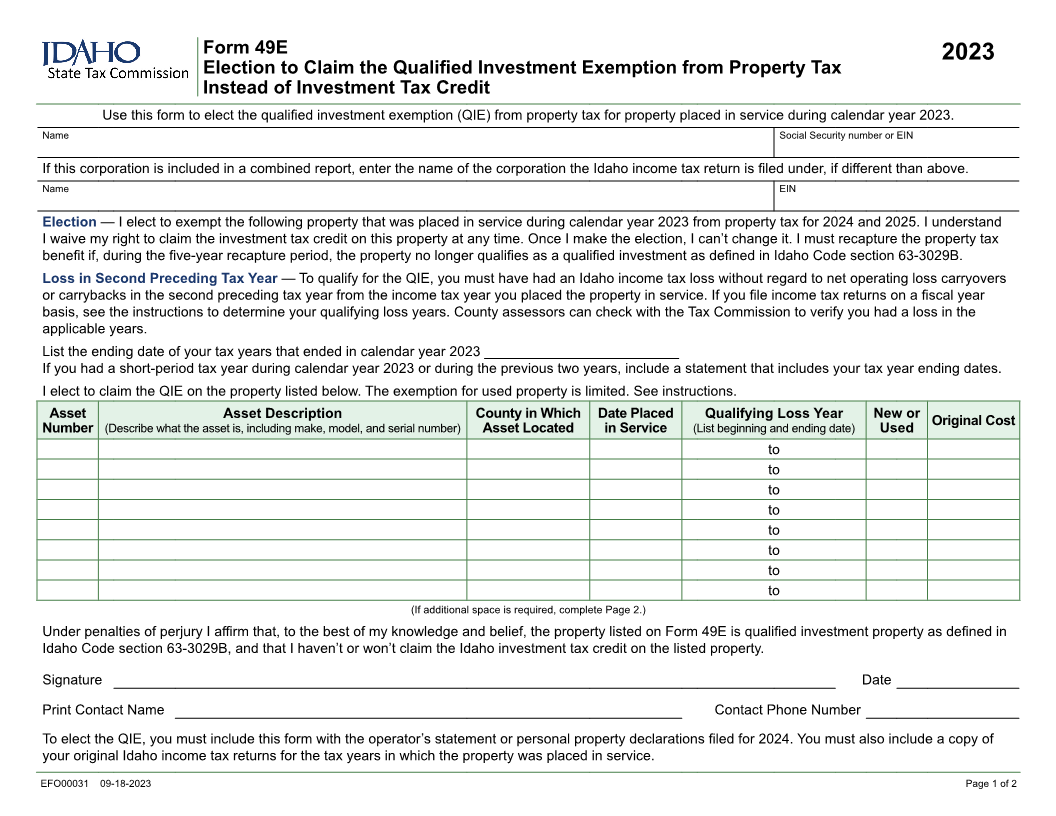

Form 49E

2023

Election to Claim the Qualified Investment Exemption from Property Tax

Instead of Investment Tax Credit

Use this form to elect the qualified investment exemption (QIE) from property tax for property placed in service during calendar year 2023.

Name Social Security number or EIN

If this corporation is included in a combined report, enter the name of the corporation the Idaho income tax return is filed under, if different than above.

Name EIN

Election — I elect to exempt the following property that was placed in service during calendar year 2023 from property tax for 2024 and 2025. I understand

I waive my right to claim the investment tax credit on this property at any time. Once I make the election, I can’t change it. I must recapture the property tax

benefit if, during the five-year recapture period, the property no longer qualifies as a qualified investment as defined in Idaho Code section 63-3029B.

Loss in Second Preceding Tax Year — To qualify for the QIE, you must have had an Idaho income tax loss without regard to net operating loss carryovers

or carrybacks in the second preceding tax year from the income tax year you placed the property in service. If you file income tax returns on a fiscal year

basis, see the instructions to determine your qualifying loss years. County assessors can check with the Tax Commission to verify you had a loss in the

applicable years.

List the ending date of your tax years that ended in calendar year 2023 _________________________

If you had a short-period tax year during calendar year 2023 or during the previous two years, include a statement that includes your tax year ending dates.

I elect to claim the QIE on the property listed below. The exemption for used property is limited. See instructions.

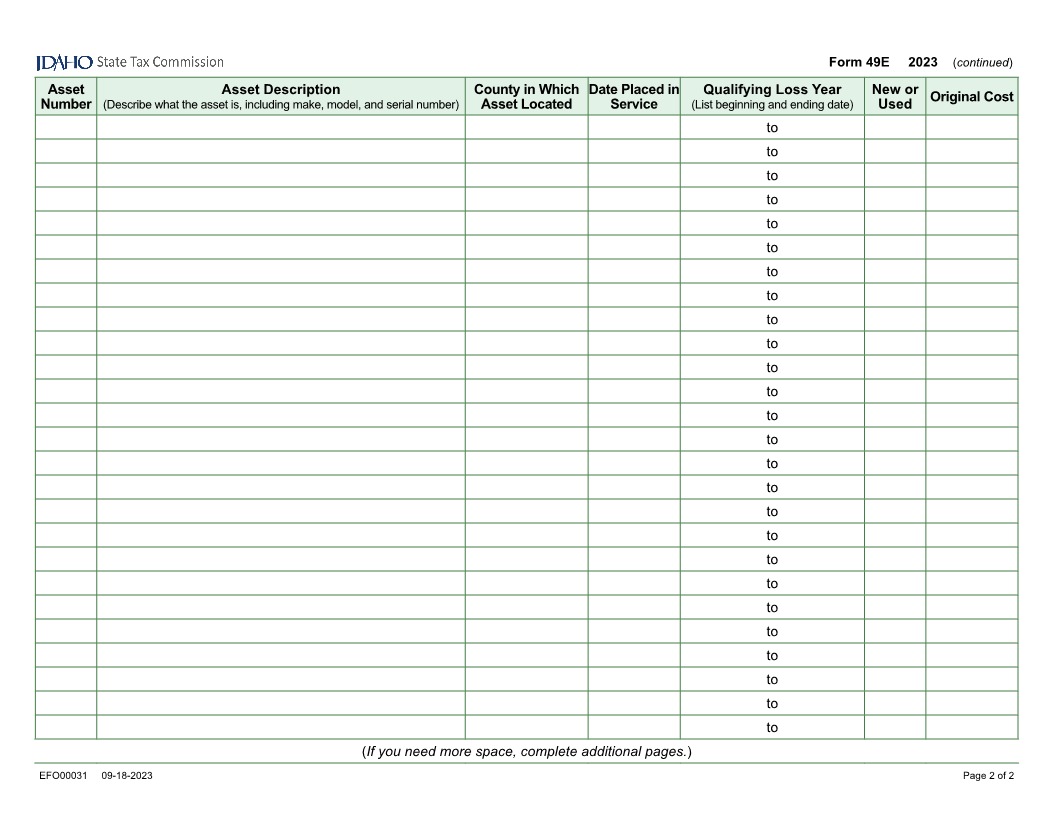

Asset Asset Description County in Which Date Placed Qualifying Loss Year New or

Original Cost

Number (Describe what the asset is, including make, model, and serial number) Asset Located in Service (List beginning and ending date) Used

to

to

to

to

to

to

to

to

(If additional space is required, complete Page 2.)

Under penalties of perjury I affirm that, to the best of my knowledge and belief, the property listed on Form 49E is qualified investment property as defined in

Idaho Code section 63-3029B, and that I haven’t or won’t claim the Idaho investment tax credit on the listed property.

Signature Date

Print Contact Name Contact Phone Number

To elect the QIE, you must include this form with the operator’s statement or personal property declarations filed for 2024. You must also include a copy of

your original Idaho income tax returns for the tax years in which the property was placed in service.

EFO00031 09-18-2023 Page 1 of 2