Enlarge image

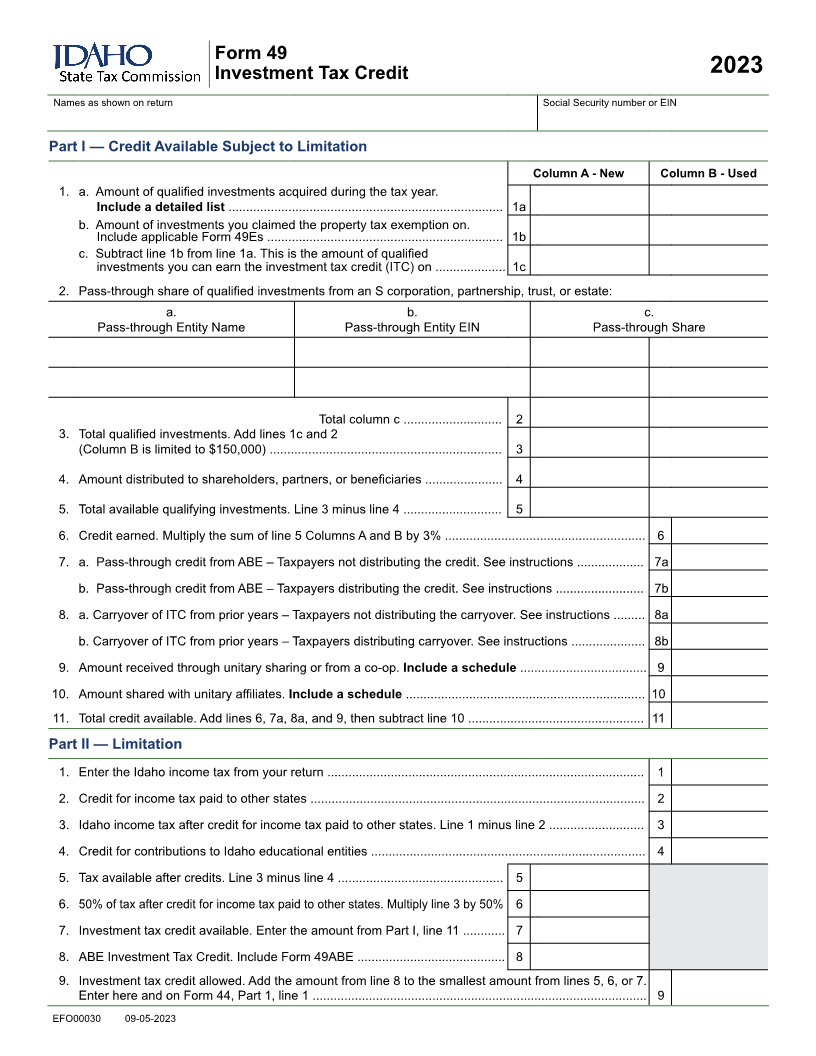

Form 49

Investment Tax Credit 2023

Names as shown on return Social Security number or EIN

Part I — Credit Available Subject to Limitation

Column A - New Column B - Used

1. a. Amount of qualified investments acquired during the tax year.

Include a detailed list .............................................................................. 1 a

b. Amount of investments you claimed the property tax exemption on.

Include applicable Form 49Es ................................................................... 1b

c. Subtract line 1b from line 1a. This is the amount of qualified

investments you can earn the investment tax credit (ITC) on .................... 1c

2. Pass-through share of qualified investments from an S corporation, partnership, trust, or estate:

a. b. c.

Pass-through Entity Name Pass-through Entity EIN Pass-through Share

Total column c ............................ 2

3. Total qualified investments. Add lines 1c and 2

(Column B is limited to $150,000) .................................................................. 3

4. Amount distributed to shareholders, partners, or beneficiaries ...................... 4

5. Total available qualifying investments. Line 3 minus line 4 ............................ 5

6. Credit earned. Multiply the sum of line 5 Columns A and B by 3% ......................................................... 6

7. a. Pass-through credit from ABE – Taxpayers not distributing the credit. See instructions ................... 7a

b. Pass-through credit from ABE – Taxpayers distributing the credit. See instructions ......................... 7 b

8. a. Carryover of ITC from prior years – Taxpayers not distributing the carryover. See instructions ......... 8a

b. Carryover of ITC from prior years – Taxpayers distributing carryover. See instructions ..................... 8 b

9. Amount received through unitary sharing or from a co-op. Include a schedule .................................... 9

10. Amount shared with unitary affiliates. Include a schedule .................................................................... 10

11. Total credit available. Add lines 6, 7a, 8a, and 9, then subtract line 10 .................................................. 11

Part II — Limitation

1. Enter the Idaho income tax from your return .......................................................................................... 1

2. Credit for income tax paid to other states ............................................................................................... 2

3. Idaho income tax after credit for income tax paid to other states. Line 1 minus line 2 ........................... 3

4. Credit for contributions to Idaho educational entities .............................................................................. 4

5. Tax available after credits. Line 3 minus line 4 ............................................... 5

6. 50% of tax after credit for income tax paid to other states. Multiply line 3 by 50% 6

7. Investment tax credit available. Enter the amount from Part I, line 11 ............ 7

8. ABE Investment Tax Credit. Include Form 49ABE .......................................... 8

9. Investment tax credit allowed. Add the amount from line 8 to the smallest amount from lines 5, 6, or 7.

Enter here and on Form 44, Part 1, line 1 ............................................................................................... 9

EFO00030 09-05-2023