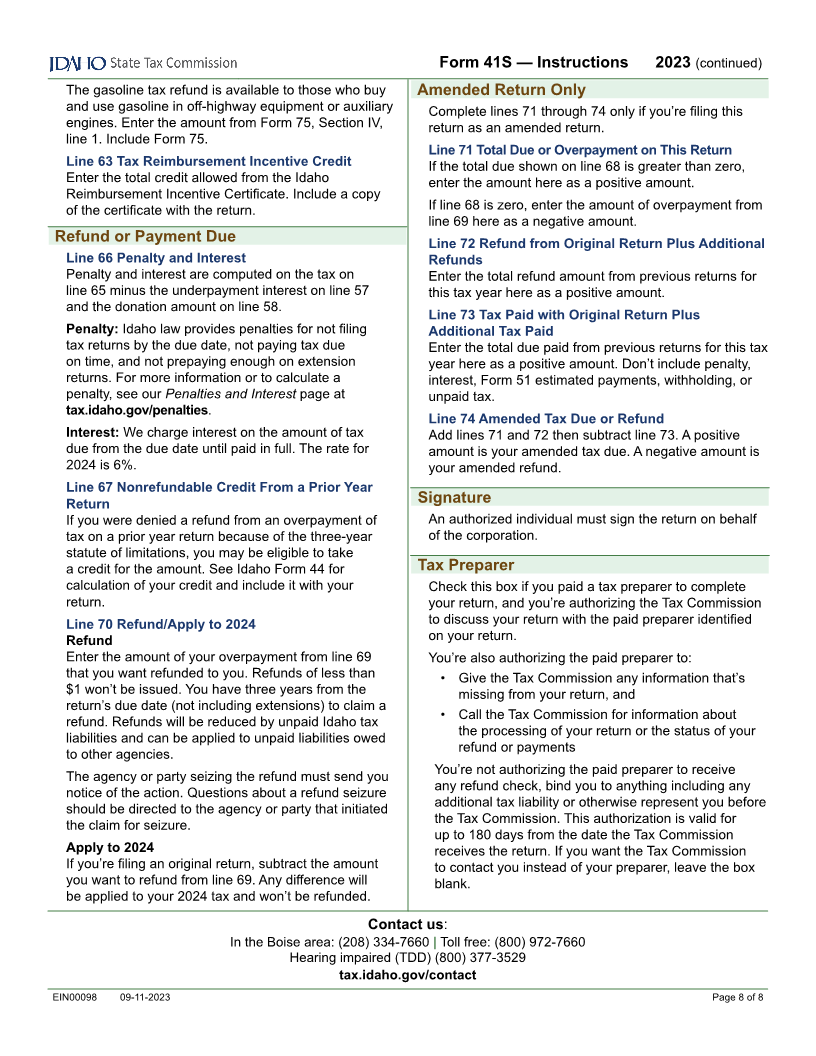

Enlarge image

Don’t Staple 8734

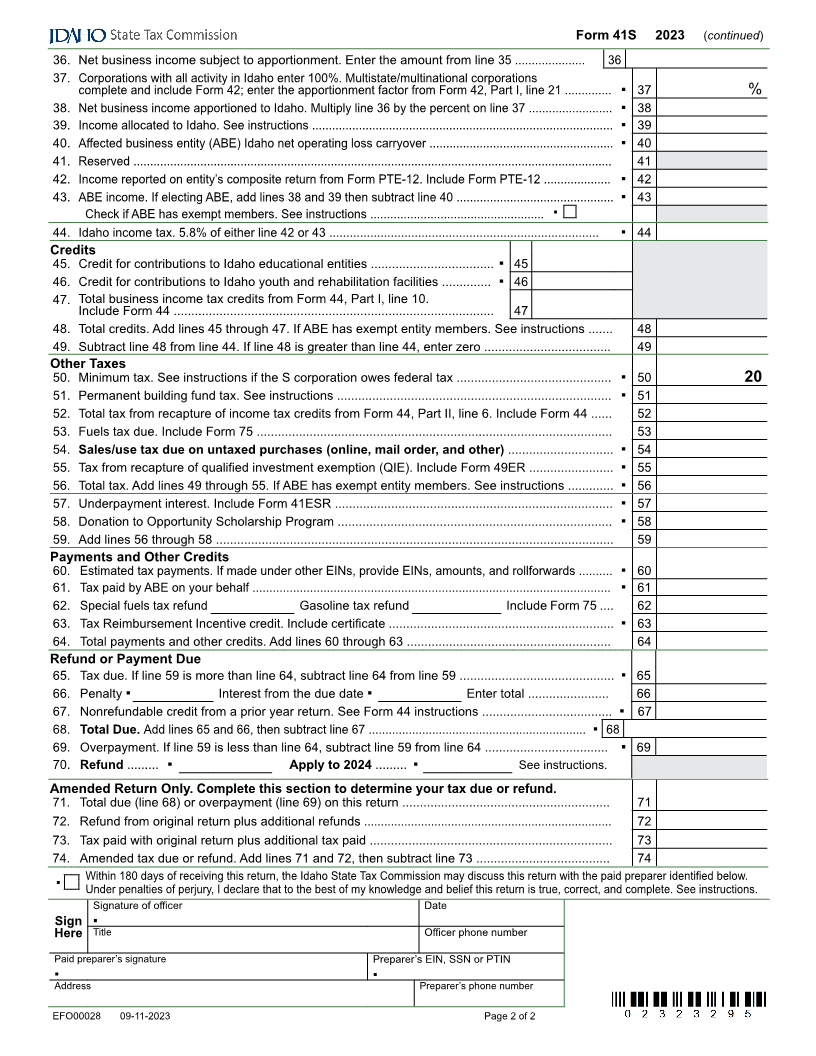

Form 41S 2023

S Corporation Income Tax Return

Amended Return? Check the box. See For calendar year State use only

Mo Day Year Mo Day Year

page 1 of the instructions for reasons to 2023 or fiscal

▪ amend and enter the number that applies. ▪ year beginning 23 ending

Business name State use only Federal Employer Identification Number (EIN)

Current business mailing address NAICS Code

▪

City State ZIP Code Foreign country (if not U.S.)

1. Check the type of return ▪ Regular ▪ Composite ▪ Affected business entity

2. If a federal audit was finalized this year, enter the latest year audited ...................... ▪

3. Is this an inactive corporation or nameholder corporation? ......................................................................... Yes ▪ No

4. a. Were federal estimated tax payments required? .................................................................................... Yes ▪ No

b. Were estimated tax payments based on annualized amounts? ............................................................. Yes ▪ No

5. Is this a final return? .................................................................................................................................... Yes ▪ No

If yes, check the proper box below and enter the date the event occurred

Withdrawn from Idaho Dissolved Merged or reorganized Enter new EIN

6. Is this an electrical or telephone utility? ....................................................................................................... Yes ▪ No

7. Did the ownership change during the year?................................................................................................ Yes ▪ No

8. Enter the amount of total qualified investments for investment tax credit acquired during this tax year ..... ▪

9. Enter the amount of broadband equipment investment credit earned this tax year .................................... ▪

10. Enter the amount of credit for Idaho research activities earned this tax year ............................................. ▪

11. Reserved .....................................................................................................................................................

12. Did you claim the property tax exemption for investment tax credit property acquired this tax year? ......... Yes ▪ No

Income

13. Ordinary income (loss). Form 1120S, page 1 ................................................................................ ▪ 13

14. Net income (loss) from rental real estate activities. Form 1120S, Schedule K .............................. ▪ 14

15. Net income (loss) from other rental activities. Form 1120S, Schedule K ....................................... ▪ 15

16. Portfolio income (loss). Form 1120S, Schedule K ......................................................................... ▪ 16

Don’t Staple 17. Other items. See instructions ........................................................................................................ ▪ 17

18. Net distributable income. Add lines 13 through 17 ........................................................................ 18

Additions

19. Interest and dividends not taxable under Internal Revenue Code. Include a schedule ............... ▪ 19

20. State, municipal, and local taxes measured by net income. Include a schedule .......................... ▪ 20

21. Bonus depreciation. Include a schedule ....................................................................................... ▪ 21

22. Other additions ............................................................................................................................. ▪ 22

23. Add lines 18 through 22 ................................................................................................................ 23

Subtractions

24. Interest from Idaho municipal securities ...................................................... ▪ 24

25. Interest on U.S. government obligations. Include a schedule ..................... ▪ 25

26. Interest and other expenses related to lines 24 and 25................................ ▪ 26

27. Add lines 24 and 25, then subtract line 26 .................................................................................... 27

28. Technological equipment donation ................................................................................................ ▪ 28

29. Allocated income. Include a schedule .......................................................... ▪ 29

30. Interest and other expenses related to line 29. Include a schedule ............. ▪ 30

31. Subtract line 30 from line 29 .......................................................................................................... 31

32. Bonus depreciation. Include a schedule ........................................................................................ ▪ 32

33. Other subtractions. See instructions .............................................................................................. ▪ 33

34. Total subtractions. Add lines 27, 28, 31, 32, and 33 ...................................................................... 34

35. Net business income subject to apportionment. Subtract line 34 from line 23 .............................. ▪ 35

Continue to page 2. —Include a complete copy of your federal Form 1120S.

Return and payment - Mail to: Idaho State Tax Commission, PO Box 83784 Boise ID 83707-3784

Return only - Mail to: Idaho State Tax Commission, PO Box 56, Boise, ID 83756-0056

EFO00028 09-11-2023 Page 1 of 2