Enlarge image

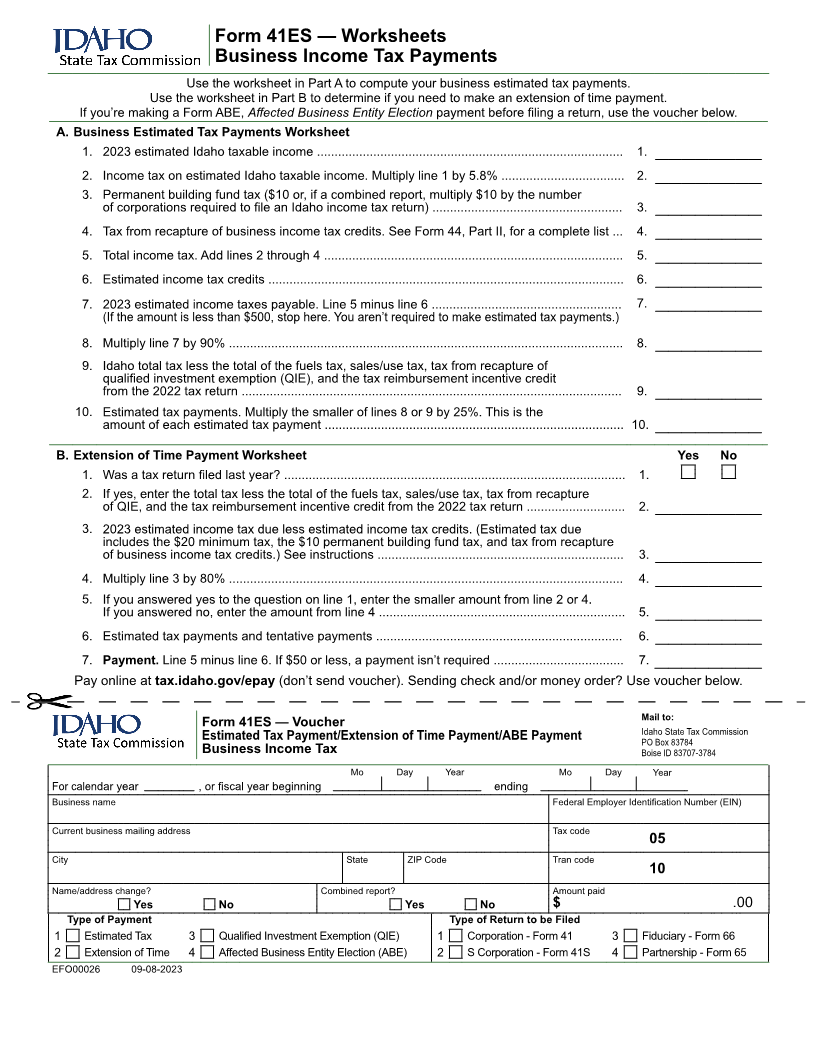

Form 41ES — Worksheets

Business Income Tax Payments

Use the worksheet in Part A to compute your business estimated tax payments.

Use the worksheet in Part B to determine if you need to make an extension of time payment.

If you’re making a Form ABE, Affected Business Entity Election payment before filing a return, use the voucher below.

A. Business Estimated Tax Payments Worksheet

1. 2023 estimated Idaho taxable income ....................................................................................... 1.

2. Income tax on estimated Idaho taxable income. Multiply line 1 by 5.8% ................................... 2.

3. Permanent building fund tax ($10 or, if a combined report, multiply $10 by the number

of corporations required to file an Idaho income tax return) ...................................................... 3.

4. Tax from recapture of business income tax credits. See Form 44, Part II, for a complete list ... 4.

5. Total income tax. Add lines 2 through 4 ..................................................................................... 5.

6. Estimated income tax credits ..................................................................................................... 6.

7. 2023 estimated income taxes payable. Line 5 minus line 6 ...................................................... 7.

(If the amount is less than $500, stop here. You aren’t required to make estimated tax payments.)

8. Multiply line 7 by 90% ................................................................................................................ 8.

9. Idaho total tax less the total of the fuels tax, sales/use tax, tax from recapture of

qualified investment exemption (QIE), and the tax reimbursement incentive credit

from the 2022 tax return ............................................................................................................ 9.

10. Estimated tax payments. Multiply the smaller of lines 8 or 9 by 25%. This is the

amount of each estimated tax payment ..................................................................................... 10.

B. Extension of Time Payment Worksheet Yes No

1. Was a tax return filed last year? ................................................................................................. 1.

2. If yes, enter the total tax less the total of the fuels tax, sales/use tax, tax from recapture

of QIE, and the tax reimbursement incentive credit from the 2022 tax return ............................ 2.

3. 2023 estimated income tax due less estimated income tax credits. (Estimated tax due

includes the $20 minimum tax, the $10 permanent building fund tax, and tax from recapture

of business income tax credits.) See instructions ...................................................................... 3.

4. Multiply line 3 by 80% ................................................................................................................ 4.

5. If you answered yes to the question on line 1, enter the smaller amount from line 2 or 4.

If you answered no, enter the amount from line 4 ...................................................................... 5.

6. Estimated tax payments and tentative payments ...................................................................... 6.

7. Payment. Line 5 minus line 6. If $50 or less, a payment isn’t required ..................................... 7.

Pay online at tax.idaho.gov/epay (don’t send voucher). Sending check and/or money order? Use voucher below.

Mail to:

Form 41ES — Voucher Idaho State Tax Commission

Estimated Tax Payment/Extension of Time Payment/ABE Payment PO Box 83784

Business Income Tax Boise ID 83707-3784

Mo Day Year Mo Day Year

For calendar year , or fiscal year beginning ending

Business name Federal Employer Identification Number (EIN)

Current business mailing address Tax code

05

City State ZIP Code Tran code

10

Name/address change? Combined report? Amount paid

Yes No Yes No $ .00

Type of Payment Type of Return to be Filed

1 Estimated Tax 3 Qualified Investment Exemption (QIE) 1 Corporation - Form 41 3 Fiduciary - Form 66

2 Extension of Time 4 Affected Business Entity Election (ABE) 2 S Corporation - Form 41S 4 Partnership - Form 65

EFO00026 09-08-2023