Enlarge image

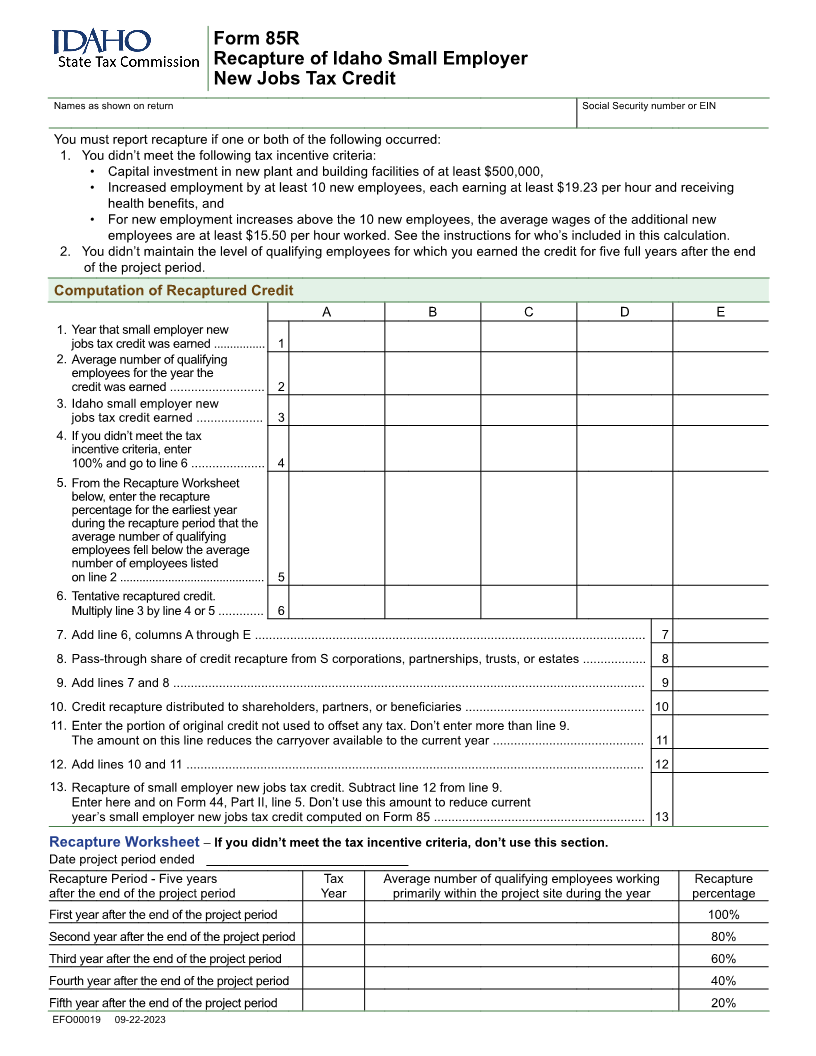

Form 85R

Recapture of Idaho Small Employer

New Jobs Tax Credit

Names as shown on return Social Security number or EIN

You must report recapture if one or both of the following occurred:

1. You didn’t meet the following tax incentive criteria:

• Capital investment in new plant and building facilities of at least $500,000,

• Increased employment by at least 10 new employees, each earning at least $19.23 per hour and receiving

health benefits, and

• For new employment increases above the 10 new employees, the average wages of the additional new

employees are at least $15.50 per hour worked. See the instructions for who’s included in this calculation.

2. You didn’t maintain the level of qualifying employees for which you earned the credit for five full years after the end

of the project period.

Computation of Recaptured Credit

A B C D E

1. Year that small employer new

jobs tax credit was earned ................ 1

2. Average number of qualifying

employees for the year the

credit was earned ........................... 2

3. Idaho small employer new

jobs tax credit earned ................... 3

4. If you didn’t meet the tax

incentive criteria, enter

100% and go to line 6 ..................... 4

5. From the Recapture Worksheet

below, enter the recapture

percentage for the earliest year

during the recapture period that the

average number of qualifying

employees fell below the average

number of employees listed

on line 2 ............................................. 5

6. Tentative recaptured credit.

Multiply line 3 by line 4 or 5 ............. 6

7. Add line 6, columns A through E ............................................................................................................... 7

8. Pass-through share of credit recapture from S corporations, partnerships, trusts, or estates .................. 8

9. Add lines 7 and 8 ...................................................................................................................................... 9

10. Credit recapture distributed to shareholders, partners, or beneficiaries ................................................... 10

11. Enter the portion of original credit not used to offset any tax. Don’t enter more than line 9.

The amount on this line reduces the carryover available to the current year ........................................... 11

12. Add lines 10 and 11 .................................................................................................................................. 12

13. Recapture of small employer new jobs tax credit. Subtract line 12 from line 9.

Enter here and on Form 44, Part II, line 5. Don’t use this amount to reduce current

year’s small employer new jobs tax credit computed on Form 85 ............................................................ 13

Recapture Worksheet – If you didn’t meet the tax incentive criteria, don’t use this section.

Date project period ended

Recapture Period - Five years Tax Average number of qualifying employees working Recapture

after the end of the project period Year primarily within the project site during the year percentage

First year after the end of the project period 100%

Second year after the end of the project period 80%

Third year after the end of the project period 60%

Fourth year after the end of the project period 40%

Fifth year after the end of the project period 20%

EFO00019 09-22-2023