Enlarge image

01

0000000000111111111122222222223333333333444444444455555555556666666666777777777788888

1234567890123456789012345678901234567890123456789012345678901234567890123456789012345

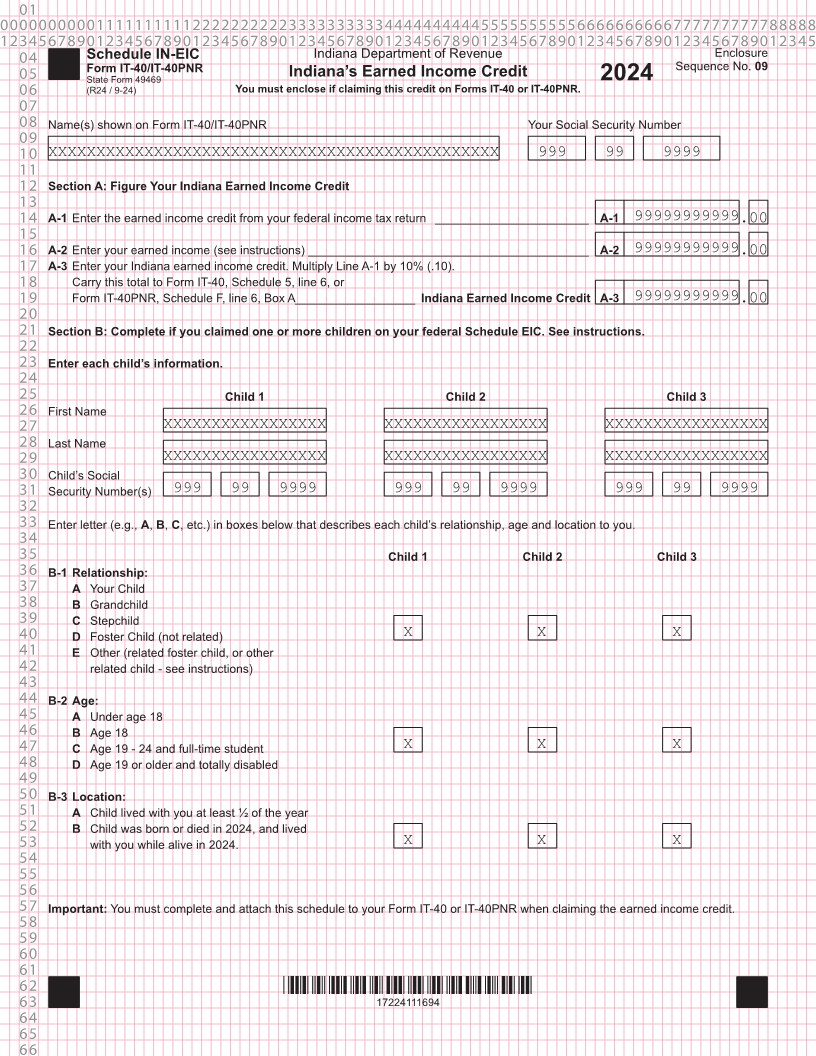

04 Schedule IN-EIC Indiana Department of Revenue Enclosure

05 Form IT-40/IT-40PNR Indiana’s Earned Income Credit Sequence No. 09

State Form 49469 2024

06 (R24 / 9-24) You must enclose if claiming this credit on Forms IT-40 or IT-40PNR.

07

08 Name(s) shown on Form IT-40/IT-40PNR Your Social Security Number

09

10 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 999 99 9999

11

12 Section A: Figure Your Indiana Earned Income Credit

13

14 A-1 Enter the earned income credit from your federal income tax return _______________________ A-1 99999999999.00

15

16 A-2 Enter your earned income (see instructions) __________________________________________ A-2 99999999999.00

17 A-3 Enter your Indiana earned income credit. Multiply Line A-1 by 10% (.10).

18 Carry this total to Form IT-40, Schedule 5, line 6, or

19 Form IT-40PNR, Schedule F, line 6, Box A __________________Indiana Earned Income Credit A-3 99999999999.00

20

21 Section B: Complete if you claimed one or more children on your federal Schedule EIC. See instructions.

22

23 Enter each child’s information.

24

25 Child 1 Child 2 Child 3

26 First Name

27 XXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXX

28 Last Name

29 XXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXX

30 Child’s Social

31 Security Number(s) 999 99 9999 999 99 9999 999 99 9999

32

33 Enter letter (e.g., A, B, ,Cetc.) in boxes below that describes each child’s relationship, age and location to you.

34

35 Child 1 Child 2 Child 3

36 B-1 Relationship:

37 A Your Child

38 B Grandchild

39 C Stepchild

40 D Foster Child (not related) X X X

41 E Other (related foster child, or other

42 related child - see instructions)

43

44 B-2 Age:

45 A Under age 18

46 B Age 18

47 C Age 19 - 24 and full-time student X X X

48 D Age 19 or older and totally disabled

49

50 B-3 Location:

51 A Child lived with you at least ½ of the year

52 B Child was born or died in 2024, and lived

53 with you while alive in 2024. X X X

54

55

56

57 Important: You must complete and attach this schedule to your Form IT-40 or IT-40PNR when claiming the earned income credit.

58

59

60

61

62 *17224111694*

63 17224111694

64

65

66