Enlarge image

01

0000000000111111111122222222223333333333444444444455555555556666666666777777777788888

1234567890123456789012345678901234567890123456789012345678901234567890123456789012345

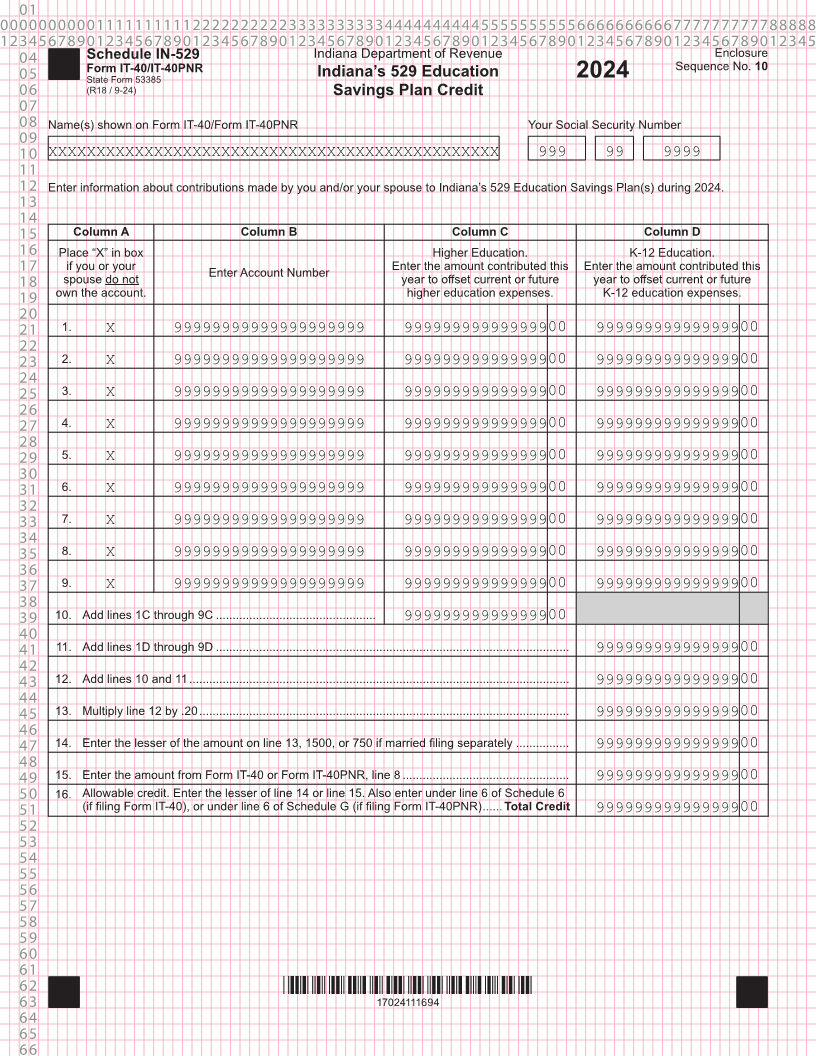

04 Schedule IN-529 Indiana Department of Revenue Enclosure

05 Form IT-40/IT-40PNR Indiana’s 529 Education Sequence No. 10

State Form 53385 2024

06 (R18 / 9-24) Savings Plan Credit

07

08 Name(s) shown on Form IT-40/Form IT-40PNR Your Social Security Number

09

10 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 999 99 9999

11

12 Enter information about contributions made by you and/or your spouse to Indiana’s 529 Education Savings Plan(s) during 2024.

13

14

15 Column A Column B Column C Column D

16 Place “X” in box Higher Education. K-12 Education.

17 if you or your Enter the amount contributed this Enter the amount contributed this

Enter Account Number

18 spouse do not year to offset current or future year to offset current or future

19 own the account. higher education expenses. K-12 education expenses.

20

21 1. X 99999999999999999999 99999999999999900 99999999999999900

22

23 2. X 99999999999999999999 99999999999999900 99999999999999900

24

25 3. X 99999999999999999999 99999999999999900 99999999999999900

26

27 4. X 99999999999999999999 99999999999999900 99999999999999900

28

29 5. X 99999999999999999999 99999999999999900 99999999999999900

30

31 6. X 99999999999999999999 99999999999999900 99999999999999900

32

33 7. X 99999999999999999999 99999999999999900 99999999999999900

34

35 8. X 99999999999999999999 99999999999999900 99999999999999900

36

37 9. X 99999999999999999999 99999999999999900 99999999999999900

38

39 10. Add lines 1C through 9C ................................................ 99999999999999900

40

41 11. Add lines 1D through 9D .......................................................................................................... 99999999999999900

42

43 12. Add lines 10 and 11 .................................................................................................................. 99999999999999900

44

45 13. Multiply line 12 by .20 ............................................................................................................... 99999999999999900

46

47 14. Enter the lesser of the amount on line 13, 1500, or 750 if married filing separately ................ 99999999999999900

48

49 15. Enter the amount from Form IT-40 or Form IT-40PNR, line 8 .................................................. 99999999999999900

50 16. Allowable credit. Enter the lesser of line 14 or line 15. Also enter under line 6 of Schedule 6

51 (if filing Form IT-40), or under line 6 of Schedule G (if filing Form IT-40PNR) ...... Total Credit 99999999999999900

52

53

54

55

56

57

58

59

60

61

62 *17024111694*

63 17024111694

64

65

66