Enlarge image

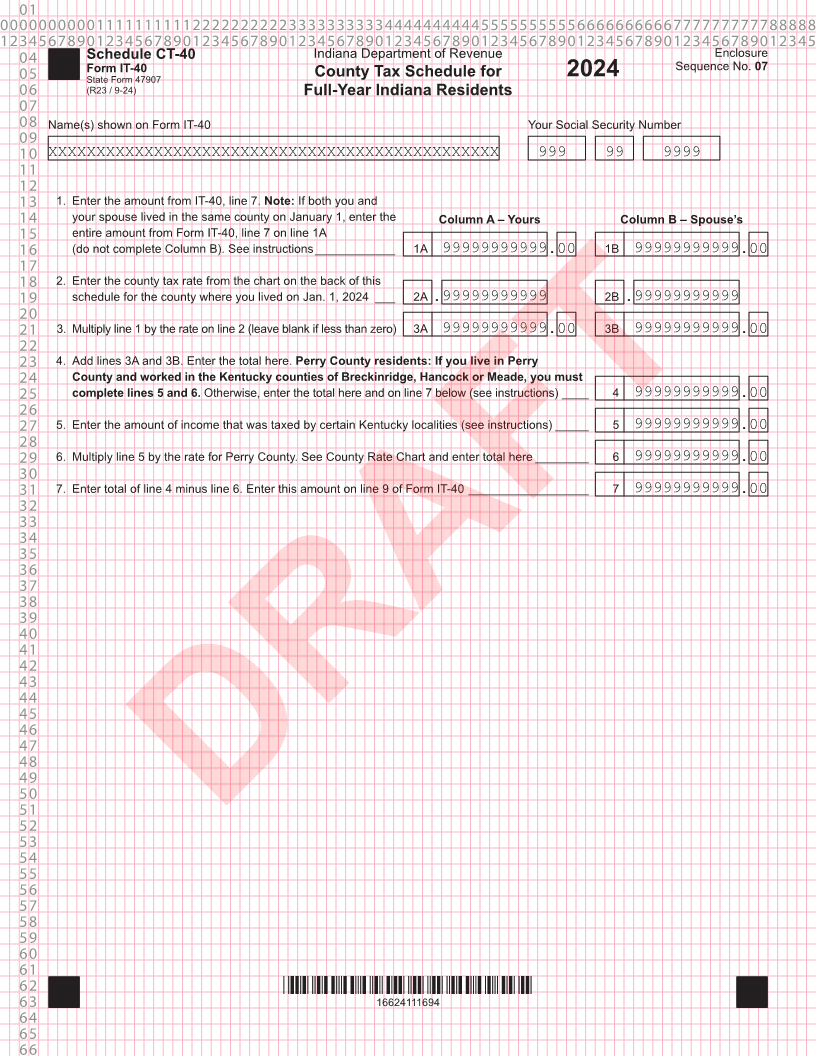

01 0000000000111111111122222222223333333333444444444455555555556666666666777777777788888 1234567890123456789012345678901234567890123456789012345678901234567890123456789012345 04 Schedule CT-40 Indiana Department of Revenue Enclosure 05 Form IT-40 County Tax Schedule for Sequence No. 07 State Form 47907 2024 06 (R23 / 9-24) Full-Year Indiana Residents 07 08 Name(s) shown on Form IT-40 Your Social Security Number 09 10 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 999 99 9999 11 12 13 1. Enter the amount from IT-40, line 7. Note: If both you and 14 your spouse lived in the same county on January 1, enter the Column A – Yours Column B – Spouse’s 15 entire amount from Form IT-40, line 7 on line 1A 16 (do not complete Column B). See instructions ____________ 1A 99999999999.00 1B 99999999999.00 17 18 2. Enter the county tax rate from the chart on the back of this 19 schedule for the county where you lived on Jan. 1, 2024 ___ 2A . 99999999999 2B .99999999999 20 21 3. Multiply line 1 by the rate on line 2 (leave blank if less than zero) 3A 99999999999.00 3B 99999999999.00 22 23 4. Add lines 3A and 3B. Enter the total here. Perry County residents: If you live in Perry 24 County and worked in the Kentucky counties of Breckinridge, Hancock or Meade, you must 25 complete lines 5 and 6. Otherwise, enter the total here and on line 7 below (see instructions) ____ 4 99999999999.00 26 27 5. Enter the amount of income that was taxed by certain Kentucky localities (see instructions) _____ 5 99999999999.00 28 29 6. Multiply line 5 by the rate for Perry County. See County Rate Chart and enter total here ________ 6 99999999999.00 30 31 7. Enter total of line 4 minus line 6. Enter this amount on line 9 of Form IT-40 __________________ 7 99999999999.00 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 DRAFT 55 56 57 58 59 60 61 62 *16624111694* 63 16624111694 64 65 66