- 2 -

Enlarge image

|

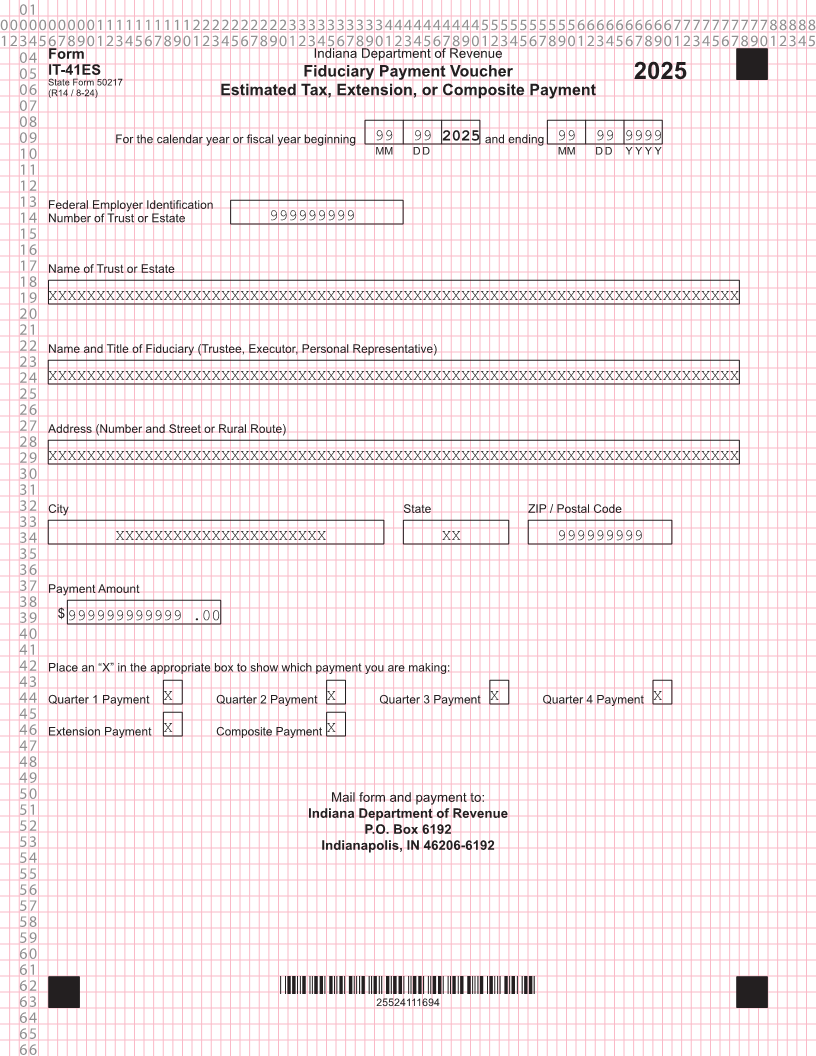

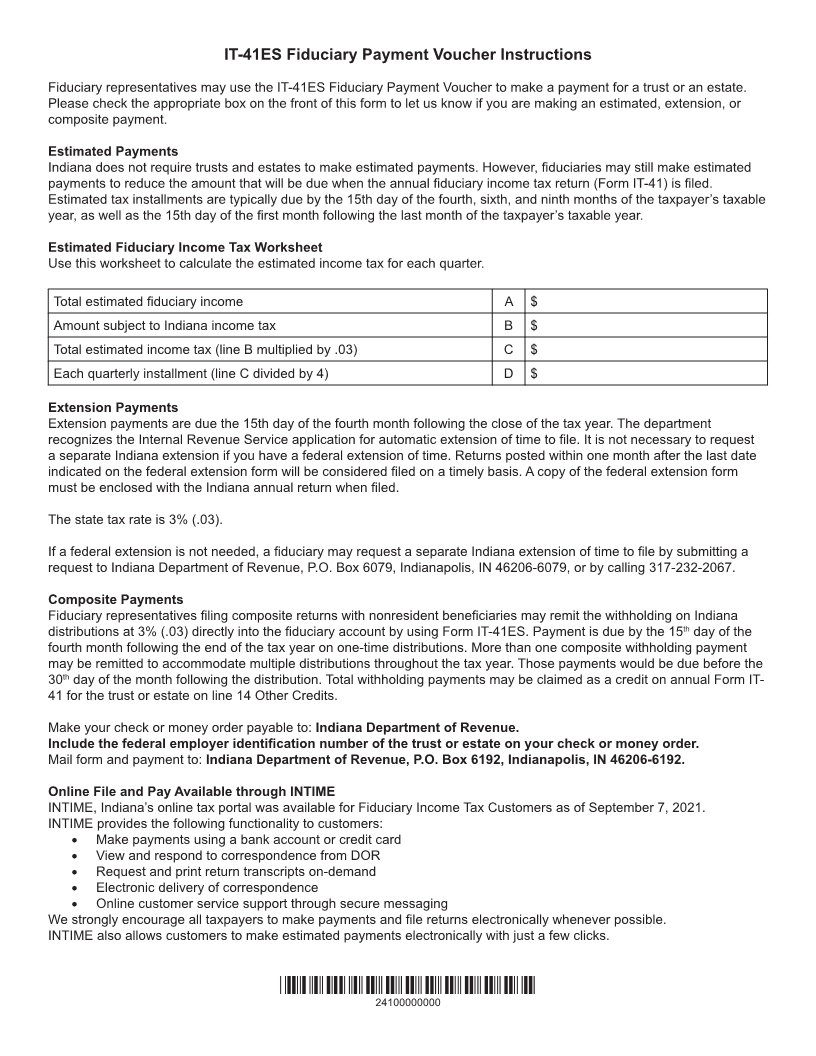

IT-41ES Fiduciary Payment Voucher Instructions

Fiduciary representatives may use the IT-41ES Fiduciary Payment Voucher to make a payment for a trust or an estate.

Please check the appropriate box on the front of this form to let us know if you are making an estimated, extension, or

composite payment.

Estimated Payments

Indiana does not require trusts and estates to make estimated payments. However, fiduciaries may still make estimated

payments to reduce the amount that will be due when the annual fiduciary income tax return (Form IT-41) is filed.

Estimated tax installments are typically due by the 15th day of the fourth, sixth, and ninth months of the taxpayer’s taxable

year, as well as the 15th day of the first month following the last month of the taxpayer’s taxable year.

Estimated Fiduciary Income Tax Worksheet

Use this worksheet to calculate the estimated income tax for each quarter.

Total estimated fiduciary income A $

Amount subject to Indiana income tax B $

Total estimated income tax (line B multiplied by .03) C $

Each quarterly installment (line C divided by 4) D $

Extension Payments

Extension payments are due the 15th day of the fourth month following the close of the tax year. The department

recognizes the Internal Revenue Service application for automatic extension of time to file. It is not necessary to request

a separate Indiana extension if you have a federal extension of time. Returns posted within one month after the last date

indicated on the federal extension form will be considered filed on a timely basis. A copy of the federal extension form

must be enclosed with the Indiana annual return when filed.

The state tax rate is 3% (.03).

If a federal extension is not needed, a fiduciary may request a separate Indiana extension of time to file by submitting a

request to Indiana Department of Revenue, P.O. Box 6079, Indianapolis, IN 46206-6079, or by calling 317-232-2067.

Composite Payments

Fiduciary representatives filing composite returns with nonresident beneficiaries may remit the withholding on Indiana

distributions at 3% (.03) directly into the fiduciary account by using Form IT-41ES. Payment is due by the 15th day of the

fourth month following the end of the tax year on one-time distributions. More than one composite withholding payment

may be remitted to accommodate multiple distributions throughout the tax year. Those payments would be due before the

30th day of the month following the distribution. Total withholding payments may be claimed as a credit on annual Form IT-

41 for the trust or estate on line 14 Other Credits.

Make your check or money order payable to: Indiana Department of Revenue.

Include the federal employer identification number of the trust or estate on your check or money order.

Mail form and payment to: Indiana Department of Revenue, P.O. Box 6192, Indianapolis, IN 46206-6192.

Online File and Pay Available through INTIME

INTIME, Indiana’s online tax portal was available for Fiduciary Income Tax Customers as of September 7, 2021.

INTIME provides the following functionality to customers:

• Make payments using a bank account or credit card

• View and respond to correspondence from DOR

• Request and print return transcripts on-demand

• Electronic delivery of correspondence

• Online customer service support through secure messaging

We strongly encourage all taxpayers to make payments and file returns electronically whenever possible.

INTIME also allows customers to make estimated payments electronically with just a few clicks.

*24100000000*

24100000000

|