Enlarge image

01

0000000000111111111122222222223333333333444444444455555555556666666666777777777788888

1234567890123456789012345678901234567890123456789012345678901234567890123456789012345

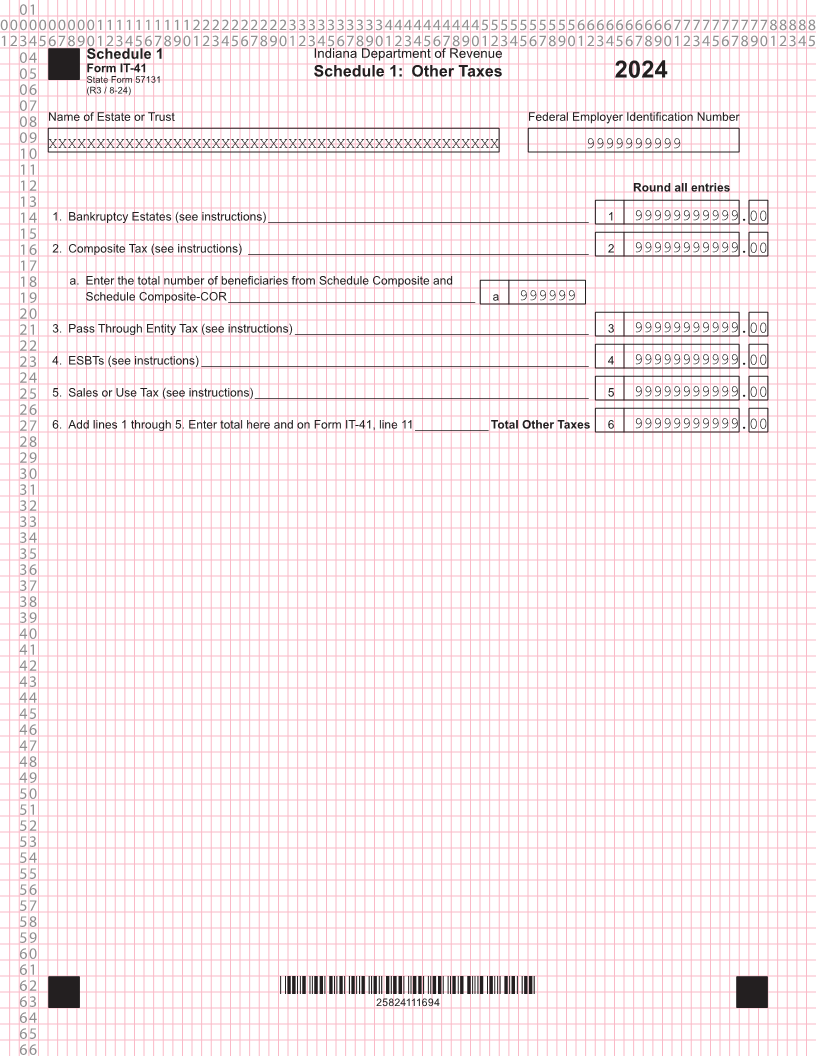

04 Schedule 1 Indiana Department of Revenue

05 Form IT-41 Schedule 1: Other Taxes

State Form 57131 2024

06 (R3 / 8-24)

07

08 Name of Estate or Trust Federal Employer Identification Number

09

10 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 9999999999

11

12 Round all entries

13

14 1. Bankruptcy Estates (see instructions) ________________________________________________ 1 99999999999.00

15

16 2. Composite Tax (see instructions) ___________________________________________________ 2 99999999999.00

17

18 a. Enter the total number of beneficiaries from Schedule Composite and

19 Schedule Composite-COR _____________________________________ a 999999

20

21 3. Pass Through Entity Tax (see instructions) ____________________________________________ 3 99999999999.00

22

23 4. ESBTs (see instructions) __________________________________________________________ 4 99999999999.00

24

25 5. Sales or Use Tax (see instructions) __________________________________________________ 5 99999999999.00

26

27 6. Add lines 1 through 5. Enter total here and on Form IT-41, line 11 ___________ Total Other Taxes 6 99999999999.00

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62 *25824111694*

63 25824111694

64

65

66