Enlarge image

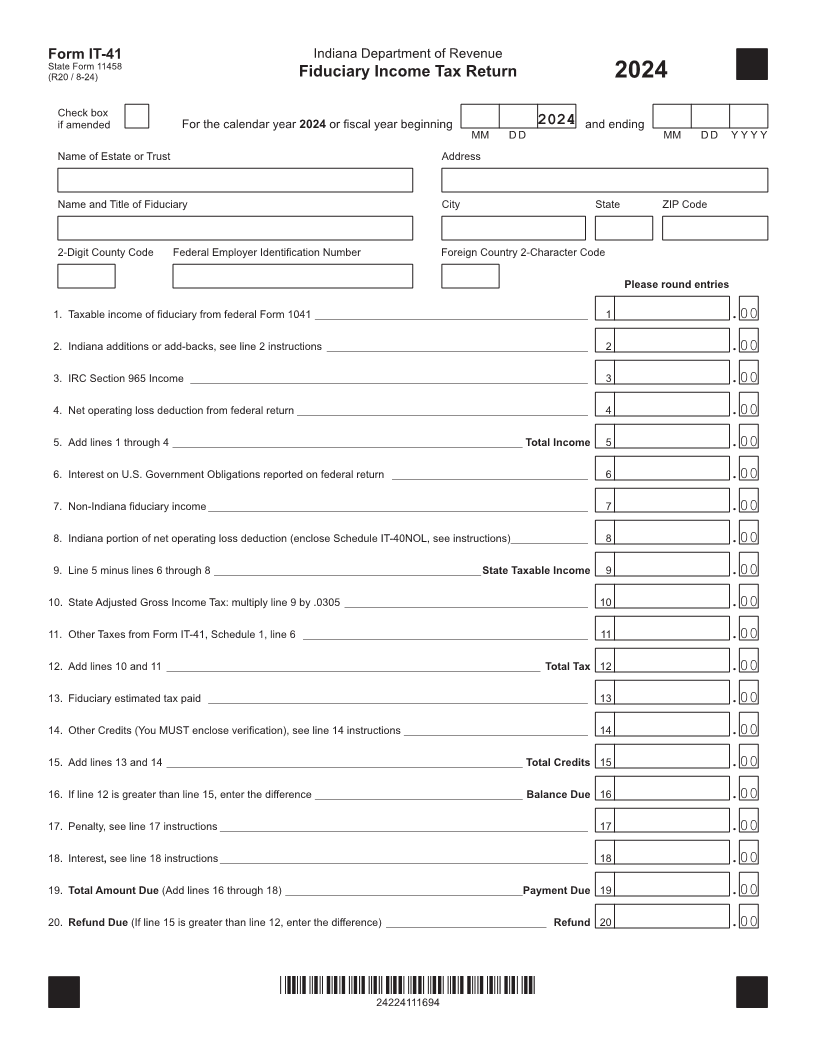

Form IT-41 Indiana Department of Revenue

State Form 11458

(R20 / 8-24) Fiduciary Income Tax Return 2024

Check box

if amended For the calendar year 2024 or fiscal year beginning 2024 and ending

MM D D MM D D Y Y Y Y

Name of Estate or Trust Address

Name and Title of Fiduciary City State ZIP Code

2-Digit County Code Federal Employer Identification Number Foreign Country 2-Character Code

Please round entries

1. Taxable income of fiduciary from federal Form 1041 ______________________________________________ 1 .00

2. Indiana additions or add-backs, see line 2 instructions ____________________________________________ 2 .00

3. IRC Section 965 Income ___________________________________________________________________ 3 .00

4. Net operating loss deduction from federal return _________________________________________________ 4 .00

5. Add lines 1 through 4 ___________________________________________________________ Total Income 5 .00

6. Interest on U.S. Government Obligations reported on federal return _________________________________ 6 .00

7. Non-Indiana fiduciary income ________________________________________________________________ 7 .00

8. Indiana portion of net operating loss deduction (enclose Schedule IT-40NOL, see instructions) _____________ 8 .00

9. Line 5 minus lines 6 through 8 _____________________________________________ State Taxable Income 9 .00

10. State Adjusted Gross Income Tax: multiply line 9 by .0305 _________________________________________ 10 .00

11. Other Taxes from Form IT-41, Schedule 1, line 6 ________________________________________________ 11 .00

12. Add lines 10 and 11 _______________________________________________________________ Total Tax 12 .00

13. Fiduciary estimated tax paid ________________________________________________________________ 13 .00

14. Other Credits (You MUST enclose verification), see line 14 instructions _______________________________ 14 .00

15. Add lines 13 and 14 ____________________________________________________________ Total Credits 15 .00

16. If line 12 is greater than line 15, enter the difference ___________________________________ Balance Due 16 .00

17. Penalty, see line 17 instructions ______________________________________________________________ 17 .00

18. Interest ,see line 18 instructions ______________________________________________________________ 18 .00

19. Total Amount Due (Add lines 16 through 18) ________________________________________ Payment Due 19 .00

20. Refund Due (If line 15 is greater than line 12, enter the difference) ___________________________ Refund 20 .00

*24224111694*

24224111694