Enlarge image

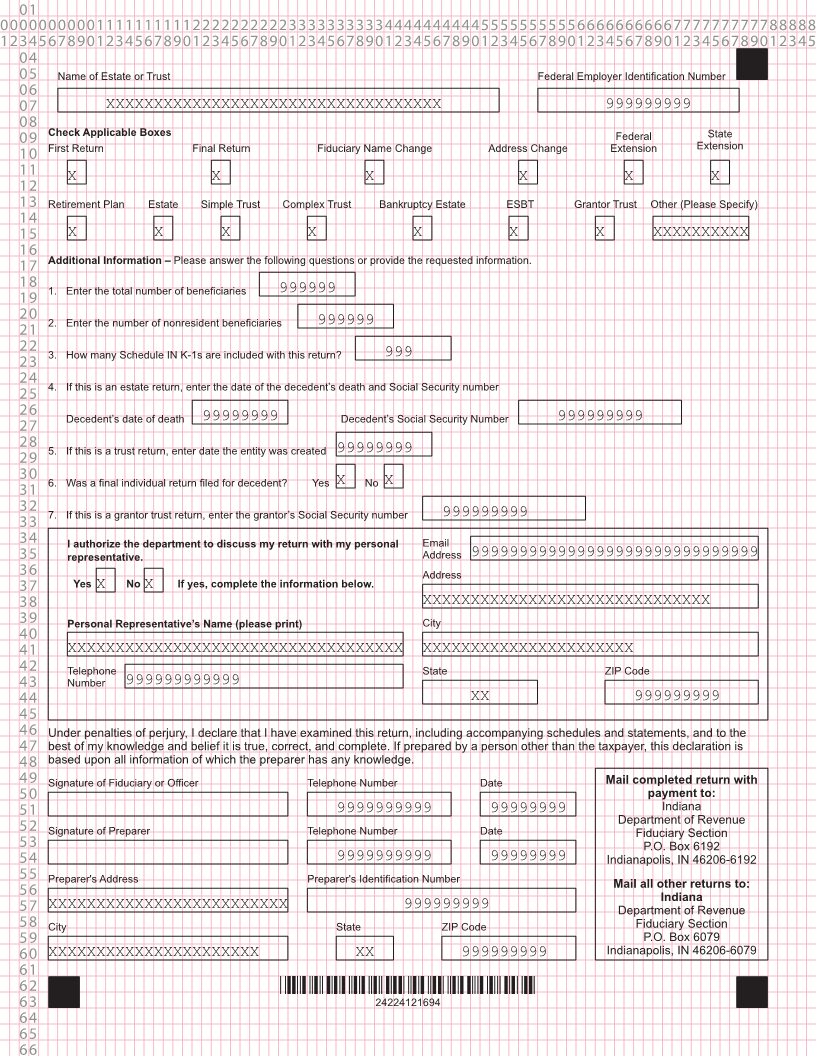

01 0000000000111111111122222222223333333333444444444455555555556666666666777777777788888 1234567890123456789012345678901234567890123456789012345678901234567890123456789012345 04 Form IT-41 Indiana Department of Revenue State Form 11458 05 (R20 / 8-24) Fiduciary Income Tax Return 2024 06 07 Check box 08 if amended X For the calendar year 2024 or fiscal year beginning 99 99 2024 and ending 99 99 9999 09 MM D D MM D D Y Y Y Y 10 Name of Estate or Trust Address 11 12 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 13 Name and Title of Fiduciary City State ZIP Code 14 15 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXX XX 999999999 16 2-Digit County Code Federal Employer Identification Number Foreign Country 2-Character Code 17 18 XX 999999999 XX Please round entries 19 20 1. Taxable income of fiduciary from federal Form 1041 ______________________________________________ 1 99999999999.00 21 22 2. Indiana additions or add-backs, see line 2 instructions ____________________________________________ 2 99999999999.00 23 24 3. IRC Section 965 Income ___________________________________________________________________ 3 99999999999.00 25 26 4. Net operating loss deduction from federal return _________________________________________________ 4 99999999999.00 27 28 5. Add lines 1 through 4 ___________________________________________________________ Total Income 5 99999999999.00 29 30 6. Interest on U.S. Government Obligations reported on federal return _________________________________ 6 99999999999.00 31 32 7. Non-Indiana fiduciary income ________________________________________________________________ 7 99999999999.00 33 34 8. Indiana portion of net operating loss deduction (enclose Schedule IT-40NOL, see instructions) _____________ 8 99999999999.00 35 36 9. Line 5 minus lines 6 through 8 _____________________________________________ State Taxable Income 9 99999999999.00 37 38 10. State Adjusted Gross Income Tax: multiply line 9 by .0305 _________________________________________ 10 99999999999.00 39 40 11. Other Taxes from Form IT-41, Schedule 1, line 6 ________________________________________________ 11 99999999999.00 41 42 12. Add lines 10 and 11 _______________________________________________________________ Total Tax 12 99999999999.00 43 44 13. Fiduciary estimated tax paid ________________________________________________________________ 13 99999999999.00 45 46 14. Other Credits (You MUST enclose verification), see line 14 instructions _______________________________ 14 99999999999.00 47 48 15. Add lines 13 and 14 ____________________________________________________________ Total Credits 15 99999999999.00 49 50 16. If line 12 is greater than line 15, enter the difference ___________________________________ Balance Due 16 99999999999.00 51 52 17. Penalty, see line 17 instructions ______________________________________________________________ 17 99999999999.00 53 54 18. Interest ,see line 18 instructions ______________________________________________________________ 18 99999999999.00 55 56 19. Total Amount Due (Add lines 16 through 18) ________________________________________ Payment Due 19 99999999999.00 57 58 20. Refund Due (If line 15 is greater than line 12, enter the difference) ___________________________ Refund 20 99999999999.00 59 60 61 62 *24224111694* 63 24224111694 64 65 66