Enlarge image

01

0000000000111111111122222222223333333333444444444455555555556666666666777777777788888

1234567890123456789012345678901234567890123456789012345678901234567890123456789012345

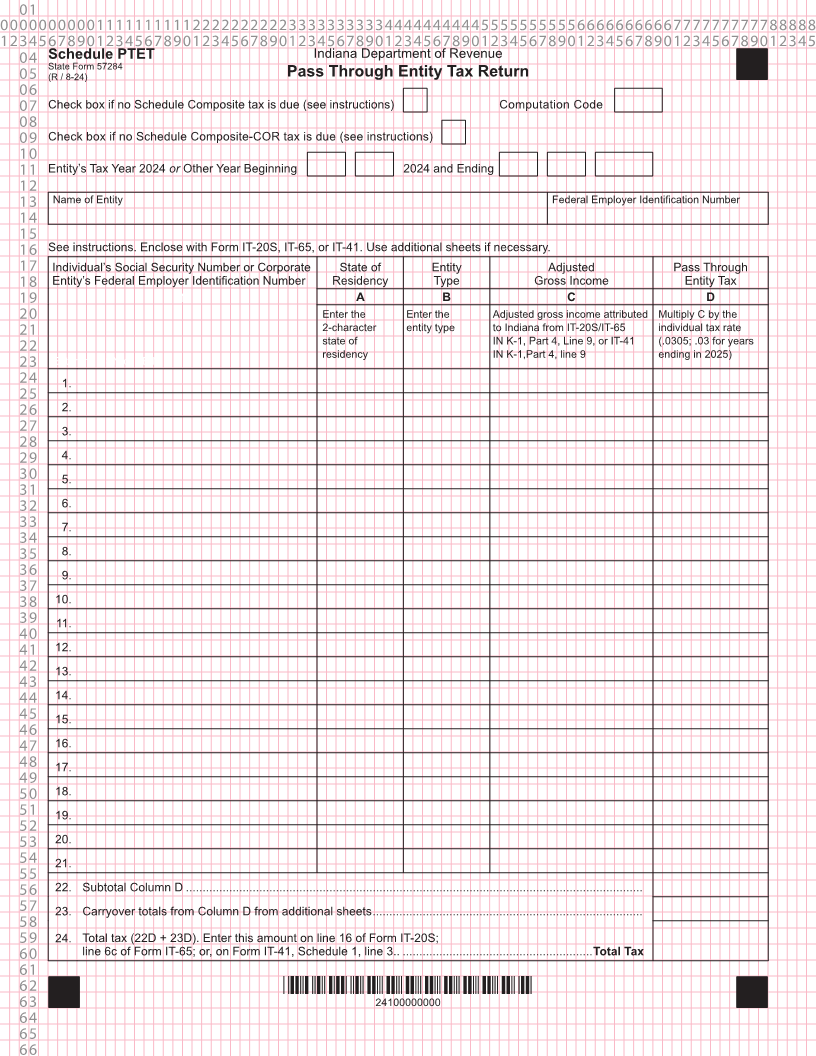

04 Schedule PTET Indiana Department of Revenue

State Form 57284

05 (R / 8-24) Pass Through Entity Tax Return

06

07 Check box if no Schedule Composite tax is due (see instructions) Computation Code

08

09 Check box if no Schedule Composite-COR tax is due (see instructions)

10

11 Entity’s Tax Year 2024 or Other Year Beginning 2024 and Ending

12

13 Name of Entity Federal Employer Identification Number

14

15

16 See instructions. Enclose with Form IT-20S, IT-65, or IT-41. Use additional sheets if necessary.

17 Individual’s Social Security Number or Corporate State of Entity Adjusted Pass Through

18 Entity’s Federal Employer Identification Number Residency Type Gross Income Entity Tax

19 1 A B C D

20 Enter the Enter the Adjusted gross income attributed Multiply C by the

21 2-character entity type to Indiana from IT-20S/IT-65 individual tax rate

state of IN K-1, Part 4, Line 9, or IT-41 (.0305; .03 for years

22 residency IN K-1,Part 4, line 9 ending in 2025)

23 Enter the SSN or FEIN

24 1.

25

26 2.

27 3.

28

29 4.

30 5.

31

32 6.

33 7.

34

35 8.

36 9.

37

38 10.

39 11.

40

41 12.

42 13.

43

44 14.

45 15.

46

47 16.

48 17.

49

50 18.

51 19.

52

53 20.

54 21.

55

56 22. Subtotal Column D .........................................................................................................................................

57 23. Carryover totals from Column D from additional sheets .................................................................................

58

59 24. Total tax (22D + 23D). Enter this amount on line 16 of Form IT-20S;

60 line 6c of Form IT-65; or, on Form IT-41, Schedule 1, line 3.. .........................................................Total Tax

61

62 *24100000000*

63 24100000000

64

65

66