- 4 -

Enlarge image

|

I. An agreement is on file with the department allowing an 3. apportioned the items of income that corresponded to the

alternative method of allocation or apportionment under the expense as required under Indiana law.

adjusted gross income tax statute; or

C. The interest expense corresponded to an item of income for a

J. The department has determined, after the taxpayer’s petition, recipient that:

that the adjustment is unnecessary. 1. was subject to a net income tax, a franchise tax

measured by net income, or a value added tax in a state

K. No exception under Indiana law applies. Enter the amount or possession of the U.S or in a country other than the

reported in Column H in Column I. U.S. that is its commercial domicile.

2. included the corresponding items of income within the

Column H. Enter the amount paid, accrued, or incurred recipient’s income that is subject to tax in that state or

(expensed). Round all entries to the nearest whole dollar. possession of the U.S or in a country other than the U.S.;

3. resulted from transactions made at a commercially

Column I. Enter the amount required to be added back. This is reasonable rate that is comparable to an arm’s length

the amount in Column H that does not meet an exception. Round transaction; and

all entries to the nearest whole dollar. 4. resulted from transactions that did not have Indiana tax

avoidance as a principal purpose.

Report the total from Column I on Form IT-20, lines 4-10, as add-

back code 140. D. The items of income corresponding to the interest expense:

1. resulted from transactions with recipient’s on terms

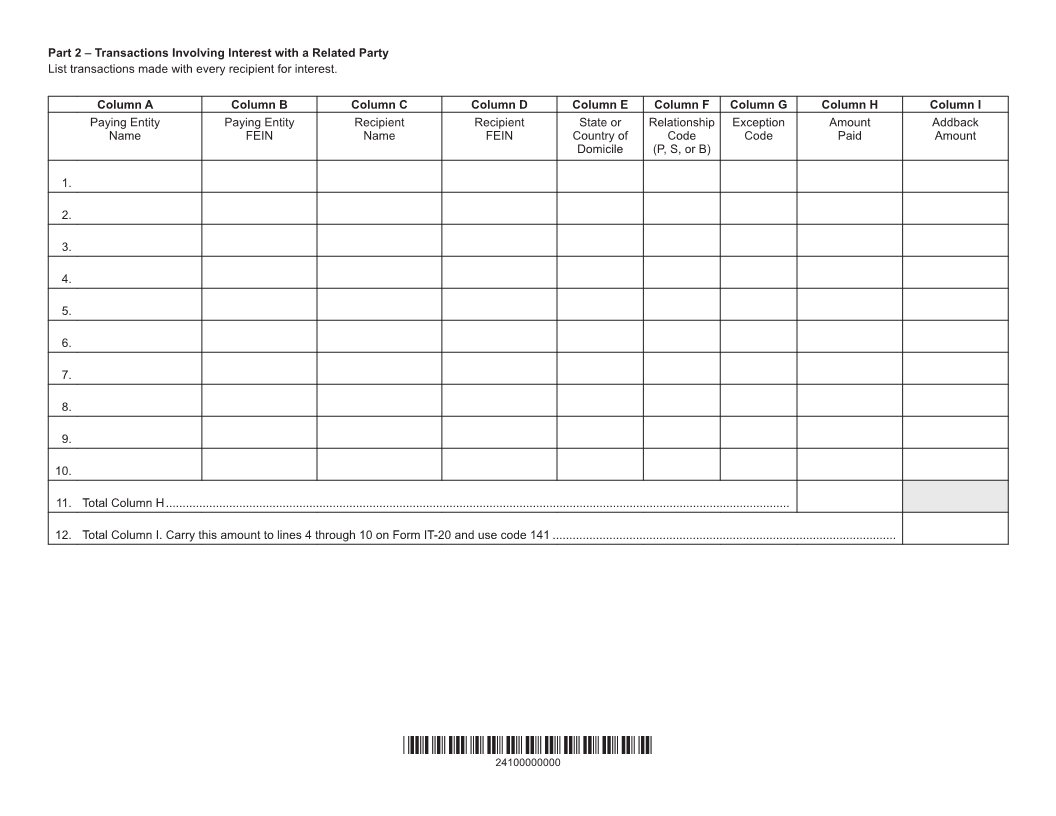

Part 2 – Transactions Involving Interest with a Related Party substantially similar to transactions in which the recipient

Provide the following information on all related transactions made regularly engages in with one or more unrelated parties.

with a recipient member of the same affiliated group or a foreign 2. resulted from transactions that did not have Indiana tax

corporation involving a directly related interest expenses. avoidance as a principal purpose.

Column A. Enter the name of the paying entity (This should E. The interest expense relates to an amount paid to the

be the filing entity or a member of the filer’s consolidated or recipient that:

combined return). 1. was made on the behalf of an unrelated party;

2. was paid at an arm’s length rate; and

Column B. Enter the Federal Employer Identification Number 3. resulted from transactions that did not have Indiana tax

(FEIN) of the paying entity. avoidance as a principal purpose.

Column C. Enter the name of the recipient. F. The interest expense related to an amount paid to the

recipient that:

Column D. Enter the FEIN of the recipient. If the recipient does 1. was for an amount that was received by the taxpayer

not have an FEIN, leave blank. from an unrelated party and was paid to the recipient on

behalf of that unrelated party;

Column E. Enter the state or country of domicile of the recipient. 2. resulted from transactions made at a commercially

reasonable rate that is comparable to an arm’s length

Column F. Enter the relationship of the recipient entity to the transaction; and

paying entity: 3. resulted from transactions that did not have Indiana tax

P – Parent avoidance as a principal purpose.

S – Subsidiary

B – Brother/Sister G. The interest expense related to an amount paid to the

recipient that:

Column G – Exception Code. Indiana statutes provide for 1. was equal to or greater than an amount that the recipient

exceptions to adding back interest expenses deducted for federal paid, accrued, or incurred, to an unrelated party in

tax purposes. Enter the letter corresponding to the appropriate connection with the same property giving rise to the

exception or enter “K” if no exception applies. Do not leave this expense; and

column blank. You must enter a letter from A through K. 2. resulted from transactions that did not have Indiana tax

A. The taxpayer and all interest income recipients, for the avoidance as a principal purpose.

purposes of the add-back requirement for line 6b of the

return, are included in the same consolidated or combined H. The interest expense related to an amount paid to a recipient

Indiana return, or an Indiana financial institutions tax return. that:

1. maintained a permanent office space with an adequate

B. The interest expense corresponded to an item of income for a number of full-time experienced employees to engage

recipient that: in substantial business activities either from acquisition,

1. was subject to financial institutions tax in Indiana; use, or disposition of intangible property, or from other

2. filed an Indiana financial institutions tax return in Indiana; activities separate and apart from the intangible property;

and

|