Enlarge image

01

00000000001111111111222222222233333333334444444444555555555566666666667777777777888888888899999999990000000000

12345678901234567890123456789012345678901234567890123456789012345678901234567890123456789012345678901234567890

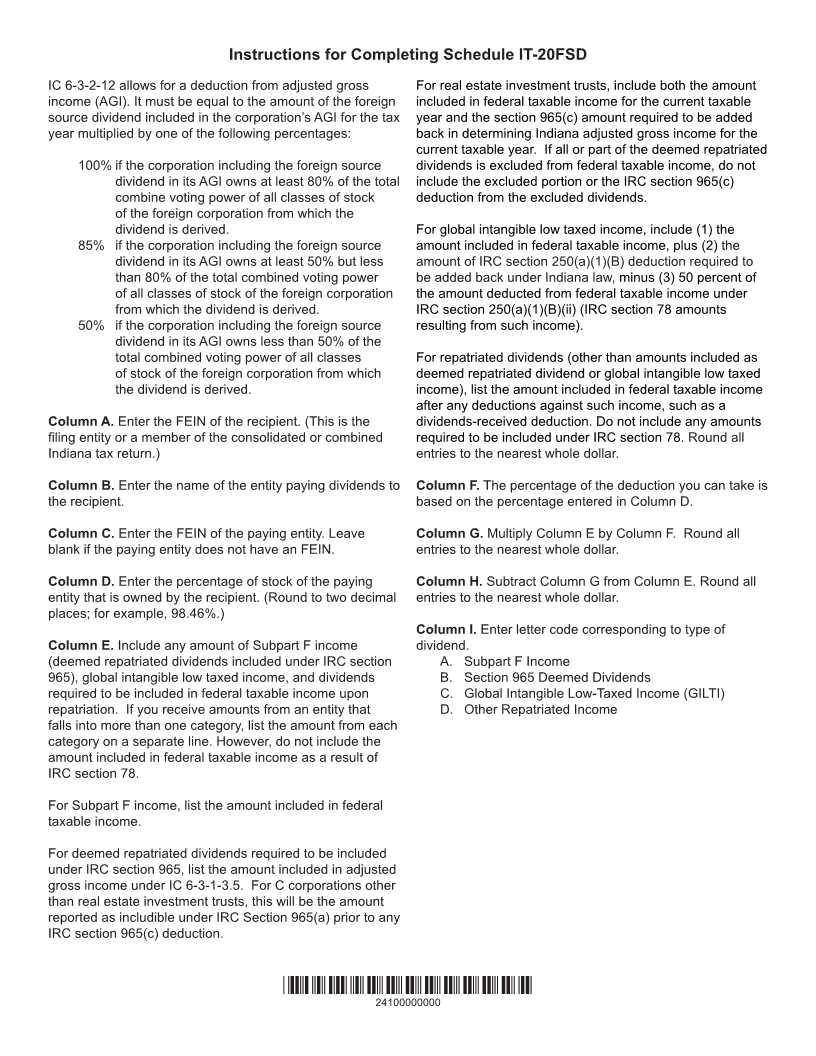

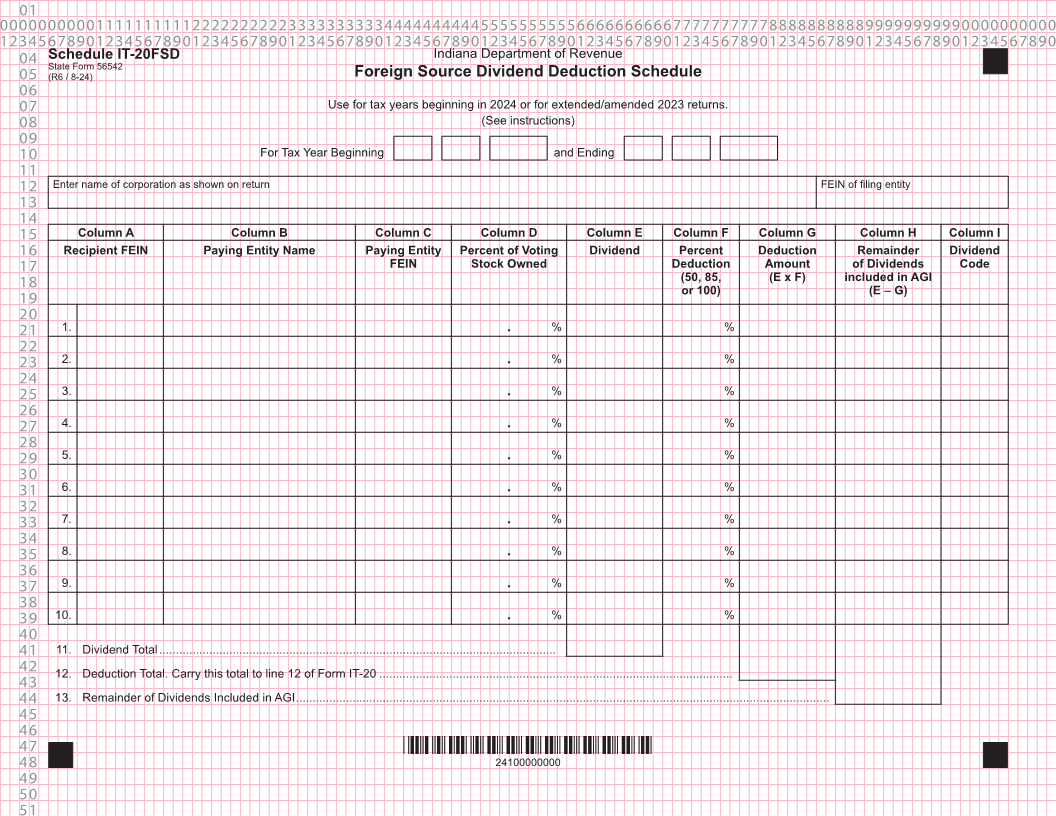

04 Schedule IT-20FSD Indiana Department of Revenue

State Form 56542

05 (R6 / 8-24) Foreign Source Dividend Deduction Schedule

06

07 Use for tax years beginning in 2024 or for extended/amended 2023 returns.

08 (See instructions)

09

10 For Tax Year Beginning and Ending

11

12 Enter name of corporation as shown on return FEIN of filing entity

13

14

15 Column A Column B Column C Column D Column E Column F Column G Column H Column I

16 Recipient FEIN Paying Entity Name Paying Entity Percent of Voting Dividend Percent Deduction Remainder Dividend

17 FEIN Stock Owned Deduction Amount of Dividends Code

18 (50, 85, (E x F) included in AGI

or 100) (E – G)

19

20

21 1. . % %

22

23 2. . % %

24

25 3. . % %

26

27 4. . % %

28

29 5. . % %

30

31 6. . % %

32

33 7. . % %

34

35 8. . % %

36

37 9. . % %

38

39 10. . % %

40

41 11. Dividend Total .......................................................................................................................

42 12. Deduction Total. Carry this total to line 12 of Form IT-20 ..........................................................................................................

43

44 13. Remainder of Dividends Included in AGI ................................................................................................................................................................

45

46

47 *24100000000*

48 24100000000

49

50

51