Enlarge image

01

0000000000111111111122222222223333333333444444444455555555556666666666777777777788888

1234567890123456789012345678901234567890123456789012345678901234567890123456789012345

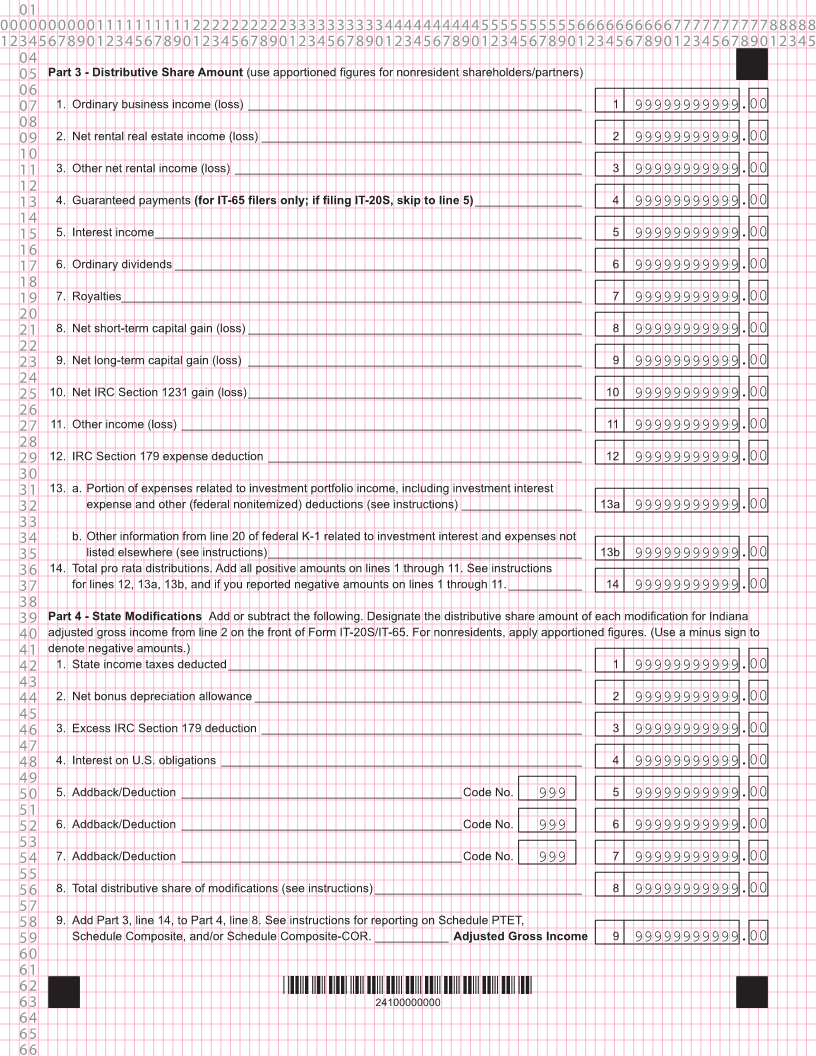

04 IT-20S/IT-65 Indiana Department of Revenue

05 2024 Schedule IN K-1 Shareholder’s/Partner’s Share of Indiana Adjusted Gross

State Form 49181

06 (R24 / 8-24) Income, Deductions, Modifications, and Credits

07

08 Tax Year Beginning 99 99 2024 and Ending 99 99 9999

09

10 Name of S Corporation/Partnership Federal Employer Identification Number

11

12 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 9999999999

13

14 Distributions – Provide Schedule IN K-1 to each shareholder/partner. Enclose Schedule IN K-1 with Form IT-20S/IT-65 return.

15

16 Part 1 – Shareholder/Partner’s Identification Section

17 1. Shareholder/Partner Name

18

19 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX Check if amended X

20 2. Shareholder/Partner FEIN or Social Security Number 3. Shareholder/Partner Federal Pro Rata Percentage

21

22 9999999999 999. 99 %

23 4. If the partner is a disregarded entity (DE), enter the partner’s:

24 a. Name b. FEIN

25

26 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 9999999999

27 5. What type of entity is the partner?

28

29 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

30 6. Shareholder/Partner State of Residence or Commercial Domicile 7. Indiana County of Principal Employment 2-digit code

31

32 XX XX

33 8. Payer’s Name 9. Payer’s FEIN

34

35 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 9999999999

36

37 10. Pass Through Entity Tax_________________________________________________________ 10 99999999999.00

38

39 11. IN State Tax Withheld ___________________________________________________________ 11 99999999999.00

40

41 12. IN County Tax Withheld _________________________________________________________ 12 99999999999.00

42

43

44 Part 2 - Pro Rata Share of Indiana Pass-through Tax Credits from S Corporation/Partnership

45

46 Column A Column B Column C Column D

47 IT-20S/IT-65 FEIN Certification Certification/Project/PIN Tax Credit Column E

48 if Credit is from IN K-1 Year Number Code Amount Claimed

49

50 1. 9999999999 9999 9999999999999999 9999 99999999999 .00

51

52 2. 9999999999 9999 9999999999999999 9999 99999999999 .00

53

54 3. 9999999999 9999 9999999999999999 9999 99999999999 .00

55

56 4. 9999999999 9999 9999999999999999 9999 99999999999 .00

57 Pass-through entities with more than 24 IN K-1s must file electronically

58

59

60

61

62 *24100000000*

63 24100000000

64

65

66