Enlarge image

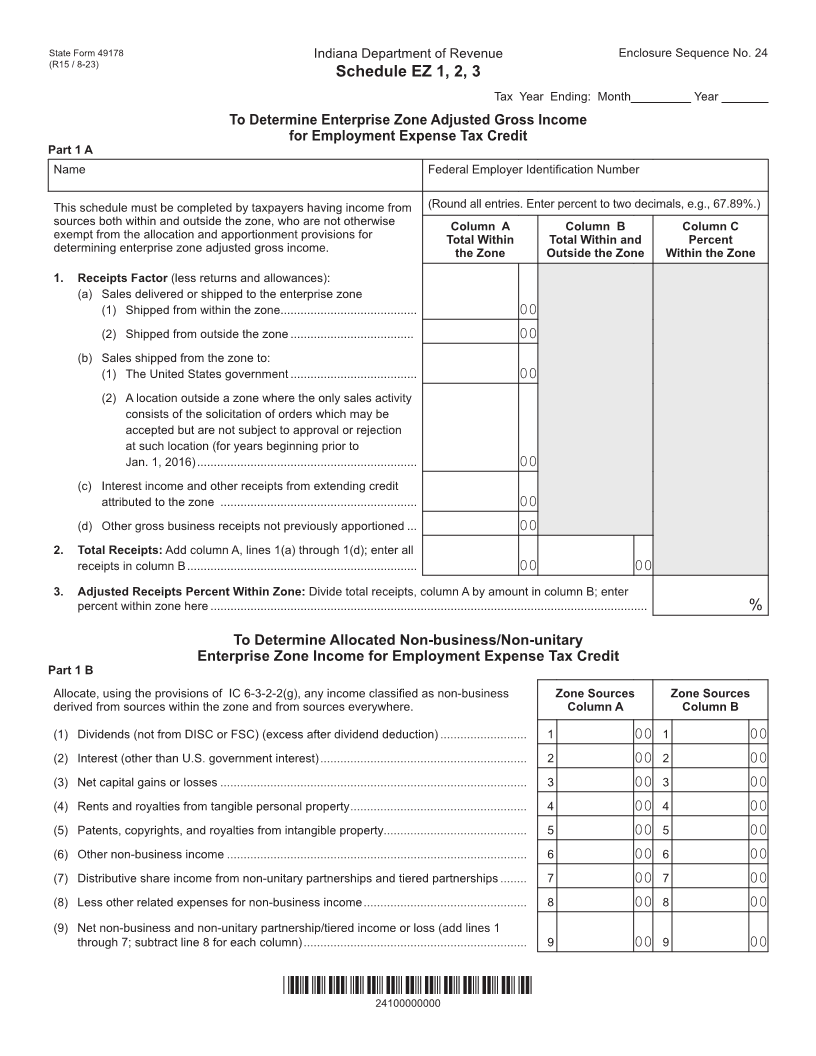

State Form 49178 Indiana Department of Revenue Enclosure Sequence No. 24

(R15 / 8-23)

Schedule EZ 1, 2, 3

Tax Year Ending: Month_________ Year _______

To Determine Enterprise Zone Adjusted Gross Income

for Employment Expense Tax Credit

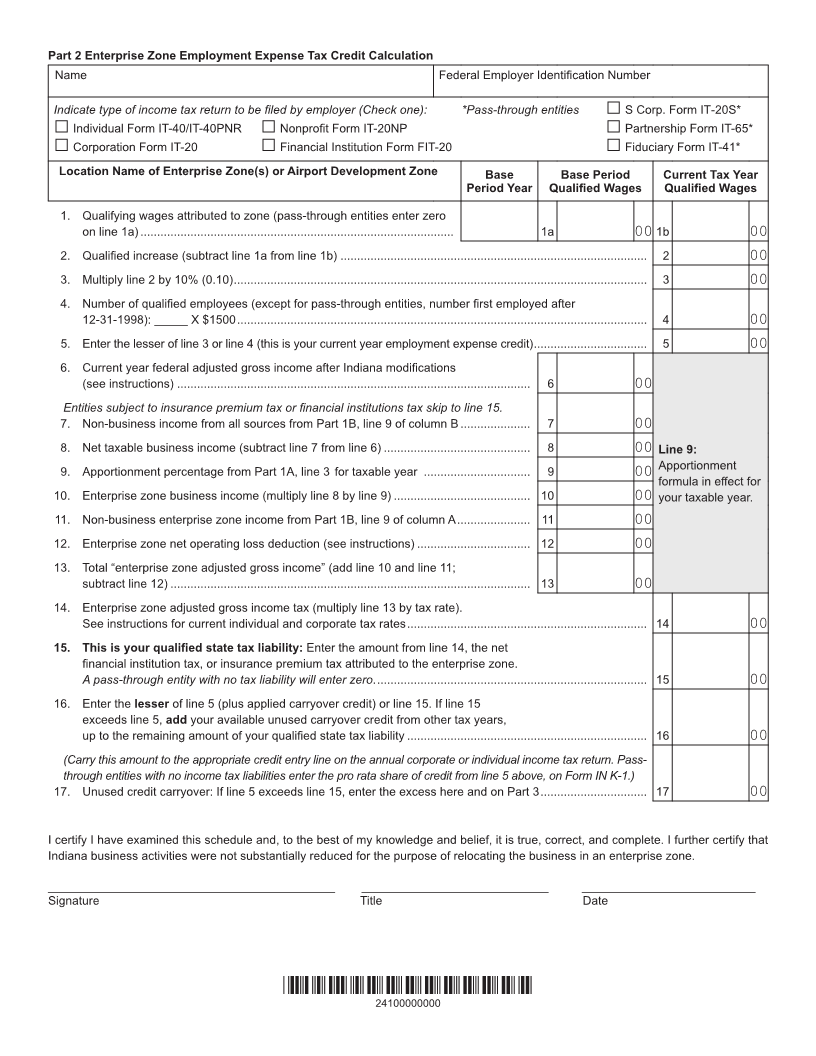

Part 1 A

Name Federal Employer Identification Number

This schedule must be completed by taxpayers having income from (Round all entries. Enter percent to two decimals, e.g., 67.89%.)

sources both within and outside the zone, who are not otherwise Column A Column B Column C

exempt from the allocation and apportionment provisions for Total Within Total Within and Percent

determining enterprise zone adjusted gross income. the Zone Outside the Zone Within the Zone

1. Receipts Factor (less returns and allowances):

(a) Sales delivered or shipped to the enterprise zone

(1) Shipped from within the zone......................................... 00

(2) Shipped from outside the zone ..................................... 00

(b) Sales shipped from the zone to:

(1) The United States government ...................................... 00

(2) A location outside a zone where the only sales activity

consists of the solicitation of orders which may be

accepted but are not subject to approval or rejection

at such location (for years beginning prior to

Jan. 1, 2016) .................................................................. 00

(c) Interest income and other receipts from extending credit

attributed to the zone ........................................................... 00

(d) Other gross business receipts not previously apportioned ... 00

2. Total Receipts: Add column A, lines 1(a) through 1(d); enter all

receipts in column B ..................................................................... 00 00

3. Adjusted Receipts Percent Within Zone: Divide total receipts, column A by amount in column B; enter

percent within zone here ................................................................................................................................... %

To Determine Allocated Non-business/Non-unitary

Enterprise Zone Income for Employment Expense Tax Credit

Part 1 B

Allocate, using the provisions of IC 6-3-2-2(g), any income classified as non-business Zone Sources Zone Sources

derived from sources within the zone and from sources everywhere. Column A Column B

(1) Dividends (not from DISC or FSC) (excess after dividend deduction) .......................... 1 00 1 00

(2) Interest (other than U.S. government interest) .............................................................. 2 00 2 00

(3) Net capital gains or losses ............................................................................................ 3 00 3 00

(4) Rents and royalties from tangible personal property ..................................................... 4 00 4 00

(5) Patents, copyrights, and royalties from intangible property........................................... 5 00 5 00

(6) Other non-business income .......................................................................................... 6 00 6 00

(7) Distributive share income from non-unitary partnerships and tiered partnerships ........ 7 00 7 00

(8) Less other related expenses for non-business income ................................................. 8 00 8 00

(9) Net non-business and non-unitary partnership/tiered income or loss (add lines 1

through 7; subtract line 8 for each column) ................................................................... 9 00 9 00

*24100000000*

24100000000