Enlarge image

Vermont MeF Corporate and Business Income ATS Test Package for Tax Year 2023

Enlarge image | Vermont MeF Corporate and Business Income ATS Test Package for Tax Year 2023 |

Enlarge image |

Contents

General Information ..................................................................................................................................... 2

Who Must Test? ........................................................................................................................................... 2

Why Test? ..................................................................................................................................................... 2

What is tested? ............................................................................................................................................. 2

When to test? ............................................................................................................................................... 2

Test Feedback Report and Certification Letter ............................................................................................ 2

Direct Debit................................................................................................................................................... 2

Transmitting Testing Files ............................................................................................................................. 3

Test Acknowledgement ................................................................................................................................ 3

Vermont Schema and Forms Supported ...................................................................................................... 3

Software Developer Responsibilities ............................................................................................................ 4

Vermont Test Cases …………………………………………………………………………………………………………………………….….5

1

|

Enlarge image |

General Information

This publication describes the Vermont State Acceptance Testing system procedures for software developers

participating in Vermont’s MeF electronic filing program using currently accepted Vermont schema versions.

Who Must Test?

All software developers who wish to participate in supporting Vermont returns for electronic filing must

complete the ATS test package provided by Vermont. Before submitting the first test file, an e-mail is required

to alert the MeF coordinator.

Why Test?

Testing is performed to ensure that the software adheres to Vermont business rules and to ensure successful

transmission and receipt of acknowledgements.

A list of all approved software vendors will be posted to the Vermont Department of Taxes website at

https://tax.vermont.gov/tax-professionals/software-and-vendor-updates. The 8879-VT is approved as part of

the e-file testing process for preparer products.

What is tested?

Vermont’s test package includes 12 test returns and includes information needed to prepare each return. A

completed return for each test case is provided. All 8 test cases must be submitted for each Online and Preparer

product. Vermont does not limit the type of form or schedule that your software will support. Please indicate

what is not supported to the e-file coordinator. All forms do not need to be supported to pass ATS testing for

Vermont.

“The Vermont MeF Handbook” should be used for general system instructions. Also refer to current releases of

Vermont schema, validations and data elements.

When to test?

Testing can begin with Vermont as soon as the IRS opens its testing platform (November 4, 2019). ATS testing is

scheduled to begin in early November but is subject to IRS system availability. It is suggested that all software

testing be completed by March 1st.

Test Feedback Report and Certification Letter

Within 48 hours after Vermont receives the test file, you will receive and e-mail if there are any errors within

your file. If errors are found, you must resubmit the entire test package. A separate letter will be sent for an

Online product and Preparer product. Once testing is completed, you will receive a certification letter indicating

you are approved for Vermont.

Direct Debit

Vermont will be accepting direct debits. A payment may be for all or a portion of the balance due. Vermont

allows 5 days after the due date for processing the direct debits as the IRS does.

***NOTE taxpayers may receive a bill if the payment is posted for a date past the original due date.

2

|

Enlarge image |

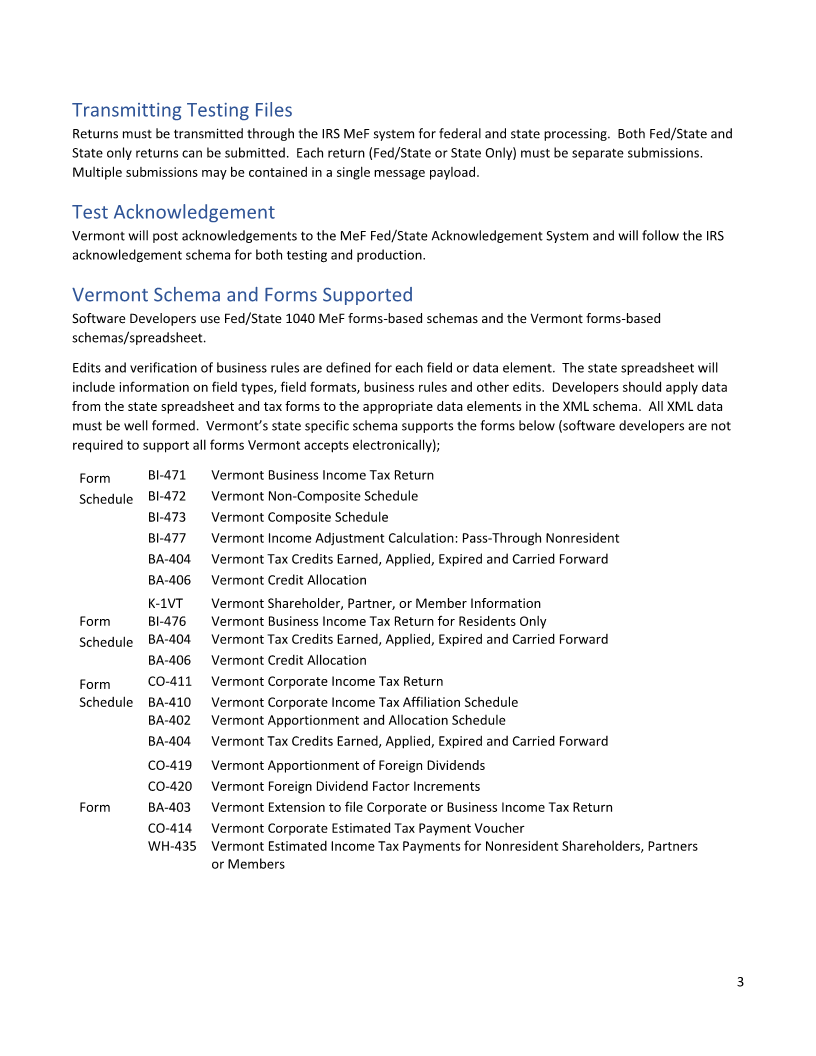

Transmitting Testing Files

Returns must be transmitted through the IRS MeF system for federal and state processing. Both Fed/State and

State only returns can be submitted. Each return (Fed/State or State Only) must be separate submissions.

Multiple submissions may be contained in a single message payload.

Test Acknowledgement

Vermont will post acknowledgements to the MeF Fed/State Acknowledgement System and will follow the IRS

acknowledgement schema for both testing and production.

Vermont Schema and Forms Supported

Software Developers use Fed/State 1040 MeF forms-based schemas and the Vermont forms-based

schemas/spreadsheet.

Edits and verification of business rules are defined for each field or data element. The state spreadsheet will

include information on field types, field formats, business rules and other edits. Developers should apply data

from the state spreadsheet and tax forms to the appropriate data elements in the XML schema. All XML data

must be well formed. Vermont’s state specific schema supports the forms below (software developers are not

required to support all forms Vermont accepts electronically);

Form BI-471 Vermont Business Income Tax Return

Schedule BI-472 Vermont Non-Composite Schedule

BI-473 Vermont Composite Schedule

BI-477 Vermont Income Adjustment Calculation: Pass-Through Nonresident

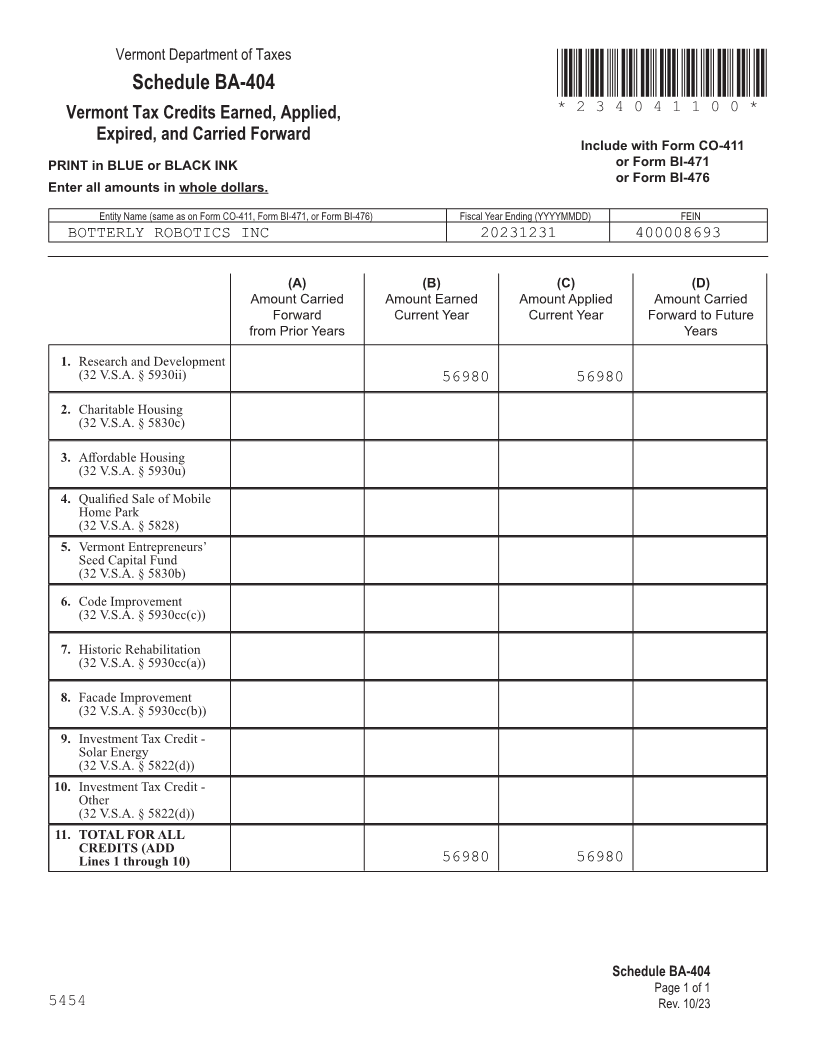

BA-404 Vermont Tax Credits Earned, Applied, Expired and Carried Forward

BA-406 Vermont Credit Allocation

K-1VT Vermont Shareholder, Partner, or Member Information

Form BI-476 Vermont Business Income Tax Return for Residents Only

Schedule BA-404 Vermont Tax Credits Earned, Applied, Expired and Carried Forward

BA-406 Vermont Credit Allocation

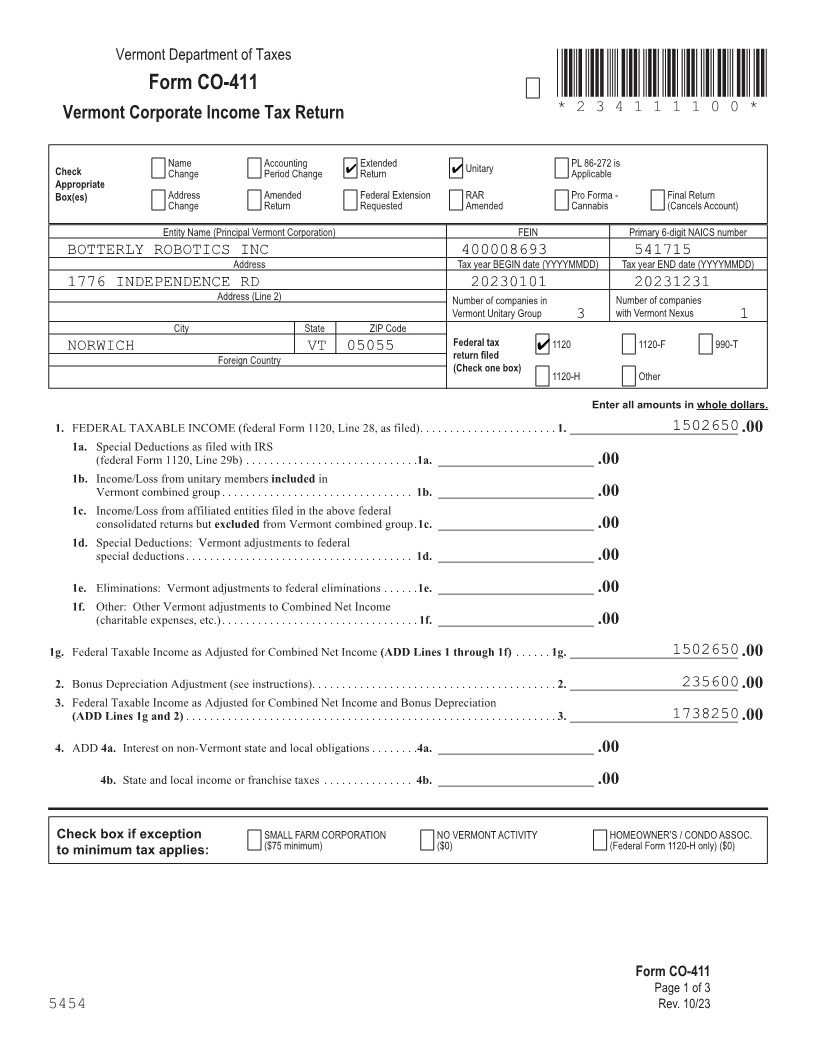

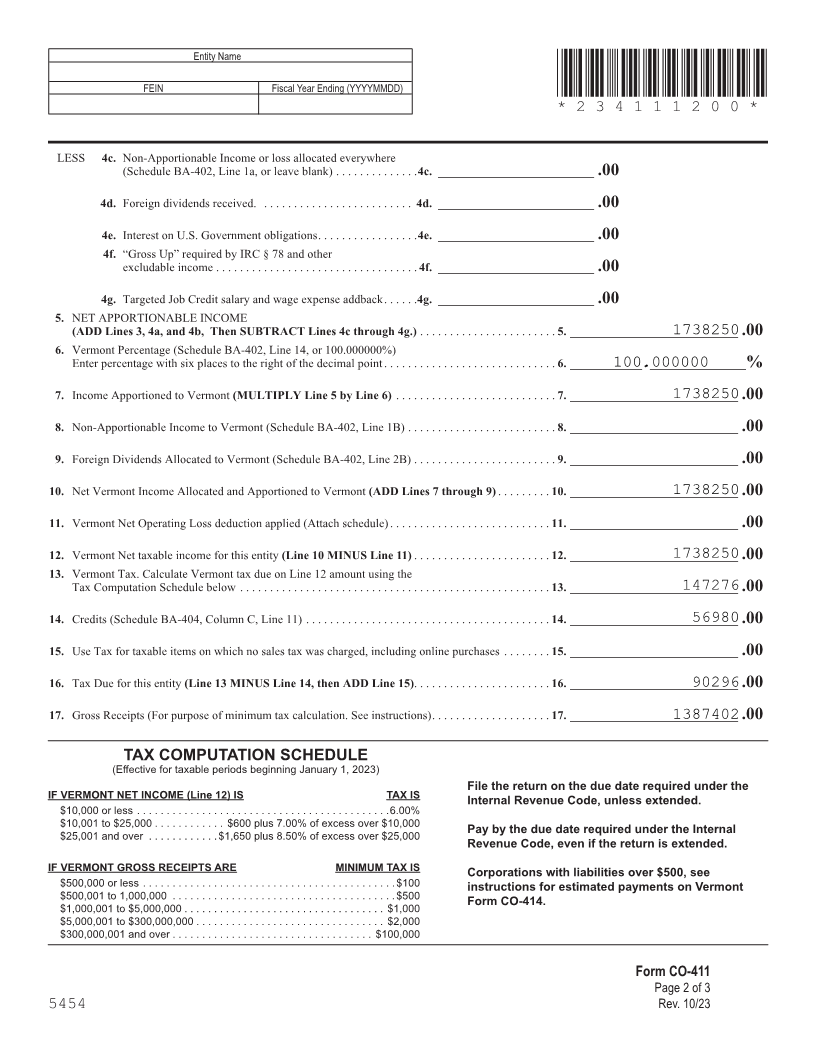

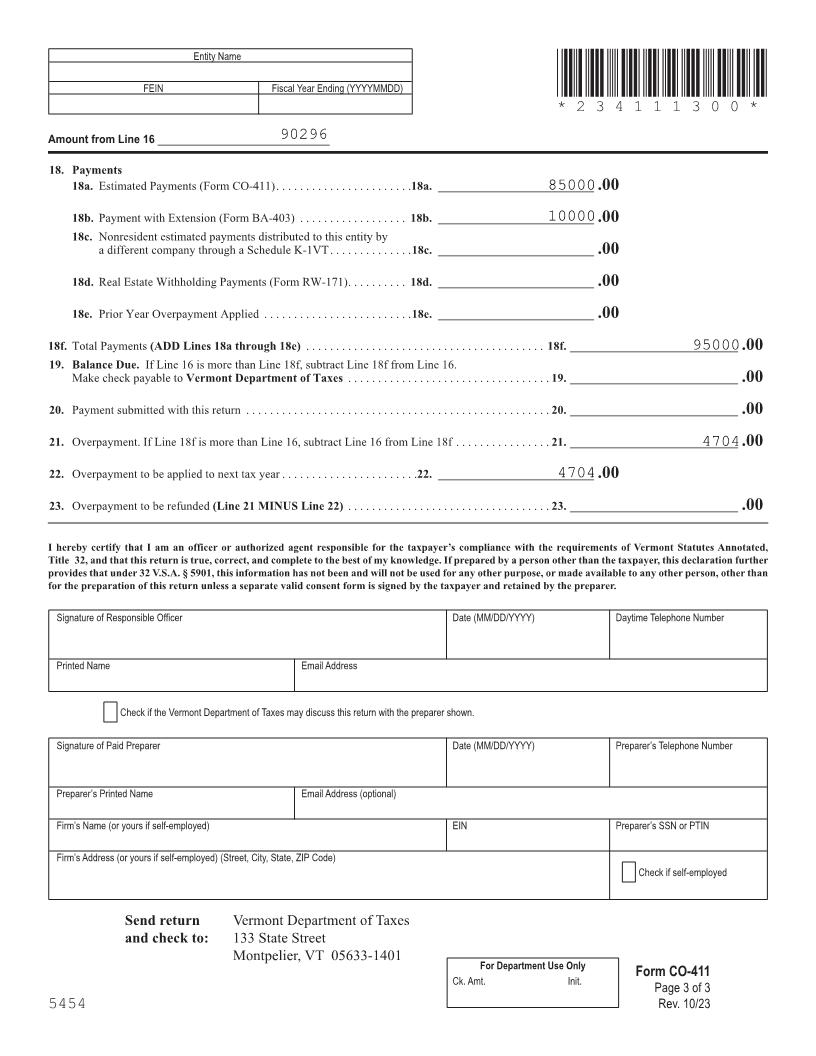

Form CO-411 Vermont Corporate Income Tax Return

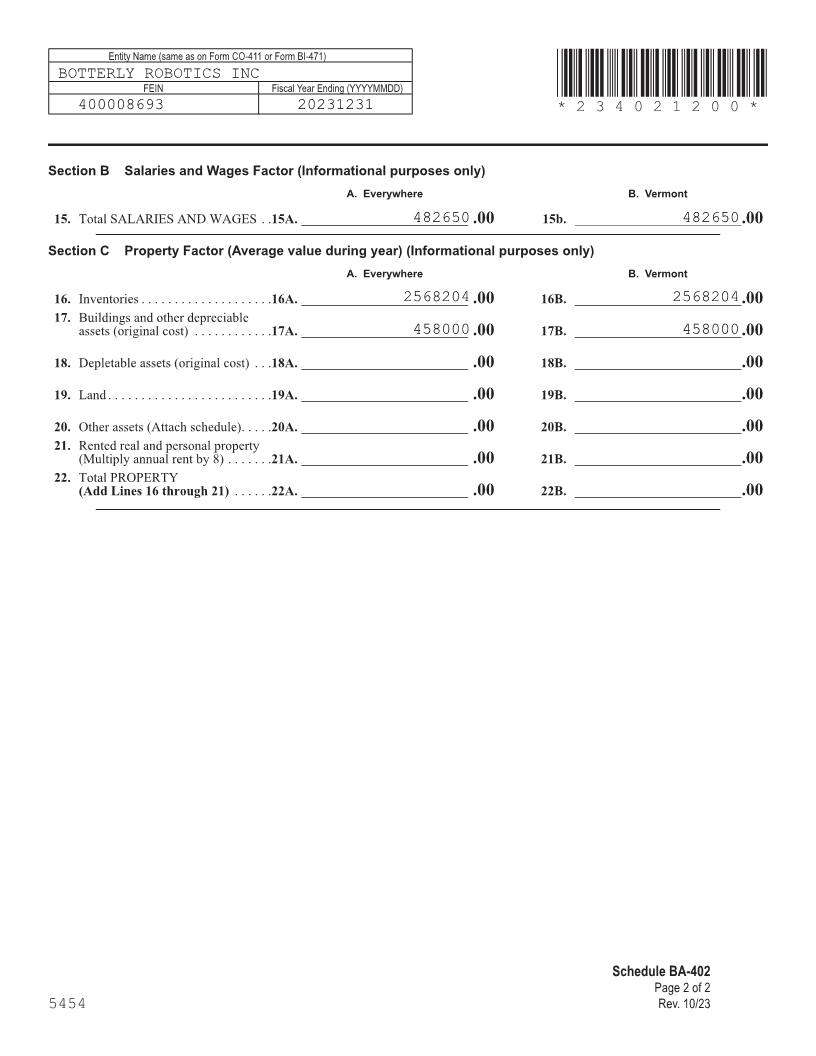

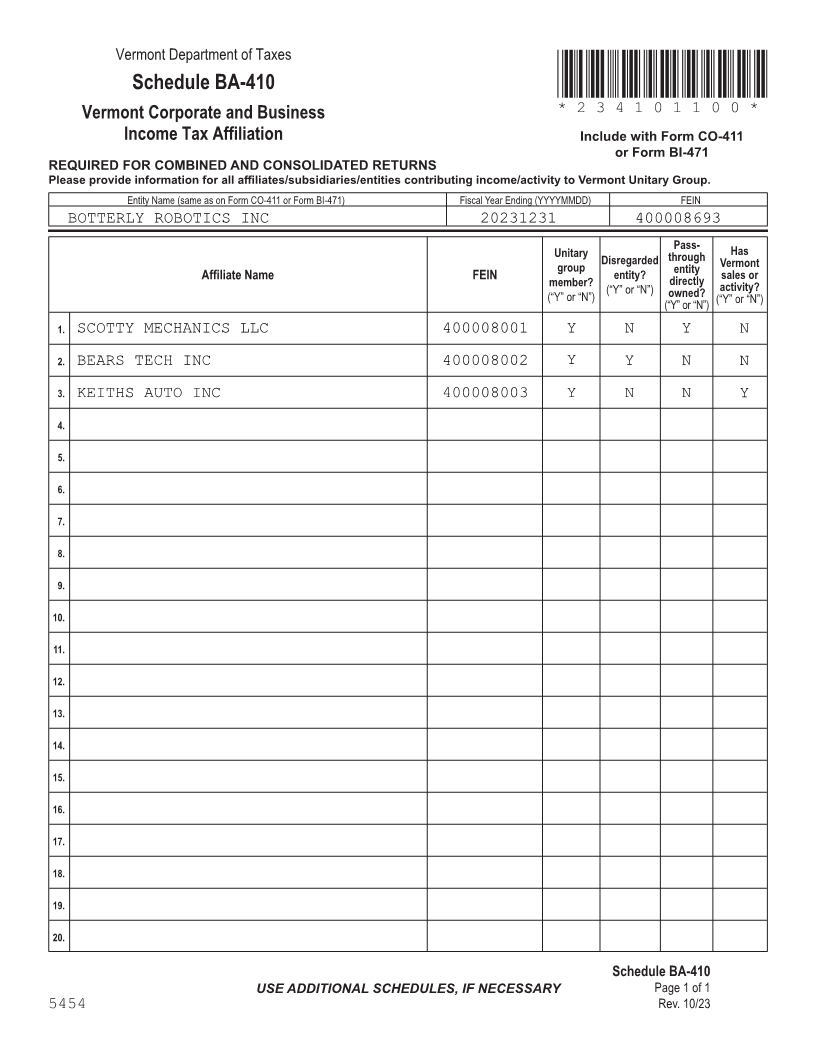

Schedule BA-410 Vermont Corporate Income Tax Affiliation Schedule

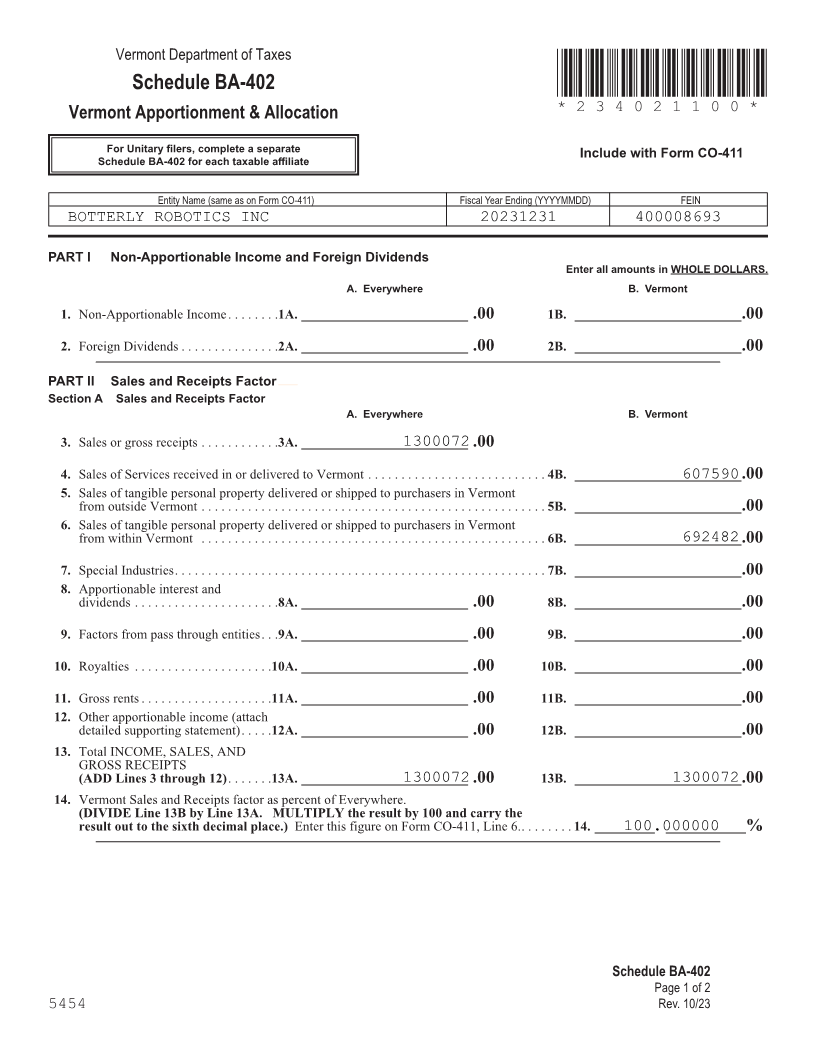

BA-402 Vermont Apportionment and Allocation Schedule

BA-404 Vermont Tax Credits Earned, Applied, Expired and Carried Forward

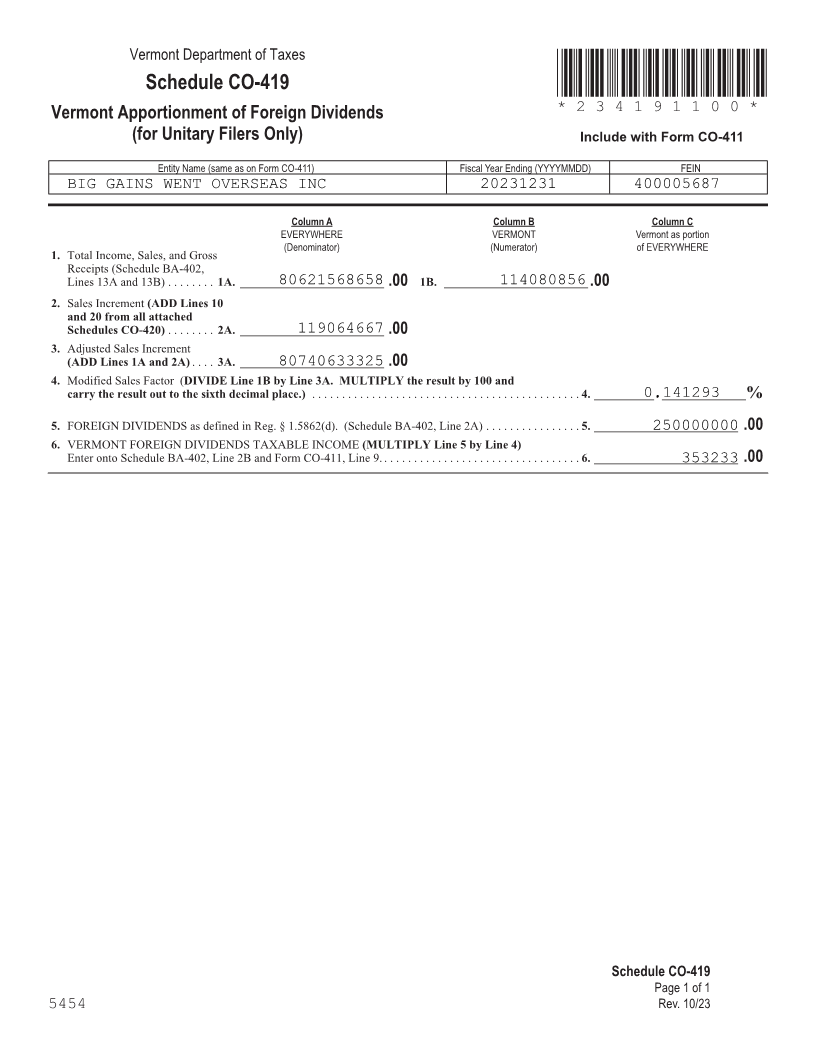

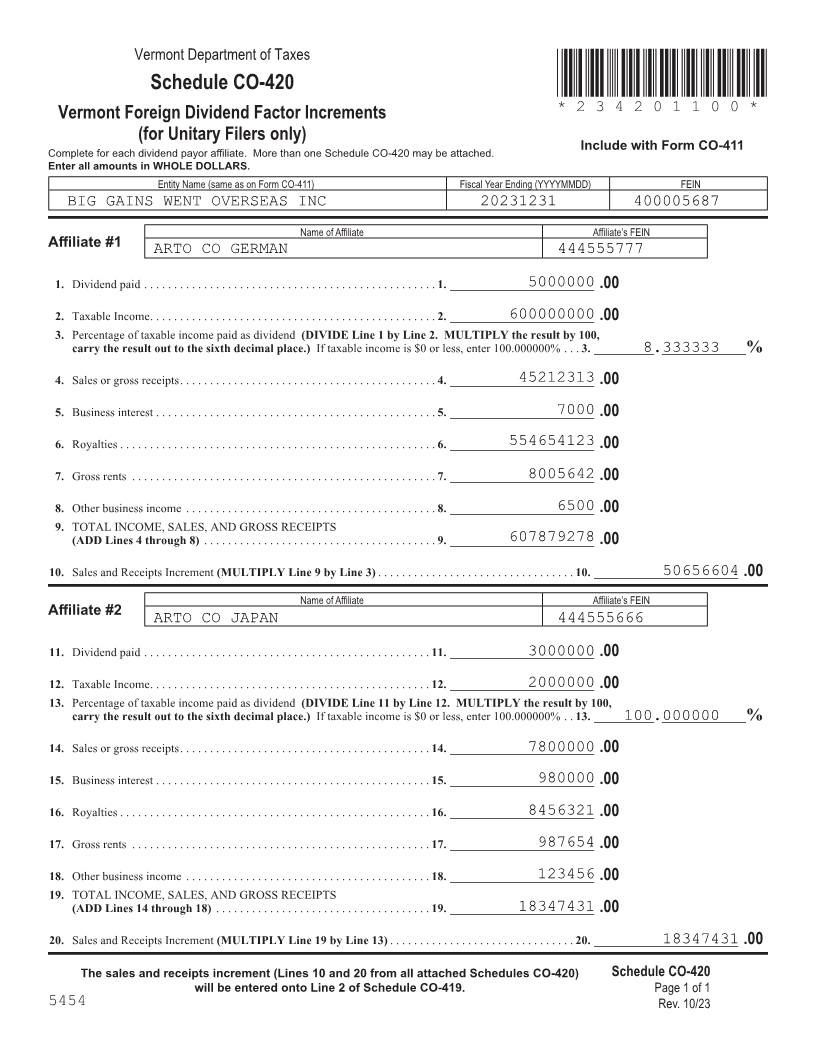

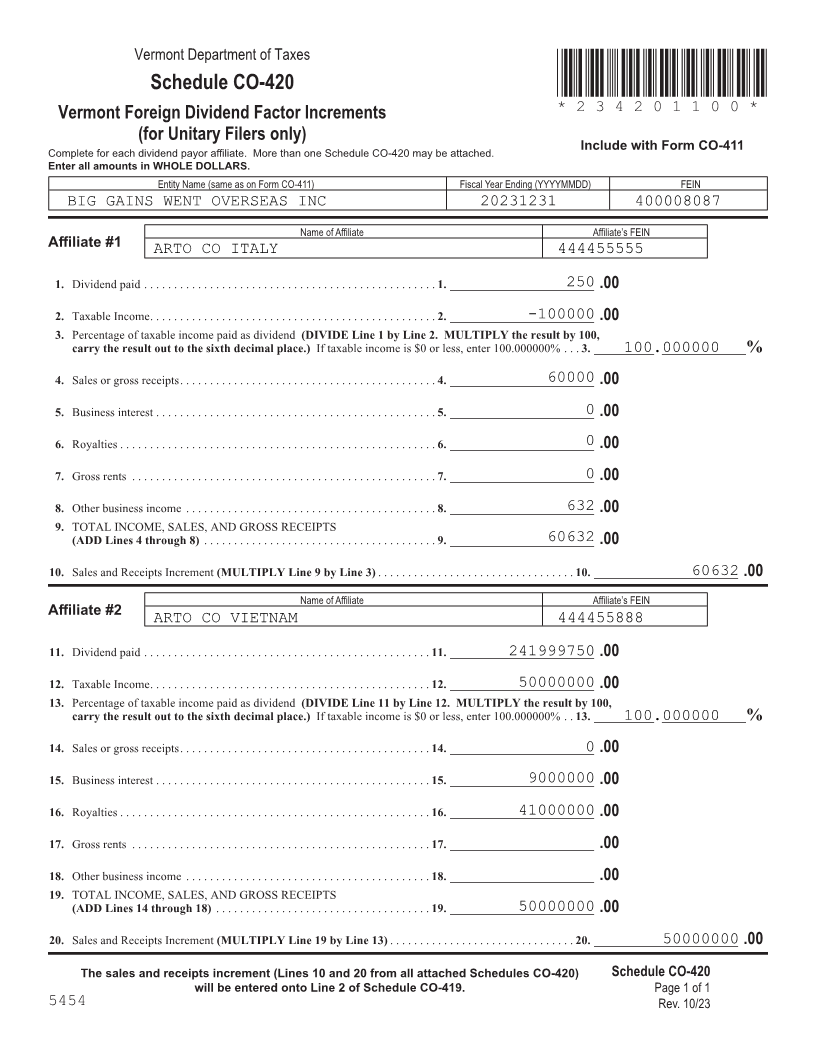

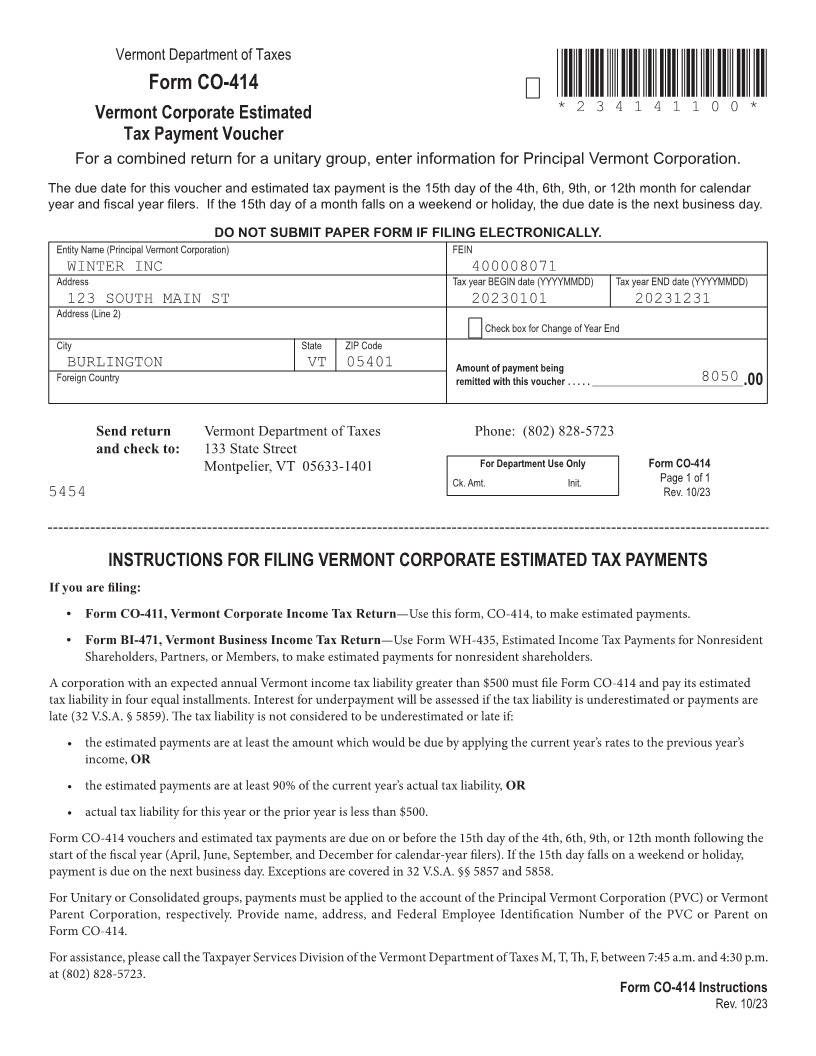

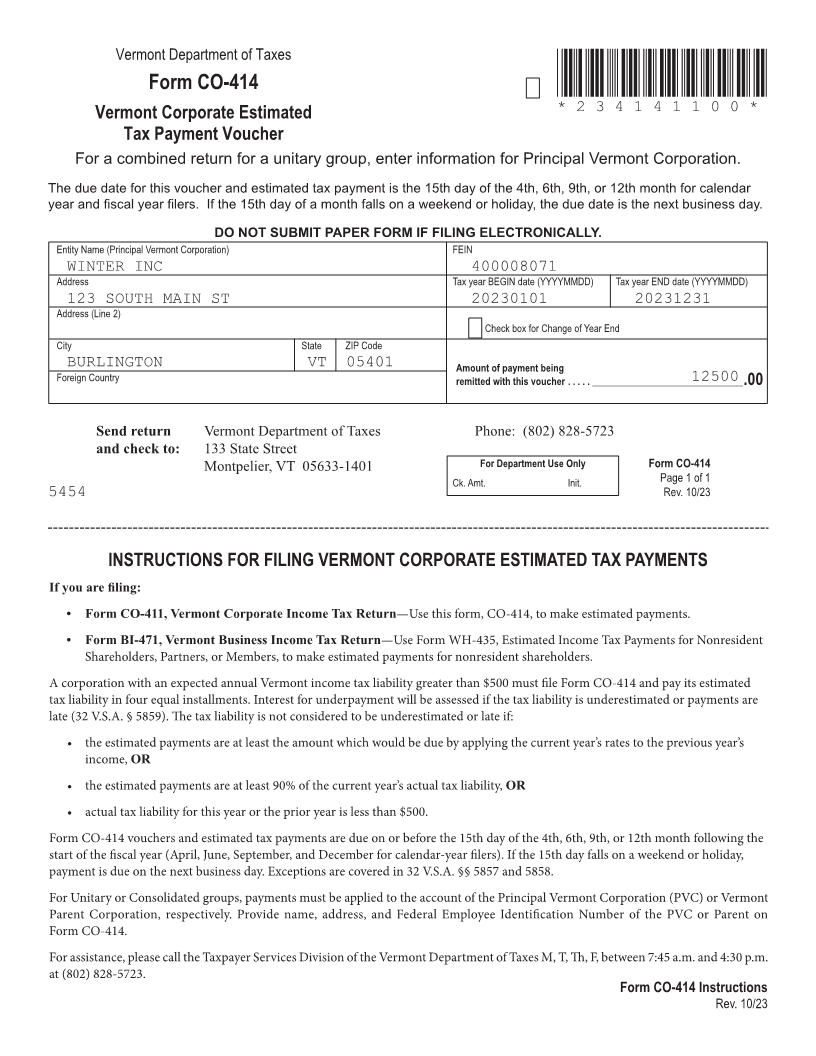

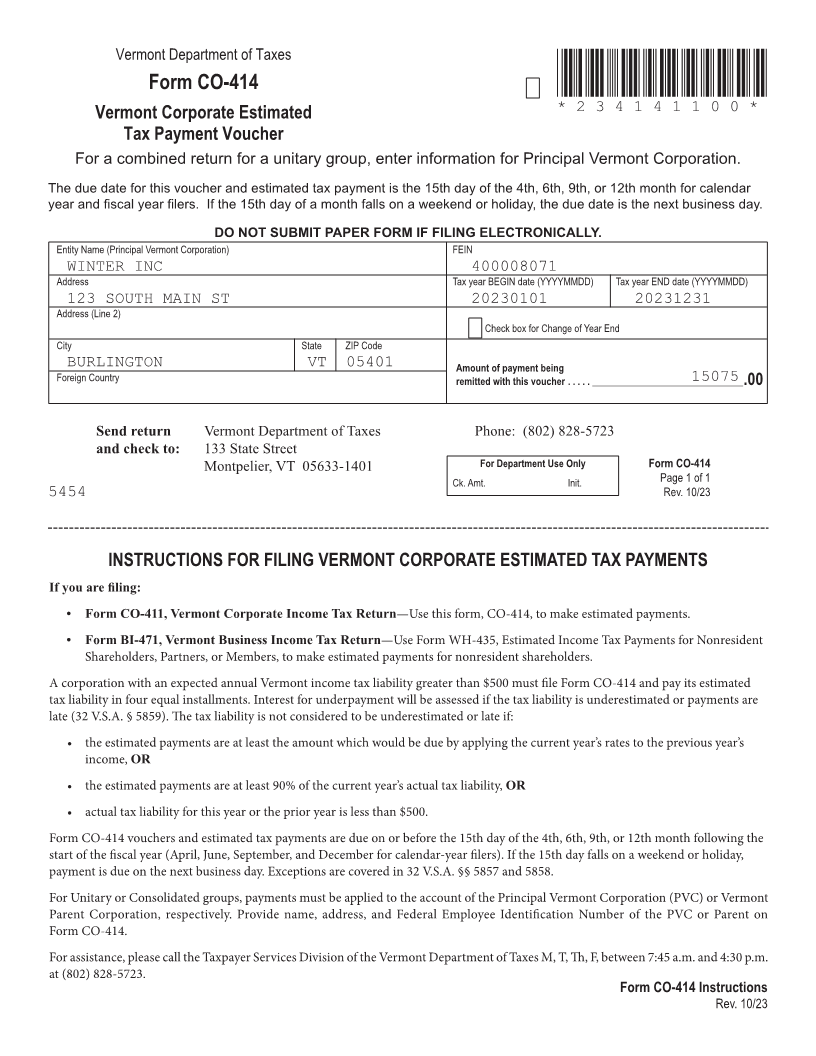

CO-419 Vermont Apportionment of Foreign Dividends

CO-420 Vermont Foreign Dividend Factor Increments

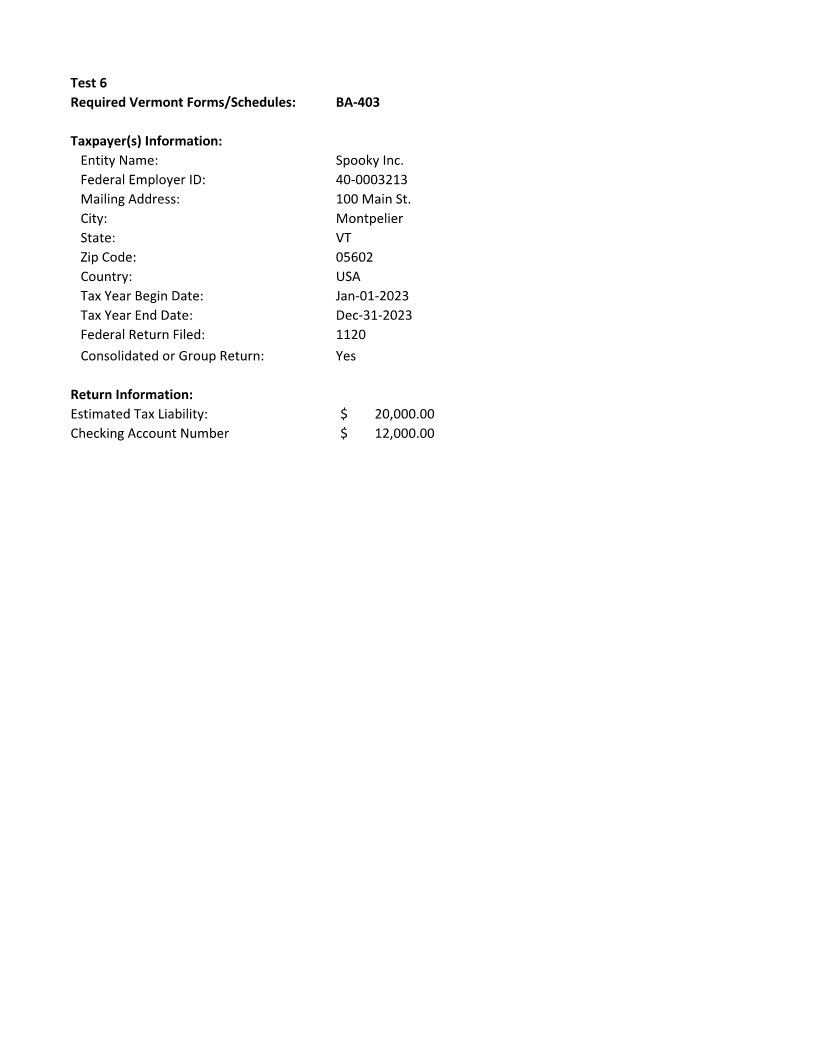

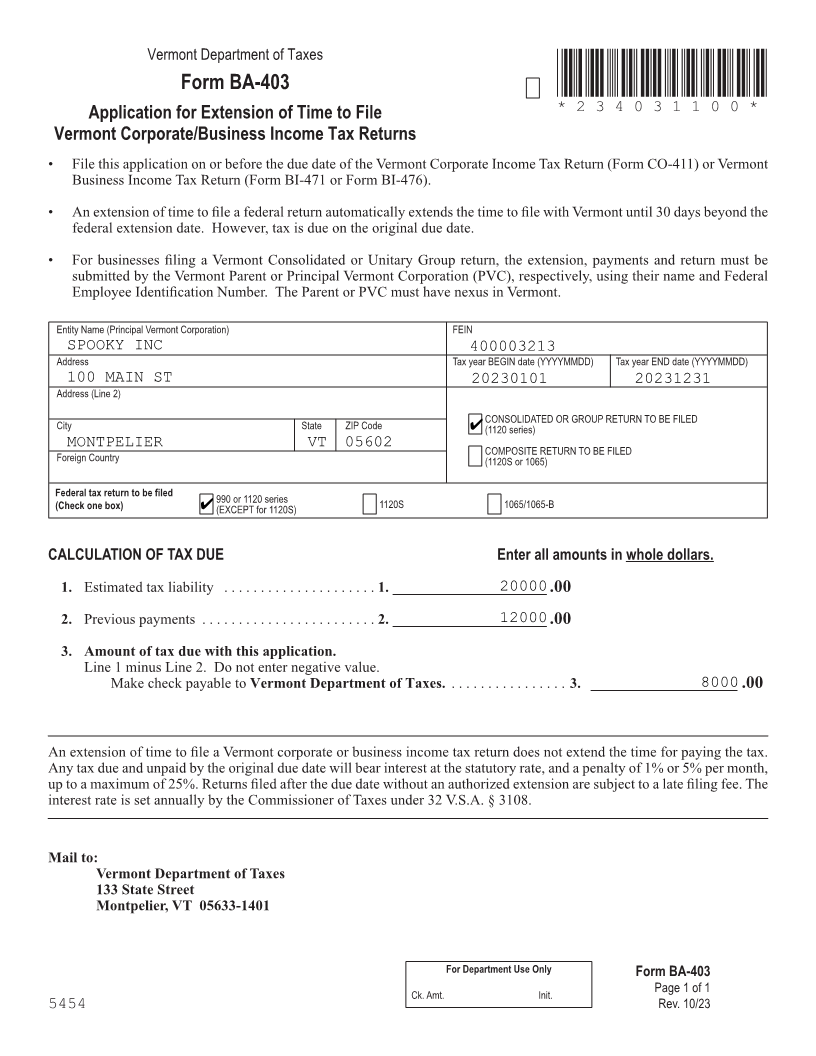

Form BA-403 Vermont Extension to file Corporate or Business Income Tax Return

CO-414 Vermont Corporate Estimated Tax Payment Voucher

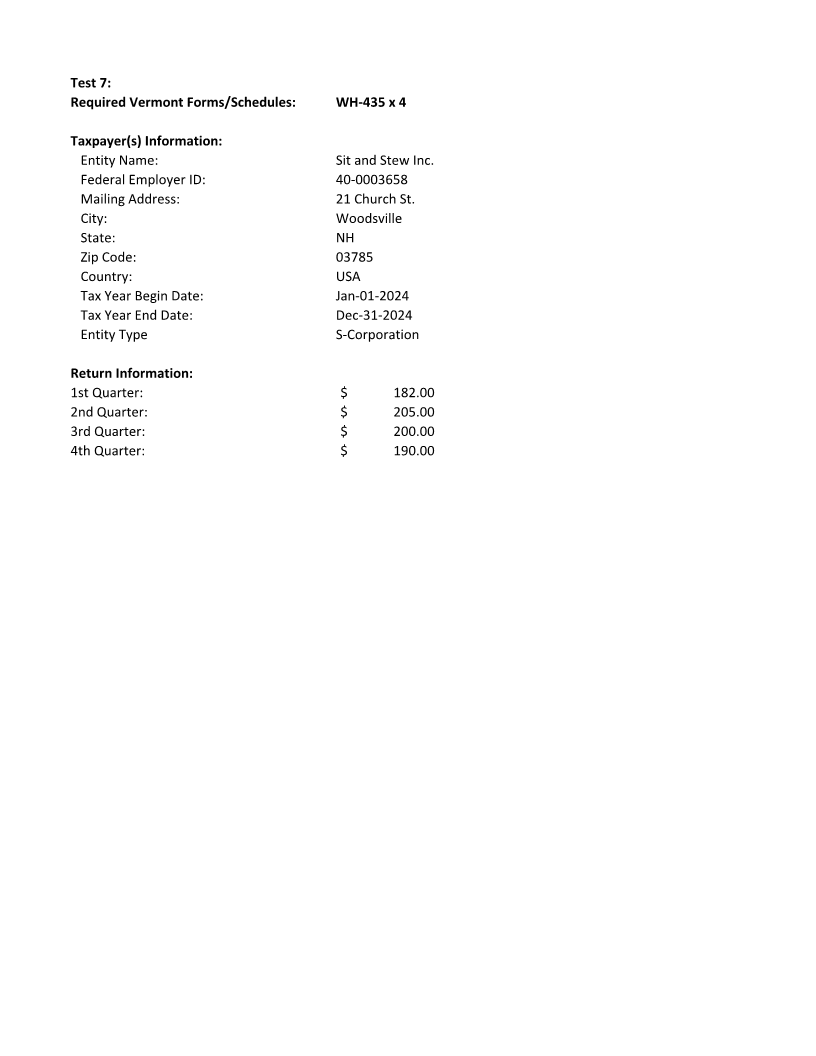

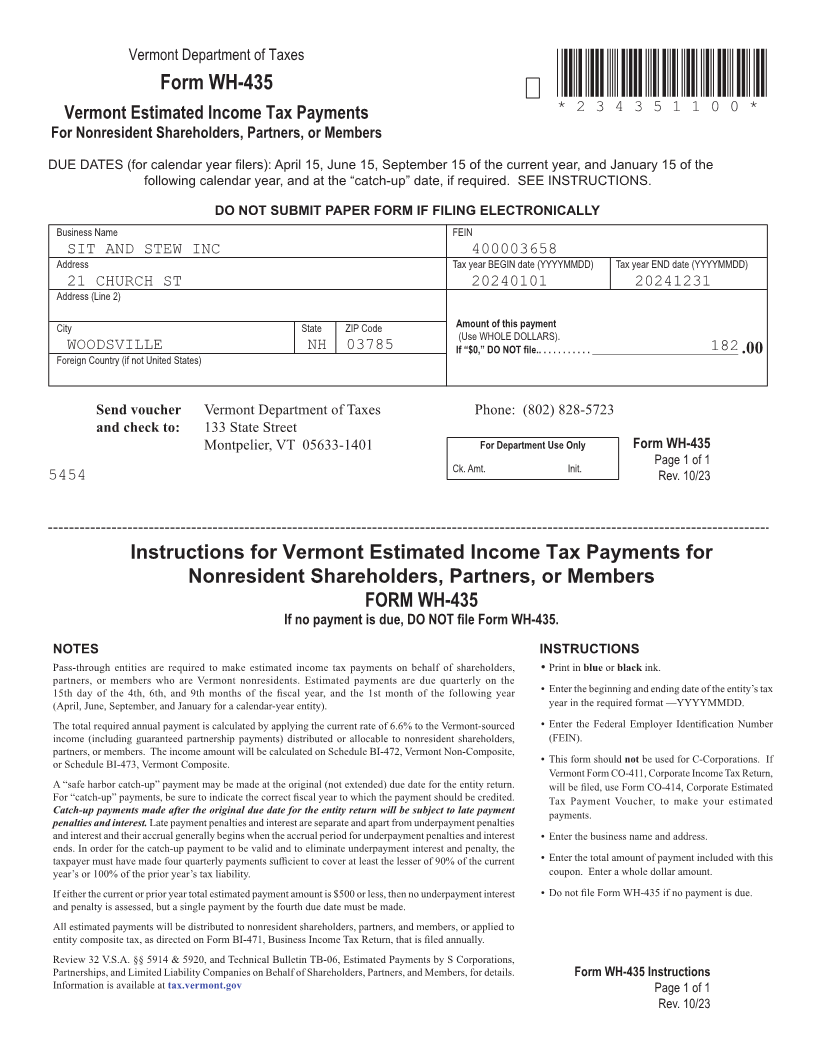

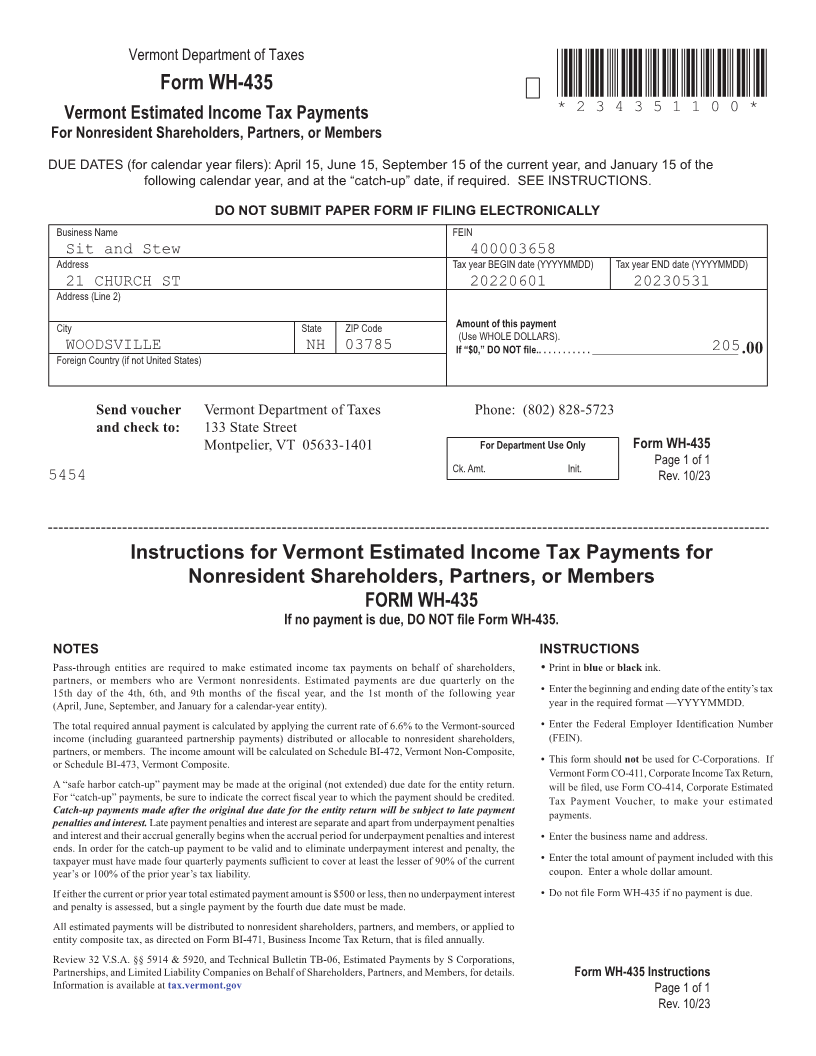

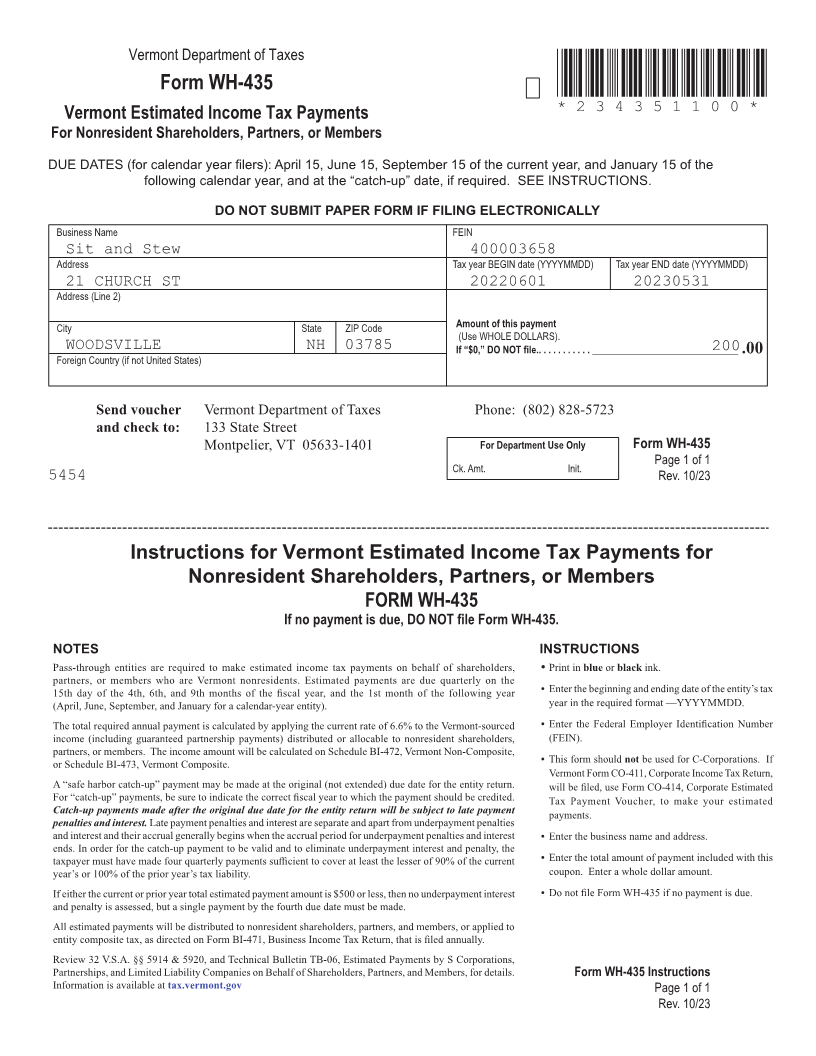

WH-435 Vermont Estimated Income Tax Payments for Nonresident Shareholders, Partners

or Members

3

|

Enlarge image |

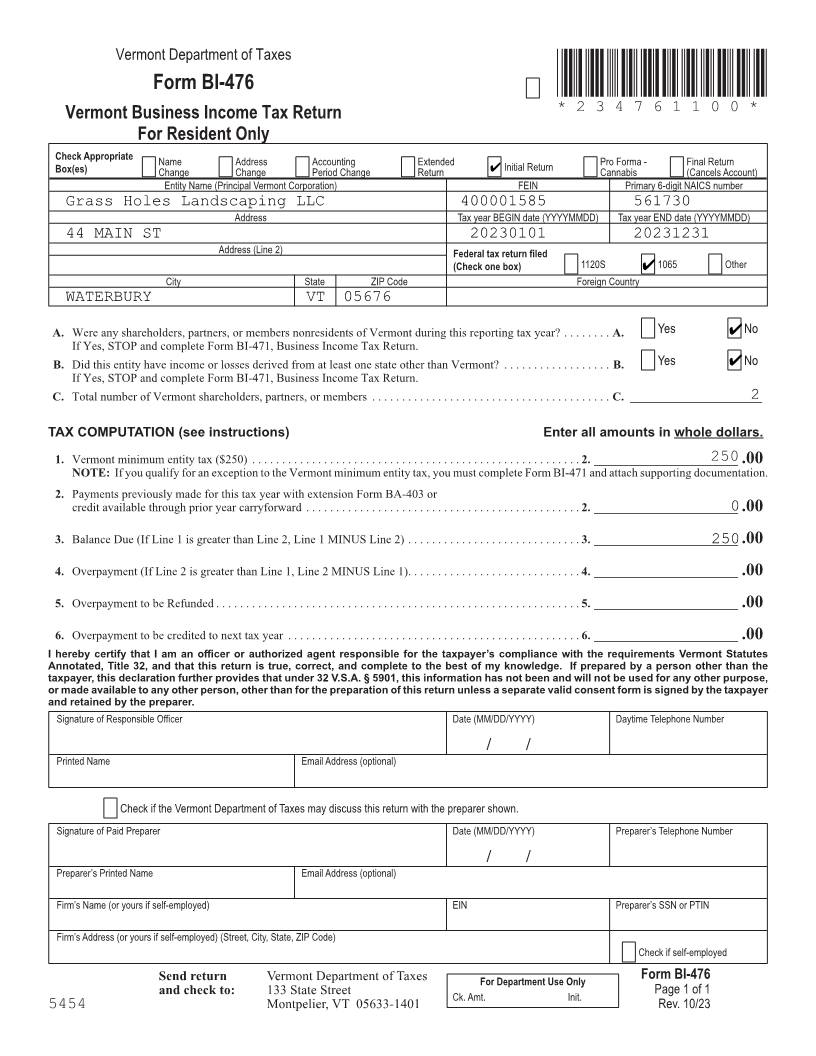

Software Developer Responsibilities

If the Software Developer is not acting as the ERO, the Software Developer is responsible for providing state

acknowledgements to the ERO no later than two days after receipt. Failure to do so could lead to suspension

from the Vermont Program.

Software errors which cause electronic returns to be rejected that arise after testing has been completed should

be quickly corrected to ensure that the ERO is able to timely and accurately file its electronic returns. Software

updates related to software errors should be distributed promptly to users along with any documentation

needed.

4

|

Enlarge image |

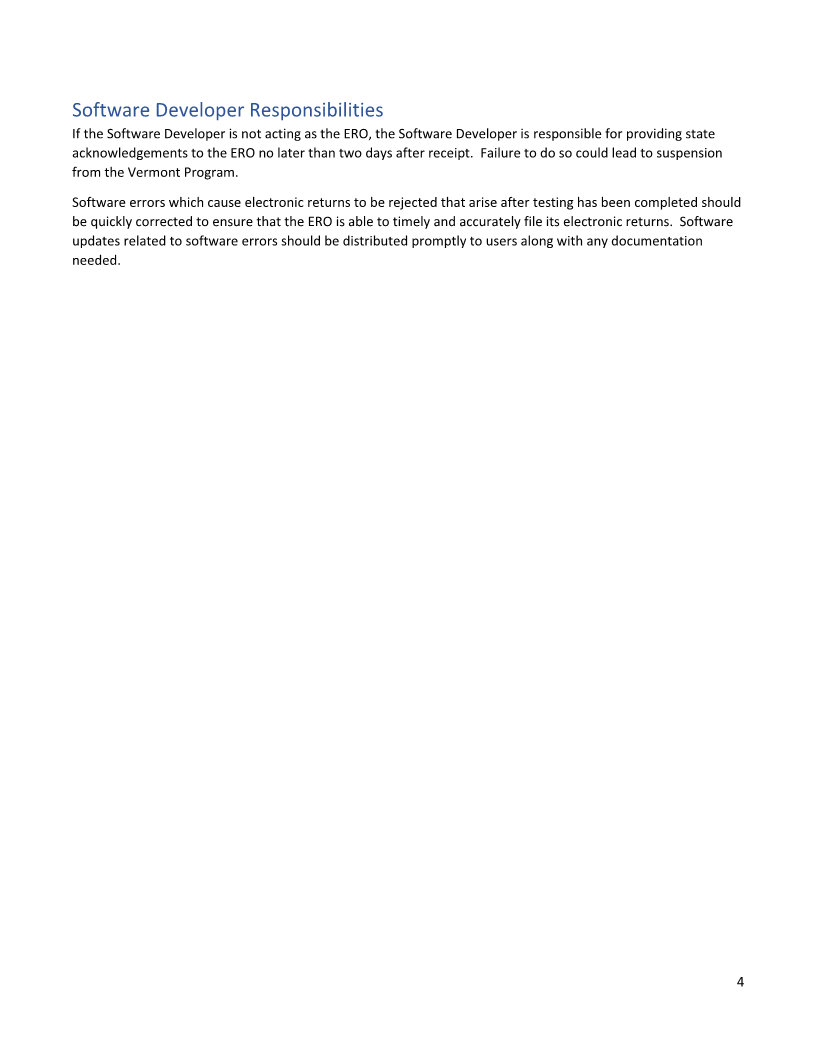

Vermont Test Cases

Test 1 - Direct Deposit

Required Vermont Forms/Schedules: BI-476

Taxpayer(s) Information:

Entity Name: Grass Holes Landscaping LLC

Federal Employer ID: 40-0001585

Primary 6-digit NAICS #: 561730

Mailing Address: 44 Main St.

City: Waterbury

State: VT

Zip Code: 05676

Country: USA

Initial Return Y

Tax Year Begin Date: Jan-01-2023

Tax Year End Date: Dec-31-2023

Federal Return Filed: 1065

# of Shareholders: 2

# of VT Shareholders: 2

# of Non-Resident Shareholders: 0

Direct Debit Information for Vermont:

Routing Number: 211691185

Checking Account Number 75486756

Payment Date: 03/15/2024

|

Enlarge image |

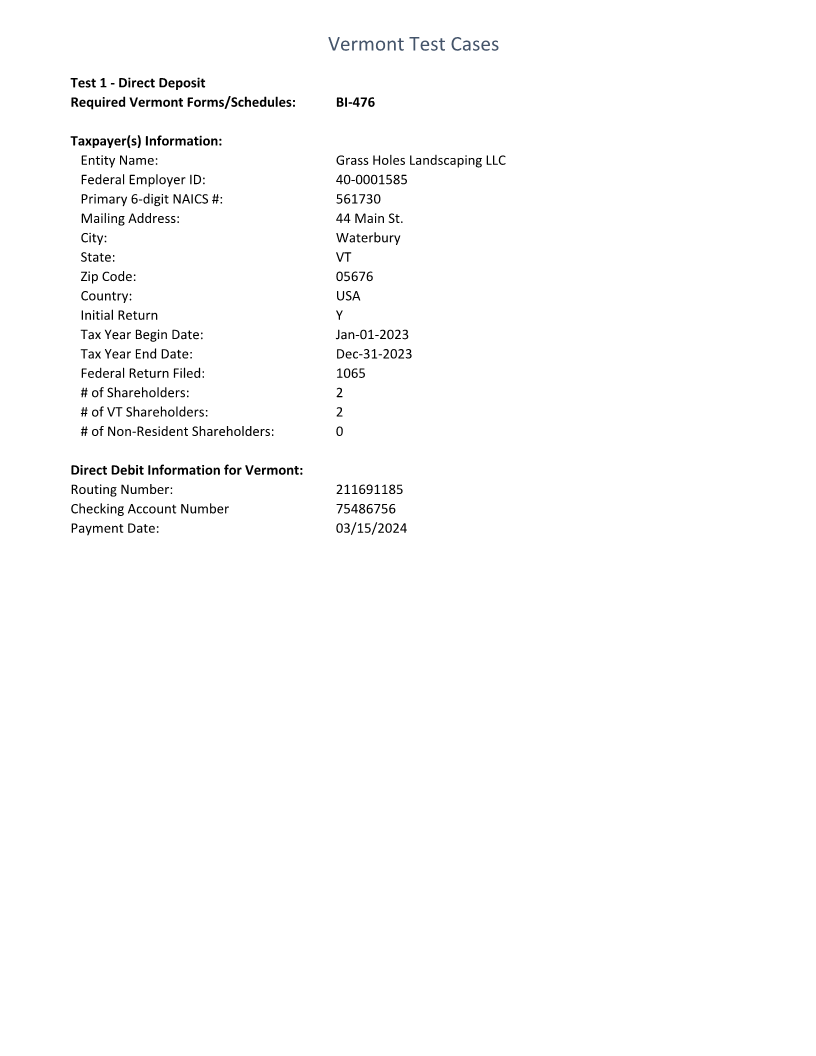

Vermont Department of Taxes

Form BI-476 *234761100*

Vermont Business Income Tax Return *234761100*

Page 5

For Resident Only

Check Appropriate Name Address Accounting Extended 4 Initial Return Pro Forma - Final Return

Box(es) Change Change Period Change Return Cannabis (Cancels Account)

Entity Name (Principal Vermont Corporation) FEIN Primary 6-digit NAICS number

Grass Holes Landscaping LLC 400001585 561730

Address Tax year BEGIN date (YYYYMMDD) Tax year END date (YYYYMMDD)

44 MAIN ST 20230101 20231231

Address (Line 2) Federal tax return filed

(Check one box) 1120S 4 1065 Other

City State ZIP Code Foreign Country

WATERBURY VT 05676

A. Were any shareholders, partners, or members nonresidents of Vermont during this reporting tax year? . . . . . . . . A. Yes 4 No

If Yes, STOP and complete Form BI-471, Business Income Tax Return .

B. Did this entity have income or losses derived from at least one state other than Vermont? . . . . . . . . . . . . . . . . . . B. Yes 4 No

If Yes, STOP and complete Form BI-471, Business Income Tax Return .

C. Total number of Vermont shareholders, partners, or members . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . C. ______________________ FORM (Place at FIRST page)

2

Form pages

TAX COMPUTATION (see instructions) Enter all amounts in whole dollars.

1. Vermont minimum entity tax ($250) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2. ________________________250 .00

NOTE: If you qualify for an exception to the Vermont minimum entity tax, you must complete Form BI-471 and attach supporting documentation .

2. Payments previously made for this tax year with extension Form BA-403 or 5 - 5

credit available through prior year carryforward . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2. ________________________0 .00

3. Balance Due (If Line 1 is greater than Line 2, Line 1 MINUS Line 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3. ________________________250 .00

4. Overpayment (If Line 2 is greater than Line 1, Line 2 MINUS Line 1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4. ________________________ .00

5. Overpayment to be Refunded . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5. ________________________ .00

6. Overpayment to be credited to next tax year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6. ________________________ .00

I hereby certify that I am an officer or authorized agent responsible for the taxpayer’s compliance with the requirements Vermont Statutes

Annotated, Title 32, and that this return is true, correct, and complete to the best of my knowledge. If prepared by a person other than the

taxpayer, this declaration further provides that under 32 V.S.A. § 5901, this information has not been and will not be used for any other purpose,

or made available to any other person, other than for the preparation of this return unless a separate valid consent form is signed by the taxpayer

and retained by the preparer.

Signature of Responsible Officer Date (MM/DD/YYYY) Daytime Telephone Number

/ /

Printed Name Email Address (optional)

Check if the Vermont Department of Taxes may discuss this return with the preparer shown.

Signature of Paid Preparer Date (MM/DD/YYYY) Preparer’s Telephone Number

/ /

Preparer’s Printed Name Email Address (optional)

FORM (Place at LAST page)

Firm’s Name (or yours if self-employed) EIN Preparer’s SSN or PTIN Form pages

Firm’s Address (or yours if self-employed) (Street, City, State, ZIP Code)

Check if self-employed

Send return Vermont Department of Taxes For Department Use Only Form BI-476

and check to: 133 State Street Ck. Amt. Init. Page 1 of 1 5 - 5

5454 Montpelier, VT 05633-1401 Rev. 10/23

|

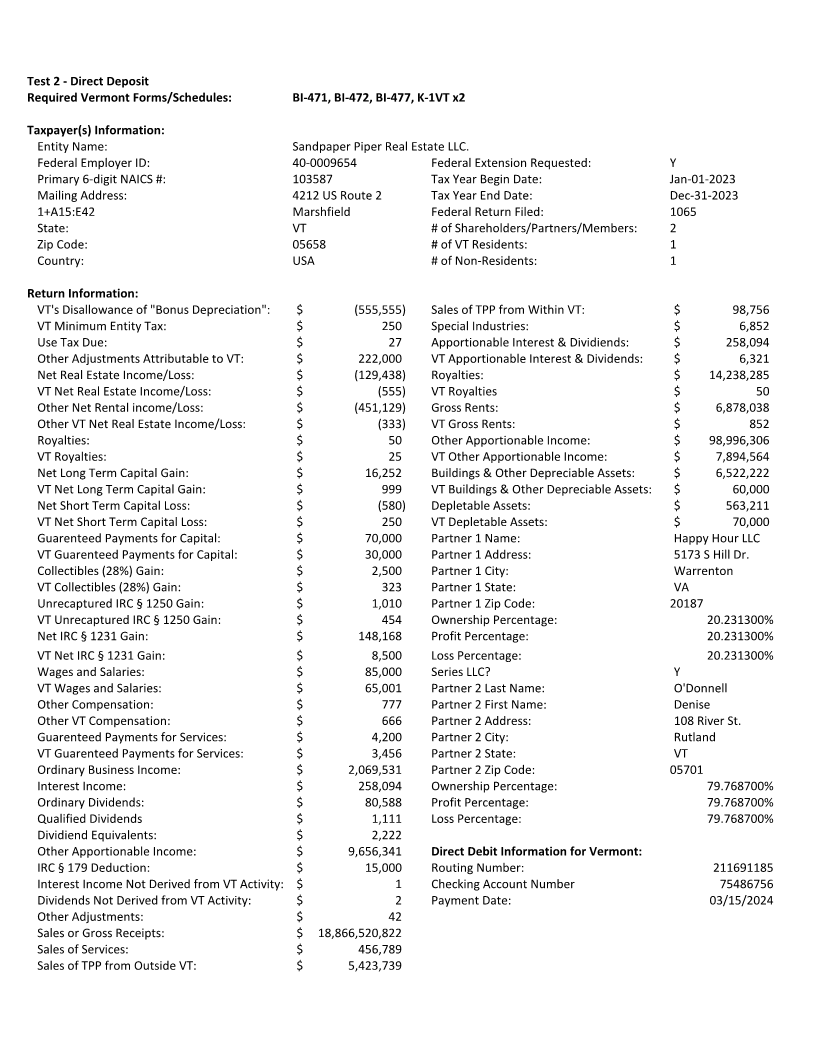

Enlarge image | Test 2 - Direct Deposit Required Vermont Forms/Schedules: BI-471, BI-472, BI-477, K-1VT x2 Taxpayer(s) Information: Entity Name: Sandpaper Piper Real Estate LLC. Federal Employer ID: 40-0009654 Federal Extension Requested: Y Primary 6-digit NAICS #: 103587 Tax Year Begin Date: Jan-01-2023 Mailing Address: 4212 US Route 2 Tax Year End Date: Dec-31-2023 1+A15:E42 Marshfield Federal Return Filed: 1065 State: VT # of Shareholders/Partners/Members: 2 Zip Code: 05658 # of VT Residents: 1 Country: USA # of Non-Residents: 1 Return Information: VT's Disallowance of "Bonus Depreciation": $ (555,555) Sales of TPP from Within VT: $ 98,756 VT Minimum Entity Tax: $ 250 Special Industries: $ 6,852 Use Tax Due: $ 27 Apportionable Interest & Dividiends: $ 258,094 Other Adjustments Attributable to VT: $ 222,000 VT Apportionable Interest & Dividends: $ 6,321 Net Real Estate Income/Loss: $ (129,438) Royalties: $ 14,238,285 VT Net Real Estate Income/Loss: $ (555) VT Royalties $ 50 Other Net Rental income/Loss: $ (451,129) Gross Rents: $ 6,878,038 Other VT Net Real Estate Income/Loss: $ (333) VT Gross Rents: $ 852 Royalties: $ 50 Other Apportionable Income: $ 98,996,306 VT Royalties: $ 25 VT Other Apportionable Income: $ 7,894,564 Net Long Term Capital Gain: $ 16,252 Buildings & Other Depreciable Assets: $ 6,522,222 VT Net Long Term Capital Gain: $ 999 VT Buildings & Other Depreciable Assets: $ 60,000 Net Short Term Capital Loss: $ (580) Depletable Assets: $ 563,211 VT Net Short Term Capital Loss: $ 250 VT Depletable Assets: $ 70,000 Guarenteed Payments for Capital: $ 70,000 Partner 1 Name: Happy Hour LLC VT Guarenteed Payments for Capital: $ 30,000 Partner 1 Address: 5173 S Hill Dr. Collectibles (28%) Gain: $ 2,500 Partner 1 City: Warrenton VT Collectibles (28%) Gain: $ 323 Partner 1 State: VA Unrecaptured IRC § 1250 Gain: $ 1,010 Partner 1 Zip Code: 20187 VT Unrecaptured IRC § 1250 Gain: $ 454 Ownership Percentage: 20.231300% Net IRC § 1231 Gain: $ 148,168 Profit Percentage: 20.231300% VT Net IRC § 1231 Gain: $ 8,500 Loss Percentage: 20.231300% Wages and Salaries: $ 85,000 Series LLC? Y VT Wages and Salaries: $ 65,001 Partner 2 Last Name: O'Donnell Other Compensation: $ 777 Partner 2 First Name: Denise Other VT Compensation: $ 666 Partner 2 Address: 108 River St. Guarenteed Payments for Services: $ 4,200 Partner 2 City: Rutland VT Guarenteed Payments for Services: $ 3,456 Partner 2 State: VT Ordinary Business Income: $ 2,069,531 Partner 2 Zip Code: 05701 Interest Income: $ 258,094 Ownership Percentage: 79.768700% Ordinary Dividends: $ 80,588 Profit Percentage: 79.768700% Qualified Dividends $ 1,111 Loss Percentage: 79.768700% Dividiend Equivalents: $ 2,222 Other Apportionable Income: $ 9,656,341 Direct Debit Information for Vermont: IRC § 179 Deduction: $ 15,000 Routing Number: 211691185 Interest Income Not Derived from VT Activity: $ 1 Checking Account Number 75486756 Dividends Not Derived from VT Activity: $ 2 Payment Date: 03/15/2024 Other Adjustments: $ 42 Sales or Gross Receipts: $ 18,866,520,822 Sales of Services: $ 456,789 Sales of TPP from Outside VT: $ 5,423,739 |

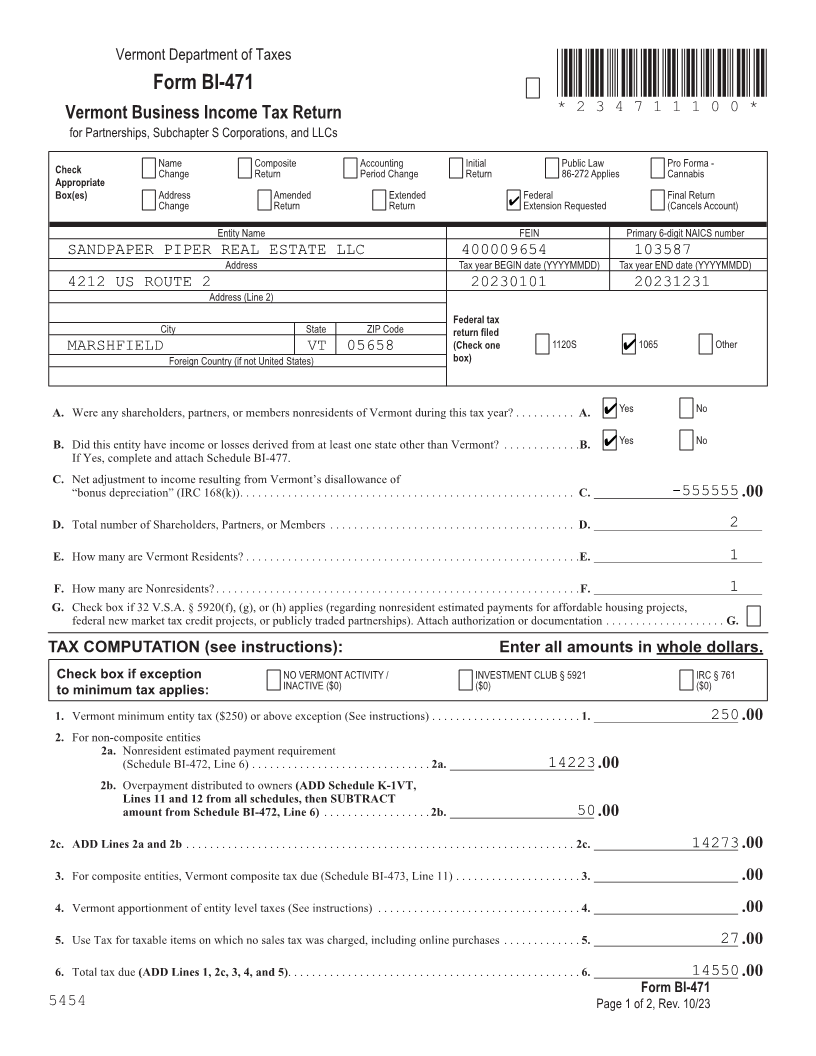

Enlarge image |

Vermont Department of Taxes

Form BI-471 *234711100*

Vermont Business Income Tax Return *234711100*

for Partnerships, Subchapter S Corporations, and LLCs Page 11

Check Name Composite Accounting Initial Public Law Pro Forma -

Change Return Period Change Return 86-272 Applies Cannabis

Appropriate

Box(es) Address Amended Extended 4 Federal Final Return

Change Return Return Extension Requested (Cancels Account)

Entity Name FEIN Primary 6-digit NAICS number

SANDPAPER PIPER REAL ESTATE LLC 400009654 103587

Address Tax year BEGIN date (YYYYMMDD) Tax year END date (YYYYMMDD)

4212 US ROUTE 2 20230101 20231231

Address (Line 2)

Federal tax

City State ZIP Code return filed

MARSHFIELD Foreign Country (if not United States)VT 05658 box) 4

(Check one 1120S 1065 Other

FORM (Place at FIRST page)

A. Were any shareholders, partners, or members nonresidents of Vermont during this tax year? . . . . . . . . . . A. 4 Yes No Form pages

B. Did this entity have income or losses derived from at least one state other than Vermont? . . . . . . . . . . . . . B. 4 Yes No

If Yes, complete and attach Schedule BI-477 .

C. Net adjustment to income resulting from Vermont’s disallowance of

“bonus depreciation” (IRC 168(k)) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . C. ________________________-555555 .00 11 - 12

D. Total number of Shareholders, Partners, or Members . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . D. ____________________________2

E. How many are Vermont Residents? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . E. ____________________________1

F. How many are Nonresidents? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F. ____________________________1

G. Check box if 32 V .S .A . § 5920(f), (g), or (h) applies (regarding nonresident estimated payments for affordable housing projects,

federal new market tax credit projects, or publicly traded partnerships) . Attach authorization or documentation . . . . . . . . . . . . . . . . . . . . G.

TAX COMPUTATION (see instructions): Enter all amounts in whole dollars.

Check box if exception NO VERMONT ACTIVITY / INVESTMENT CLUB § 5921 IRC § 761

INACTIVE ($0) ($0) ($0)

to minimum tax applies:

1. Vermont minimum entity tax ($250) or above exception (See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . 1. ________________________250 .00

2. For non-composite entities

2a. Nonresident estimated payment requirement

(Schedule BI-472, Line 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2a. ________________________14223 .00

2b. Overpayment distributed to owners (ADD Schedule K-1VT,

Lines 11 and 12 from all schedules, then SUBTRACT

amount from Schedule BI-472, Line 6) . . . . . . . . . . . . . . . . . . 2b. ________________________50 .00

2c. ADD Lines 2a and 2b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .2c. ________________________14273.00

3. For composite entities, Vermont composite tax due (Schedule BI-473, Line 11) . . . . . . . . . . . . . . . . . . . . . 3. ________________________ .00

4. Vermont apportionment of entity level taxes (See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4. ________________________ .00

5. Use Tax for taxable items on which no sales tax was charged, including online purchases . . . . . . . . . . . . . 5. ________________________27 .00

6. Total tax due (ADD Lines 1, 2c, 3, 4, and 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6. ________________________14550 .00

Form BI-471

5454 Page 1 of 2, Rev. 10/23

|

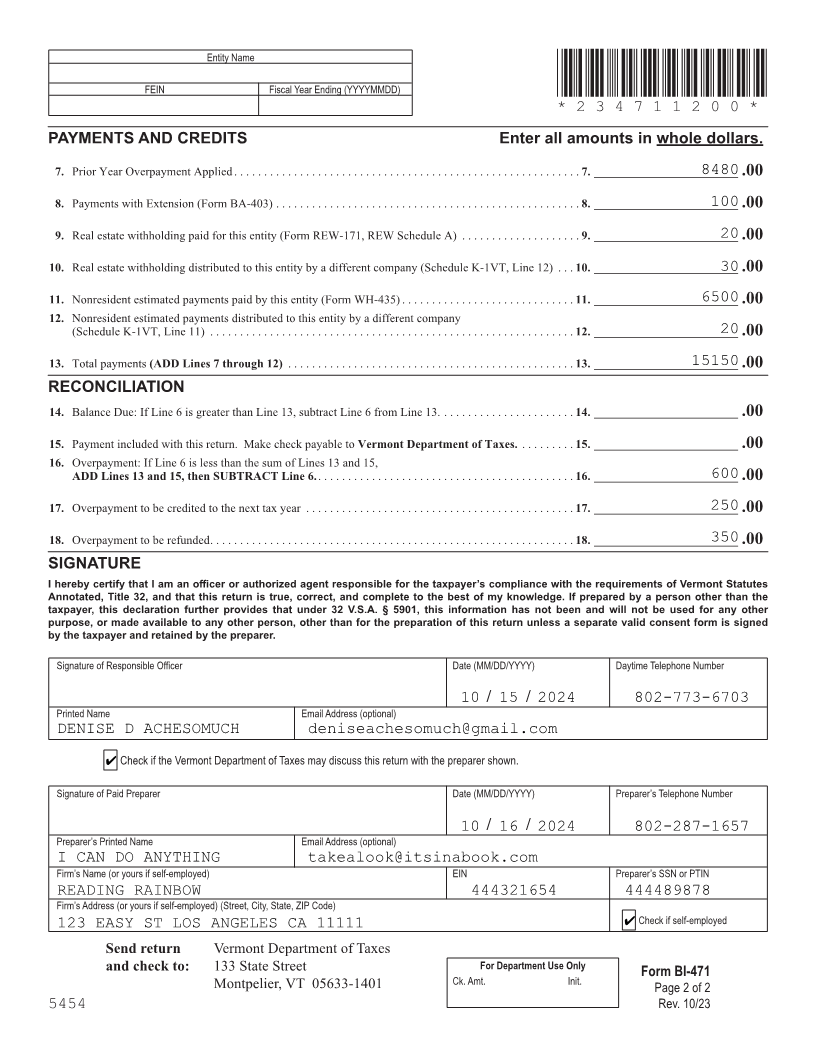

Enlarge image |

Entity Name

FEIN Fiscal Year Ending (YYYYMMDD) *234711200*

*234711200*

Page 12

PAYMENTS AND CREDITS Enter all amounts in whole dollars.

7. Prior Year Overpayment Applied . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7. ________________________8480 .00

8. Payments with Extension (Form BA-403) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8. ________________________100 .00

9. Real estate withholding paid for this entity (Form REW-171, REW Schedule A) . . . . . . . . . . . . . . . . . . . . 9. ________________________20 .00

10. Real estate withholding distributed to this entity by a different company (Schedule K-1VT, Line 12) . . . 10. ________________________30 .00

11. Nonresident estimated payments paid by this entity (Form WH-435) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11. ________________________6500 .00

12. Nonresident estimated payments distributed to this entity by a different company

(Schedule K-1VT, Line 11) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12. ________________________20 .00

13. Total payments (ADD Lines 7 through 12) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13. ________________________15150 .00

RECONCILIATION FORM (Place at LAST page)

14. Balance Due: If Line 6 is greater than Line 13, subtract Line 6 from Line 13 . . . . . . . . . . . . . . . . . . . . . . . 14. ________________________ .00 Form pages

15. Payment included with this return . Make check payable to Vermont Department of Taxes. . . . . . . . . . 15. ________________________ .00

16. Overpayment: If Line 6 is less than the sum of Lines 13 and 15,

ADD Lines 13 and 15, then SUBTRACT Line 6. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16. ________________________600 .00

11 - 12

17. Overpayment to be credited to the next tax year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17. ________________________250 .00

18. Overpayment to be refunded . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18. ________________________350 .00

SIGNATURE

I hereby certify that I am an officer or authorized agent responsible for the taxpayer’s compliance with the requirements of Vermont Statutes

Annotated, Title 32, and that this return is true, correct, and complete to the best of my knowledge. If prepared by a person other than the

taxpayer, this declaration further provides that under 32 V.S.A. § 5901, this information has not been and will not be used for any other

purpose, or made available to any other person, other than for the preparation of this return unless a separate valid consent form is signed

by the taxpayer and retained by the preparer.

Signature of Responsible Officer Date (MM/DD/YYYY) Daytime Telephone Number

10 / 15 / 2024 802-773-6703

Printed Name Email Address (optional)

DENISE D ACHESOMUCH deniseachesomuch@gmail.com

4 Check if the Vermont Department of Taxes may discuss this return with the preparer shown.

Signature of Paid Preparer Date (MM/DD/YYYY) Preparer’s Telephone Number

10 / 16 / 2024 802-287-1657

Preparer’s Printed Name Email Address (optional)

I CAN DO ANYTHING takealook@itsinabook.com

Firm’s Name (or yours if self-employed) EIN Preparer’s SSN or PTIN

READING RAINBOW 444321654 444489878

Firm’s Address (or yours if self-employed) (Street, City, State, ZIP Code)

4 Check if self-employed

123 EASY ST LOS ANGELES CA 11111

Send return Vermont Department of Taxes

and check to: 133 State Street For Department Use Only Form BI-471

Montpelier, VT 05633-1401 Ck. Amt. Init. Page 2 of 2

5454 Rev. 10/23

|

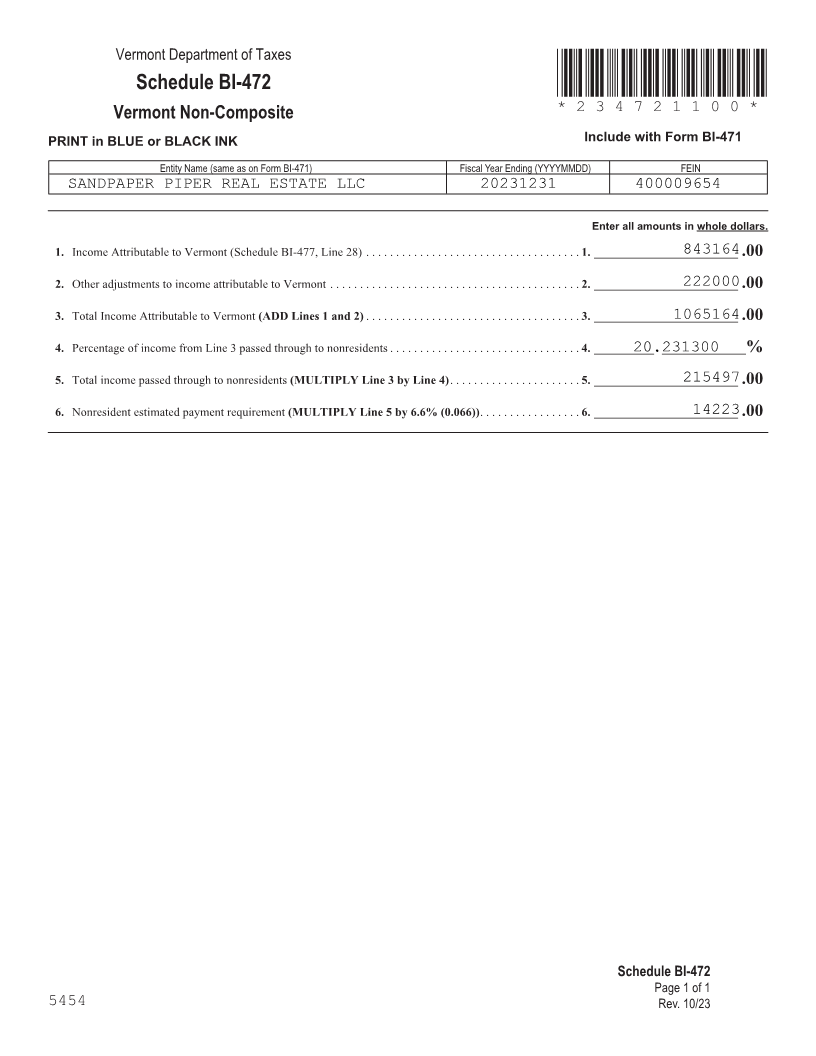

Enlarge image |

Vermont Department of Taxes

Schedule BI-472 *234721100*

Vermont Non-Composite *234721100*

Page 5

PRINT in BLUE or BLACK INK Include with Form BI-471

Entity Name (same as on Form BI-471) Fiscal Year Ending (YYYYMMDD) FEIN

SANDPAPER PIPER REAL ESTATE LLC 20231231 400009654

Enter all amounts in whole dollars.

1. Income Attributable to Vermont (Schedule BI-477, Line 28) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1. ________________________843164.00

2. Other adjustments to income attributable to Vermont . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2. ________________________222000 .00

3. Total Income Attributable to Vermont (ADD Lines 1 and 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3. ________________________1065164 .00

4. Percentage of income from Line 3 passed through to nonresidents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4. . __________20.231300. ______________%

5. Total income passed through to nonresidents (MULTIPLY Line 3 by Line 4) . . . . . . . . . . . . . . . . . . . . . . 5. ________________________215497 .00

FORM (Place at FIRST page)

6. Nonresident estimated payment requirement (MULTIPLY Line 5 by 6.6% (0.066)) . . . . . . . . . . . . . . . . . 6. ________________________14223 .00 Form pages

5 - 5

FORM (Place at LAST page)

Form pages

5 - 5

Schedule BI-472

Page 1 of 1

5454 Rev. 10/23

|

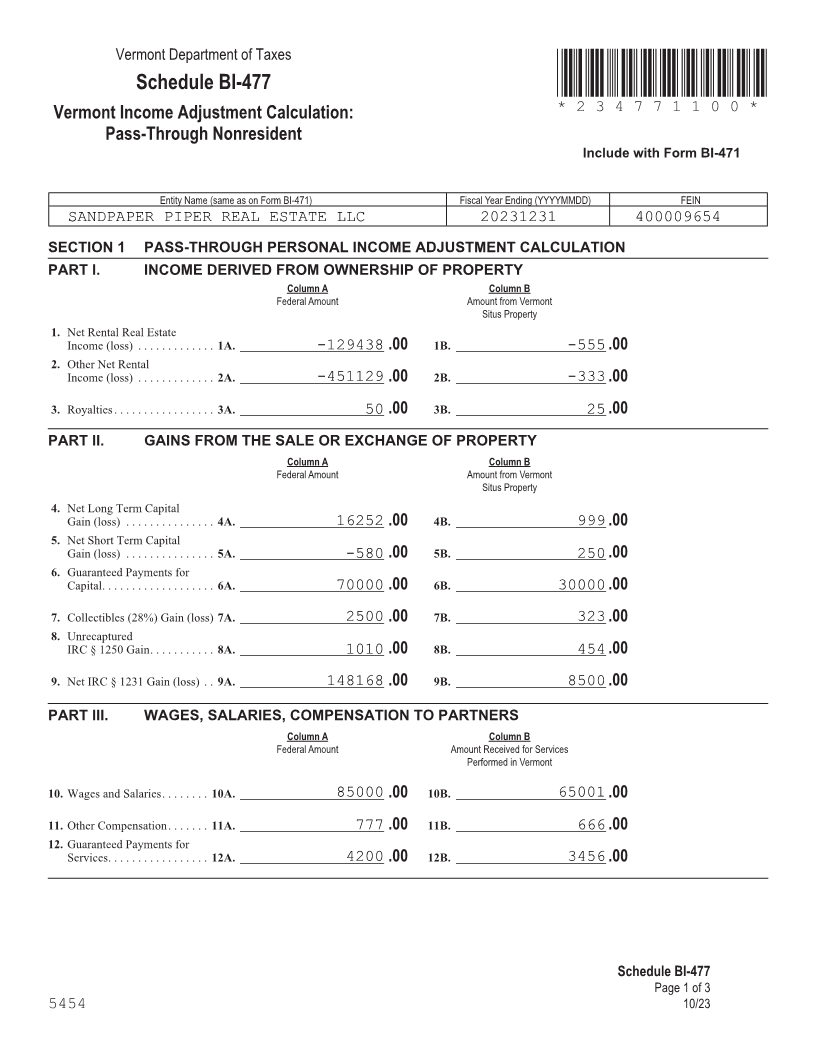

Enlarge image |

Vermont Department of Taxes

Schedule BI-477 *234771100*

Vermont Income Adjustment Calculation: *234771100*

Page 3

Pass-Through Nonresident

Include with Form BI-471

Entity Name (same as on Form BI-471) Fiscal Year Ending (YYYYMMDD) FEIN

SANDPAPER PIPER REAL ESTATE LLC 20231231 400009654

SECTION 1 PASS-THROUGH PERSONAL INCOME ADJUSTMENT CALCULATION

PART I. INCOME DERIVED FROM OWNERSHIP OF PROPERTY

Column A Column B

Federal Amount Amount from Vermont

Situs Property

1. Net Rental Real Estate

Income (loss) . . . . . . . . . . . . . 1A. ________________________-129438 .00 1B. _________________________-555 .00

2. Other Net Rental

Income (loss) . . . . . . . . . . . . . 2A. ________________________-451129 .00 2B. _________________________-333 .00

FORM (Place at FIRST page)

3. Royalties . . . . . . . . . . . . . . . . . 3A. ________________________50 .00 3B. _________________________25 .00 Form pages

PART II. GAINS FROM THE SALE OR EXCHANGE OF PROPERTY

Column A Column B

Federal Amount Amount from Vermont

Situs Property

3 - 5

4. Net Long Term Capital

Gain (loss) . . . . . . . . . . . . . . . 4A. ________________________16252 .00 4B. _________________________999 .00

5. Net Short Term Capital

Gain (loss) . . . . . . . . . . . . . . . 5A. ________________________-580 .00 5B. _________________________250 .00

6. Guaranteed Payments for

Capital . . . . . . . . . . . . . . . . . . . 6A. ________________________70000 .00 6B. _________________________30000 .00

7. Collectibles (28%) Gain (loss) 7A. ________________________2500 .00 7B. _________________________323 .00

8. Unrecaptured

IRC § 1250 Gain . . . . . . . . . . . 8A. ________________________1010 .00 8B. _________________________454 .00

9. Net IRC § 1231 Gain (loss) . . 9A. ________________________148168 .00 9B. _________________________8500 .00

PART III. WAGES, SALARIES, COMPENSATION TO PARTNERS

Column A Column B

Federal Amount Amount Received for Services

Performed in Vermont

10. Wages and Salaries . . . . . . . . 10A. ________________________85000 .00 10B. _________________________65001 .00

11. Other Compensation . . . . . . . 11A. ________________________777 .00 11B. _________________________666 .00

12. Guaranteed Payments for

Services . . . . . . . . . . . . . . . . . 12A. ________________________4200 .00 12B. _________________________3456 .00

Schedule BI-477

Page 1 of 3

5454 10/23

|

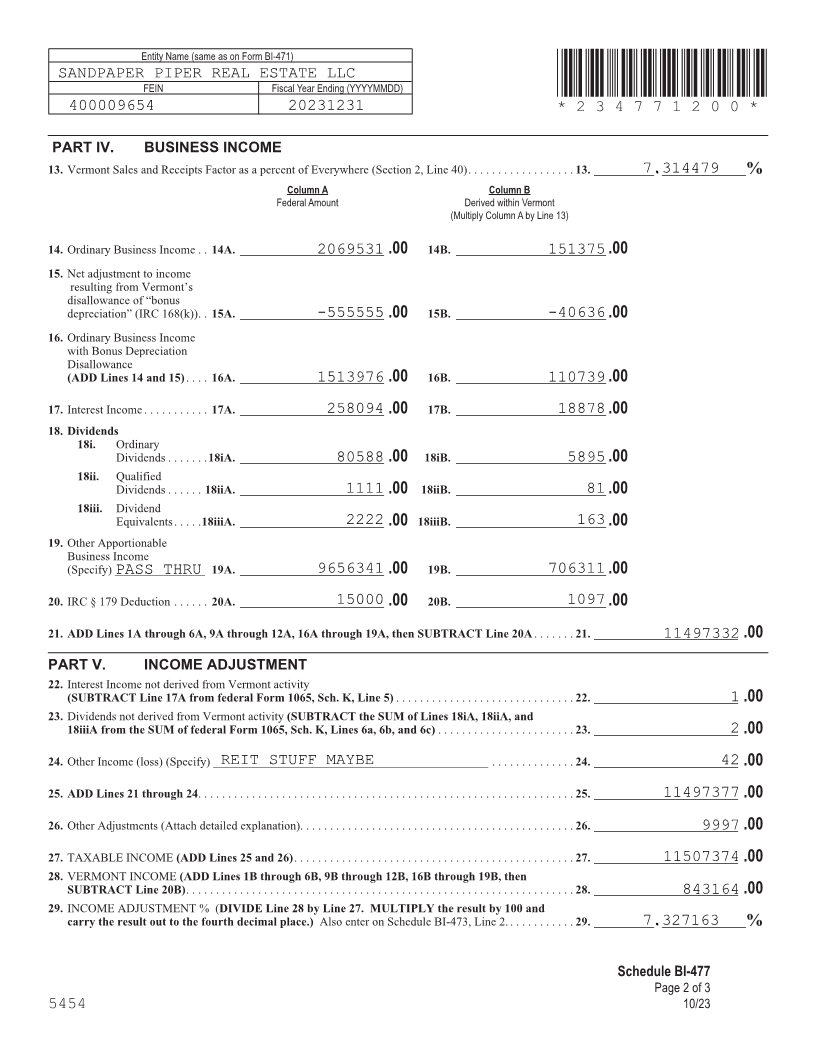

Enlarge image |

Entity Name (same as on Form BI-471)

SANDPAPER PIPER REAL ESTATE LLC

FEIN Fiscal Year Ending (YYYYMMDD) *234771200*

400009654 20231231 *234771200*

Page 10

PART IV. BUSINESS INCOME

13. Vermont Sales and Receipts Factor as a percent of Everywhere (Section 2, Line 40) . . . . . . . . . . . . . . . . . 13. . __________7.314479. ______________%

Column A Column B

Federal Amount Derived within Vermont

(Multiply Column A by Line 13)

14. Ordinary Business Income . . 14A. ________________________2069531 .00 14B. _________________________151375 .00

15. Net adjustment to income

resulting from Vermont’s

disallowance of “bonus

depreciation” (IRC 168(k)) . . 15A. ________________________-555555 .00 15B. _________________________-40636 .00

16. Ordinary Business Income

with Bonus Depreciation

Disallowance

(ADD Lines 14 and 15) . . . . 16A. ________________________1513976 .00 16B. _________________________110739 .00

17. Interest Income . . . . . . . . . . . 17A. ________________________258094 .00 17B. _________________________18878 .00

18. Dividends

18i. Ordinary

Dividends . . . . . . . 18iA. ________________________80588 .00 18iB. _________________________5895 .00

18ii. Qualified

Dividends . . . . . . 18iiA. ________________________1111 .00 18iiB. _________________________81 .00

18iii. Dividend

Equivalents . . . . . 18iiiA. ________________________2222 .00 18iiiB. _________________________163 .00

19. Other Apportionable

Business Income

(Specify) _______________ PASS THRU 19A. ________________________9656341 .00 19B. _________________________706311 .00

20. IRC § 179 Deduction . . . . . . 20A. ________________________15000 .00 20B. _________________________1097 .00

21. ADD Lines 1A through 6A, 9A through 12A, 16A through 19A, then SUBTRACT Line 20A . . . . . . . 21. ________________________11497332 .00

PART V. INCOME ADJUSTMENT

22. Interest Income not derived from Vermont activity

(SUBTRACT Line 17A from federal Form 1065, Sch. K, Line 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22. ________________________1 .00

23. Dividends not derived from Vermont activity (SUBTRACT the SUM of Lines 18iA, 18iiA, and

18iiiA from the SUM of federal Form 1065, Sch. K, Lines 6a, 6b, and 6c) . . . . . . . . . . . . . . . . . . . . . . . 23. ________________________2 .00

24. Other Income (loss) (Specify) ______________________________________________ REIT STUFF MAYBE . . . . . . . . . . . . . 24. . ________________________42.00

25. ADD Lines 21 through 24 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25. ________________________11497377 .00

26. Other Adjustments (Attach detailed explanation) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26. ________________________9997 .00

27. TAXABLE INCOME (ADD Lines 25 and 26) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27. ________________________11507374 .00

28. VERMONT INCOME (ADD Lines 1B through 6B, 9B through 12B, 16B through 19B, then

SUBTRACT Line 20B) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28. ________________________843164 .00

29. INCOME ADJUSTMENT % (DIVIDE Line 28 by Line 27. MULTIPLY the result by 100 and

carry the result out to the fourth decimal place.) Also enter on Schedule BI-473, Line 2 . . . . . . . . . . . 29. . __________7.327163. ______________%

Schedule BI-477

Page 2 of 3

5454 10/23

|

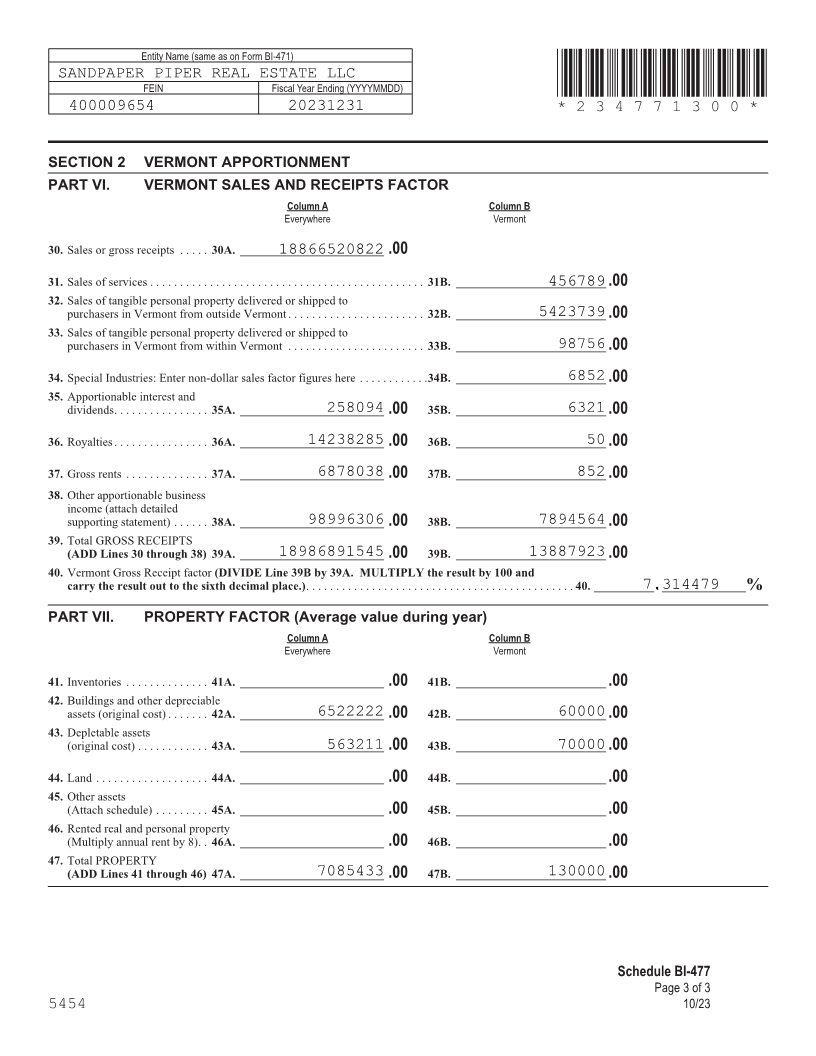

Enlarge image |

Entity Name (same as on Form BI-471)

SANDPAPER PIPER REAL ESTATE LLC

FEIN Fiscal Year Ending (YYYYMMDD) *234771300*

400009654 20231231 *234771300*

Page 5

SECTION 2 VERMONT APPORTIONMENT

PART VI. VERMONT SALES AND RECEIPTS FACTOR

Column A Column B

Everywhere Vermont

30. Sales or gross receipts . . . . . 30A. ________________________18866520822 .00

31. Sales of services . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31B. _________________________456789 .00

32. Sales of tangible personal property delivered or shipped to

purchasers in Vermont from outside Vermont . . . . . . . . . . . . . . . . . . . . . . . 32B. _________________________5423739 .00

33. Sales of tangible personal property delivered or shipped to

purchasers in Vermont from within Vermont . . . . . . . . . . . . . . . . . . . . . . . 33B. _________________________98756 .00

34. Special Industries: Enter non-dollar sales factor figures here . . . . . . . . . . . .34B. _________________________6852 .00

35. Apportionable interest and FORM (Place at LAST page)

dividends . . . . . . . . . . . . . . . . 35A. ________________________258094 .00 35B. _________________________6321 .00 Form pages

36. Royalties . . . . . . . . . . . . . . . . 36A. ________________________14238285 .00 36B. _________________________50 .00

37. Gross rents . . . . . . . . . . . . . . 37A. ________________________6878038 .00 37B. _________________________852 .00

38. Other apportionable business 3 - 5

income (attach detailed

supporting statement) . . . . . . 38A. ________________________98996306 .00 38B. _________________________7894564 .00

39. Total GROSS RECEIPTS

(ADD Lines 30 through 38) 39A. ________________________ 18986891545.00 39B. _________________________13887923.00

40. Vermont Gross Receipt factor (DIVIDE Line 39B by 39A. MULTIPLY the result by 100 and

carry the result out to the sixth decimal place.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40. . __________7.314479. ______________%

PART VII. PROPERTY FACTOR (Average value during year)

Column A Column B

Everywhere Vermont

41. Inventories . . . . . . . . . . . . . . 41A. ________________________ .00 41B. _________________________ .00

42. Buildings and other depreciable

assets (original cost) . . . . . . . 42A. ________________________6522222 .00 42B. _________________________60000 .00

43. Depletable assets

(original cost) . . . . . . . . . . . . 43A. ________________________563211 .00 43B. _________________________70000 .00

44. Land . . . . . . . . . . . . . . . . . . . 44A. ________________________ .00 44B. _________________________ .00

45. Other assets

(Attach schedule) . . . . . . . . . 45A. ________________________ .00 45B. _________________________ .00

46. Rented real and personal property

(Multiply annual rent by 8) . . 46A. ________________________ .00 46B. _________________________ .00

47. Total PROPERTY

(ADD Lines 41 through 46) 47A. ________________________ 7085433.00 47B. _________________________130000.00

Schedule BI-477

Page 3 of 3

5454 10/23

|

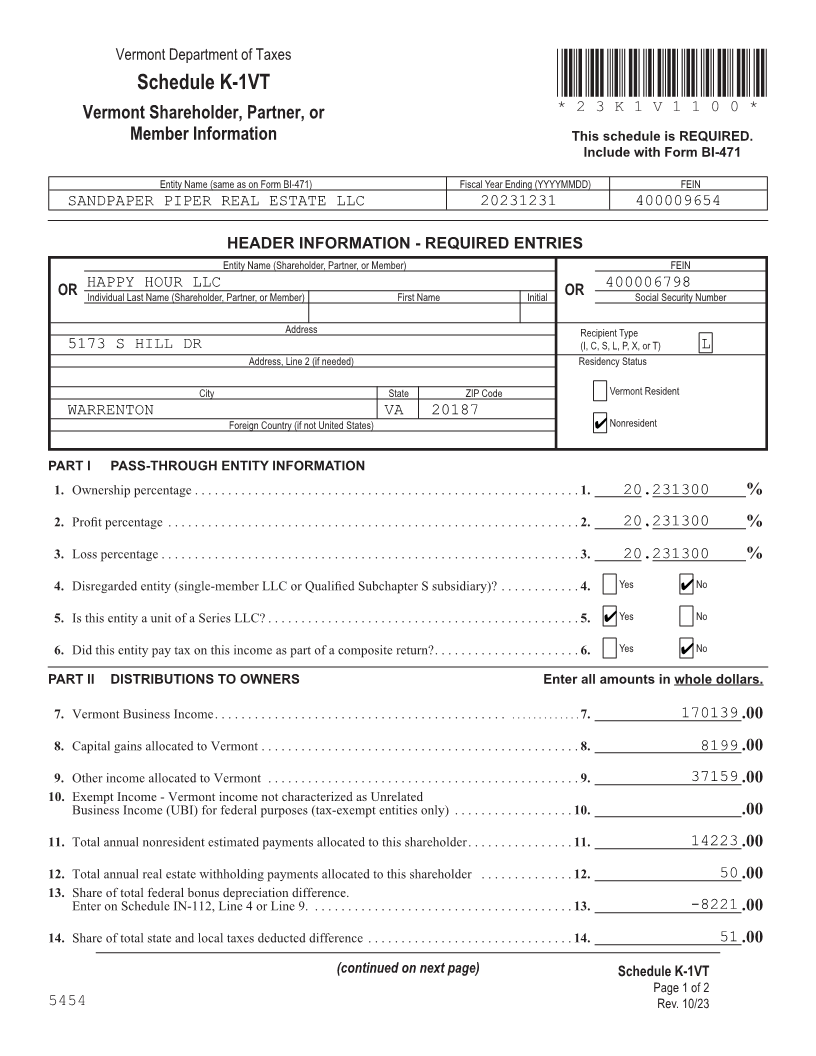

Enlarge image |

Vermont Department of Taxes

Schedule K-1VT *23K1V1100*

Vermont Shareholder, Partner, or *23K1V1100*

Page 7

Member Information This schedule is REQUIRED.

Include with Form BI-471

Entity Name (same as on Form BI-471) Fiscal Year Ending (YYYYMMDD) FEIN

SANDPAPER PIPER REAL ESTATE LLC 20231231 400009654

HEADER INFORMATION - REQUIRED ENTRIES

Entity Name (Shareholder, Partner, or Member) FEIN

HAPPY HOUR LLC 400006798

OR Individual Last Name (Shareholder, Partner, or Member) First Name Initial OR Social Security Number

Address Recipient Type

5173 S HILL DR (I, C, S, L, P, X, or T) L

Address, Line 2 (if needed) Residency Status

City State ZIP Code Vermont Resident FORM (Place at FIRST page)

WARRENTON VA 20187 Form pages

Foreign Country (if not United States) 4 Nonresident

PART I PASS-THROUGH ENTITY INFORMATION

1. Ownership percentage . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1. . _______20.231300. ______________% 7 - 8

2. Profit percentage . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2. . _______20.231300. ______________%

3. Loss percentage . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3. . _______20.231300. ______________%

4. Disregarded entity (single-member LLC or Qualified Subchapter S subsidiary)? . . . . . . . . . . . . 4. Yes 4 No

5. Is this entity a unit of a Series LLC? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5. 4 Yes No

6. Did this entity pay tax on this income as part of a composite return? . . . . . . . . . . . . . . . . . . . . . . 6. Yes 4 No

PART II DISTRIBUTIONS TO OWNERS Enter all amounts in whole dollars.

7. Vermont Business Income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7. ______________________170139 .00

8. Capital gains allocated to Vermont . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8. ______________________8199 .00

9. Other income allocated to Vermont . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9. ______________________37159 .00

10. Exempt Income - Vermont income not characterized as Unrelated

Business Income (UBI) for federal purposes (tax-exempt entities only) . . . . . . . . . . . . . . . . . . 10. ______________________.00

11. Total annual nonresident estimated payments allocated to this shareholder . . . . . . . . . . . . . . . . 11. ______________________14223 .00

12. Total annual real estate withholding payments allocated to this shareholder . . . . . . . . . . . . . . 12. ______________________50 .00

13. Share of total federal bonus depreciation difference.

Enter on Schedule IN-112, Line 4 or Line 9. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13. ______________________-8221 .00

14. Share of total state and local taxes deducted difference . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14. ______________________51 .00

(continued on next page) Schedule K-1VT

Page 1 of 2

5454 Rev. 10/23

|

Enlarge image |

Entity Name (same as on Form Form BI-471)

SANDPAPER PIPER REAL ESTATE LLC

FEIN Fiscal Year Ending (YYYYMMDD) *23K1V1200*

400009654 20231231 *23K1V1200*

Page 8

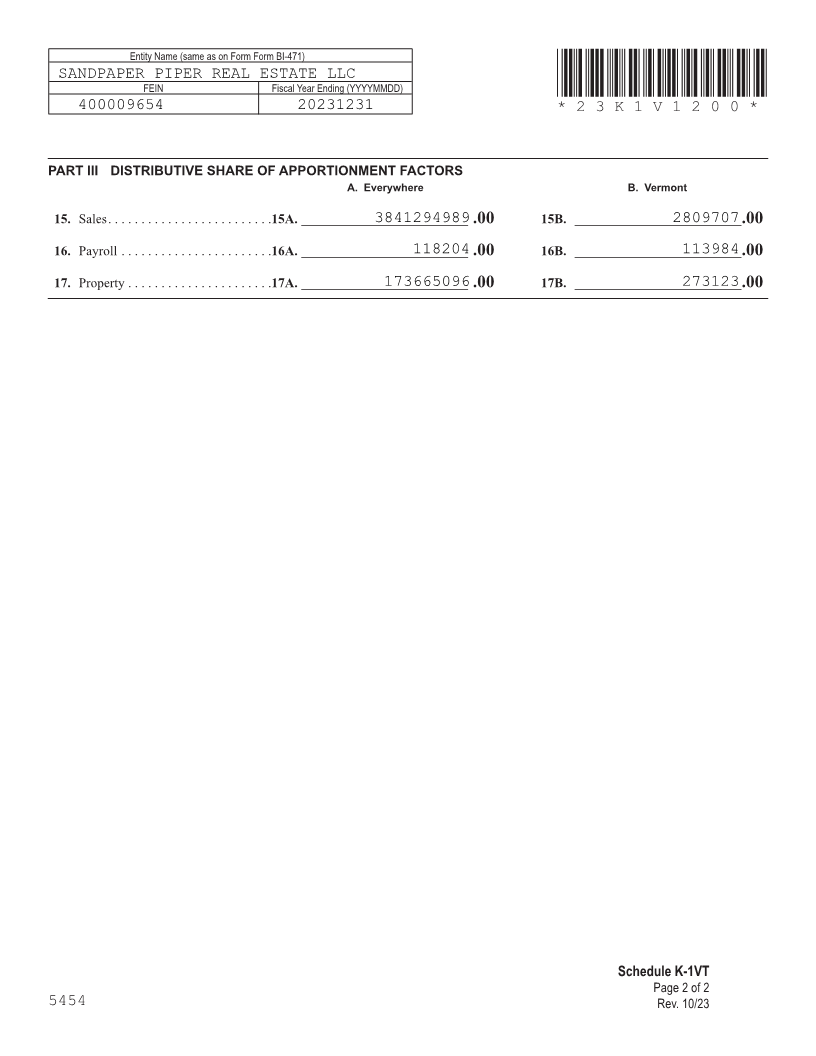

PART III DISTRIBUTIVE SHARE OF APPORTIONMENT FACTORS

A. Everywhere B. Vermont

15. Sales . . . . . . . . . . . . . . . . . . . . . . . . .15A. _________________________3841294989 .00 15B. _________________________2809707 .00

16. Payroll . . . . . . . . . . . . . . . . . . . . . . .16A. _________________________118204 .00 16B. _________________________113984 .00

17. Property . . . . . . . . . . . . . . . . . . . . . .17A. _________________________173665096 .00 17B. _________________________273123 .00

FORM (Place at LAST page)

Form pages

7 - 8

Schedule K-1VT

Page 2 of 2

5454 Rev. 10/23

|

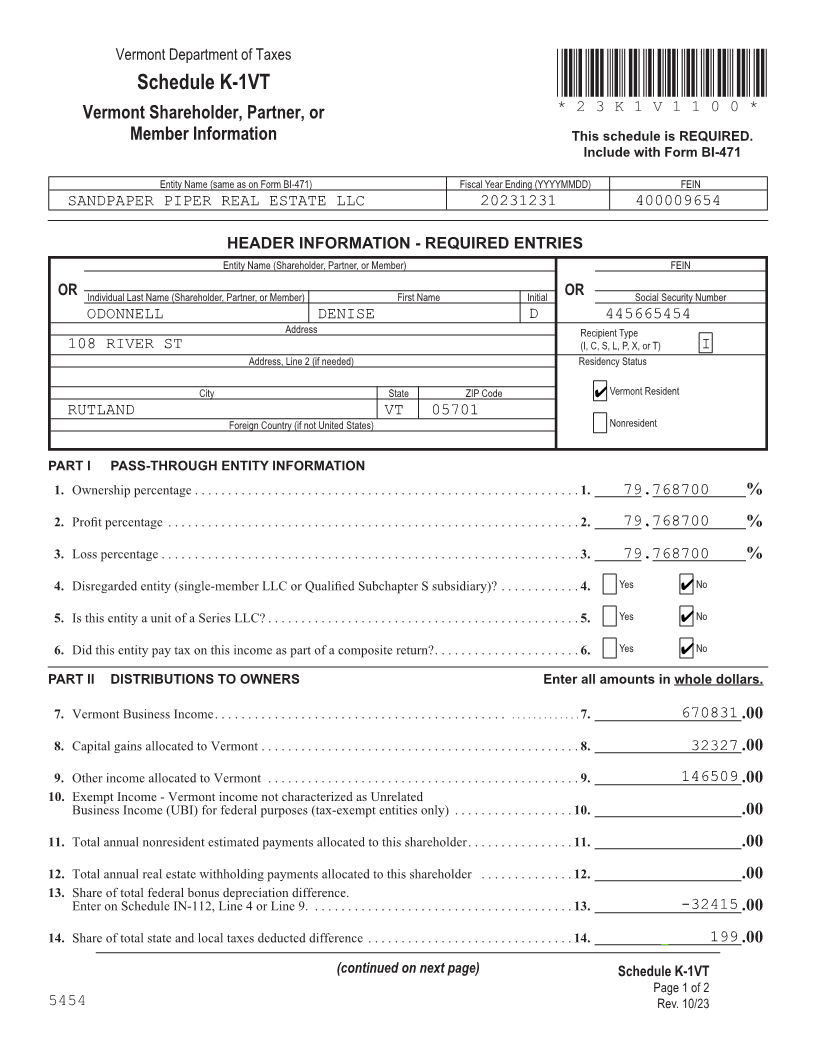

Enlarge image |

Vermont Department of Taxes

Schedule K-1VT *23K1V1100*

Vermont Shareholder, Partner, or *23K1V1100*

Page 7

Member Information This schedule is REQUIRED.

Include with Form BI-471

Entity Name (same as on Form BI-471) Fiscal Year Ending (YYYYMMDD) FEIN

SANDPAPER PIPER REAL ESTATE LLC 20231231 400009654

HEADER INFORMATION - REQUIRED ENTRIES

Entity Name (Shareholder, Partner, or Member) FEIN

OR Individual Last Name (Shareholder, Partner, or Member) First Name Initial OR Social Security Number

ODONNELL DENISE D 445665454

Address Recipient Type

108 RIVER ST (I, C, S, L, P, X, or T) I

Address, Line 2 (if needed) Residency Status

City State ZIP Code 4 Vermont Resident FORM (Place at FIRST page)

RUTLAND VT 05701 Form pages

Foreign Country (if not United States) Nonresident

PART I PASS-THROUGH ENTITY INFORMATION

1. Ownership percentage . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1. . _______79.768700. ______________% 7 - 8

2. Profit percentage . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2. . _______79.768700. ______________%

3. Loss percentage . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3. . _______79.768700. ______________%

4. Disregarded entity (single-member LLC or Qualified Subchapter S subsidiary)? . . . . . . . . . . . . 4. Yes 4 No

5. Is this entity a unit of a Series LLC? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5. Yes 4 No

6. Did this entity pay tax on this income as part of a composite return? . . . . . . . . . . . . . . . . . . . . . . 6. Yes 4 No

PART II DISTRIBUTIONS TO OWNERS Enter all amounts in whole dollars.

7. Vermont Business Income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7. ______________________670831 .00

8. Capital gains allocated to Vermont . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8. ______________________32327 .00

9. Other income allocated to Vermont . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9. ______________________146509 .00

10. Exempt Income - Vermont income not characterized as Unrelated

Business Income (UBI) for federal purposes (tax-exempt entities only) . . . . . . . . . . . . . . . . . . 10. ______________________.00

11. Total annual nonresident estimated payments allocated to this shareholder . . . . . . . . . . . . . . . . 11. ______________________.00

12. Total annual real estate withholding payments allocated to this shareholder . . . . . . . . . . . . . . 12. ______________________.00

13. Share of total federal bonus depreciation difference.

Enter on Schedule IN-112, Line 4 or Line 9. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13. ______________________-32415 .00

14. Share of total state and local taxes deducted difference . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14. ______________________199 .00

(continued on next page) Schedule K-1VT

Page 1 of 2

5454 Rev. 10/23

|

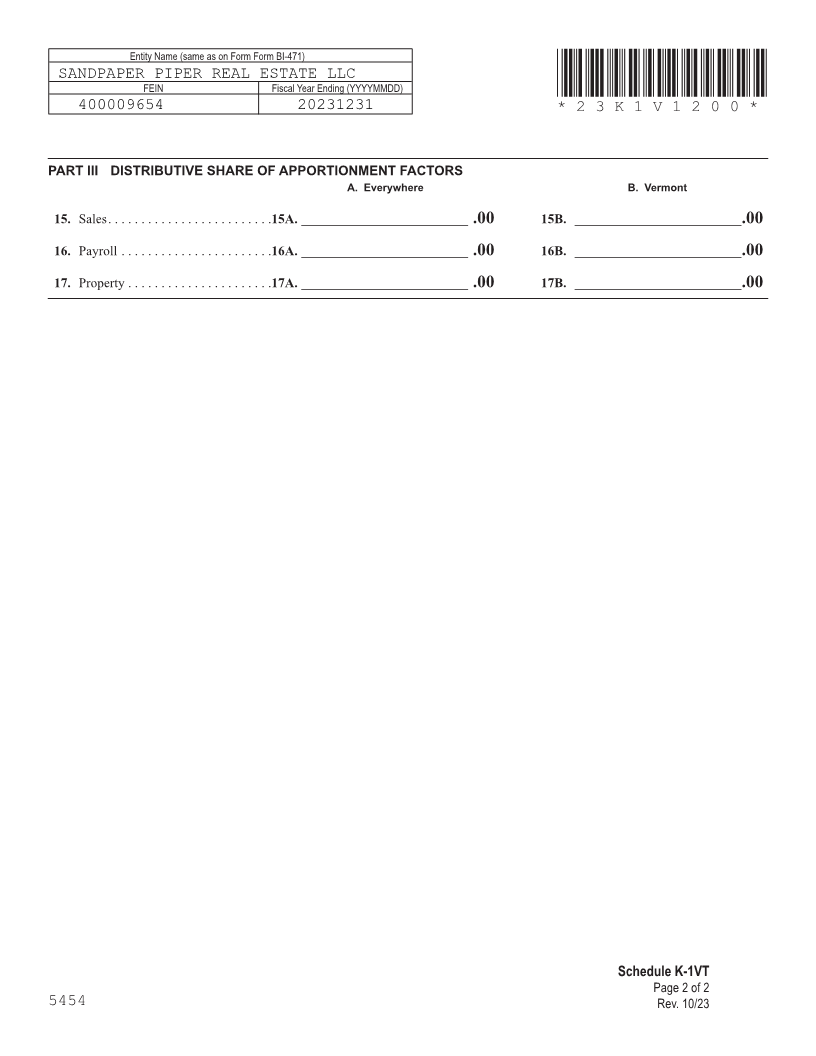

Enlarge image |

Entity Name (same as on Form Form BI-471)

SANDPAPER PIPER REAL ESTATE LLC

FEIN Fiscal Year Ending (YYYYMMDD) *23K1V1200*

400009654 20231231 *23K1V1200*

Page 8

PART III DISTRIBUTIVE SHARE OF APPORTIONMENT FACTORS

A. Everywhere B. Vermont

15. Sales . . . . . . . . . . . . . . . . . . . . . . . . .15A. _________________________ .00 15B. _________________________.00

16. Payroll . . . . . . . . . . . . . . . . . . . . . . .16A. _________________________ .00 16B. _________________________.00

17. Property . . . . . . . . . . . . . . . . . . . . . .17A. _________________________ .00 17B. _________________________.00

FORM (Place at LAST page)

Form pages

7 - 8

Schedule K-1VT

Page 2 of 2

5454 Rev. 10/23

|

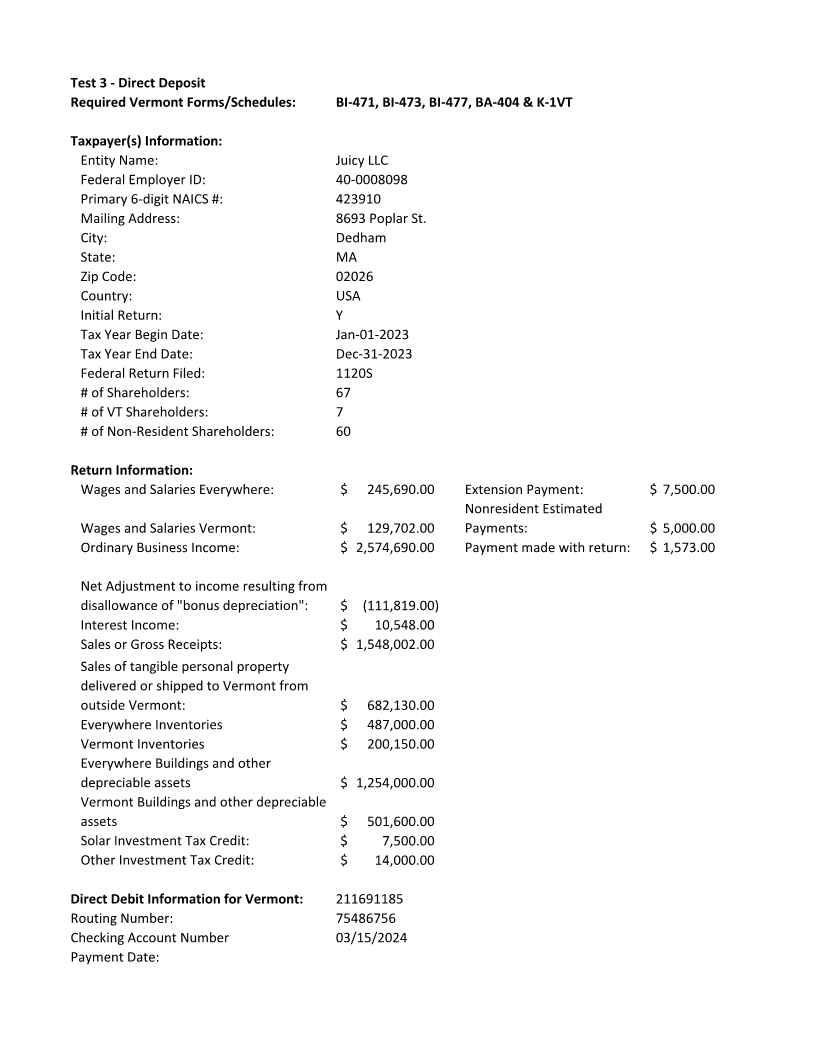

Enlarge image |

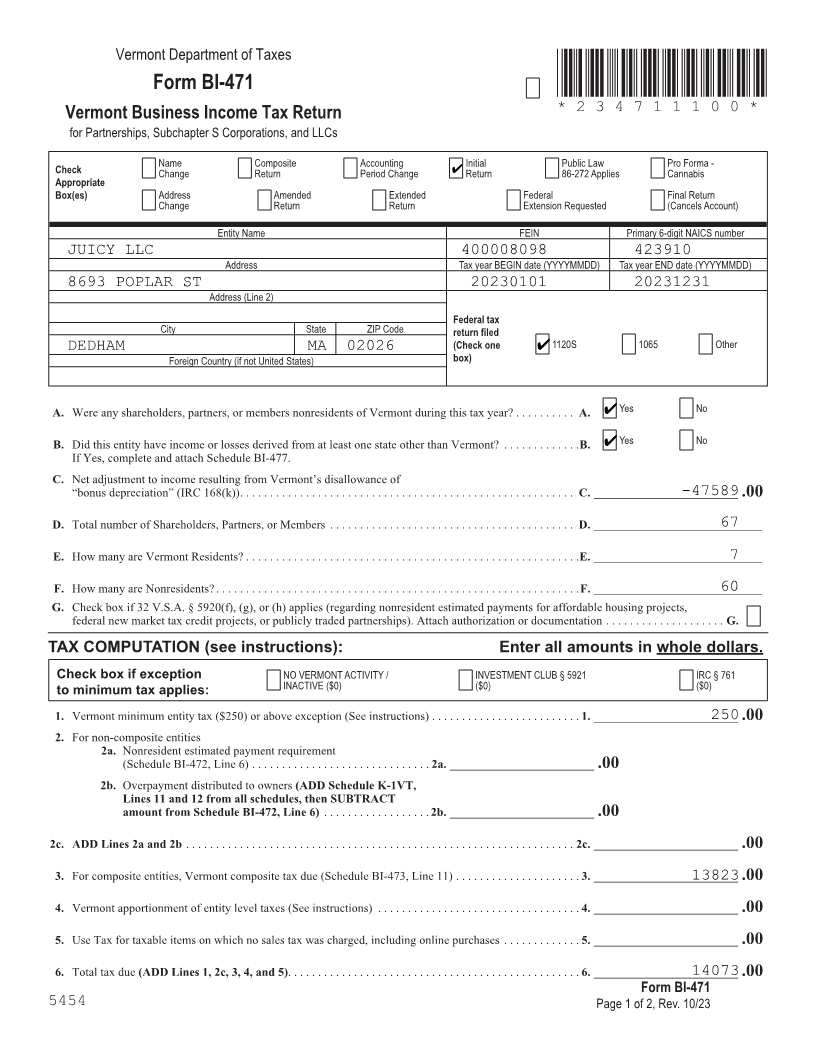

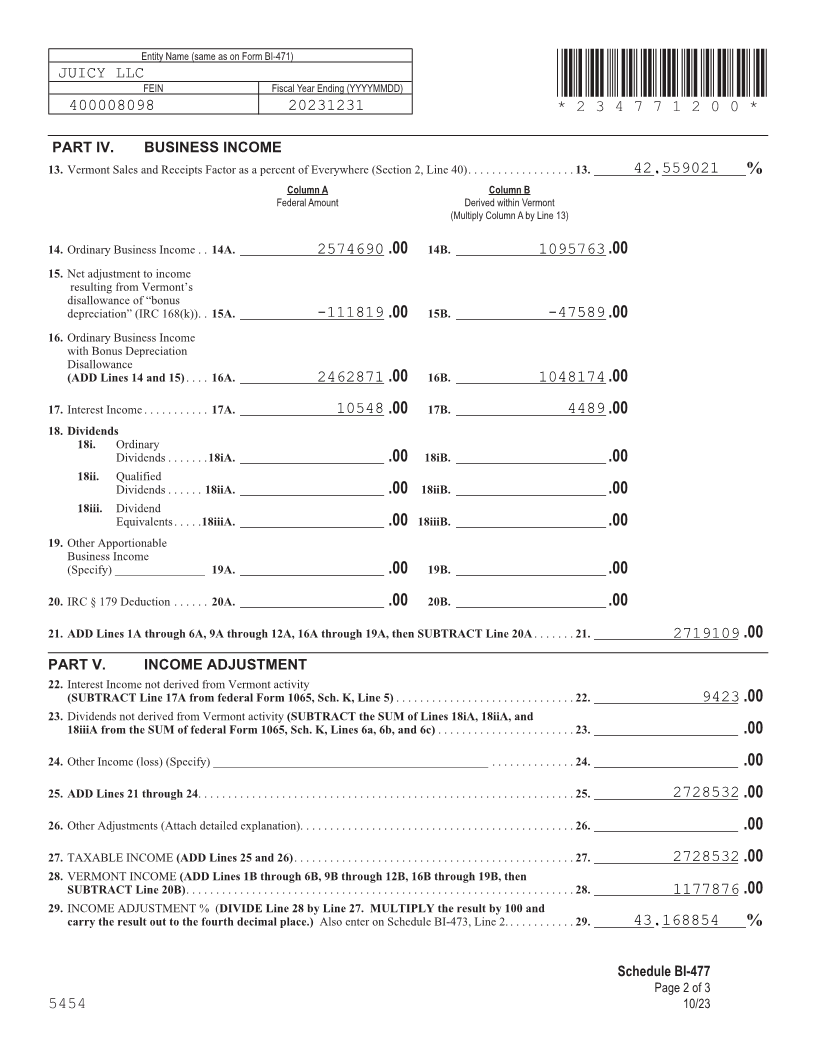

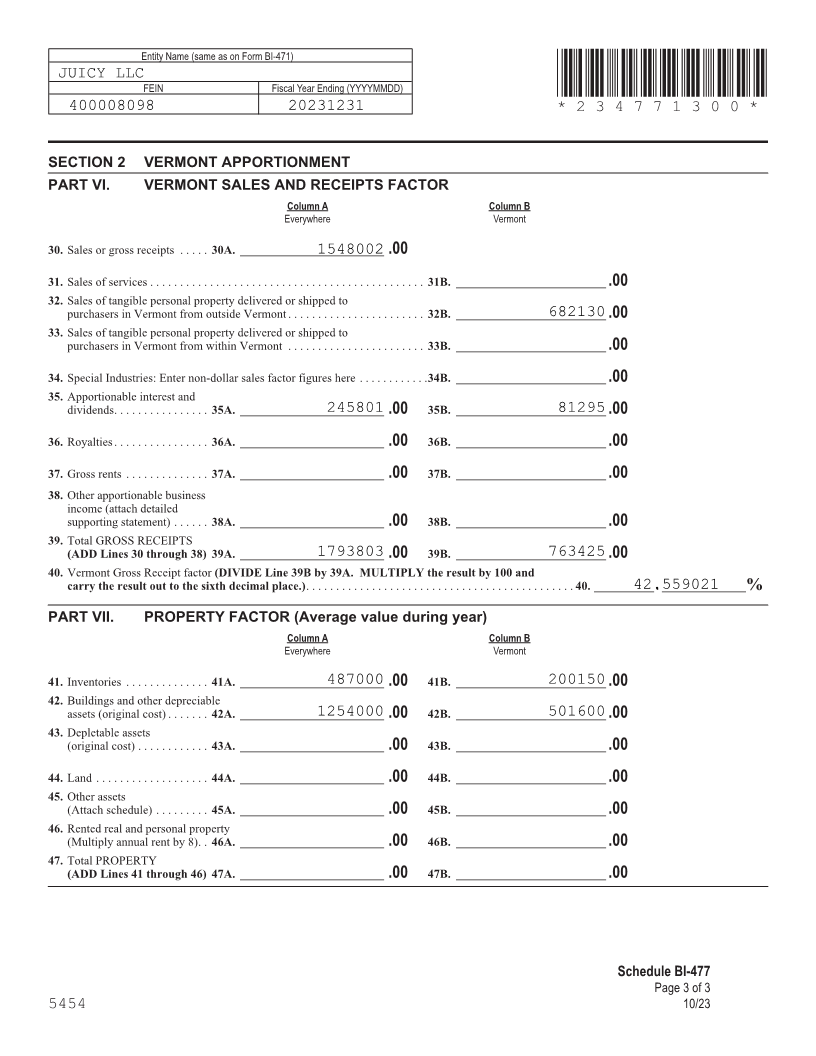

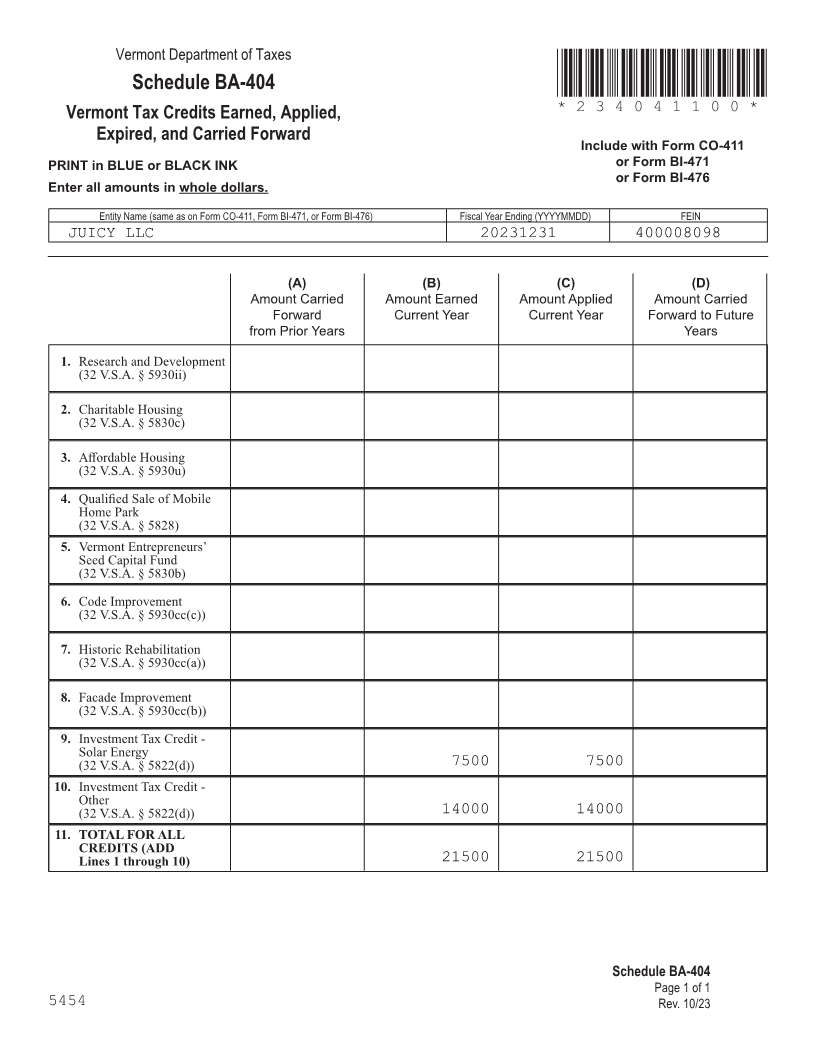

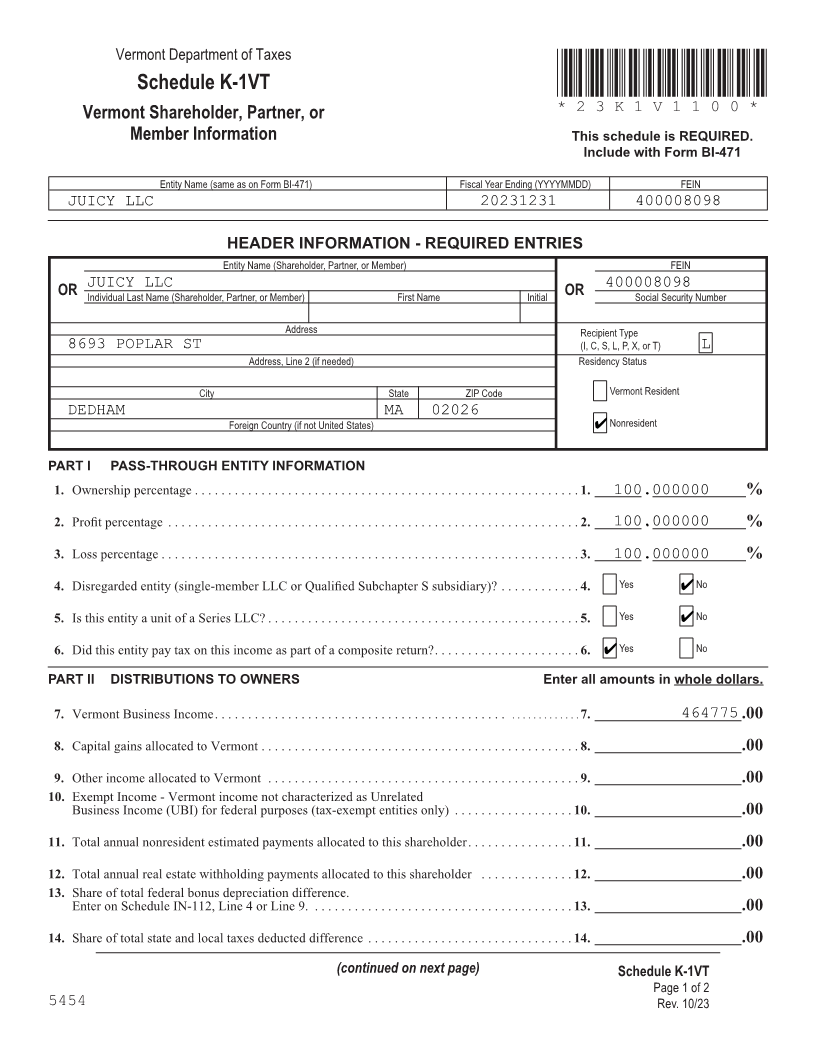

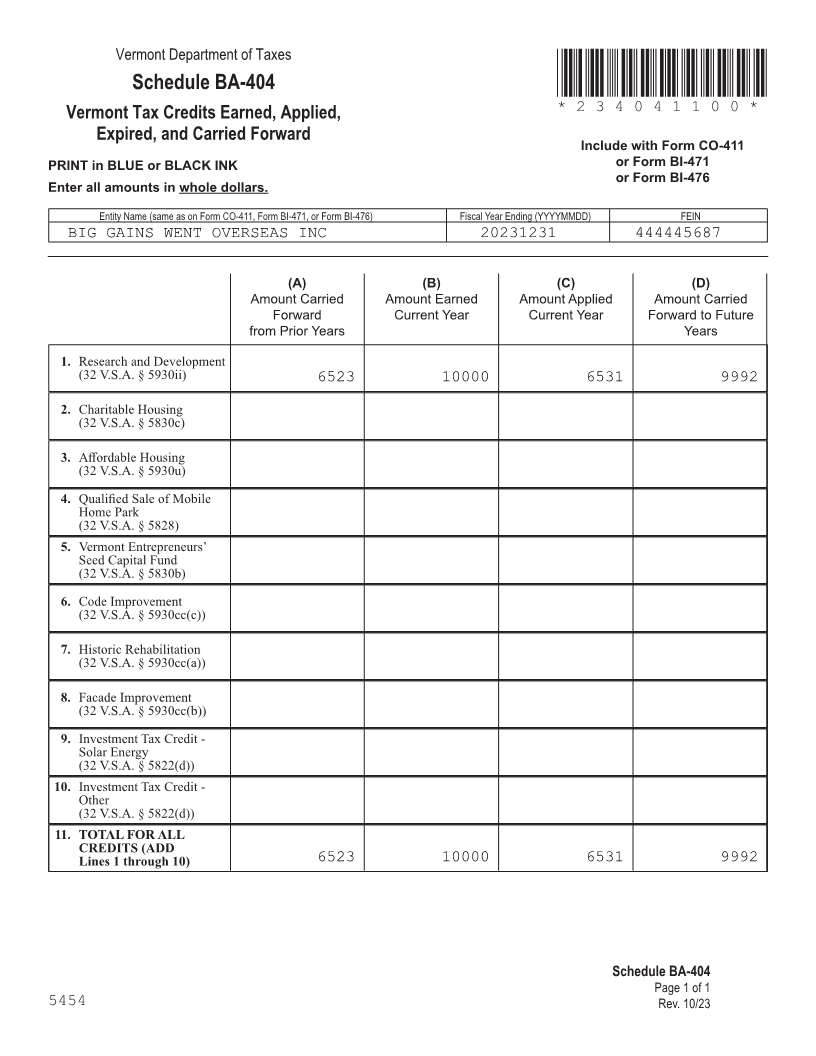

Test 3 - Direct Deposit

Required Vermont Forms/Schedules: BI-471, BI-473, BI-477, BA-404 & K-1VT

Taxpayer(s) Information:

Entity Name: Juicy LLC

Federal Employer ID: 40-0008098

Primary 6-digit NAICS #: 423910

Mailing Address: 8693 Poplar St.

City: Dedham

State: MA

Zip Code: 02026

Country: USA

Initial Return: Y

Tax Year Begin Date: Jan-01-2023

Tax Year End Date: Dec-31-2023

Federal Return Filed: 1120S

# of Shareholders: 67

# of VT Shareholders: 7

# of Non-Resident Shareholders: 60

Return Information:

Wages and Salaries Everywhere: $ 245,690.00 Extension Payment: $ 7,500.00

Nonresident Estimated

Wages and Salaries Vermont: $ 129,702.00 Payments: $ 5,000.00

Ordinary Business Income: $ 2,574,690.00 Payment made with return: $ 1,573.00

Net Adjustment to income resulting from

disallowance of "bonus depreciation": $ (111,819.00)

Interest Income: $ 10,548.00

Sales or Gross Receipts: $ 1,548,002.00

Sales of tangible personal property

delivered or shipped to Vermont from

outside Vermont: $ 682,130.00

Everywhere Inventories $ 487,000.00

Vermont Inventories $ 200,150.00

Everywhere Buildings and other

depreciable assets $ 1,254,000.00

Vermont Buildings and other depreciable

assets $ 501,600.00

Solar Investment Tax Credit: $ 7,500.00

Other Investment Tax Credit: $ 14,000.00

Direct Debit Information for Vermont: 211691185

Routing Number: 75486756

Checking Account Number 03/15/2024

Payment Date:

|

Enlarge image |

Vermont Department of Taxes

Form BI-471 *234711100*

Vermont Business Income Tax Return *234711100*

for Partnerships, Subchapter S Corporations, and LLCs Page 11

Check Name Composite Accounting 4 Initial Public Law Pro Forma -

Change Return Period Change Return 86-272 Applies Cannabis

Appropriate

Box(es) Address Amended Extended Federal Final Return

Change Return Return Extension Requested (Cancels Account)

Entity Name FEIN Primary 6-digit NAICS number

JUICY LLC 400008098 423910

Address Tax year BEGIN date (YYYYMMDD) Tax year END date (YYYYMMDD)

8693 POPLAR ST 20230101 20231231

Address (Line 2)

Federal tax

City State ZIP Code return filed

DEDHAM Foreign Country (if not United States)MA 02026 box) 4

(Check one 1120S 1065 Other

FORM (Place at FIRST page)

A. Were any shareholders, partners, or members nonresidents of Vermont during this tax year? . . . . . . . . . . A. 4 Yes No Form pages

B. Did this entity have income or losses derived from at least one state other than Vermont? . . . . . . . . . . . . . B. 4 Yes No

If Yes, complete and attach Schedule BI-477 .

C. Net adjustment to income resulting from Vermont’s disallowance of

“bonus depreciation” (IRC 168(k)) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . C. ________________________-47589 .00 11 - 12

D. Total number of Shareholders, Partners, or Members . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . D. ____________________________67

E. How many are Vermont Residents? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . E. ____________________________7

F. How many are Nonresidents? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F. ____________________________60

G. Check box if 32 V .S .A . § 5920(f), (g), or (h) applies (regarding nonresident estimated payments for affordable housing projects,

federal new market tax credit projects, or publicly traded partnerships) . Attach authorization or documentation . . . . . . . . . . . . . . . . . . . . G.

TAX COMPUTATION (see instructions): Enter all amounts in whole dollars.

Check box if exception NO VERMONT ACTIVITY / INVESTMENT CLUB § 5921 IRC § 761

INACTIVE ($0) ($0) ($0)

to minimum tax applies:

1. Vermont minimum entity tax ($250) or above exception (See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . 1. ________________________250 .00

2. For non-composite entities

2a. Nonresident estimated payment requirement

(Schedule BI-472, Line 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2a. ________________________ .00

2b. Overpayment distributed to owners (ADD Schedule K-1VT,

Lines 11 and 12 from all schedules, then SUBTRACT

amount from Schedule BI-472, Line 6) . . . . . . . . . . . . . . . . . . 2b. ________________________ .00

2c. ADD Lines 2a and 2b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .2c. ________________________ .00

3. For composite entities, Vermont composite tax due (Schedule BI-473, Line 11) . . . . . . . . . . . . . . . . . . . . . 3. ________________________13823 .00

4. Vermont apportionment of entity level taxes (See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4. ________________________ .00

5. Use Tax for taxable items on which no sales tax was charged, including online purchases . . . . . . . . . . . . . 5. ________________________ .00

6. Total tax due (ADD Lines 1, 2c, 3, 4, and 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6. ________________________14073 .00

Form BI-471

5454 Page 1 of 2, Rev. 10/23

|

Enlarge image |

Entity Name

FEIN Fiscal Year Ending (YYYYMMDD) *234711200*

*234711200*

Page 12

PAYMENTS AND CREDITS Enter all amounts in whole dollars.

7. Prior Year Overpayment Applied . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7. ________________________ .00

8. Payments with Extension (Form BA-403) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8. ________________________7500 .00

9. Real estate withholding paid for this entity (Form REW-171, REW Schedule A) . . . . . . . . . . . . . . . . . . . . 9. ________________________ .00

10. Real estate withholding distributed to this entity by a different company (Schedule K-1VT, Line 12) . . . 10. ________________________ .00

11. Nonresident estimated payments paid by this entity (Form WH-435) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11. ________________________5000 .00

12. Nonresident estimated payments distributed to this entity by a different company

(Schedule K-1VT, Line 11) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12. ________________________ .00

13. Total payments (ADD Lines 7 through 12) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13. ________________________12500 .00

RECONCILIATION FORM (Place at LAST page)

14. Balance Due: If Line 6 is greater than Line 13, subtract Line 6 from Line 13 . . . . . . . . . . . . . . . . . . . . . . . 14. ________________________1573 .00 Form pages

15. Payment included with this return . Make check payable to Vermont Department of Taxes. . . . . . . . . . 15. ________________________1573 .00

16. Overpayment: If Line 6 is less than the sum of Lines 13 and 15,

ADD Lines 13 and 15, then SUBTRACT Line 6. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16. ________________________ .00

11 - 12

17. Overpayment to be credited to the next tax year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17. ________________________ .00

18. Overpayment to be refunded . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18. ________________________ .00

SIGNATURE

I hereby certify that I am an officer or authorized agent responsible for the taxpayer’s compliance with the requirements of Vermont Statutes

Annotated, Title 32, and that this return is true, correct, and complete to the best of my knowledge. If prepared by a person other than the

taxpayer, this declaration further provides that under 32 V.S.A. § 5901, this information has not been and will not be used for any other

purpose, or made available to any other person, other than for the preparation of this return unless a separate valid consent form is signed

by the taxpayer and retained by the preparer.

Signature of Responsible Officer Date (MM/DD/YYYY) Daytime Telephone Number

/ /

Printed Name Email Address (optional)

Check if the Vermont Department of Taxes may discuss this return with the preparer shown.

Signature of Paid Preparer Date (MM/DD/YYYY) Preparer’s Telephone Number

/ /

Preparer’s Printed Name Email Address (optional)

Firm’s Name (or yours if self-employed) EIN Preparer’s SSN or PTIN

Firm’s Address (or yours if self-employed) (Street, City, State, ZIP Code)

Check if self-employed

Send return Vermont Department of Taxes

and check to: 133 State Street For Department Use Only Form BI-471

Montpelier, VT 05633-1401 Ck. Amt. Init. Page 2 of 2

5454 Rev. 10/23

|

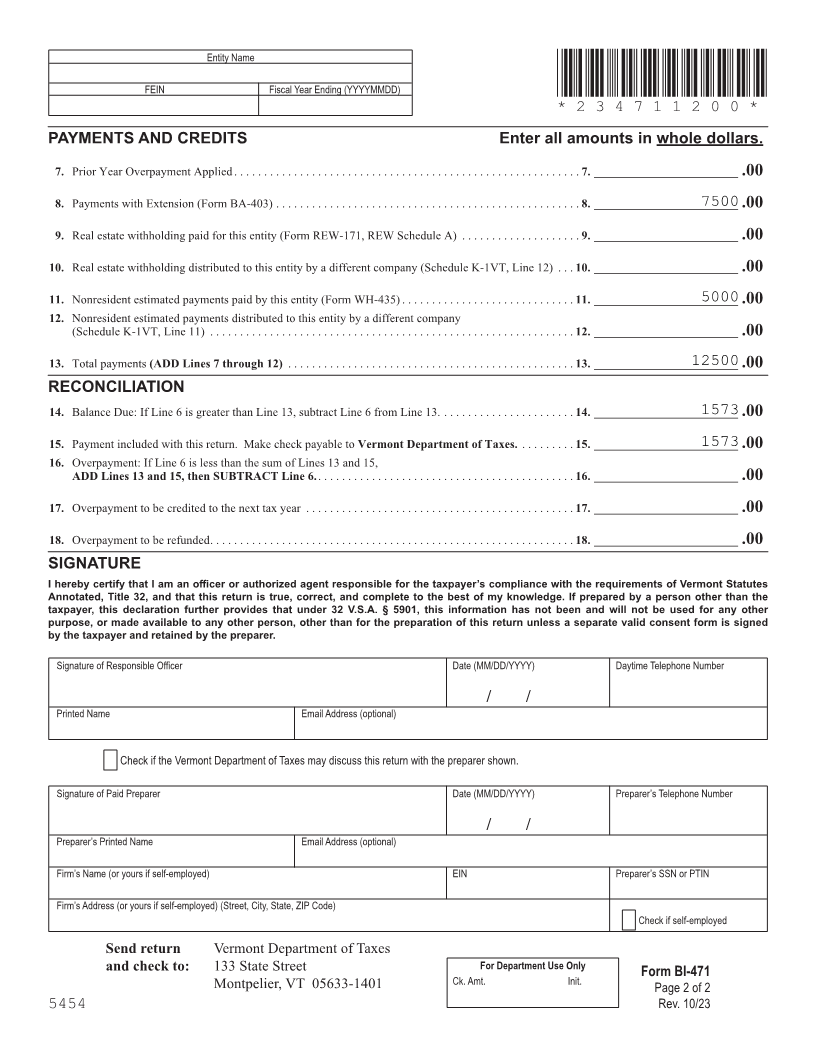

Enlarge image |

Vermont Department of Taxes

Schedule BI-473 *234731100*

Vermont Composite *234731100*

Page 5

Include with Form BI-471

PRINT in BLUE or BLACK INK

Entity Name (same as on Form BI-471) Fiscal Year Ending (YYYYMMDD) FEIN

JUICY LLC 20231231 400008098

Enter all amounts in whole dollars.

1. Taxable Income (Schedule BI-477, Line 27) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1. ________________________2728532 .00

2. Vermont Income Tax Adjustment % (Schedule BI-477, Line 29) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2. . __________43.168854. ______________%

3. Vermont Adjusted Income (MULTIPLY Line 1 by Line 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3. ________________________1177876 .00

4. Percentage of income from Line 3 passed through to nonresidents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4. . __________39.458712. ______________%

FORM (Place at FIRST page)

5. Total nonresident income (MULTIPLY Line 3 by Line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5. ________________________464775 .00 Form pages

6. Composite net operating loss (Enter as a Positive Number, Attach Statement) . . . . . . . . . . . . . . . . . . . . . . . 6. ________________________ .00

7. Additional Adjustments (Specify) __________________________________________ . . . . . . . . . . . . . . . 7. ________________________ .00

5 - 5

8. Vermont taxable composite income (SUBTRACT Line 6 from Line 5 and ADD Line 7) . . . . . . . . . . . . 8. ________________________464775 .00

9. Composite Tax (MULTIPLY Line 8 by 7.6% (0.076)) . If negative, enter -0- . . . . . . . . . . . . . . . . . . . . . . 9. ________________________35323 .00

10. Tax credits available for composite shareholders/partners/members

(Attach Schedules BA-404 and BA-406) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10. ________________________21500 .00

NOTE: Line 10 tax credits may not reduce your tax liability to less than the minimum tax . Review

program guidelines to determine if there are other limitations regarding usage of tax credits .

11. Vermont Composite Tax due (Line 9 MINUS Line 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11. ________________________13823 .00

FORM (Place at LAST page)

Form pages

Schedule BI-473 5 - 5

Page 1 of 1

5454 Rev. 10/23

|

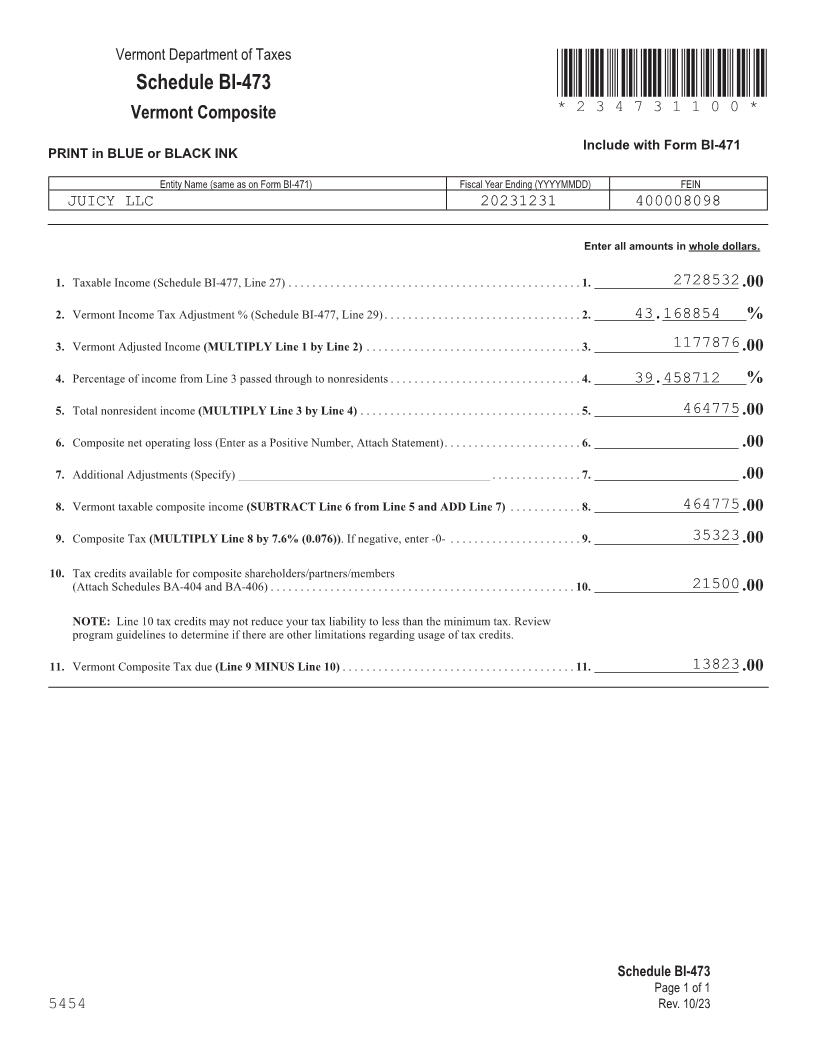

Enlarge image |

Vermont Department of Taxes

Schedule BI-477 *234771100*

Vermont Income Adjustment Calculation: *234771100*

Page 3

Pass-Through Nonresident

Include with Form BI-471

Entity Name (same as on Form BI-471) Fiscal Year Ending (YYYYMMDD) FEIN

JUICY LLC 20231231 400008098

SECTION 1 PASS-THROUGH PERSONAL INCOME ADJUSTMENT CALCULATION

PART I. INCOME DERIVED FROM OWNERSHIP OF PROPERTY

Column A Column B

Federal Amount Amount from Vermont

Situs Property

1. Net Rental Real Estate

Income (loss) . . . . . . . . . . . . . 1A. ________________________ .00 1B. _________________________ .00

2. Other Net Rental

Income (loss) . . . . . . . . . . . . . 2A. ________________________ .00 2B. _________________________ .00

FORM (Place at FIRST page)

3. Royalties . . . . . . . . . . . . . . . . . 3A. ________________________ .00 3B. _________________________ .00 Form pages

PART II. GAINS FROM THE SALE OR EXCHANGE OF PROPERTY

Column A Column B

Federal Amount Amount from Vermont

Situs Property

3 - 5

4. Net Long Term Capital

Gain (loss) . . . . . . . . . . . . . . . 4A. ________________________ .00 4B. _________________________ .00

5. Net Short Term Capital

Gain (loss) . . . . . . . . . . . . . . . 5A. ________________________ .00 5B. _________________________ .00

6. Guaranteed Payments for

Capital . . . . . . . . . . . . . . . . . . . 6A. ________________________ .00 6B. _________________________ .00

7. Collectibles (28%) Gain (loss) 7A. ________________________ .00 7B. _________________________ .00

8. Unrecaptured

IRC § 1250 Gain . . . . . . . . . . . 8A. ________________________ .00 8B. _________________________ .00

9. Net IRC § 1231 Gain (loss) . . 9A. ________________________ .00 9B. _________________________ .00

PART III. WAGES, SALARIES, COMPENSATION TO PARTNERS

Column A Column B

Federal Amount Amount Received for Services

Performed in Vermont

10. Wages and Salaries . . . . . . . . 10A. ________________________245690 .00 10B. _________________________129702 .00

11. Other Compensation . . . . . . . 11A. ________________________ .00 11B. _________________________ .00

12. Guaranteed Payments for

Services . . . . . . . . . . . . . . . . . 12A. ________________________ .00 12B. _________________________ .00

Schedule BI-477

Page 1 of 3

5454 10/23

|

Enlarge image |

Entity Name (same as on Form BI-471)

JUICY LLC

FEIN Fiscal Year Ending (YYYYMMDD) *234771200*

400008098 20231231 *234771200*

Page 10

PART IV. BUSINESS INCOME

13. Vermont Sales and Receipts Factor as a percent of Everywhere (Section 2, Line 40) . . . . . . . . . . . . . . . . . 13. . __________42.559021. ______________%

Column A Column B

Federal Amount Derived within Vermont

(Multiply Column A by Line 13)

14. Ordinary Business Income . . 14A. ________________________2574690 .00 14B. _________________________1095763 .00

15. Net adjustment to income

resulting from Vermont’s

disallowance of “bonus

depreciation” (IRC 168(k)) . . 15A. ________________________-111819 .00 15B. _________________________-47589 .00

16. Ordinary Business Income

with Bonus Depreciation

Disallowance

(ADD Lines 14 and 15) . . . . 16A. ________________________2462871 .00 16B. _________________________1048174 .00

17. Interest Income . . . . . . . . . . . 17A. ________________________10548 .00 17B. _________________________4489 .00

18. Dividends

18i. Ordinary

Dividends . . . . . . . 18iA. ________________________ .00 18iB. _________________________ .00

18ii. Qualified

Dividends . . . . . . 18iiA. ________________________ .00 18iiB. _________________________ .00

18iii. Dividend

Equivalents . . . . . 18iiiA. ________________________ .00 18iiiB. _________________________ .00

19. Other Apportionable

Business Income

(Specify) _______________ 19A. ________________________ .00 19B. _________________________ .00

20. IRC § 179 Deduction . . . . . . 20A. ________________________ .00 20B. _________________________ .00

21. ADD Lines 1A through 6A, 9A through 12A, 16A through 19A, then SUBTRACT Line 20A . . . . . . . 21. ________________________2719109 .00

PART V. INCOME ADJUSTMENT

22. Interest Income not derived from Vermont activity

(SUBTRACT Line 17A from federal Form 1065, Sch. K, Line 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22. ________________________9423 .00

23. Dividends not derived from Vermont activity (SUBTRACT the SUM of Lines 18iA, 18iiA, and

18iiiA from the SUM of federal Form 1065, Sch. K, Lines 6a, 6b, and 6c) . . . . . . . . . . . . . . . . . . . . . . . 23. ________________________ .00

24. Other Income (loss) (Specify) ______________________________________________ . . . . . . . . . . . . . . 24. ________________________ .00

25. ADD Lines 21 through 24 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25. ________________________2728532 .00

26. Other Adjustments (Attach detailed explanation) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26. ________________________ .00

27. TAXABLE INCOME (ADD Lines 25 and 26) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27. ________________________2728532 .00

28. VERMONT INCOME (ADD Lines 1B through 6B, 9B through 12B, 16B through 19B, then

SUBTRACT Line 20B) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28. ________________________1177876 .00

29. INCOME ADJUSTMENT % (DIVIDE Line 28 by Line 27. MULTIPLY the result by 100 and

carry the result out to the fourth decimal place.) Also enter on Schedule BI-473, Line 2 . . . . . . . . . . . 29. . __________43.168854. ______________%

Schedule BI-477

Page 2 of 3

5454 10/23

|

Enlarge image |

Entity Name (same as on Form BI-471)

JUICY LLC

FEIN Fiscal Year Ending (YYYYMMDD) *234771300*

400008098 20231231 *234771300*

Page 5

SECTION 2 VERMONT APPORTIONMENT

PART VI. VERMONT SALES AND RECEIPTS FACTOR

Column A Column B

Everywhere Vermont

30. Sales or gross receipts . . . . . 30A. ________________________1548002 .00

31. Sales of services . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31B. _________________________ .00

32. Sales of tangible personal property delivered or shipped to

purchasers in Vermont from outside Vermont . . . . . . . . . . . . . . . . . . . . . . . 32B. _________________________682130 .00

33. Sales of tangible personal property delivered or shipped to

purchasers in Vermont from within Vermont . . . . . . . . . . . . . . . . . . . . . . . 33B. _________________________ .00

34. Special Industries: Enter non-dollar sales factor figures here . . . . . . . . . . . .34B. _________________________ .00

35. Apportionable interest and FORM (Place at LAST page)

dividends . . . . . . . . . . . . . . . . 35A. ________________________245801 .00 35B. _________________________81295 .00 Form pages

36. Royalties . . . . . . . . . . . . . . . . 36A. ________________________ .00 36B. _________________________ .00

37. Gross rents . . . . . . . . . . . . . . 37A. ________________________ .00 37B. _________________________ .00

38. Other apportionable business 3 - 5

income (attach detailed

supporting statement) . . . . . . 38A. ________________________ .00 38B. _________________________ .00

39. Total GROSS RECEIPTS

(ADD Lines 30 through 38) 39A. ________________________ 1793803.00 39B. _________________________763425.00

40. Vermont Gross Receipt factor (DIVIDE Line 39B by 39A. MULTIPLY the result by 100 and

carry the result out to the sixth decimal place.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40. . __________42.559021. ______________%

PART VII. PROPERTY FACTOR (Average value during year)

Column A Column B

Everywhere Vermont

41. Inventories . . . . . . . . . . . . . . 41A. ________________________487000 .00 41B. _________________________200150 .00

42. Buildings and other depreciable

assets (original cost) . . . . . . . 42A. ________________________1254000 .00 42B. _________________________501600 .00

43. Depletable assets

(original cost) . . . . . . . . . . . . 43A. ________________________ .00 43B. _________________________ .00

44. Land . . . . . . . . . . . . . . . . . . . 44A. ________________________ .00 44B. _________________________ .00

45. Other assets

(Attach schedule) . . . . . . . . . 45A. ________________________ .00 45B. _________________________ .00

46. Rented real and personal property

(Multiply annual rent by 8) . . 46A. ________________________ .00 46B. _________________________ .00

47. Total PROPERTY

(ADD Lines 41 through 46) 47A. ________________________ .00 47B. _________________________ .00

Schedule BI-477

Page 3 of 3

5454 10/23

|

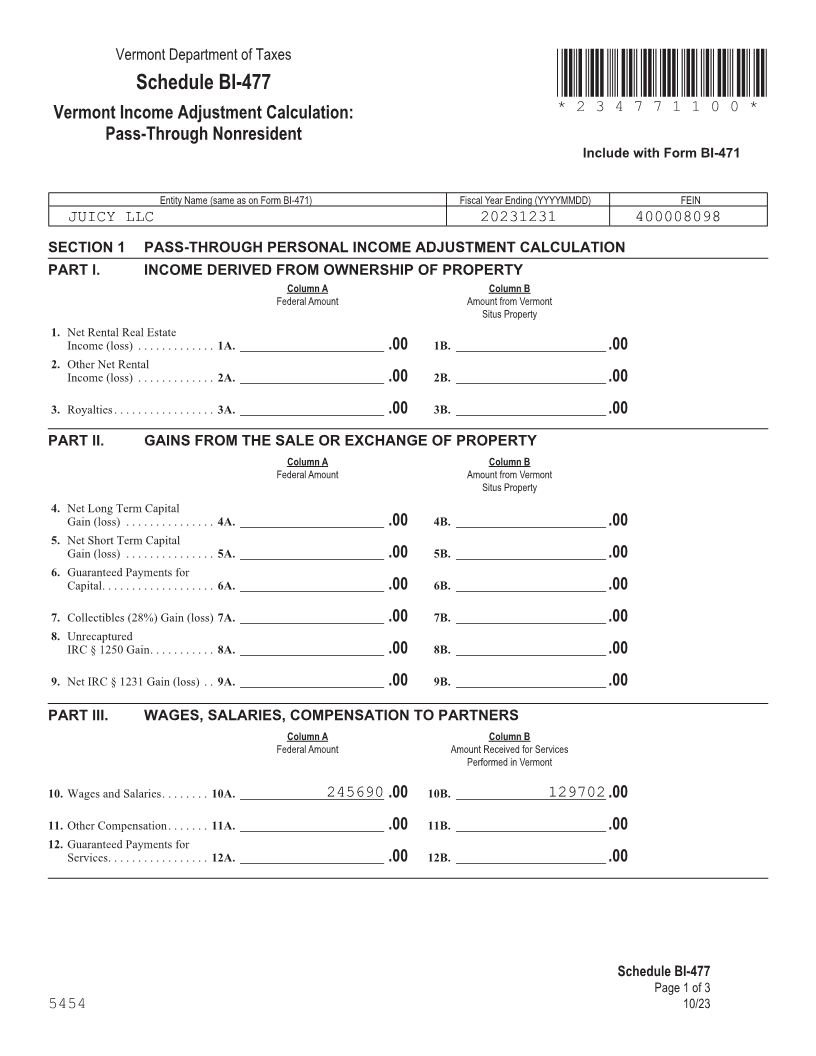

Enlarge image |

Vermont Department of Taxes

Schedule BA-404 *234041100*

Vermont Tax Credits Earned, Applied, *234041100*

Page 5

Expired, and Carried Forward

Include with Form CO-411

PRINT in BLUE or BLACK INK or Form BI-471

or Form BI-476

Enter all amounts in whole dollars.

Entity Name (same as on Form CO-411, Form BI-471, or Form BI-476) Fiscal Year Ending (YYYYMMDD) FEIN

JUICY LLC 20231231 400008098

(A) (B) (C) (D)

Amount Carried Amount Earned Amount Applied Amount Carried

Forward Current Year Current Year Forward to Future

from Prior Years Years

1. Research and Development

(32 V.S.A. § 5930ii)

FORM (Place at FIRST page)

2. Charitable Housing Form pages

(32 V.S.A. § 5830c)

3. Affordable Housing

(32 V.S.A. § 5930u)

4. Qualified Sale of Mobile 5 - 5

Home Park

(32 V.S.A. § 5828)

5. Vermont Entrepreneurs’

Seed Capital Fund

(32 V.S.A. § 5830b)

6. Code Improvement

(32 V.S.A. § 5930cc(c))

7. Historic Rehabilitation

(32 V.S.A. § 5930cc(a))

8. Facade Improvement

(32 V.S.A. § 5930cc(b))

9. Investment Tax Credit -

Solar Energy

(32 V.S.A. § 5822(d)) 7500 7500

10. Investment Tax Credit -

Other

(32 V.S.A. § 5822(d)) 14000 14000

FORM (Place at LAST page)

11. TOTAL FOR ALL Form pages

CREDITS (ADD

Lines 1 through 10) 21500 21500

5 - 5

Schedule BA-404

Page 1 of 1

5454 Rev. 10/23

|

Enlarge image |

Vermont Department of Taxes

Schedule K-1VT *23K1V1100*

Vermont Shareholder, Partner, or *23K1V1100*

Page 7

Member Information This schedule is REQUIRED.

Include with Form BI-471

Entity Name (same as on Form BI-471) Fiscal Year Ending (YYYYMMDD) FEIN

JUICY LLC 20231231 400008098

HEADER INFORMATION - REQUIRED ENTRIES

Entity Name (Shareholder, Partner, or Member) FEIN

JUICY LLC 400008098

OR Individual Last Name (Shareholder, Partner, or Member) First Name Initial OR Social Security Number

Address Recipient Type

8693 POPLAR ST (I, C, S, L, P, X, or T) L

Address, Line 2 (if needed) Residency Status

City State ZIP Code Vermont Resident FORM (Place at FIRST page)

DEDHAM MA 02026 Form pages

Foreign Country (if not United States) 4 Nonresident

PART I PASS-THROUGH ENTITY INFORMATION

1. Ownership percentage . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1. . _______100.000000. ______________% 7 - 8

2. Profit percentage . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2. . _______100.000000. ______________%

3. Loss percentage . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3. . _______100.000000. ______________%

4. Disregarded entity (single-member LLC or Qualified Subchapter S subsidiary)? . . . . . . . . . . . . 4. Yes 4 No

5. Is this entity a unit of a Series LLC? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5. Yes 4 No

6. Did this entity pay tax on this income as part of a composite return? . . . . . . . . . . . . . . . . . . . . . . 6. 4 Yes No

PART II DISTRIBUTIONS TO OWNERS Enter all amounts in whole dollars.

7. Vermont Business Income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7. ______________________464775 .00

8. Capital gains allocated to Vermont . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8. ______________________.00

9. Other income allocated to Vermont . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9. ______________________.00

10. Exempt Income - Vermont income not characterized as Unrelated

Business Income (UBI) for federal purposes (tax-exempt entities only) . . . . . . . . . . . . . . . . . . 10. ______________________.00

11. Total annual nonresident estimated payments allocated to this shareholder . . . . . . . . . . . . . . . . 11. ______________________.00

12. Total annual real estate withholding payments allocated to this shareholder . . . . . . . . . . . . . . 12. ______________________.00

13. Share of total federal bonus depreciation difference.

Enter on Schedule IN-112, Line 4 or Line 9. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13. ______________________.00

14. Share of total state and local taxes deducted difference . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14. ______________________.00

(continued on next page) Schedule K-1VT

Page 1 of 2

5454 Rev. 10/23

|

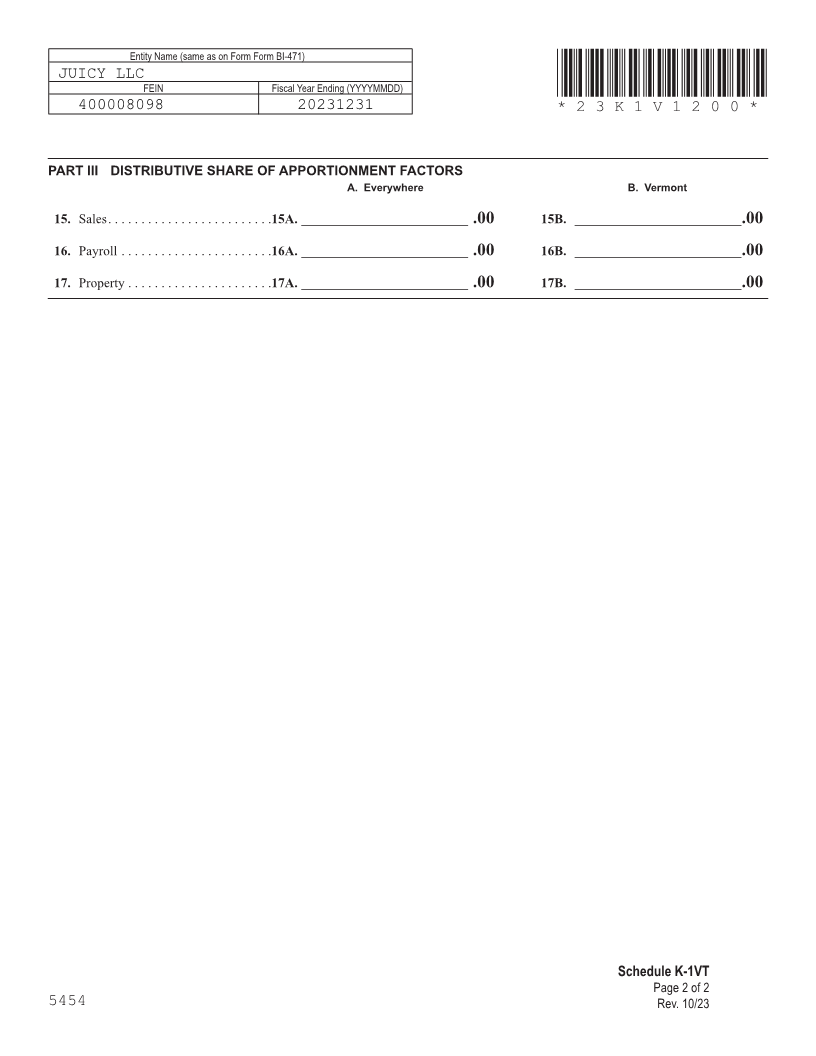

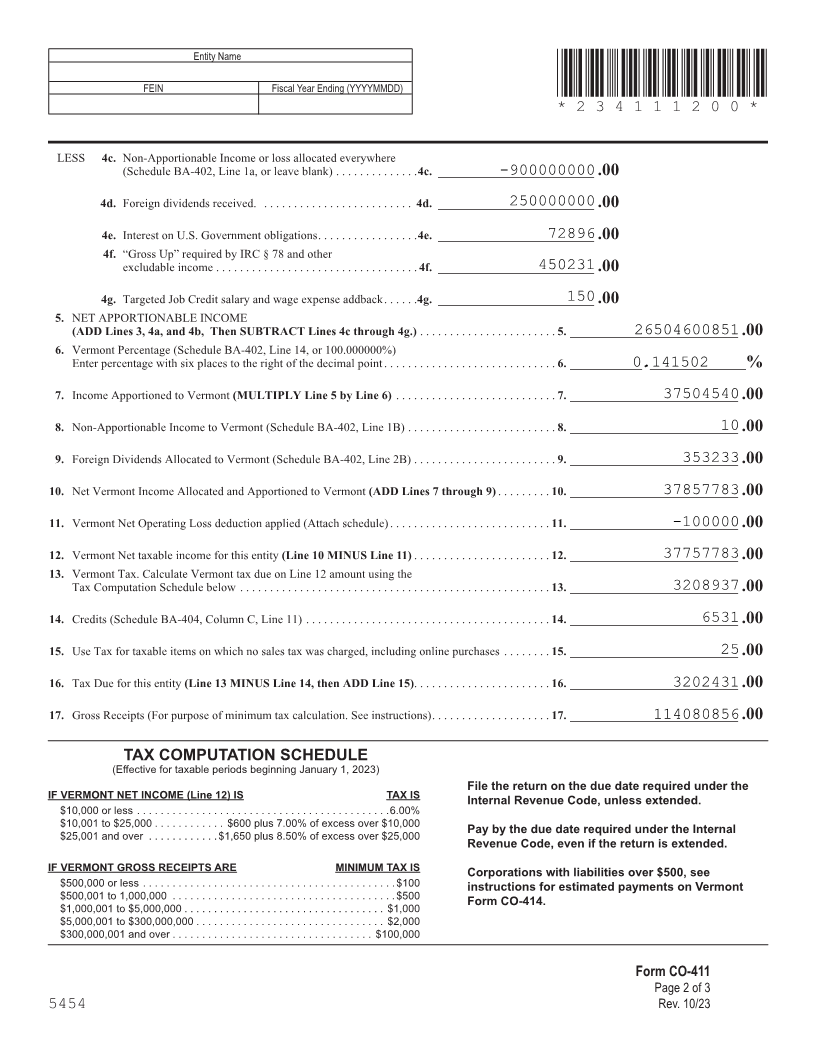

Enlarge image |

Entity Name (same as on Form Form BI-471)

JUICY LLC

FEIN Fiscal Year Ending (YYYYMMDD) *23K1V1200*

400008098 20231231 *23K1V1200*

Page 8

PART III DISTRIBUTIVE SHARE OF APPORTIONMENT FACTORS

A. Everywhere B. Vermont

15. Sales . . . . . . . . . . . . . . . . . . . . . . . . .15A. _________________________ .00 15B. _________________________.00

16. Payroll . . . . . . . . . . . . . . . . . . . . . . .16A. _________________________ .00 16B. _________________________.00

17. Property . . . . . . . . . . . . . . . . . . . . . .17A. _________________________ .00 17B. _________________________.00

FORM (Place at LAST page)

Form pages

7 - 8

Schedule K-1VT

Page 2 of 2

5454 Rev. 10/23

|

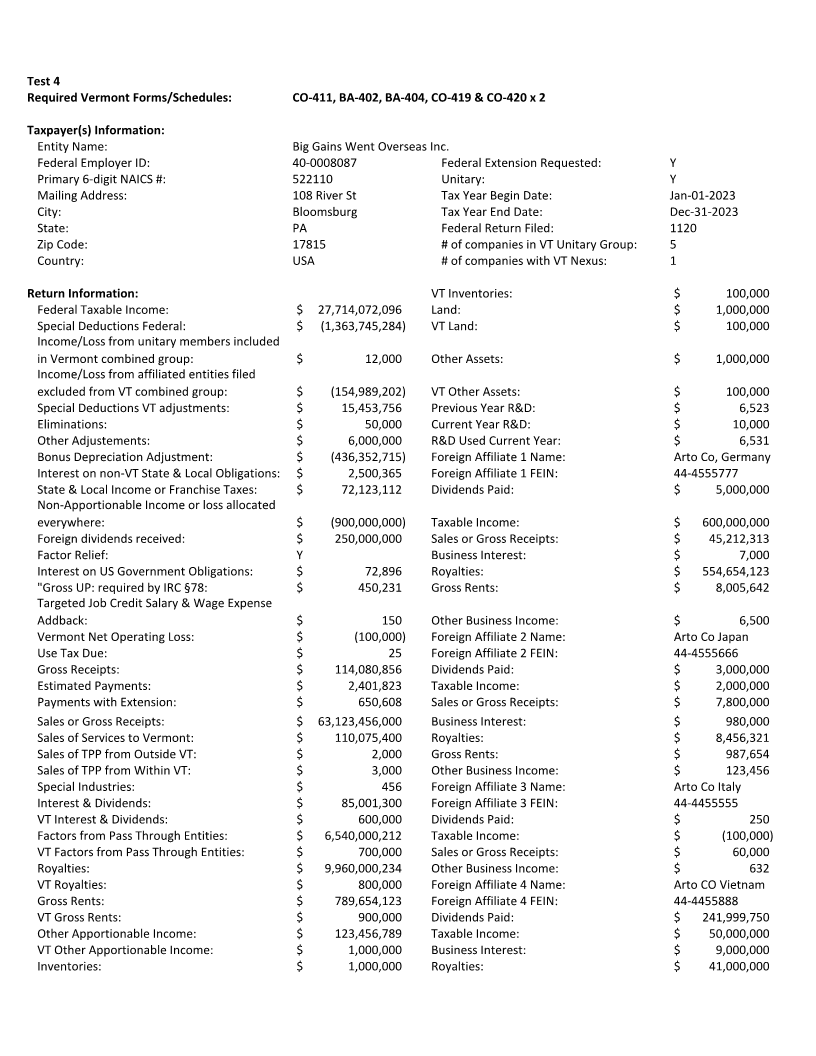

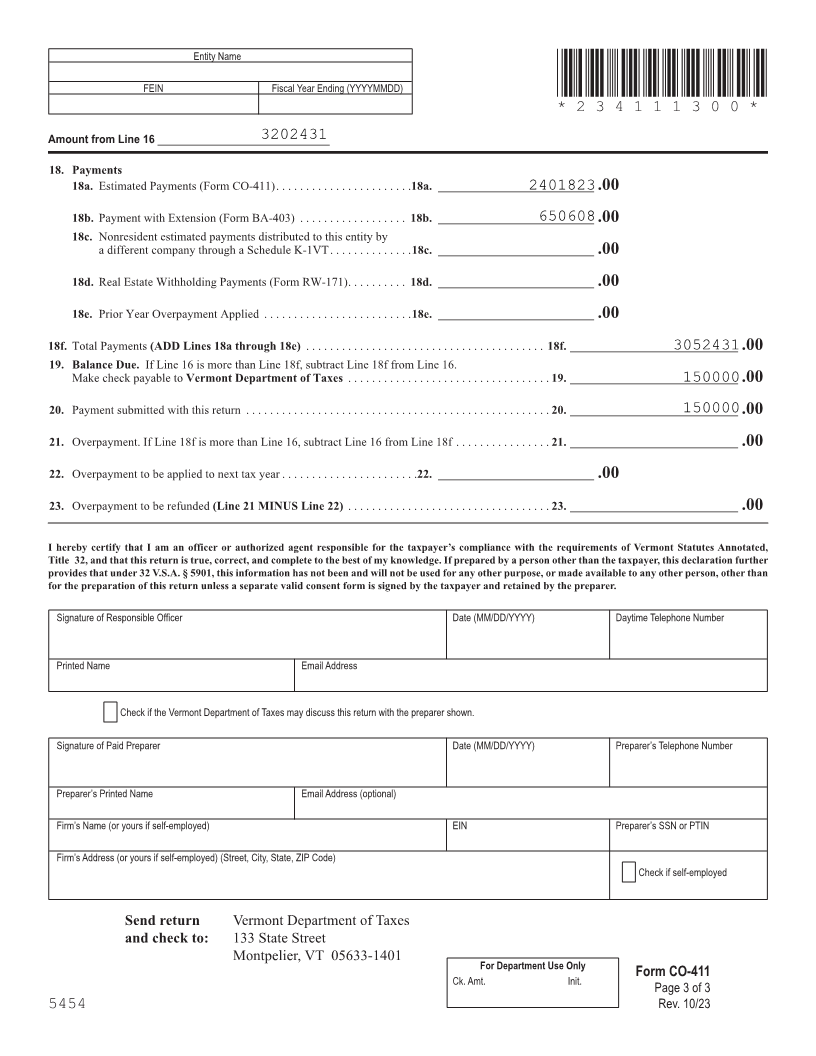

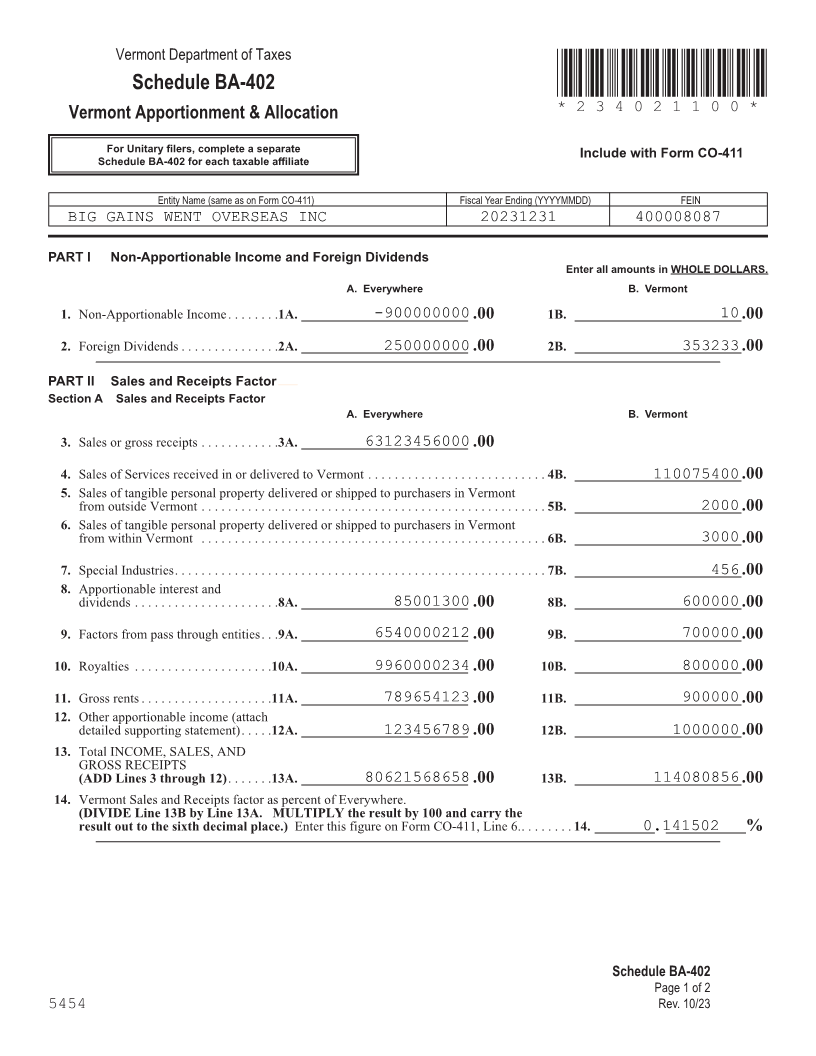

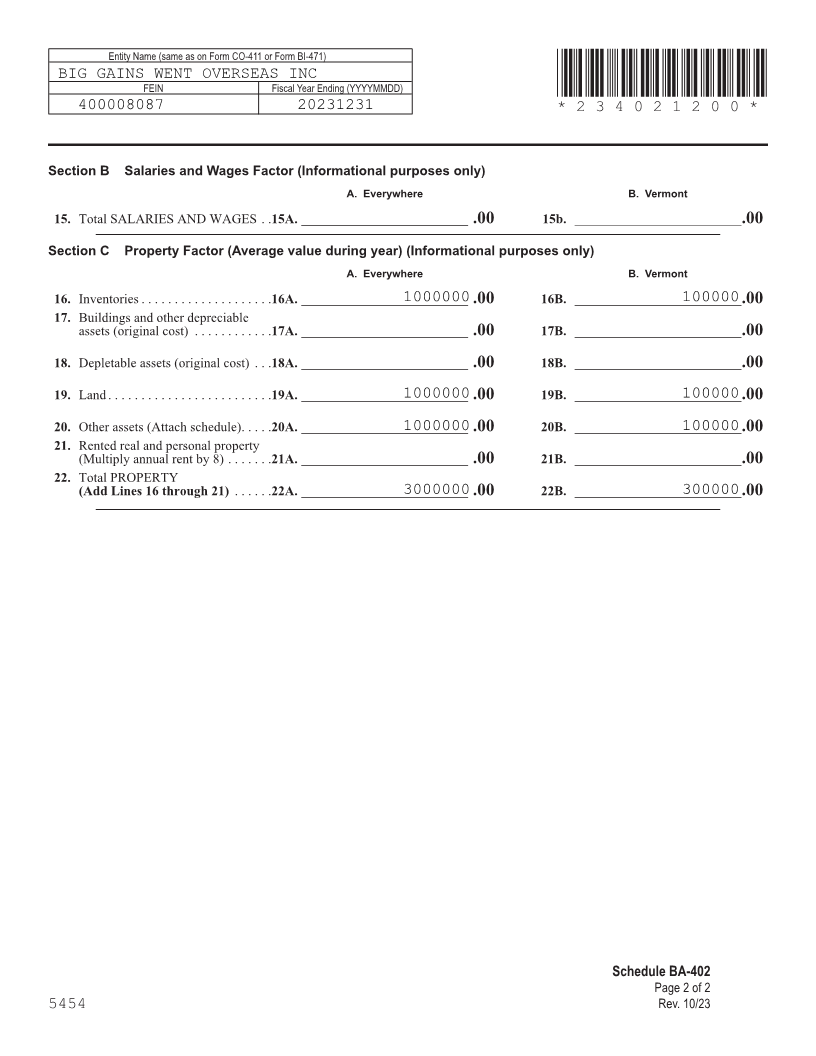

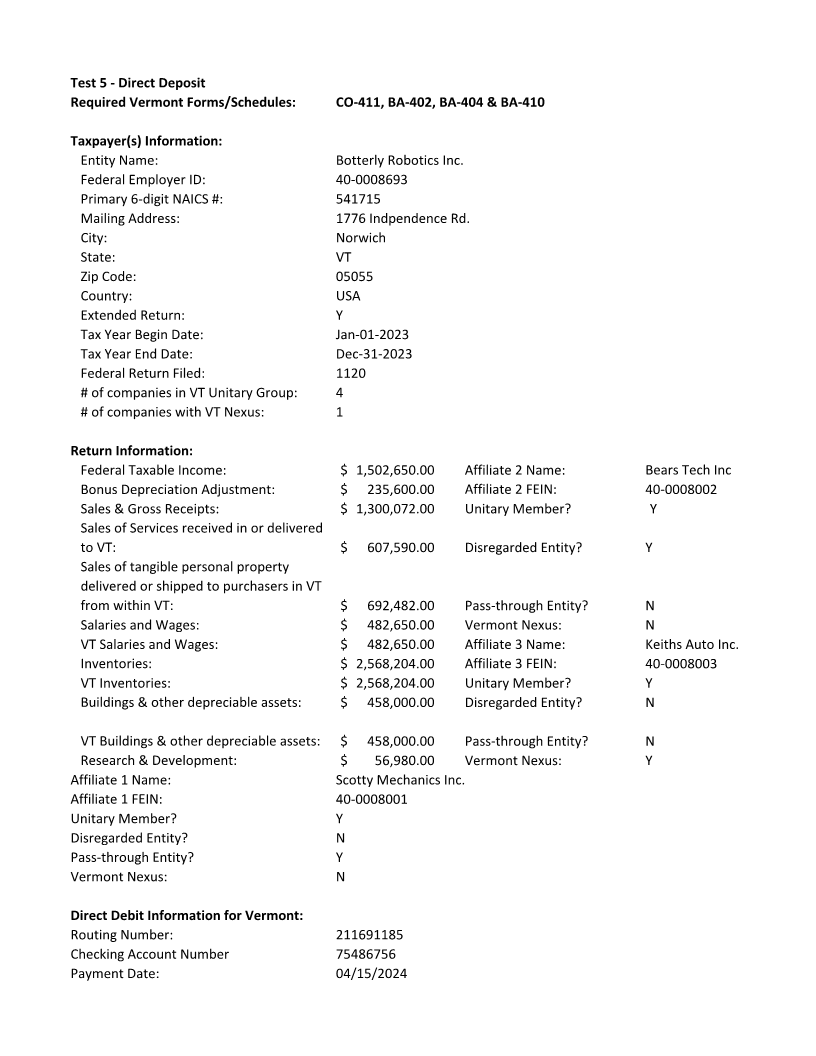

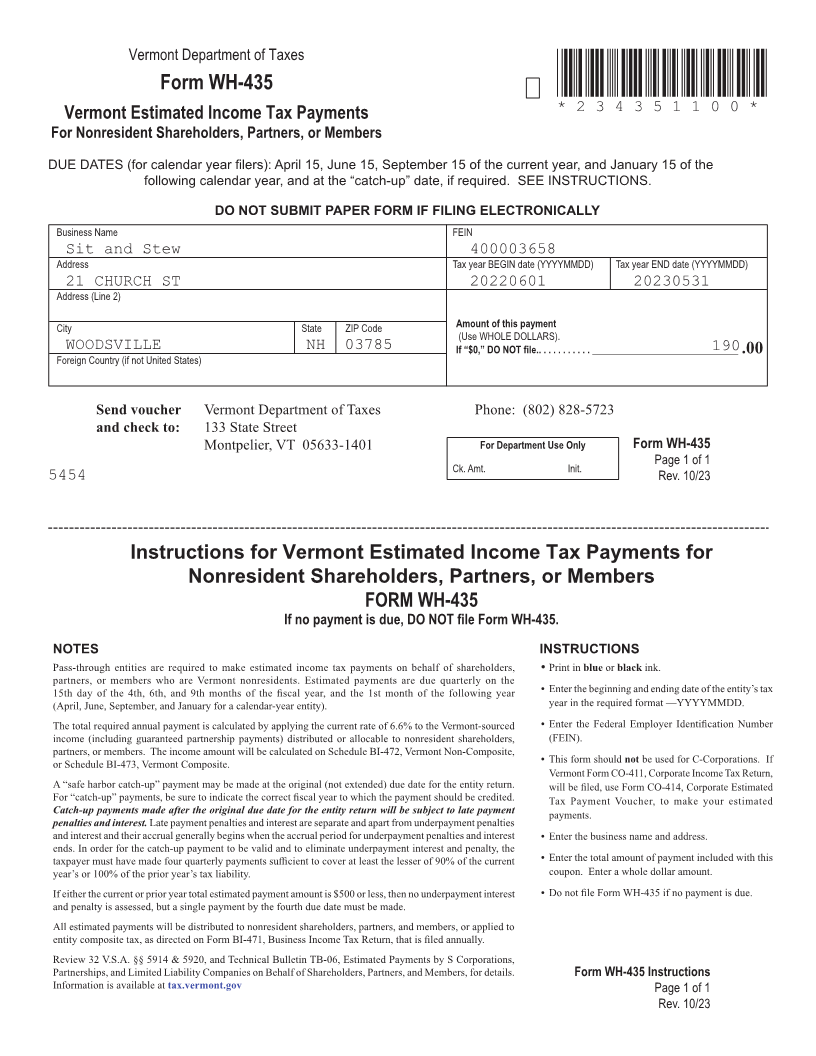

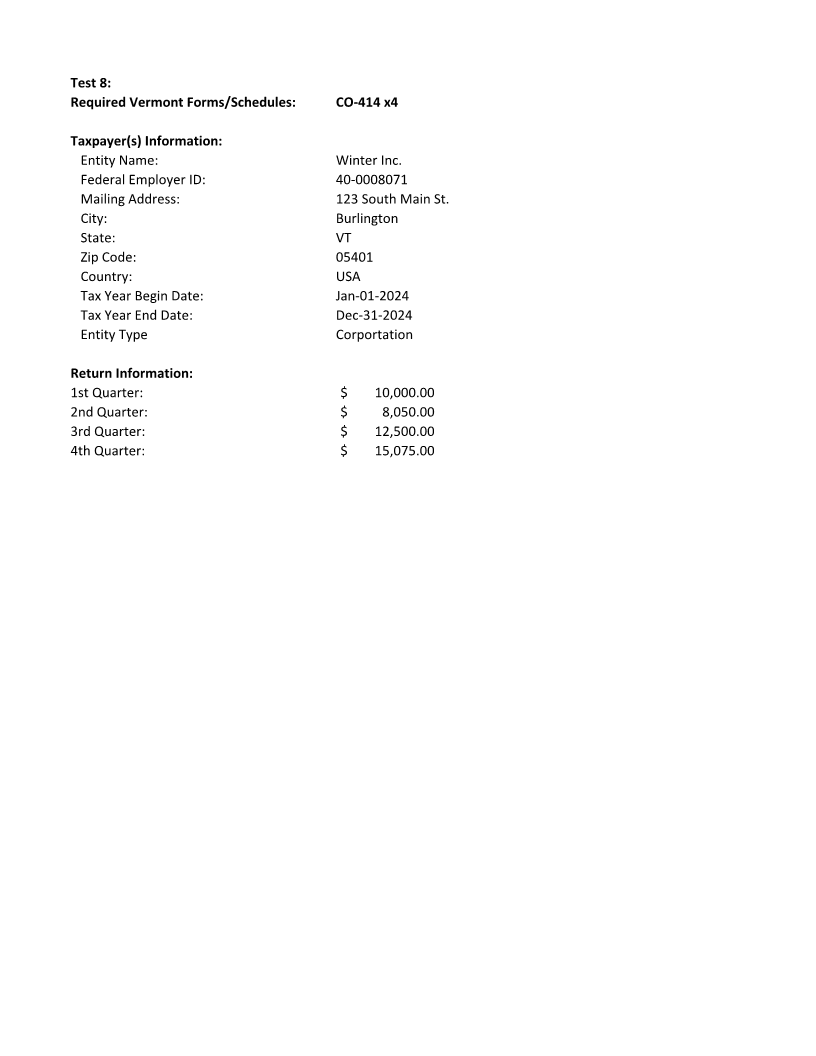

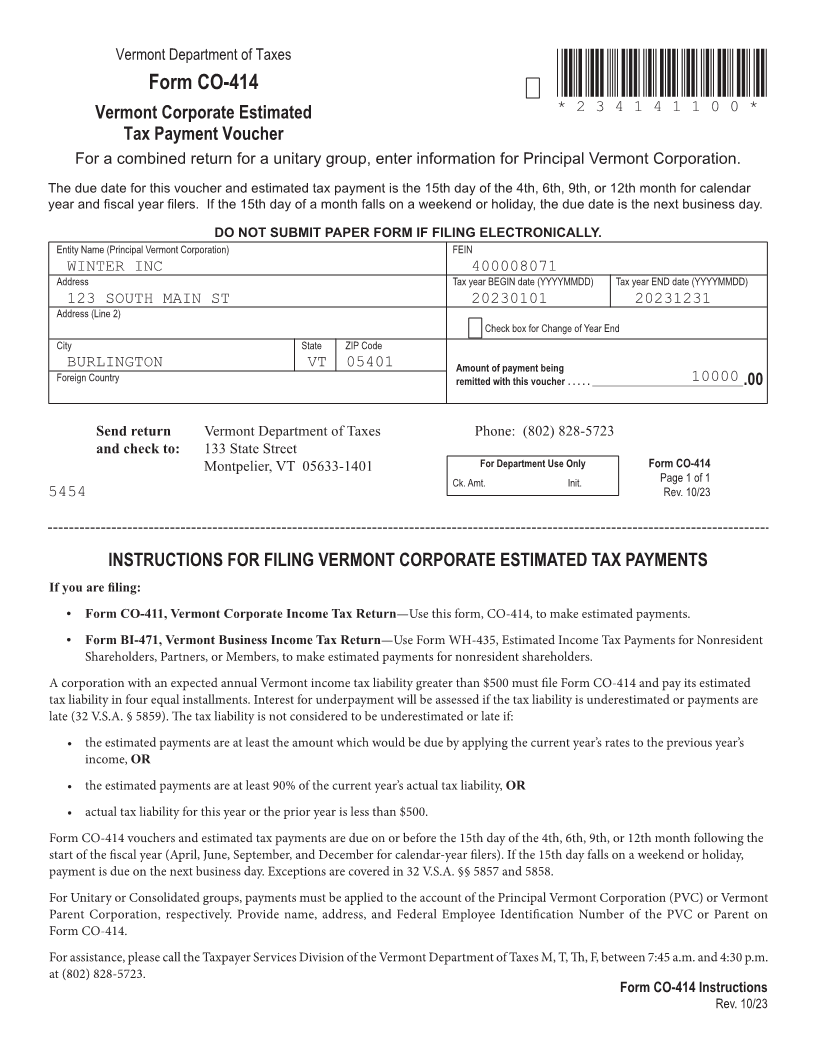

Enlarge image | Test 4 Required Vermont Forms/Schedules: CO-411, BA-402, BA-404, CO-419 & CO-420 x 2 Taxpayer(s) Information: Entity Name: Big Gains Went Overseas Inc. Federal Employer ID: 40-0008087 Federal Extension Requested: Y Primary 6-digit NAICS #: 522110 Unitary: Y Mailing Address: 108 River St Tax Year Begin Date: Jan-01-2023 City: Bloomsburg Tax Year End Date: Dec-31-2023 State: PA Federal Return Filed: 1120 Zip Code: 17815 # of companies in VT Unitary Group: 5 Country: USA # of companies with VT Nexus: 1 Return Information: VT Inventories: $ 100,000 Federal Taxable Income: $ 27,714,072,096 Land: $ 1,000,000 Special Deductions Federal: $ (1,363,745,284) VT Land: $ 100,000 Income/Loss from unitary members included in Vermont combined group: $ 12,000 Other Assets: $ 1,000,000 Income/Loss from affiliated entities filed excluded from VT combined group: $ (154,989,202) VT Other Assets: $ 100,000 Special Deductions VT adjustments: $ 15,453,756 Previous Year R&D: $ 6,523 Eliminations: $ 50,000 Current Year R&D: $ 10,000 Other Adjustements: $ 6,000,000 R&D Used Current Year: $ 6,531 Bonus Depreciation Adjustment: $ (436,352,715) Foreign Affiliate 1 Name: Arto Co, Germany Interest on non-VT State & Local Obligations: $ 2,500,365 Foreign Affiliate 1 FEIN: 44-4555777 State & Local Income or Franchise Taxes: $ 72,123,112 Dividends Paid: $ 5,000,000 Non-Apportionable Income or loss allocated everywhere: $ (900,000,000) Taxable Income: $ 600,000,000 Foreign dividends received: $ 250,000,000 Sales or Gross Receipts: $ 45,212,313 Factor Relief: Y Business Interest: $ 7,000 Interest on US Government Obligations: $ 72,896 Royalties: $ 554,654,123 "Gross UP: required by IRC §78: $ 450,231 Gross Rents: $ 8,005,642 Targeted Job Credit Salary & Wage Expense Addback: $ 150 Other Business Income: $ 6,500 Vermont Net Operating Loss: $ (100,000) Foreign Affiliate 2 Name: Arto Co Japan Use Tax Due: $ 25 Foreign Affiliate 2 FEIN: 44-4555666 Gross Receipts: $ 114,080,856 Dividends Paid: $ 3,000,000 Estimated Payments: $ 2,401,823 Taxable Income: $ 2,000,000 Payments with Extension: $ 650,608 Sales or Gross Receipts: $ 7,800,000 Sales or Gross Receipts: $ 63,123,456,000 Business Interest: $ 980,000 Sales of Services to Vermont: $ 110,075,400 Royalties: $ 8,456,321 Sales of TPP from Outside VT: $ 2,000 Gross Rents: $ 987,654 Sales of TPP from Within VT: $ 3,000 Other Business Income: $ 123,456 Special Industries: $ 456 Foreign Affiliate 3 Name: Arto Co Italy Interest & Dividends: $ 85,001,300 Foreign Affiliate 3 FEIN: 44-4455555 VT Interest & Dividends: $ 600,000 Dividends Paid: $ 250 Factors from Pass Through Entities: $ 6,540,000,212 Taxable Income: $ (100,000) VT Factors from Pass Through Entities: $ 700,000 Sales or Gross Receipts: $ 60,000 Royalties: $ 9,960,000,234 Other Business Income: $ 632 VT Royalties: $ 800,000 Foreign Affiliate 4 Name: Arto CO Vietnam Gross Rents: $ 789,654,123 Foreign Affiliate 4 FEIN: 44-4455888 VT Gross Rents: $ 900,000 Dividends Paid: $ 241,999,750 Other Apportionable Income: $ 123,456,789 Taxable Income: $ 50,000,000 VT Other Apportionable Income: $ 1,000,000 Business Interest: $ 9,000,000 Inventories: $ 1,000,000 Royalties: $ 41,000,000 |

Enlarge image |

Vermont Department of Taxes

Form CO-411 *234111100*

Vermont Corporate Income Tax Return *234111100*

Page 15

Name Accounting Extended 4 Unitary PL 86-272 is

Check Change Period Change Return Applicable

Appropriate

Box(es) Address Amended 4 Federal Extension RAR Pro Forma - Final Return

Change Return Requested Amended Cannabis (Cancels Account)

Entity Name (Principal Vermont Corporation) FEIN Primary 6-digit NAICS number

BIG GAINS WENT OVERSEAS INC 400008087 522110

Address Tax year BEGIN date (YYYYMMDD) Tax year END date (YYYYMMDD)

108 RIVER ST 20230101 20231231

Address (Line 2) Number of companies in Number of companies

Vermont Unitary Group 5 with Vermont Nexus 1

City State ZIP Code

Federal tax 1120 1120-F 990-T

BLOOMSBURG Foreign Country PA 17815 return filed 4

(Check one box)

1120-H Other

FORM (Place at FIRST page)

Enter all amounts in whole dollars. Form pages

1. FEDERAL TAXABLE INCOME (federal Form 1120, Line 28, as filed) . . . . . . . . . . . . . . . . . . . . . . . 1. ____________________________27714072096 .00

1a. Special Deductions as filed with IRS

(federal Form 1120, Line 29b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .1a. __________________________-1363745284 .00

1b. Income/Loss from unitary members included in

Vermont combined group . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1b. __________________________12000 .00 15 - 17

1c. Income/Loss from affiliated entities filed in the above federal

consolidated returns but excluded from Vermont combined group . 1c. __________________________-154989202 .00

1d. Special Deductions: Vermont adjustments to federal

special deductions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1d. __________________________15453756 .00

1e. Eliminations: Vermont adjustments to federal eliminations . . . . . . 1e. __________________________50000 .00

1f. Other: Other Vermont adjustments to Combined Net Income

(charitable expenses, etc .) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1f. __________________________6000000 .00

1g. Federal Taxable Income as Adjusted for Combined Net Income (ADD Lines 1 through 1f) . . . . . . 1g. ____________________________26216853366 .00

2. Bonus Depreciation Adjustment (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2. ____________________________-436352715 .00

3. Federal Taxable Income as Adjusted for Combined Net Income and Bonus Depreciation

(ADD Lines 1g and 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3. ____________________________25780500651 .00

4. ADD 4a. Interest on non-Vermont state and local obligations . . . . . . . .4a. __________________________2500365 .00

4b. State and local income or franchise taxes . . . . . . . . . . . . . . . 4b. __________________________72123112 .00

Check box if exception SMALL FARM CORPORATION NO VERMONT ACTIVITY HOMEOWNER’S / CONDO ASSOC.

($75 minimum) ($0) (Federal Form 1120-H only) ($0)

to minimum tax applies:

Form CO-411

Page 1 of 3

5454 Rev. 10/23

|

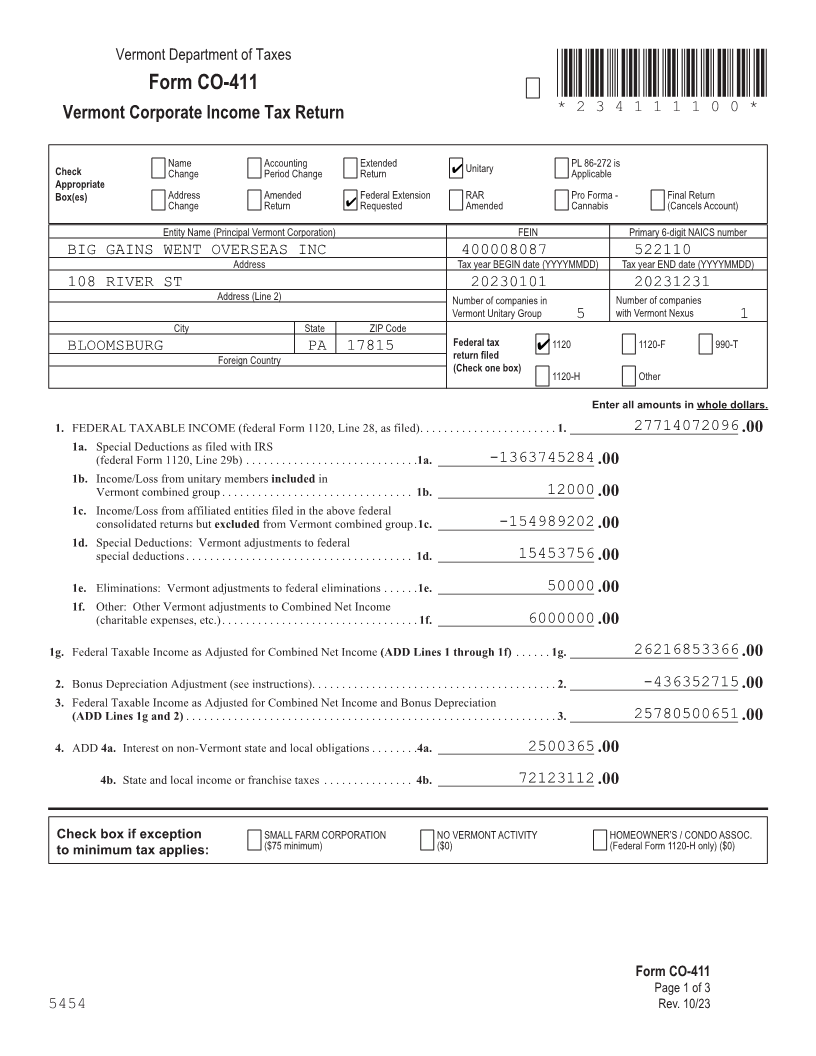

Enlarge image |

Entity Name

FEIN Fiscal Year Ending (YYYYMMDD) *234111200*

*234111200*

Page 16

LESS 4c. Non-Apportionable Income or loss allocated everywhere

(Schedule BA-402, Line 1a, or leave blank) . . . . . . . . . . . . . . 4c. __________________________-900000000 .00

4d. Foreign dividends received . . . . . . . . . . . . . . . . . . . . . . . . . . 4d. __________________________250000000 .00

4e. Interest on U .S . Government obligations . . . . . . . . . . . . . . . . . 4e. __________________________72896 .00

4f. “Gross Up” required by IRC § 78 and other