Enlarge image

STATE OF VERMONT DEPARTMENT OF

TAXES

SCAN SUBSTITUTE FORMS

For

CORPORATE & BUSINESS INCOME

2023 TAX YEAR

1

Enlarge image |

STATE OF VERMONT DEPARTMENT OF

TAXES

SCAN SUBSTITUTE FORMS

For

CORPORATE & BUSINESS INCOME

2023 TAX YEAR

1

|

Enlarge image |

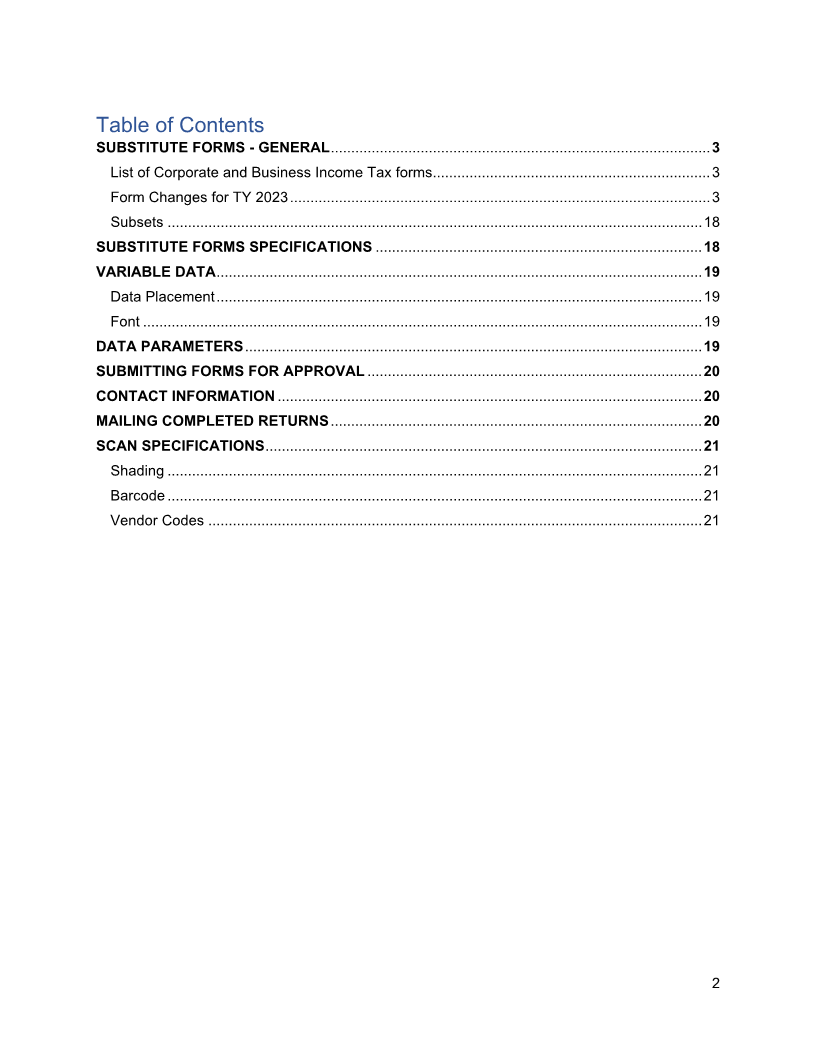

Table of Contents

SUBSTITUTE FORMS - GENERAL ............................................................................................. 3

List of Corporate and Business Income Tax forms .................................................................... 3

Form Changes for TY 2023 ....................................................................................................... 3

Subsets ................................................................................................................................... 18

SUBSTITUTE FORMS SPECIFICATIONS ................................................................................ 18

VARIABLE DATA ....................................................................................................................... 19

Data Placement ....................................................................................................................... 19

Font ......................................................................................................................................... 19

DATA PARAMETERS ................................................................................................................ 19

SUBMITTING FORMS FOR APPROVAL .................................................................................. 20

CONTACT INFORMATION ........................................................................................................ 20

MAILING COMPLETED RETURNS ........................................................................................... 20

SCAN SPECIFICATIONS ........................................................................................................... 21

Shading ................................................................................................................................... 21

Barcode ................................................................................................................................... 21

Vendor Codes ......................................................................................................................... 21

2

|

Enlarge image |

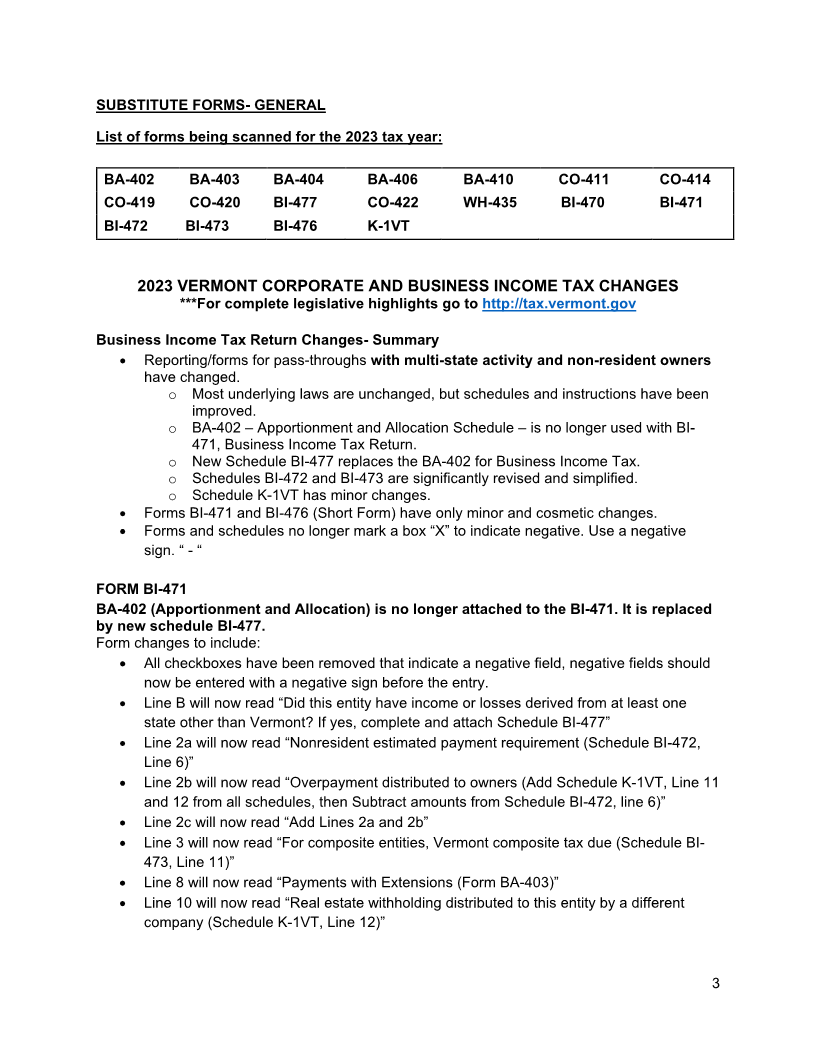

SUBSTITUTE FORMS- GENERAL

List of forms being scanned for the 2023 tax year:

BA-402 BA-403 BA-404 BA-406 BA-410 CO-411 CO-414

CO-419 CO-420 BI-477 CO-422 WH-435 BI-470 BI-471

BI-472 BI-473 BI-476 K-1VT

2023 VERMONT CORPORATE AND BUSINESS INCOME TAX CHANGES

***For complete legislative highlights go to http://tax.vermont.gov

Business Income Tax Return Changes- Summary

• Reporting/forms for pass-throughs with multi-state activity and non-resident owners

have changed.

o Most underlying laws are unchanged, but schedules and instructions have been

improved.

o BA-402 – Apportionment and Allocation Schedule – is no longer used with BI-

471, Business Income Tax Return.

o New Schedule BI-477 replaces the BA-402 for Business Income Tax.

o Schedules BI-472 and BI-473 are significantly revised and simplified.

o Schedule K-1VT has minor changes.

• Forms BI-471 and BI-476 (Short Form) have only minor and cosmetic changes.

• Forms and schedules no longer mark a box “X” to indicate negative. Use a negative

sign. “ - “

FORM BI-471

BA-402 (Apportionment and Allocation) is no longer attached to the BI-471. It is replaced

by new schedule BI-477.

Form changes to include:

• All checkboxes have been removed that indicate a negative field, negative fields should

now be entered with a negative sign before the entry.

• Line B will now read “Did this entity have income or losses derived from at least one

state other than Vermont? If yes, complete and attach Schedule BI-477”

• Line 2a will now read “Nonresident estimated payment requirement (Schedule BI-472,

Line 6)”

• Line 2b will now read “Overpayment distributed to owners (Add Schedule K-1VT, Line 11

and 12 from all schedules, then Subtract amounts from Schedule BI-472, line 6)”

• Line 2c will now read “Add Lines 2a and 2b”

• Line 3 will now read “For composite entities, Vermont composite tax due (Schedule BI-

473, Line 11)”

• Line 8 will now read “Payments with Extensions (Form BA-403)”

• Line 10 will now read “Real estate withholding distributed to this entity by a different

company (Schedule K-1VT, Line 12)”

3

|

Enlarge image |

• Line 12 will now read “Nonresident estimated payments distributed to this entity by a

different company (Schedule K-1VT, Line 11)”

• Line 14 will now read “Balance Due: If Line 6 is greater than Line 13, subtract Line 6

from Line 13”

• Line 15 will now read “Payment included with this return. Make check payable to

Vermont Department of Taxes”

• Line 16 will now read “Overpayment: If Line 6 is less than the sum of Lines 13 and 15,

add Lines 13 and 15, then subtract Line 6”

SCHEDULE BI-472

BI-472 is significantly streamlined. All income calculations and adjustments occur on BI-

477. The BI-472 now only applies the amount of income attributable to non-Vermont-

residents and calculates estimated payments due. Please review all instructions

carefully. Line 2 is expected to be a “safety” for exceptional situations, or items not

captured on BI-477, we do not expect this line to be used frequently.

Form changes to include:

• All checkboxes have been removed that indicate a negative field, negative fields should

now be entered with a negative sign before the entry.

• Removed previous lines 1-16.

• New line 1 will read “Income Attributable to Vermont (Schedule BI-477, Line 28)”

• New line 2 will read “Other adjustments to income attributable to Vermont”

• New line 3 will read “Total Income Attributable to Vermont (Add lines 1 and 2)”

• Previous line 17 is now line 4 and will read “Percentage of income from Line 3 passed

through to nonresidents”

• Previous line 18 is now line 5 and will read “Total income passed through to

nonresidents (Multiple Line 3 by Line 4)”

• Previous line 19 is now line 6 and will read “Nonresident estimated payment

requirements (Multiply Line 5 by 6.6% (0.066))”

SCHEDULE BI-473

BI-473 is significantly streamlined. All income calculations and adjustments occur on BI-

477. BI-473 now only applies the amount of income attributable to non-Vermont-residents

and calculates composite tax due. Line 6 reports Composite net operating loss available,

parallel to prior year line 20. Note the name has been changed to distinguish from

“Vermont Net Operating Loss,” which is specific in statute for C-Corporations. Line 10

allows for credits to be applied to offset tax, if earned and available, same as prior year

line 23.

Form changes to include:

• All checkboxes have been removed that indicate a negative field, negative fields should

now be entered with a negative sign before the entry.

• New line 1 will read “Taxable Income (Schedule BI-477, Line 27)”

• New line 2 will read “Vermont Income Tax Adjustment % (Schedule BI-477, Line 29)”

• New line 3 will read “Vermont Adjusted Income (Multiply Line 1 by Line 2)”

4

|

Enlarge image |

• Removed previous lines 1a-17.

• Previous line 18 is now line 4 and will read “Percentage of income from Line 3 passed

through to nonresidents”

• Previous line 19 is now line 5 and will read “Total nonresident income (Multiply Line 3 by

Line 4)”

• Previous line 20 is now line 6 and will read “Composite net operating loss (Attach

statement)”

• New line 7 will read “Additional Adjustments (specify)”

• Previous line 21 is now line 8 and will read “Vermont taxable composite income (Add

Line 5 through Line 7)”

• Previous line 22 is now line 9 and will read “Composite Tax (Multiply Line 8 by 7.6%

(0.076)). If negative enter 0”

• Previous line 23 is now line 10.

• New Note on Form:

• Previous line 24 is now line 11 and will read “Vermont Composite Tax Due (Line 9 Minus

Line 10)”

NEW SCHEDULE BI-477

BI-477- Vermont Income Adjustment Calculation: Pass-Through Nonresident

This replaces the old BA-402. Previously, the BA-402 was shared between the CO-411

and the BI-471. Now the BI-477 is paired with the BI-471 only and the BA-402 with the CO-

411 only. This schedule will be 2 sections, section 1 has 1-5 and section 2 has parts 6-7.

Please review the BI-477 instructions in detail, The beginning of the instructions provide

the background and purpose of the sections of the schedule.

BI-477 must be attached if there is a BI-472 or BI-473.

• Header information:

Section 1 Pass-Through Personal Income Adjustment Calculation

Part I: Income Derived from Ownership of Property

• New line 1 will read “Net Rental Real Estate Income (loss)”

o 1A is Federal Amount

o 1B is Amount from Vermont Situs Property

• New line 2 will read “Other Net Rental Income (loss)”

5

|

Enlarge image |

o 2A is Federal Amount

o 2B is Amount from Vermont Situs Property

• New line 3 will read “Royalties”

o 3A is Federal Amount

o 3B is Amount from Vermont Situs Property

Part II: Gains from The Sale or Exchange of Property

• New line 4 will read “Net Long Term Capital Gain (Loss)”

o 4A is Federal Amount

o 4B is Amount from Vermont Situs Property

• New line 5 will read “Net Short Term Capital Gain (loss)”

o 5A is Federal Amount

o 5B is Amount from Vermont Situs Property

• New line 6 will read “Guaranteed Payments for Capital”

o 6A is Federal Amount

o 6B is Amount from Vermont Situs Property

• New line 7 will read “Collectibles (28%) Gain (loss)”

o 7A is Federal Amount

o 7B is Amount from Vermont Situs Property

• New line 8 will read “Unrecaptured IRC §1250 Gain”

o 8A is Federal Amount

o 8B is Amount from Vermont Situs Property

• New line 9 will read “New IRC § 1231 Gain (loss)”

o 9A is Federal Amount

o 9B is Amount from Vermont Situs Property

Part III: Wages, Salaries, Compensation to Partners

• New line 10 will read “Wages and Salaries”

o 10A is Federal Amount

o 10B is Amount Received for Services Performed in Vermont

• New line 11 will read “Other Compensation”

o 11A is Federal Amount

o 11B is Amount Received for Services Performed in Vermont

• New line 12 will read “Guaranteed Payments for Services”

o 12A is Federal Amount

o 12B is Amount Received for Services Performed in Vermont

Part IV: Business Income

• New line 13 will read “Vermont Sales and Receipts Factor as a percent of Everywhere

(Section 2, Line 40)”

• New line 14 will read “Ordinary Business Income”

o 14A is Federal Amount

o 14B is Derived within Vermont (Multiply column A by Line 13)

• New line 15 will read “Net adjustment to income resulting from Vermont’s disallowance

of “bonus depreciation” (IRC 168(k))”

6

|

Enlarge image |

o 15A is Federal Amount

o 15B is Derived within Vermont (Multiply column A by Line 13)

• New line 16 will read “Ordinary Business Income with Bonus Depreciation Disallowance

(Add Lines 14 and 15)”

o 16A is Federal Amount

o 16B is Derived within Vermont (Multiply column A by Line 13)

• New line 17 will read “Interest Income”

o 17A is Federal Amount

o 17B is Derived within Vermont (Multiply column A by Line 13)

• New line 18 will read “Dividends”

• New line 18i will read “Ordinary Dividends”

o 18iA is Federal Amount

o 18iB is Derived within Vermont (Multiply column A by Line 13)

• New line 18ii will read “Qualified Dividends”

o 18iiA is Federal Amount

o 18iiB is Derived within Vermont (Multiply column A by Line 13)

• New line 18iii will read “Dividend Equivalents”

o 18iiiA is Federal Amount

o 18iiiB is Derived within Vermont (Multiply column A by Line 13)

• New line 19 will read “Other Apportionable Business Income (please specify)”

o 19A is Federal Amount

o 19B is Derived within Vermont (Multiply column A by Line 13)

• New line 20 will read “IRC § 179 Deduction”

o 20A is Federal Amount

o 20B is Derived within Vermont (Multiply column A by Line 13)

• New line 21 will read “Add lines 1A through 6A,9A through 12A, 16A through 19A, then

subtract Line 20A”

Part V: Income Adjustment

• New line 22 will read “Interest Income not derived from Vermont activity (Subtract Line

15A from federal Form 1065, Sch. K, Line 5)”

• New line 23 will read “Dividends not derived from Vermont activity (Subtract the sum of

Lines 18iA, 18iiA, and18iiiA from the sum of federal Form 1065, Sch. K, Lines 6a, 6b,

and 6c)”

• New line 24 will read “Other Income (loss) (please specify)”

• New line 25 will read “Add lines 21 through 24”

• New line 26 will read “Other Adjustments (Attach detailed explanation)”

• New line 27 will read “Taxable Income (Add Lines 25 and 26)”

• New line 28 will read “Add Lines 1B through 6B, 9B through 12B, 16B through 19B, then

subtract Line 20B”

• New line 29 will read “Income Adjustment % (Divide Line 28 by Line 27. Multiply the

result by 100 and carry the result out to the fourth decimal place.) Also enter on

Schedule BI-473, Line 2”

7

|

Enlarge image |

Section 2: Vermont Apportionment

Part VI: Vermont Sales and Receipts Factor

• New line 30 will read “Sales or gross receipts”

o 30A is Everywhere

• New line 31 will read “Sales of services”

o 31B is Vermont

• New line 32 will read “Sales of tangible personal property delivered or shipped to

purchasers in Vermont from outside Vermont”

o 32B is Vermont

• New line 33 will read “Sales of tangible personal property delivered or shipped to

purchasers in Vermont from within Vermont”

o 33B is Vermont

• New line 34 will read “Special Industries: Enter non-dollar sales factor figures here”

o 34B is Vermont

• New line 35 will read “Apportionable Interest and dividends”

o 35A is Everywhere

o 35B is Vermont

• New line 36 will read “Royalties”

o 36A is Everywhere

o 36B is Vermont

• New line 37 will read “Gross rents”

o 37A is Everywhere

o 37B is Vermont

• New line 38 will read “"Other Apportionable Business Income (attach detailed supporting

statement)”

o 38A is Everywhere

o 38B is Vermont

• New line 39 will read “Total gross receipts (Add lines 30 through 38)”

• New line 40 will read Vermont Gross Receipts factor (Divide line 39B by 39A. Multiply

the result by 100 and carry the result out to the sixth decimal place)”

Part VII: Property Factor (Average value during the year)

• New line 41 will read “Inventories”

o 41A is Everywhere

o 41B is Vermont

• New line 42 will read “Buildings and other depreciable assets (original cost)”

o 42A is Everywhere

o 42B is Vermont

• New line 43 will read “Depletable assets (original cost)”

o 43A is Everywhere

o 43B is Vermont

• New line 44 will read “Land”

o 44A is Everywhere

o 44B is Vermont

8

|

Enlarge image |

• New line 45 will read “Other assets (attach schedule)”

o 45A is Everywhere

o 45B is Vermont

• New line 46 will read “Rented real and personal property (multiple annual rent by 8)”

o 46A is Everywhere

o 46B is Vermont

• New line 47 will read “Total Property (Add lines 41 through 46”

o 47A is Everywhere

o 47B is Vermont

FORM BI-476

Form changes to include:

• No Changes

SCHEDULE K-1VT

This schedule will now include 3 parts. Please review instructions carefully.

Form changes to include:

• No header changes.

• All checkboxes have been removed that indicate a negative field, negative fields should

now be entered with a negative sign before the entry.

New PART I- Pass: Through Entity Information

• New line 1 will read “Ownership Percentage”

• New line 2 will read “Profit Percentage”

• New line 3 will read “Loss Percentage”

• New line 4 will read “Disregarded entity (Single-member LLC or Qualified subchapter S

subsidiary)?” Question is YES or No.

• New line 5 will read “Is this entity a unit of a Series LLC?” Question is YES or No.

• Previously unnumbered is now line 6 and will read “Did this entity pay tax on this income

as part of a composite return?” Question is YES or No.

New PART II: Distribution to Owners

• Previous line 1 is now line 7.

• Previous line 2 is now line 8.

• Previous line 3 is now line 9.

• Previous line 4 is now line 10.

• Previous line 5 is now line 11.

• Previous line 6 is now line 12.

• Previous line 7 is now line 13 and will read “Share of total federal bonus depreciation

difference Enter on Schedule IN-112, Line 4 or Line 9”

• Previous line 8 is now line 14.

New Part III: Distributive Share of Apportionment Factors

• New line 15 will read “Sales”

9

|

Enlarge image |

o 15A is Everywhere

o 15B is Vermont

• New line 16 will read “Payroll”

o 16A is Everywhere

o 16B is Vermont

• New line 17 will read “Property”

o 17A is Everywhere

o 17B is Vermont

SCHEDULE BA-402

This schedule has had significant calculation changes. The BA-402 is now only paired

with the CO-411. Previously, the BA-402 was shared between the CO-411 and the BI-471.

Now the BI-477 is paired with the BI-471 only and the BA-402 with the CO-411 only. ONLY

1 BA-402 per CO-411 now.

Form changes to include:

• Removed the header box “For Unitary Groups Only- Name of Affiliate” and “Affiliates

FEIN”

• All checkboxes have been removed that indicate a negative field, negative fields now

should be entered with a negative sign before the entry.

Part I: Non-Apportionable Income and Foreign Dividends

• Previous line 1a-b is now line 1 “Non-Apportionable Income”

o 1A is Everywhere

o 1B is Vermont

• Previous line 1c-d is now line 2.

o 2A is Everywhere

o 2B is Vermont

Part II: Sales and Receipts Factor

Section A: Sales and Receipts Factor

• Previous line 2 is now line 3.

o 3A is Everywhere

• Previous line 3 is now line 4.

o 4B is Vermont

• Previous line 4 is now line 5 and will read “Sales of tangible personal property delivered

or shipped to purchasers in Vermont from outside Vermont”

o 5B is Vermont

• Previous line 5 is now line 6 and will read “Sales of tangible personal property delivered

or shipped to purchasers in Vermont from within Vermont”

o 6B is Vermont

• Removed previous line 6.

• Removed previous line 7.

• New line 7 will read “Special Industries”

10

|

Enlarge image |

o 7B is Vermont

• Previous line 8 will now read “Apportionable interest and dividends”

o 8A is Everywhere

o 8B is Vermont

• New line 9 will read “Factors from pass through entities”

o 9A is Everywhere

o 9B is Vermont

• Previous line 9 is now line 10.

o 10A is Everywhere

o 10B is Vermont

• Previous line 10 is now line 11.

o 11A is Everywhere

o 11B is Vermont

• Previous line 11 is now line 12 and will read “Other apportionable income (attach

detailed supporting statement)”

o 12A is Everywhere

o 12B is Vermont

• Previous line 12 is now line 13 and will read “Total Income, Sales, and Gross Receipts

Add Lines 3 through 12”

o 13A is Everywhere

o 13B is Vermont

• Previous line 12c is now line 14 and will read “Vermont Sales and Receipts factor as

percent of Everywhere. (Divide Line 13B by Line 13A. Multiply the result by 100 and

carry the result out to the sixth decimal place) Enter this figure on Form CO-411, Line 6”

Section B: Salaries and Wages Factor (Informational Purposes Only)

• Previous line 13 is now line 15.

o 15A is Everywhere

o 15B is Vermont

• Removed previous line 13c.

Section C: Property Factor (Average value during the year) (Informational Purposes Only)

• Previous line 14 is now line 16.

• Previous line 15 is now line 17.

• Previous line 16 is now line 18.

• Previous line 17 is now line 19.

• Previous line 18 is now line 20.

• Previous line 19 is now line 21.

• Previous line 20 is now line 22 and will read “Total Property (Add Lines 16 through 21)”

• Removed previous line 20c.

• Removed previous section D.

11

|

Enlarge image |

FORM BA-403

Form changes to include:

• No Changes

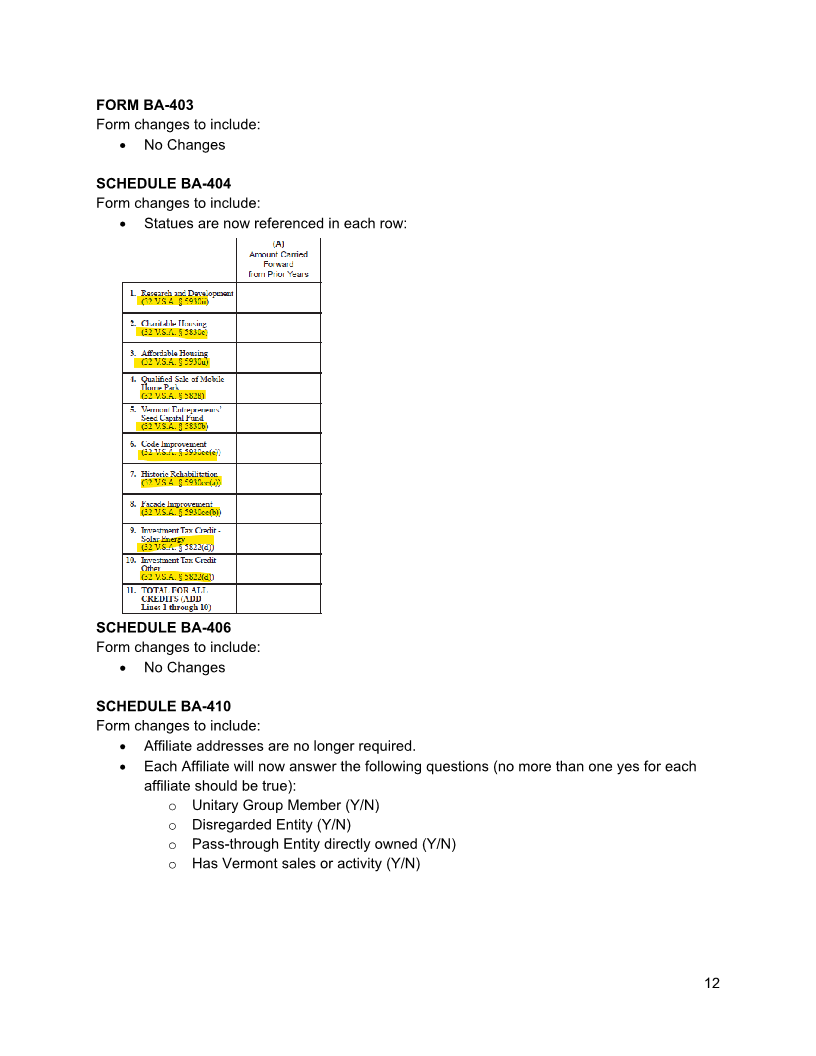

SCHEDULE BA-404

Form changes to include:

• Statues are now referenced in each row:

SCHEDULE BA-406

Form changes to include:

• No Changes

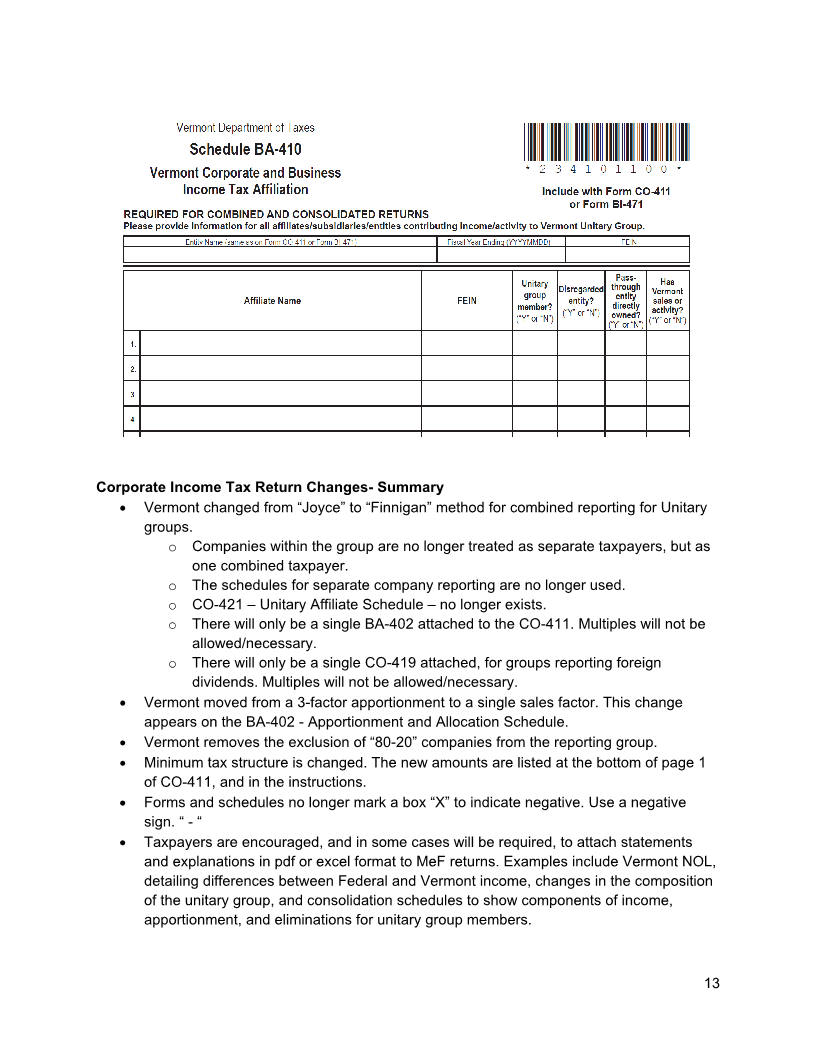

SCHEDULE BA-410

Form changes to include:

• Affiliate addresses are no longer required.

• Each Affiliate will now answer the following questions (no more than one yes for each

affiliate should be true):

o Unitary Group Member (Y/N)

o Disregarded Entity (Y/N)

o Pass-through Entity directly owned (Y/N)

o Has Vermont sales or activity (Y/N)

12

|

Enlarge image |

Corporate Income Tax Return Changes- Summary

• Vermont changed from “Joyce” to “Finnigan” method for combined reporting for Unitary

groups.

o Companies within the group are no longer treated as separate taxpayers, but as

one combined taxpayer.

o The schedules for separate company reporting are no longer used.

o CO-421 – Unitary Affiliate Schedule – no longer exists.

o There will only be a single BA-402 attached to the CO-411. Multiples will not be

allowed/necessary.

o There will only be a single CO-419 attached, for groups reporting foreign

dividends. Multiples will not be allowed/necessary.

• Vermont moved from a 3-factor apportionment to a single sales factor. This change

appears on the BA-402 - Apportionment and Allocation Schedule.

• Vermont removes the exclusion of “80-20” companies from the reporting group.

• Minimum tax structure is changed. The new amounts are listed at the bottom of page 1

of CO-411, and in the instructions.

• Forms and schedules no longer mark a box “X” to indicate negative. Use a negative

sign. “ - “

• Taxpayers are encouraged, and in some cases will be required, to attach statements

and explanations in pdf or excel format to MeF returns. Examples include Vermont NOL,

detailing differences between Federal and Vermont income, changes in the composition

of the unitary group, and consolidation schedules to show components of income,

apportionment, and eliminations for unitary group members.

13

|

Enlarge image |

FORM CO-411

Vermont has gone from Joyce to Finnegan starting for tax year 2023. Only one CO-411 is

now needed for all companies within the combined group, we no longer require multiple

company filings within a combined group. Because of this change, the CO-411 has been

updated and Vermont no longer supports the Form CO-421 since only one return (CO-

411) is needed now for return submission.

Form changes to include:

• Unitary Combined and Unitary Consolidated checkboxes have been removed. There will

now only be one Unitary Checkbox:

(The prior distinction is no longer necessary with the shift from Joyce to Finnigan method.)

• New RAR Amended Checkbox:

* Please note: If RAR Amended Checkbox is true, Amended Checkbox must also be true. *

• All checkboxes have been removed that indicate a negative field, negative fields now

should be entered with a negative sign before the entry.

• Line 1 will now read “Federal Taxable Income (federal form 1120, Line 28 as filed)” this

has been changed from Line1120 Line 30.

• New Lines 1a-1g (all fields can be a positive or negative amount):

o 1a will read “Special Deductions as filed with IRS (federal Form 1120, Line 29b)”

o 1b will read “Income/loss from unitary members included in Vermont combined

group”

o 1c will read “Income/loss from affiliated entities filed in the above federal

consolidated returns but excluded from Vermont combined group”

o 1d will read “Special Deductions: Vermont adjustments to federal special

deductions”

o 1e will read “Eliminations: Vermont adjustments to federal eliminations”

o 1f will read “Other: Other Vermont adjustments to Combined Net Income

(charitable expenses, etc.)”

o 1g will read “Federal Taxable Income as Adjusted for Combined Net Income

(Add Lines 1-1f)”

• Line 2, no changes from previous year.

• Line 3 will now read “Federal Taxable Income as Adjusted for Combined Net Income

and Bonus Depreciation, add Lines 1g and 2”

14

|

Enlarge image |

• Line 4a, no changes from previous year.

• Line 4b, no changes from previous year.

• Line 4c will now read “Non-Apportionable Income or loss allocated everywhere

(Schedule BA-402, Line 1a, or leave blank)”

• Line 4d, no changes from previous year.

• Line 4e, no changes from previous year.

• Line 4f, no changes from previous year.

• Line 4g, no changes from previous year.

• Line 5, no changes from previous year.

• Line 6 will now read “Vermont percentage (Schedule BA-402, Line 14, or 100%)

• Removed previous line 7.

• Previous line 8 is now line 7 and will read “Income Apportioned to Vermont (Multiply Line

5 by Line 6)”

• Previous line 9 is now line 8 and will read “Non-apportionable Income from Vermont

(Schedule BA-402, Line 1B)”

• Previous line 10 is now line 9 and will read “Foreign Dividends Allocated to Vermont

(Schedule BA-402, Line 2B)”

• Previous line 11 is now line 10 and will read “Net Vermont Income Allocated and

Apportioned to Vermont (Add Lines 7 through 9)”

• Previous line 12 is now line 11.

• Previous line 13 is now line 12 and will read “Vermont Net Taxable income for this entity

(Line 10 minus Line 11)”

• Previous line 14 is now line 13 and will read “Vermont Tax. Calculate Vermont tax due

on Line 12 amount using the Tax Computation Schedule Below”

• Previous line 15 is now line 14.

• Previous line 16 is now line 15.

• Previous line 17 is now line 16 and will read “Tax Due for this entity (Line 13 minus Line

14, then Add Line 15)”

• Previous line 18 is now line 17.

• Removed previous line 19.

• Previous lines 20-20e are now lines 18-18e.

o Line 18a will read “Estimated Payments (From CO-411)”

o Line 18 b will read “Payment with Extension (BA-403)”

o Line 18c will read “Nonresident estimated payments distributed to this entity by a

different company through a Schedule K-1VT”

• Previous line 20f is now line 18f and will read “Total Payments (Add Lines 18a-18e)”

• Previous line 21 is now line19 and will read “Balance Due. If Line 16 is more than Line

18f, subtract Line 18f from Line 16”

• Previous line 22 is now line 20.

• Previous line 23 is now line 21 and will read “Overpayment. If Line 18f is more than Line

16, subtract Line 16 from 18f”

• Previous line 24 is now line 22.

15

|

Enlarge image |

• Previous line 25 is now line 23 and will read “Overpayment to be refunded (Line 21

minus Line 22)”

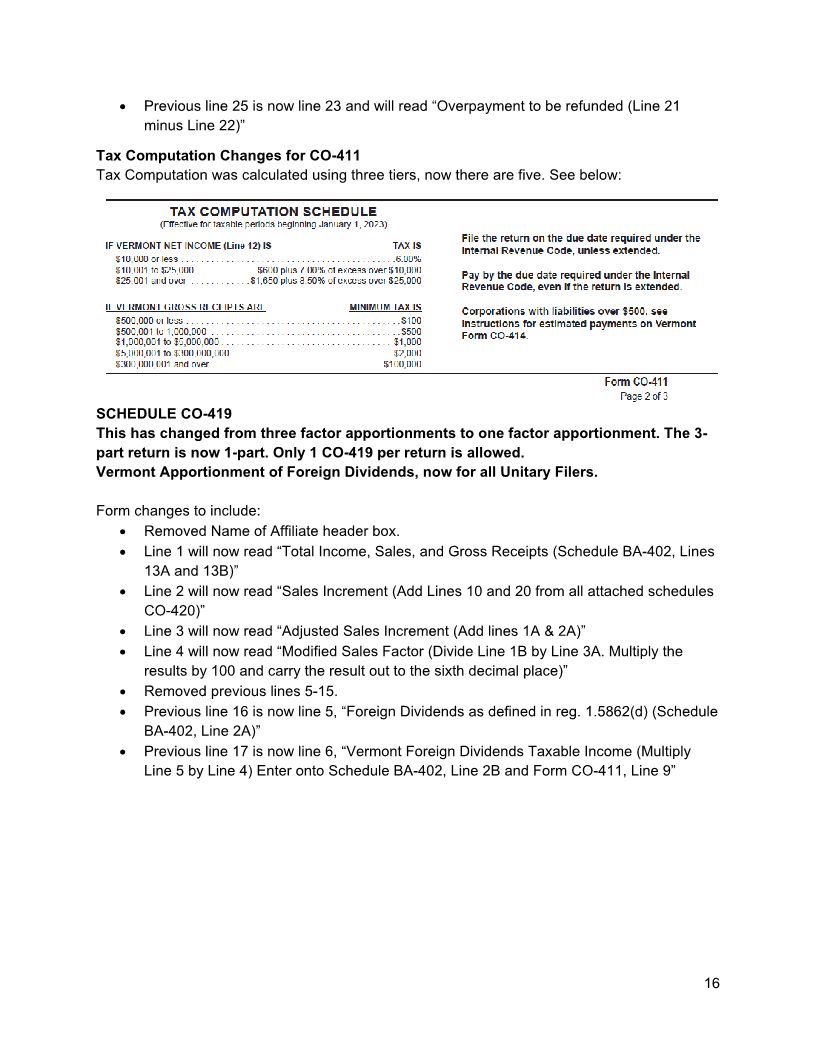

Tax Computation Changes for CO-411

Tax Computation was calculated using three tiers, now there are five. See below:

SCHEDULE CO-419

This has changed from three factor apportionments to one factor apportionment. The 3-

part return is now 1-part. Only 1 CO-419 per return is allowed.

Vermont Apportionment of Foreign Dividends, now for all Unitary Filers.

Form changes to include:

• Removed Name of Affiliate header box.

• Line 1 will now read “Total Income, Sales, and Gross Receipts (Schedule BA-402, Lines

13A and 13B)”

• Line 2 will now read “Sales Increment (Add Lines 10 and 20 from all attached schedules

CO-420)”

• Line 3 will now read “Adjusted Sales Increment (Add lines 1A & 2A)”

• Line 4 will now read “Modified Sales Factor (Divide Line 1B by Line 3A. Multiply the

results by 100 and carry the result out to the sixth decimal place)”

• Removed previous lines 5-15.

• Previous line 16 is now line 5, “Foreign Dividends as defined in reg. 1.5862(d) (Schedule

BA-402, Line 2A)”

• Previous line 17 is now line 6, “Vermont Foreign Dividends Taxable Income (Multiply

Line 5 by Line 4) Enter onto Schedule BA-402, Line 2B and Form CO-411, Line 9”

16

|

Enlarge image |

SCHEDULE CO-420

Vermont Foreign Dividend Factor Increments, now for all Unitary Filers.

Taxpayers must continue to provide information for each company paying foreign

dividends into the group.

Form changes to include:

• All checkboxes have been removed that indicate a negative field, negative fields now

should be entered with a negative sign before the entry

• Sections A, B, and C have been removed on this Schedule.

• The Schedule is now in two sections, one section for each affiliate to report required

information.

Section 1 header:

• Lines 1-10, no changes from previous year.

Section 2 header:

• Previous lines 11-20 removed.

• Lines 11-18 are the same lines as Section 1, Lines 1-8.

• New line 19 will read “Total Income, Sales and Gross Receipts (Add lines 14 through

18)”

• New line 20 will read “Sales and Receipts Increment (Multiple Line 19 by Line 13)”

The sales and receipts increment (Lines 10 and 20 from all attached Schedules CO-420) will be

entered onto Line 2 of Schedule CO-419.

SCHEDULE CO-421

Schedule has been REMOVED.

FORM BI-470

Form changes to include:

• No Changes

FORM CO-422

Form changes to include:

• No Changes

FORM CO-414

Form changes to include:

• No Changes

17

|

Enlarge image |

FORM WH-435

Form changes to include:

• No Changes

Forms will be approved in subsets as indicated below. All forms in a subset must receive

approval at the same time. Example: Form CO-411 will not receive approval until Schedules

BA-410, BA-402, and BA-404 are approved.

Subsets allowed:

1) BA-403

2) CO-414

3) WH-435

4) BI-470

5) BI-476, BA-406*, BA-404*

6) BI-471, BI-472, BI-473, Sch. K-1VT, BI-477, BA-404*, BA-406*

7) CO-411, BA-410, BA-402, BA-404*

8) CO-422

*Schedules appearing in more than one subset must be included with each subset package

submitted for approval.

Forms must be approved as a unit because our scanner cannot process “mixed-form returns”;

that is, some pages of computer-generated and some pages of Department-original forms. Each

taxpayer’s return must be all computer-generated or all Department-original.

SUBSTITUTE FORMS SPECIFICATIONS

Substitute forms must be reproduced to match the official forms. All variable data fields must be

in absolute positions and can be verified utilizing the 10 X 6 grid format. All forms that do not

meet the Department’s specifications will be rejected. The font size and style requirements are

provided below to ensure accuracy. All pages of forms and/or schedules are required to be filed

regardless of if the taxpayer is only utilizing a portion of the form.

Paper for substitute forms must be at least 20 lb. white stock and printed on 8 ½ X 11 paper. If

the form/voucher is not a full page, it needs to be located at the top of the page. The form

should be printed full scale with black ink. Please instruct software users of this information to

ensure the Department can capture the information accurately.

18

|

Enlarge image |

VARIABLE DATA FIELDS

Data placement:

Specified as exact positions using a 10X6 grid - 10 spaces per horizontal inch and 6 lines per

vertical inch. Beginning grid position and maximum length of field is given in these

specifications.

Forms produced by industry should follow all Department guidance on specific field level

restrictions. This includes the maximum character allowance, alpha and numeric rules, and

allowance of special characters.

Font:

Courier New 12pt font for ALL data fields.

Alpha characters must be in UPPERCASE only.

Do not print any information including internal codes, date/time stamps, or distribution information,

above the barcode or title of the form.

DOLLAR AMOUNTS

All forms and schedules are whole dollar only.

Do not use $ signs.

Do not use commas.

All amount fields are right justified.

If negative value, print minus sign “-“.

If no taxpayer entry, fields must be left blank except for hard coded zeros on form

template.

o Do not use non-numeric characters such as NONE, N/A, ZERO, etc. in the

amount fields.

Percentages will be shown with the last SIX (6) digits on the right indicating the six digits to the

right of the decimal point. If the percent does not have six digits to the right of the decimal point,

add “0” to the end of the number to show these places. If the percent shows six places to the right

of the decimal point, those digits are used. Examples:

100% = 100.000000 62.4% = 62.400000

27.8345% = 27.834500 3.575% = 3.575000

Fiscal Year Beginning and Ending dates must be printed on the forms where requested. If

entity operates on a calendar year, use January 1 and December 31 as the fiscal year beginning

and ending days, respectively, and use the appropriate calendar year for the return being filed.

19

|

Enlarge image |

DATES

Date format: YYYYMMDD

SUBMITTING FORMS FOR APPROVAL

When submitting forms for approval, please submit the following:

Blank forms – An example of each substitute form reproduced by the industry containing no

variable data with a barcode where applicable.

Samples - Forms recreated utilizing the test cases for all forms industry reproduces in their

software. The test cases and sample data can be found on the FTA SES website. The

submitted forms will not be tested if the Department’s test cases are not used. If industry does

not support all forms, the forms excluded need to be identified in submission.

Full-field forms – Form produced by industry demonstrating the maximum field allowance rules

on all forms. The data should be specific to each field, following all specifications listed. For

example, a dollar amount field should be only numerical.

Please include all test cases, blank and full field forms for review in one email. This will

allow the department to promptly review and provide feedback.

For fastest processing please email completed test packet to:

MeF Coordination & Substitute Forms Team

Tax.Vendorsupport@vermont.gov

When emailing, please provide your 4-digit NACTP code and product name in the subject line of

the email.

Test packages can also be mailed to:

Attn: Forms Team

Vermont Department of Taxes

133 State Street

Montpelier, VT 05633-1401

MAILING COMPLETED RETURNS

Vermont Department of Taxes

133 State Street

Montpelier, VT 05601

20

|

Enlarge image |

SCAN SPECIFICATIONS

SHADING

Should not be used on any part of the forms.

BARCODE

This is specific to the form.

The last two digits of the barcode represent your VT vendor number.

Follow grid layout for positioning.

VENDOR CODES

Vermont requires your Vendor Identification Code in two locations:

- The state provides a 2-digit vendor identification code that replaces the last two digits of

the barcode. The barcode provided on the forms has “00” as a place holder for this

information. If you are a new vendor and need this code, please contact the Vermont

Department of Taxes at tax.vendorsupport@vermont.gov

- The 4-digit identification number assigned by the National Association of Computerized

Tax Processors (NACTP) should be placed on the bottom left-hand corner on each page

of the form according to the 10X6 grid. If you need an NACTP ID number, please

complete the form at: NACTP Vendor ID Request.

21

|