Enlarge image

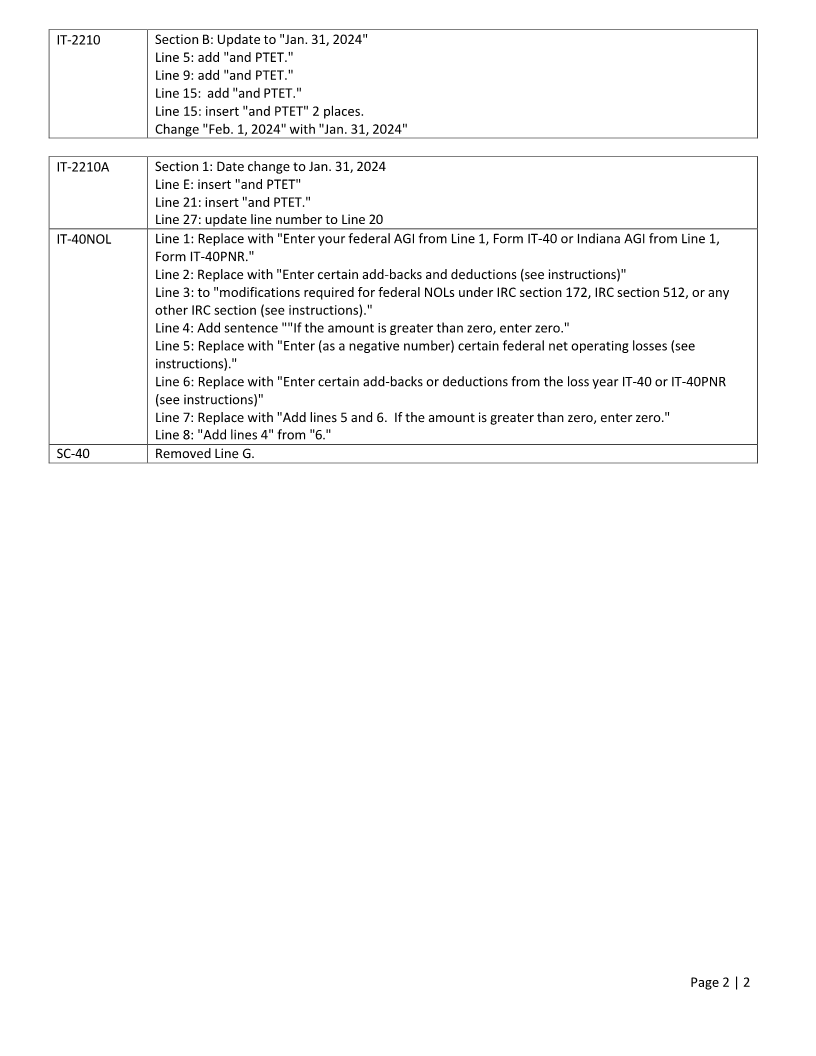

IND Change Log from 2022 to 2023

IT-40 Update Line 12 to "Schedule 5, line 13"

Add new sub line "a" below line 20 with box field "Enter code A if annualizing. Enter Code F

if Farmer or Fisherman

Line 8: Update rate to 3.15% and .0315

Sch. 2 Line 7: Replace "Military" with "Active military"

Sch. 3 Line 2: from Box 6 to Box 5

Line 3: Update Box 7 to Box 6

Sch. 5/ New Line 3: Pass Through Entity Tax Credit

Schedule IN- Renumber lines following new line 3

DONATE Line 12: Update to "Reserved for future use”.

Remove IT-40PNR references from IN-DONATE

IT-40PNR Line 8: Update rate to 3.15% and .0315

Line 12: "Schedule F, line 13"

Add new subline "a" below Line 20 with box field "Enter code A if annualizing. Enter Code F if

Farmer or Fisherman.”

Sch. A Line 21D: Changed from "Schedule D, Line 7" to "Schedule D, Line 8"

Sch. C Line 7: Replace "Military" with "Active military"

Sch. D Line 2: Update to Box 5

Line 3: Update to Box 6

Sch. F/ New Line 3: Pass Through Entity Tax Credit

Schedule IN- Renumber lines following new line 3.

DONATE Line 12: Update to "Reserved for future use."

New line 13: Update from line 11 to line 12.

Remove IT-40 references from IN-DONATE

CT-40 Line 6: Replace ".0181" with "the rate for Perry County. See County Rate Chart."

Page 2 rate chart: Update Perry County rate to .0140

CT-40PNR Line 6: Replace ".0181" with "the rate for Perry County. See County Rate Chart."

Page 2 rate chart: Update Perry County rate to .0140

ES-40 Update rate to .0305 online D under worksheet

IN-DEP Update verbiage to "Place "X" in box <<line number>>E” on lines 1E, 2E, 3E, 4E

New line F: "Place "X" in box <<line number>>F if claiming dependent child for the first time" and a

checkbox to lines 1, 2, 3, and 4.

Removed Line 5, renumbered subsequent lines.

Update line 6 to "1E, 1F, 2E, 2F, 3E, 3F, 4E and 4F"

IN-EIC Line A-2: replace "from Worksheet A, Part 1, line 1, or from Worksheet B, Part 4, line 4b" with "that

you used to determine your federal earned income tax credit."

Line A-3: Replace with "Multiply Line A-1 by 10% (.10)."

Example 1: Change "two" to "three" and "two of the three" with "the three qualified children"

Delete Example 2 in its entirety.

Section B-1 line D: delete "and lived with you the entire year."

Section B-1 line F: delete "and lived with you the entire year"

IN-529 Line 14: Update amounts to 1500 and 750

Page 1 | 2