Enlarge image

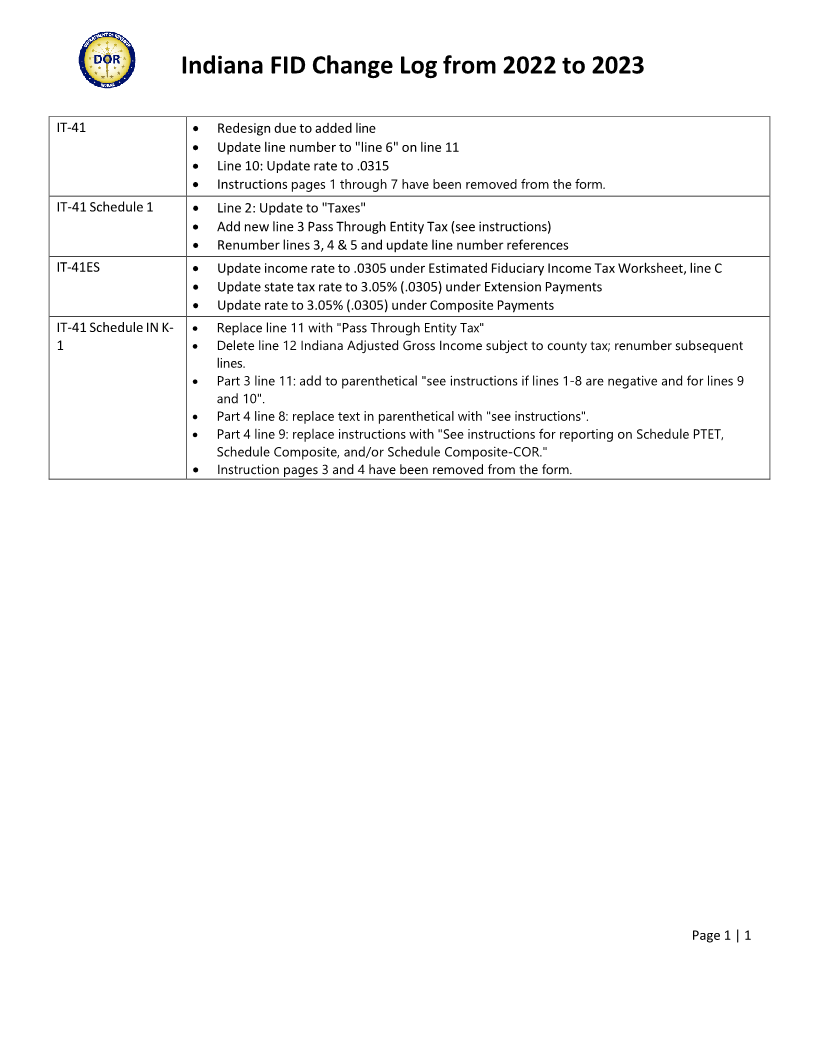

Indiana FID Change Log from 2022 to 2023

IT‐41 • Redesign due to added line

• Update line number to "line 6" on line 11

• Line 10: Update rate to .0315

• Instructions pages 1 through 7 have been removed from the form.

IT‐41 Schedule 1 • Line 2: Update to "Taxes"

• Add new line 3 Pass Through Entity Tax (see instructions)

• Renumber lines 3, 4 & 5 and update line number references

IT‐41ES • Update income rate to .0305 under Estimated Fiduciary Income Tax Worksheet, line C

• Update state tax rate to 3.05% (.0305) under Extension Payments

• Update rate to 3.05% (.0305) under Composite Payments

IT‐41 Schedule IN K‐ • Replace line 11 with "Pass Through Entity Tax"

1 • Delete line 12 Indiana Adjusted Gross Income subject to county tax; renumber subsequent

lines.

• Part 3 line 11: add to parenthetical "see instructions if lines 1-8 are negative and for lines 9

and 10".

• Part 4 line 8: replace text in parenthetical with "see instructions".

• Part 4 line 9: replace instructions with "See instructions for reporting on Schedule PTET,

Schedule Composite, and/or Schedule Composite-COR."

• Instruction pages 3 and 4 have been removed from the form.

Page 1 | 1