Enlarge image

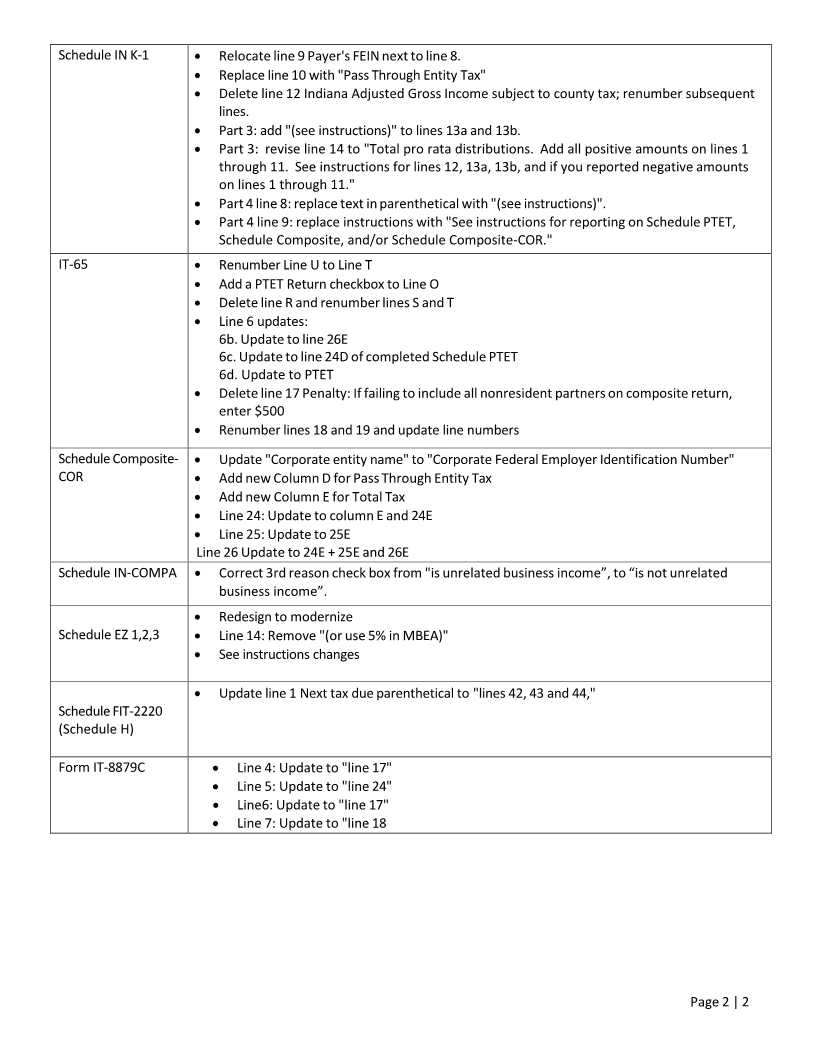

Indiana COR Change Log from 2022 to 2023

IT‐20NOL • Update line 3 to "Add any required federal NOL modifications under IRC s. 172 or s. 512"

• Update line 5 to "Subtract any Indiana modification added back both on line 1 and line 3."

• For line 10, second sentence, change to "If you have a separately stated net operating loss

under IC 6‐3‐1‐40, see instructions..."

• Update line 10 to "Add lines 8 and 9. If negative, this is an Indiana NOL deduction

available. If you have a separately stated net operating loss, see instructions."

Update to "Column A. NOL Deduction Used or Reduced"

Schedule IT‐2220 • Line 2 parenthetical add ", see instructions."

• Date header: "or Other" should be deleted and replaced with "For".

Schedule 8‐D • Page 2: Add verbiage before Corporation: "The utility receipts tax was repealed effective

July 1, 2022. However, this form may be used to file or amend a consolidated utility

receipts tax returns for tax years that include periods prior to that date."

IT‐20S • Add a PTET Return checkbox to Line P

• Update line 10: "Indiana net operating loss" (i.e., lower case)

• Add new line 16 Total Pass Through Entity Tax from Schedule PTET

• Renumber lines 17 through 26 and update line numbers

• Delete line 26. Penalty: If failing to include all nonresident shareholders on composite

return, enter $500

• Lines 27 and 28: update line numbers

Schedule Composite • Add "(leave blank if less than zero)" to Column G

• Replace "Entity Name" with "Social Security or Federal Employer Identification Number"

under Individual / Non‐Corporate Entity

• Header above Columns D, E & F, update to "Composite Adjusted Gross, Pass Through Entity

and County Income Tax"

• In Column E, update to: "Pass Through Entity Tax (Enter total amount from Schedule PTET)"

• In Column F, change to "Multiply C"

• In Column G, update parenthetical to "(D ‐ E + F)"

• Line 13: Add "Column E"

• Line 14: Add "E"

• Column D: Update rate to .0315 (.0305 for years ending in 2024)

• Column F: Replace written instructions with “(see instructions)”

Schedule PTET (NEW) • New Schedule

Page 1 | 2