Enlarge image

Tax Year 2023 Version 1.0 2023

Enlarge image | Tax Year 2023 Version 1.0 2023 |

Enlarge image |

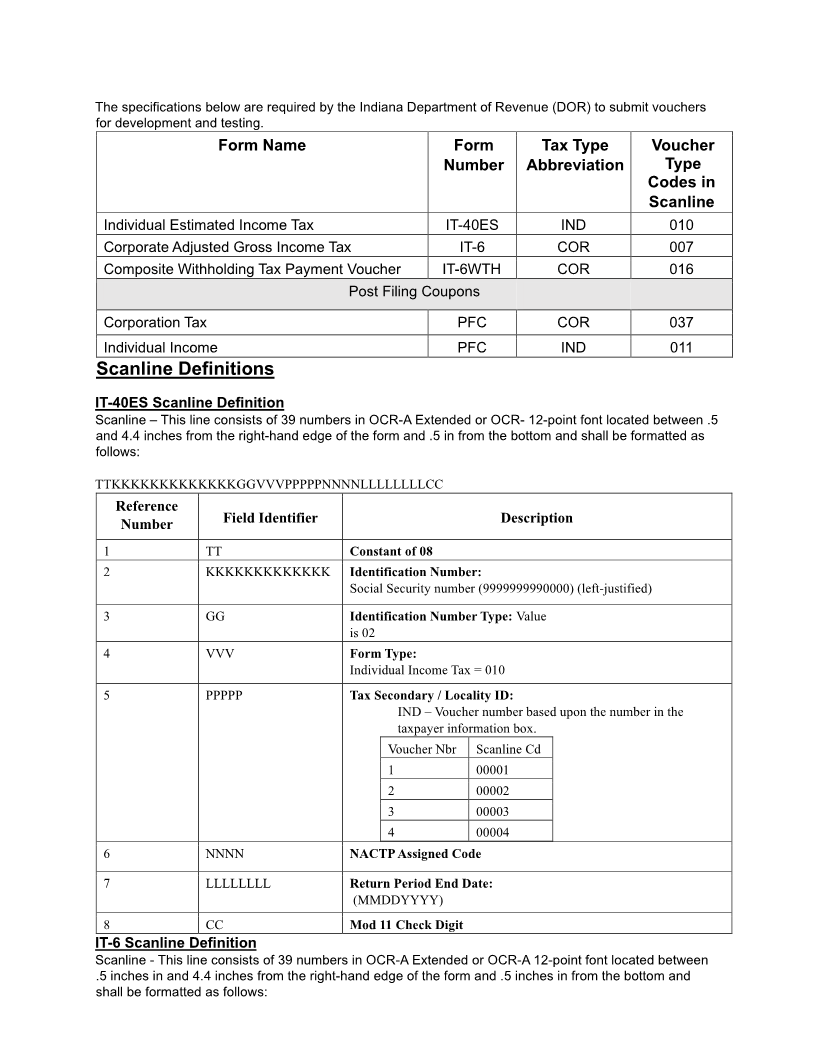

The specifications below are required by the Indiana Department of Revenue (DOR) to submit vouchers

for development and testing.

Form Name Form Tax Type Voucher

Number Abbreviation Type

Codes in

Scanline

Individual Estimated Income Tax IT-40ES IND 010

Corporate Adjusted Gross Income Tax IT-6 COR 007

Composite Withholding Tax Payment Voucher IT-6WTH COR 016

Post Filing Coupons

Corporation Tax PFC COR 037

Individual Income PFC IND 011

Scanline Definitions

IT-40ES Scanline Definition

Scanline – This line consists of 39 numbers in OCR-A Extended or OCR- 12-point font located between .5

and 4.4 inches from the right-hand edge of the form and .5 in from the bottom and shall be formatted as

follows:

TTKKKKKKKKKKKKKGGVVVPPPPPNNNNLLLLLLLLCC

Reference

Number Field Identifier Description

1 TT Constant of 08

2 KKKKKKKKKKKKK Identification Number:

Social Security number (9999999990000) (left-justified)

3 GG Identification Number Type: Value

is 02

4 VVV Form Type:

Individual Income Tax = 010

5 PPPPP Tax Secondary / Locality ID:

IND – Voucher number based upon the number in the

taxpayer information box.

Voucher Nbr Scanline Cd

1 00001

2 00002

3 00003

4 00004

6 NNNN NACTP Assigned Code

7 LLLLLLLL Return Period End Date:

(MMDDYYYY)

8 CC Mod 11 Check Digit

IT-6 Scanline Definition

Scanline - This line consists of 39 numbers in OCR-A Extended or OCR-A 12-point font located between

.5 inches in and 4.4 inches from the right-hand edge of the form and .5 inches in from the bottom and

shall be formatted as follows:

|

Enlarge image |

TTKKKKKKKKKKKKKGGVVVPPPPPNNNNLLLLLLLLCC

Reference

Field Identifier Description

Number

1 TT Constant of 08

2 KKKKKKKKKKKKK Identification Number:

This is generally the taxpayer’s federal ID number (9999999990000)

3 GG Identification Number Type:

Value is 03

4 VVV Form Type:

Corporate Income Tax = 007

5 PPPPP Tax Secondary / Locality ID:

COR – Voucher number based upon number in the taxpayer

information box.

Voucher Nbr Scanline Cd

1 00001

2 00002

3 00003

4 00004

Extension 00005

6 NNNN NACTP Assigned Code

7 LLLLLLLL Return Period End Date:

(MMDDYYYY)

8 CC Mod 11 Check Digit

IT-6WTH Scanline Definition

Scanline - This line consists of 39 numbers in OCR-A Extended or OCR-A 12-point font located between

.5 inches in and 4.4 inches from the right-hand edge of the form and .5 inches in from the bottom and

shall be formatted as follows:

TTKKKKKKKKKKKKKGGVVVPPPPPNNNNLLLLLLLLCC

Reference

Field Identifier Description

Number

1 TT Constant of 08

2 KKKKKKKKKKKKK Identification Number:

This is generally the taxpayer’s federal ID number (9999999990000)

3 GG Identification Number Type: Value

is 03

4 VVV Form Type:

Composite Income Tax = 016

5 PPPPP Tax Secondary / Locality ID:

Default to 00000 (zeros) for this tax type.

6 NNNN NACTP Assigned Code

7 LLLLLLLL Return Period End Date:

(MMDDYYYY)

8 CC Mod 11 Check Digit

|

Enlarge image |

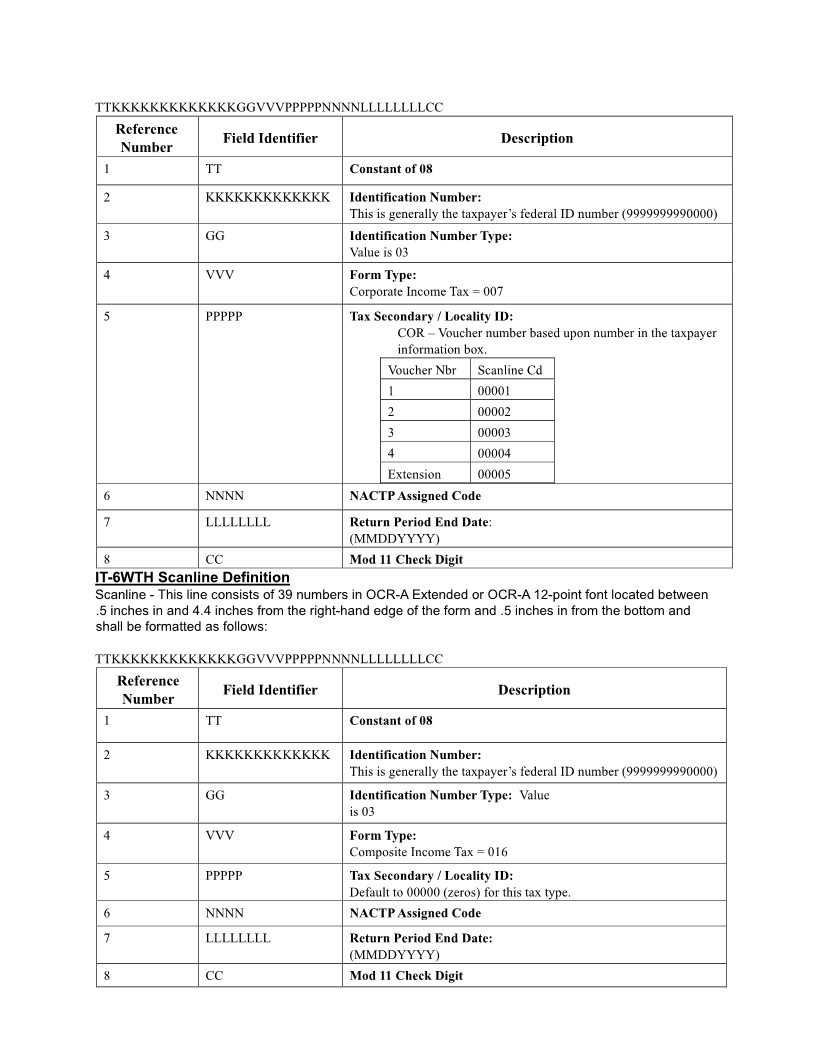

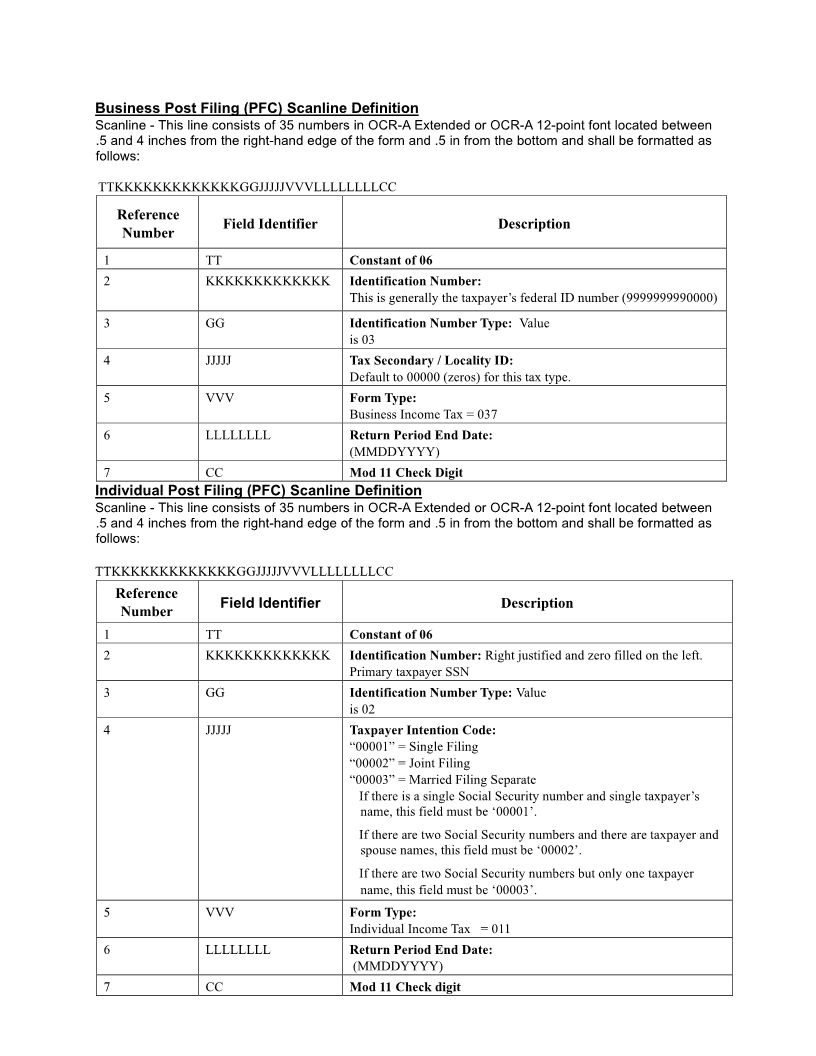

Business Post Filing (PFC) Scanline Definition

Scanline - This line consists of 35 numbers in OCR-A Extended or OCR-A 12-point font located between

.5 and 4 inches from the right-hand edge of the form and .5 in from the bottom and shall be formatted as

follows:

TTKKKKKKKKKKKKKGGJJJJJVVVLLLLLLLLCC

Reference

Field Identifier Description

Number

1 TT Constant of 06

2 KKKKKKKKKKKKK Identification Number:

This is generally the taxpayer’s federal ID number (9999999990000)

3 GG Identification Number Type: Value

is 03

4 JJJJJ Tax Secondary / Locality ID:

Default to 00000 (zeros) for this tax type.

5 VVV Form Type:

Business Income Tax = 037

6 LLLLLLLL Return Period End Date:

(MMDDYYYY)

7 CC Mod 11 Check Digit

Individual Post Filing (PFC) Scanline Definition

Scanline - This line consists of 35 numbers in OCR-A Extended or OCR-A 12-point font located between

.5 and 4 inches from the right-hand edge of the form and .5 in from the bottom and shall be formatted as

follows:

TTKKKKKKKKKKKKKGGJJJJJVVVLLLLLLLLCC

Reference

Field Identifier Description

Number

1 TT Constant of 06

2 KKKKKKKKKKKKK Identification Number: Right justified and zero filled on the left.

Primary taxpayer SSN

3 GG Identification Number Type: Value

is 02

4 JJJJJ Taxpayer Intention Code:

“00001” = Single Filing

“00002” = Joint Filing

“00003” = Married Filing Separate

If there is a single Social Security number and single taxpayer’s

name, this field must be ‘00001’.

If there are two Social Security numbers and there are taxpayer and

spouse names, this field must be ‘00002’.

If there are two Social Security numbers but only one taxpayer

name, this field must be ‘00003’.

5 VVV Form Type:

Individual Income Tax = 011

6 LLLLLLLL Return Period End Date:

(MMDDYYYY)

7 CC Mod 11 Check digit

|

Enlarge image |

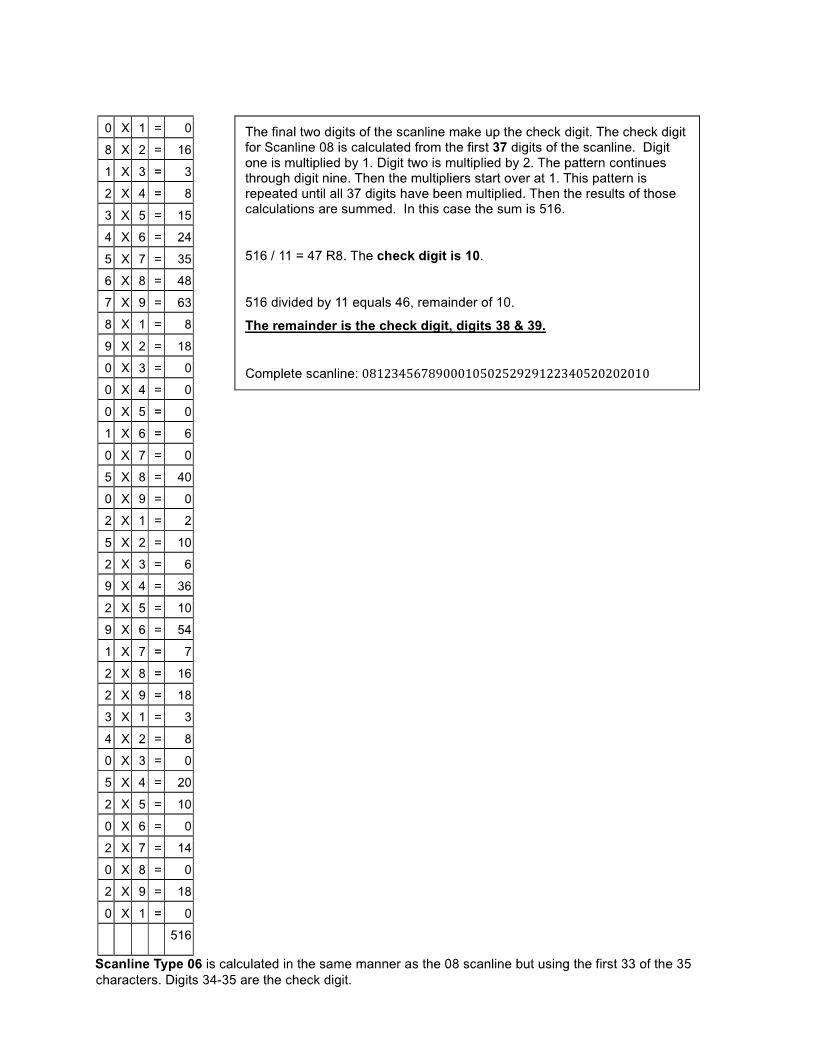

Check Digit Calculations

The MOD 11 check digit routine for DOR is as follows:

Scanline Type 08 (1 sttwo digits are “08”):

Using the 37 scanline digits, other than the check digit, pair each digit with a sequential multiplier between

1 and 9. The first digit is multiplied by 1, the second by 2, etc. until you get to 9. After nine, the next digit

is multiplied by 1, restarting the sequence. Next, the results of those multiplications are added together.

Finally, the sum of those results is divided by 11 and the check digit is the remainder. It will always be

between 00 and 10. The check digit must always be a 2-digit number, zero fill to the left of the numbers 0

through 9.

Scanline 08

The final two digits are calculated from the first 37 digits:

Scanline Number 0812345678900010502529291223405202020

Position Number X1234567891234567891234567891234567891

|

Enlarge image |

0 X 1 =0 The final two digits of the scanline make up the check digit. The check digit

8 X 2 =16 for Scanline 08 is calculated from the first 37 digits of the scanline. Digit

one is multiplied by 1. Digit two is multiplied by 2. The pattern continues

1 X 3 =3 through digit nine. Then the multipliers start over at 1. This pattern is

2 X 4 =8 repeated until all 37 digits have been multiplied. Then the results of those

3 X 5 =15 calculations are summed. In this case the sum is 516.

4 X 6 =24

5 X 7 =35 516 / 11 = 47 R8. Thecheck digit is 10.

6 X 8 =48

7 X 9 =63 516 divided by 11 equals 46, remainder of 10.

8 X 1 =8 The remainder is the check digit, digits 38 & 39.

9 X 2 =18

0 X 3 =0 Complete scanline:

081234567890001050252929122340520202010

0 X 4 =0

0 X 5 =0

1 X 6 =6

0 X 7 =0

5 X 8 =40

0 X 9 =0

2 X 1 =2

5 X 2 =10

2 X 3 =6

9 X 4 =36

2 X 5 =10

9 X 6 =54

1 X 7 =7

2 X 8 =16

2 X 9 =18

3 X 1 =3

4 X 2 =8

0 X 3 =0

5 X 4 =20

2 X 5 =10

0 X 6 =0

2 X 7 =14

0 X 8 =0

2 X 9 =18

0 X 1 =0

516

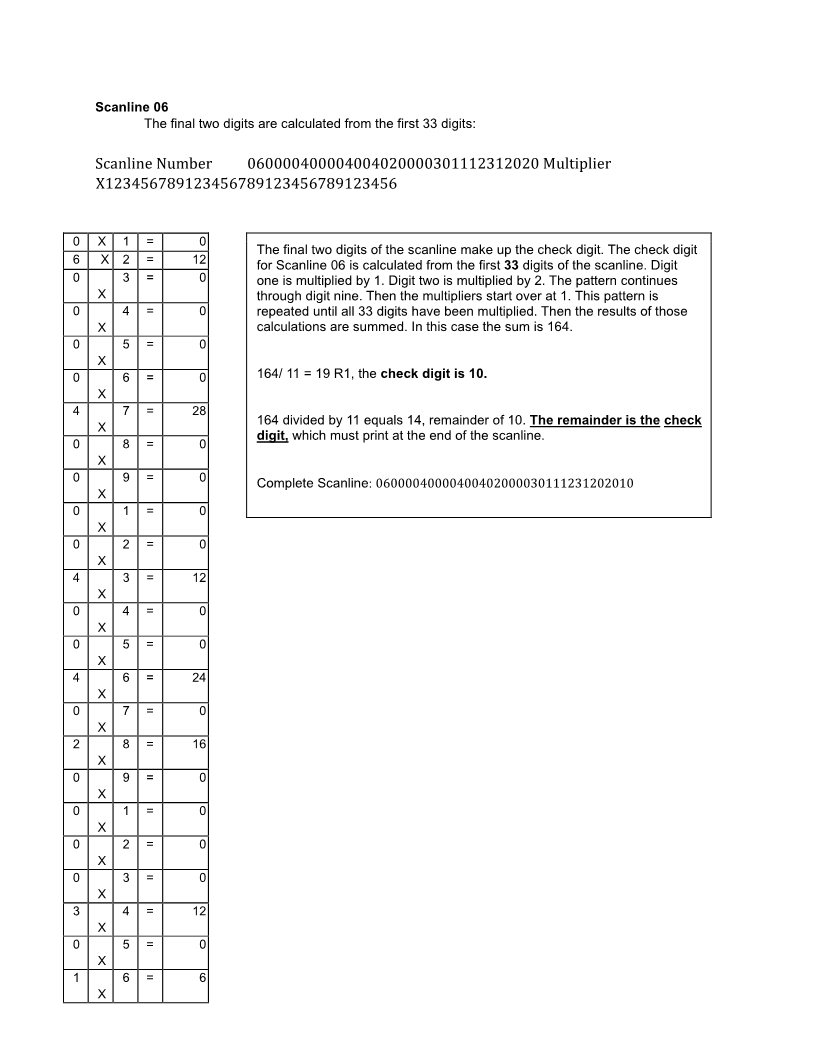

Scanline Type 06 is calculated in the same manner as the 08 scanline but using the first 33 of the 35

characters. Digits 34-35 are the check digit.

|

Enlarge image |

Scanline 06

The final two digits are calculated from the first 33 digits:

Scanline Number 060000400004004020000301112312020 Multiplier

X123456789123456789123456789123456

0 X 1 = 0

The final two digits of the scanline make up the check digit. The check digit

6 X 2 = 12 for Scanline 06 is calculated from the first 33 digits of the scanline. Digit

0 3 = 0 one is multiplied by 1. Digit two is multiplied by 2. The pattern continues

X through digit nine. Then the multipliers start over at 1. This pattern is

0 4 = 0 repeated until all 33 digits have been multiplied. Then the results of those

X calculations are summed. In this case the sum is 164.

0 5 = 0

X

0 6 = 0 164/ 11 = 19 R1, the check digit is 10.

X

4 7 = 28

164 divided by 11 equals 14, remainder of 10.

X The remainder is the check

digit, which must print at the end of the scanline.

0 8 = 0

X

0 9 = 0 Complete Scanline:

X 06000040000400402000030111231202010

0 1 = 0

X

0 2 = 0

X

4 3 = 12

X

0 4 = 0

X

0 5 = 0

X

4 6 = 24

X

0 7 = 0

X

2 8 = 16

X

0 9 = 0

X

0 1 = 0

X

0 2 = 0

X

0 3 = 0

X

3 4 = 12

X

0 5 = 0

X

1 6 = 6

X

|

Enlarge image |

1 X 7 = 7

1 X 8 = 8

2 X 9 = 18

3 X 1 = 3

1 X 2 = 2

2 X 3 = 6

0 X 4 = 0

2 X 5 = 10

0 X 6 = 0

164

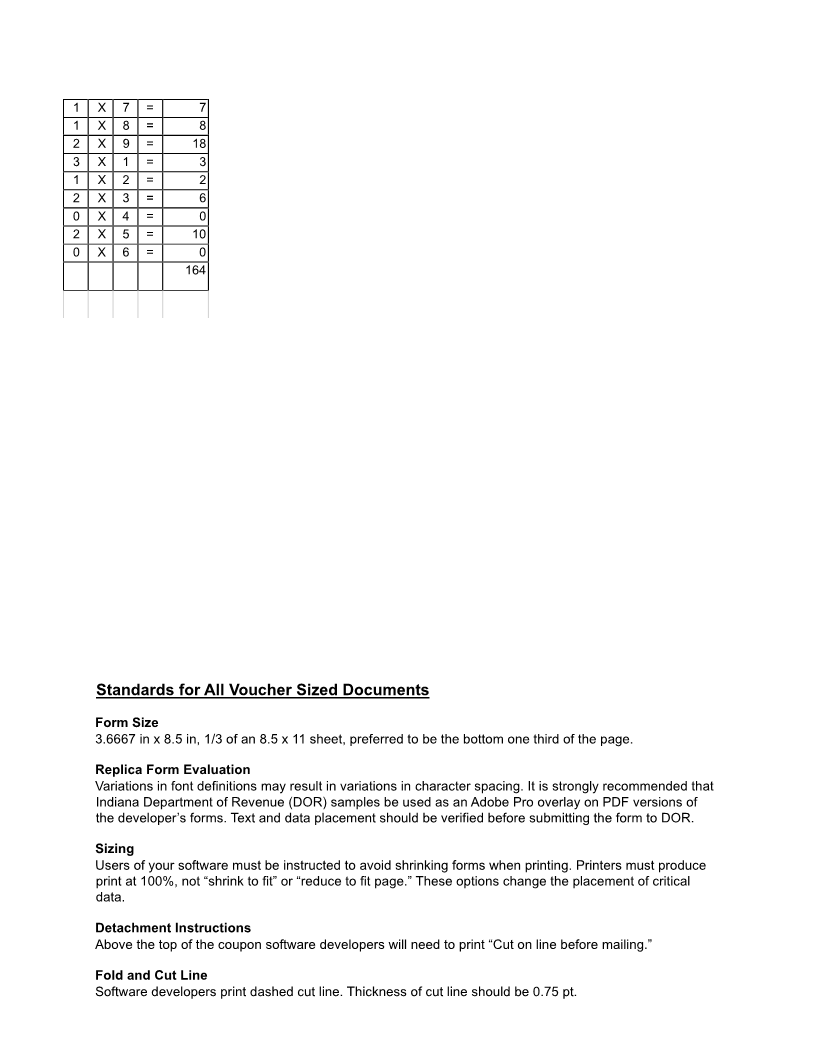

Standards for All Voucher Sized Documents

Form Size

3.6667 in x 8.5 in, 1/3 of an 8.5 x 11 sheet, preferred to be the bottom one third of the page.

Replica Form Evaluation

Variations in font definitions may result in variations in character spacing. It is strongly recommended that

Indiana Department of Revenue (DOR) samples be used as an Adobe Pro overlay on PDF versions of

the developer’s forms. Text and data placement should be verified before submitting the form to DOR.

Sizing

Users of your software must be instructed to avoid shrinking forms when printing. Printers must produce

print at 100%, not “shrink to fit” or “reduce to fit page.” These options change the placement of critical

data.

Detachment Instructions

Above the top of the coupon software developers will need to print “Cut on line before mailing.”

Fold and Cut Line

Software developers print dashed cut line. Thickness of cut line should be 0.75 pt.

|

Enlarge image |

Formatting Variables

See separate Due Date document.

Return Address

Return address barcodes are not needed on forms generated from software developer programs.

Remittance Amount

1. Remittance amount sits on a line 1-1/6 inches from the bottom edge of the form and ends 1/2

inch from the right edge of the form.

2. The field prints in OCR-A EXTENDED (or OCR-A) 12-point font.

3. A decimal point must separate dollars and cents.

4. The amount is right-justified and zero suppressed on the left.

5. No commas should be printed.

6. Location and formatting of this field are critical for DOR’s high-speed processing. Example:

99999999.99

999.99 .99

Other Dollar Amounts

1. Other dollar amounts must print in Courier New 12-point font.

2. Amount should be right justified.

3. No commas should be printed.

4. Decimal points must separate dollars from cents.

5. Negative amounts should be expressed using a negative sign/dash to the left of the number.

OCE-A Extended Scanline

The scanline must sit on a line 1/2 inch from the bottom of the form. The final digit in scanline must end

1/2 inch from the right edge of the form.

NACTP Code

Software vendors should print their vendor code without parentheses. i.e. “1234”. This code is assigned

by the National Association of Computerized Tax Processors (NACTP).

Note: PFC-IND and the PFC-COR are the only vouchers that use NACTP code in upper right corner.

|