Enlarge image

Tax Year 2023

Version 1.0 2023

Indiana Department of Revenue

Enlarge image |

Tax Year 2023

Version 1.0 2023

Indiana Department of Revenue

|

Enlarge image |

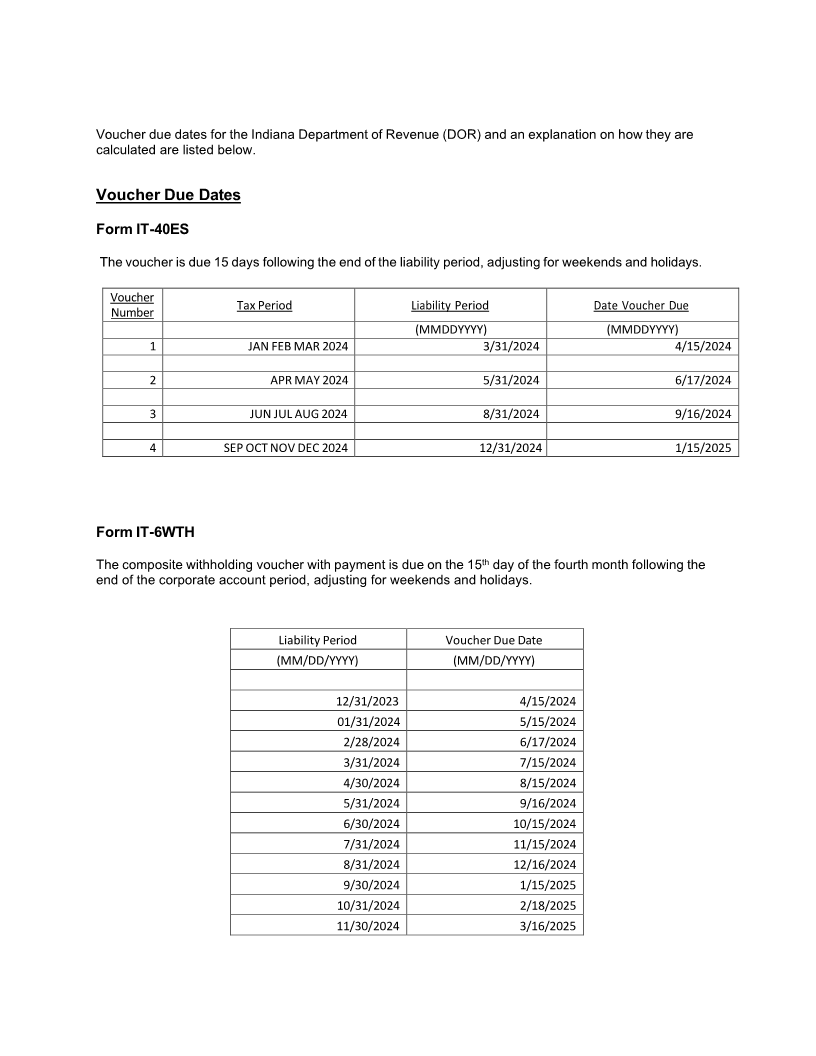

Voucher due dates for the Indiana Department of Revenue (DOR) and an explanation on how they are

calculated are listed below.

Voucher Due Dates

Form IT-40ES

The voucher is due 15 days following the end of the liability period, adjusting for weekends and holidays.

Voucher

Tax Period Liability Period Date Voucher Due

Number

(MMDDYYYY) (MMDDYYYY)

1 JAN FEB MAR 2024 3/31/2024 4/15/2024

2 APR MAY 2024 5/31/2024 6/17/2024

3 JUN JUL AUG 2024 8/31/2024 9/16/2024

4 SEP OCT NOV DEC 2024 12/31/2024 1/15/2025

Form IT-6WTH

The composite withholding voucher with payment is due on the 15thday of the fourth month following the

end of the corporate account period, adjusting for weekends and holidays.

Liability Period Voucher Due Date

(MM/DD/YYYY) (MM/DD/YYYY)

12/31/2023 4/15/2024

01/31/2024 5/15/2024

2/28/2024 6/17/2024

3/31/2024 7/15/2024

4/30/2024 8/15/2024

5/31/2024 9/16/2024

6/30/2024 10/15/2024

7/31/2024 11/15/2024

8/31/2024 12/16/2024

9/30/2024 1/15/2025

10/31/2024 2/18/2025

11/30/2024 3/16/2025

|

Enlarge image |

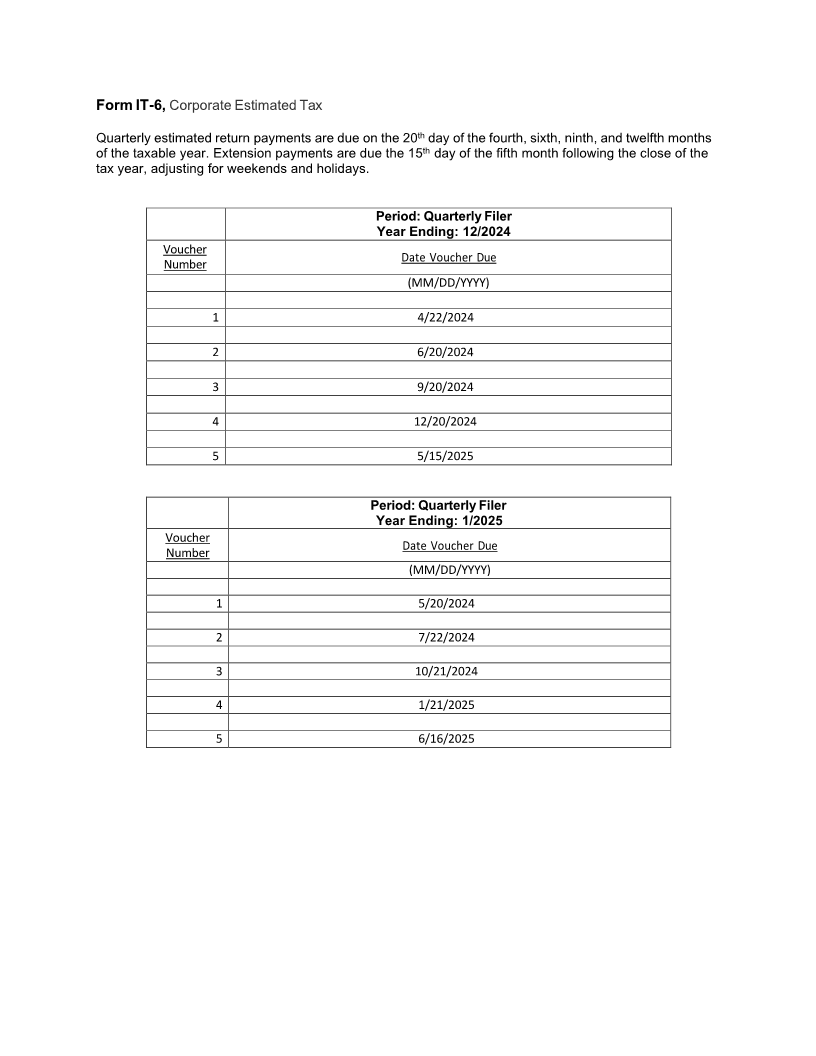

Form IT-6, Corporate Estimated Tax

Quarterly estimated return payments are due on the 20thday of the fourth, sixth, ninth, and twelfth months

of the taxable year. Extension payments are due the 15thday of the fifth month following the close of the

tax year, adjusting for weekends and holidays.

Period: Quarterly Filer

Year Ending: 12/2024

Voucher

Date Voucher Due

Number

(MM/DD/YYYY)

1 4/22/2024

2 6/20/2024

3 9/20/2024

4 12/20/2024

5 5/15/2025

Period: Quarterly Filer

Year Ending: 1/2025

Voucher

Date Voucher Due

Number

(MM/DD/YYYY)

1 5/20/2024

2 7/22/2024

3 10/21/2024

4 1/21/2025

5 6/16/2025

|

Enlarge image |

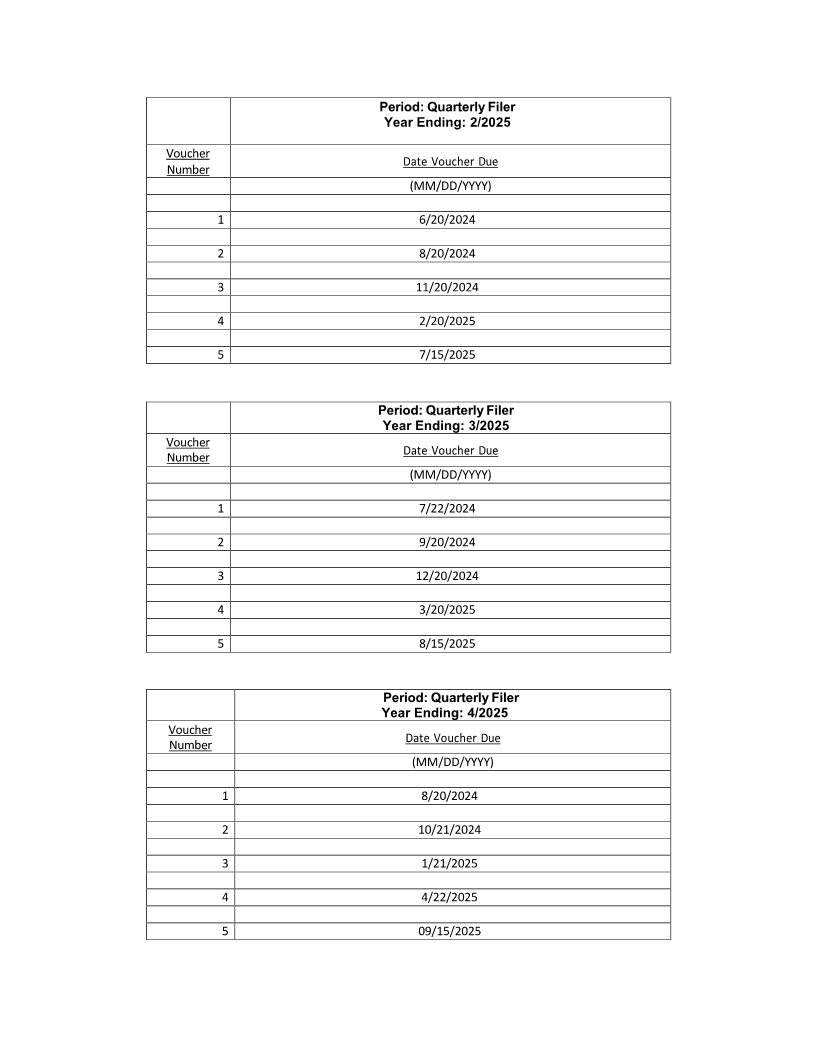

Period: Quarterly Filer

Year Ending: 2/2025

Voucher

Date Voucher Due

Number

(MM/DD/YYYY)

1 6/20/2024

2 8/20/2024

3 11/20/2024

4 2/20/2025

5 7/15/2025

Period: Quarterly Filer

Year Ending: 3/2025

Voucher

Date Voucher Due

Number

(MM/DD/YYYY)

1 7/22/2024

2 9/20/2024

3 12/20/2024

4 3/20/2025

5 8/15/2025

Period: Quarterly Filer

Year Ending: 4/2025

Voucher

Date Voucher Due

Number

(MM/DD/YYYY)

1 8/20/2024

2 10/21/2024

3 1/21/2025

4 4/22/2025

5 09/15/2025

|

Enlarge image |

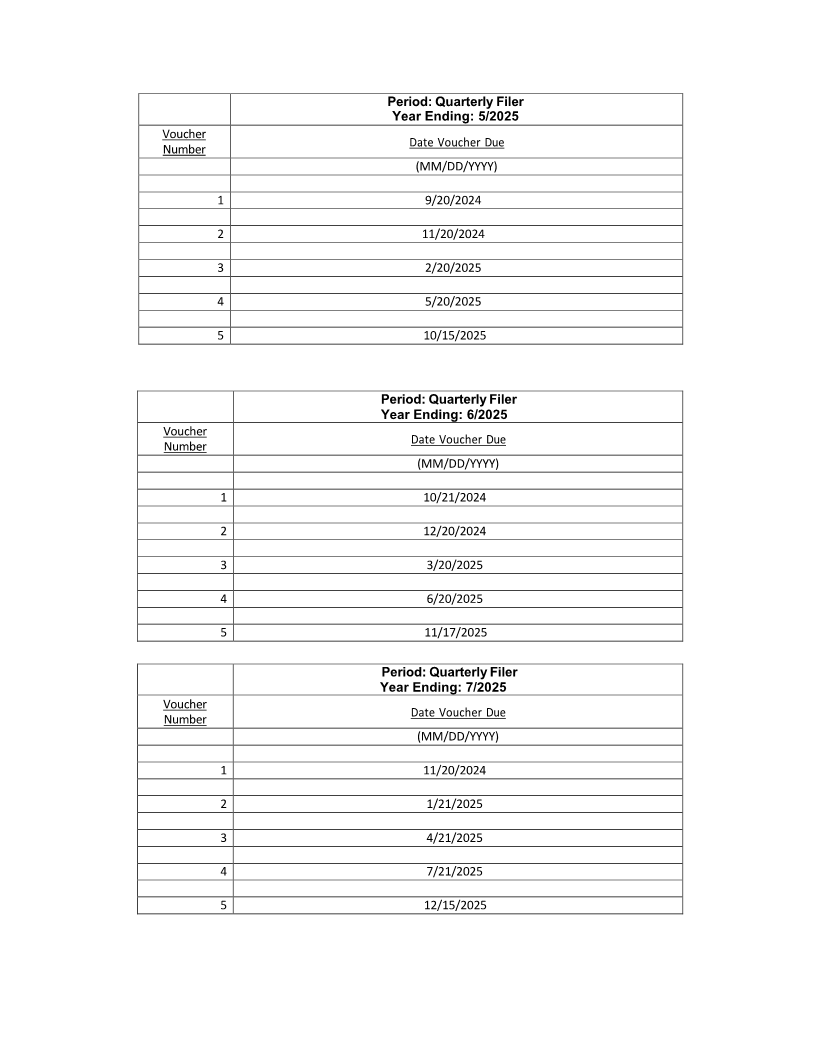

Period: Quarterly Filer

Year Ending: 5/2025

Voucher

Date Voucher Due

Number

(MM/DD/YYYY)

1 9/20/2024

2 11/20/2024

3 2/20/2025

4 5/20/2025

5 10/15/2025

Period: Quarterly Filer

Year Ending: 6/2025

Voucher

Date Voucher Due

Number

(MM/DD/YYYY)

1 10/21/2024

2 12/20/2024

3 3/20/2025

4 6/20/2025

5 11/17/2025

Period: Quarterly Filer

Year Ending: 7/2025

Voucher

Date Voucher Due

Number

(MM/DD/YYYY)

1 11/20/2024

2 1/21/2025

3 4/21/2025

4 7/21/2025

5 12/15/2025

|

Enlarge image |

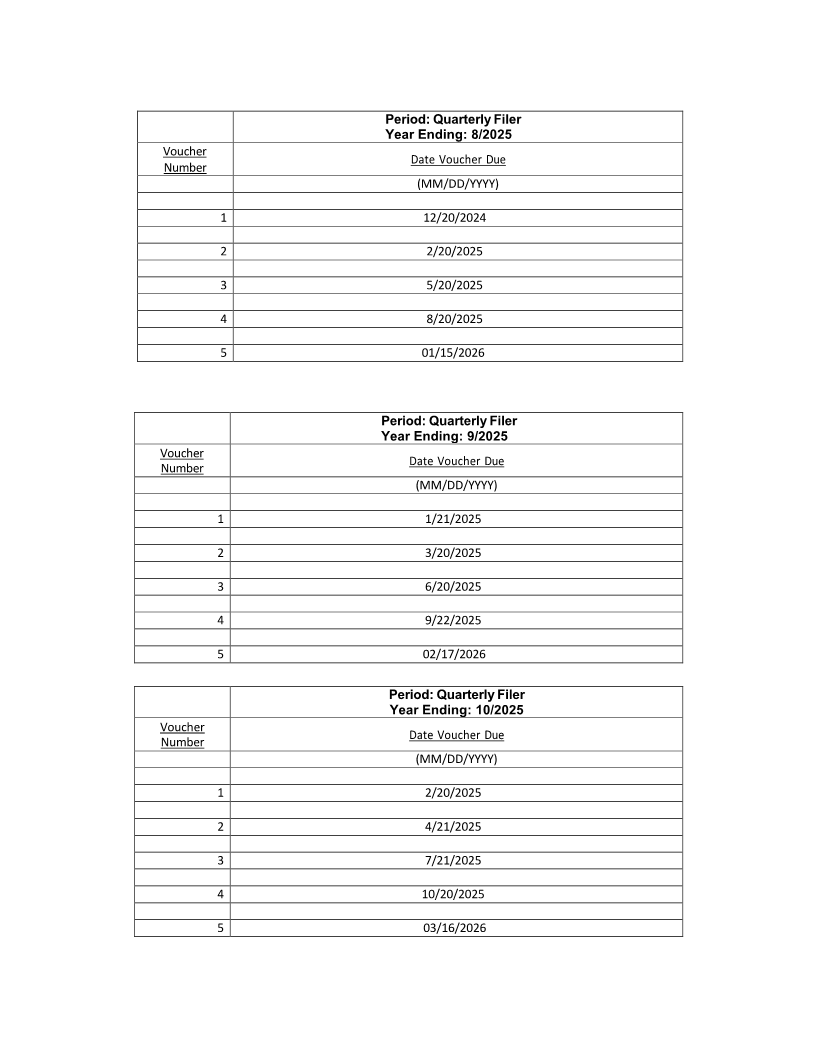

Period: Quarterly Filer

Year Ending: 8/2025

Voucher

Date Voucher Due

Number

(MM/DD/YYYY)

1 12/20/2024

2 2/20/2025

3 5/20/2025

4 8/20/2025

5 01/15/2026

Period: Quarterly Filer

Year Ending: 9/2025

Voucher

Date Voucher Due

Number

(MM/DD/YYYY)

1 1/21/2025

2 3/20/2025

3 6/20/2025

4 9/22/2025

5 02/17/2026

Period: Quarterly Filer

Year Ending: 10/2025

Voucher

Date Voucher Due

Number

(MM/DD/YYYY)

1 2/20/2025

2 4/21/2025

3 7/21/2025

4 10/20/2025

5 03/16/2026

|

Enlarge image |

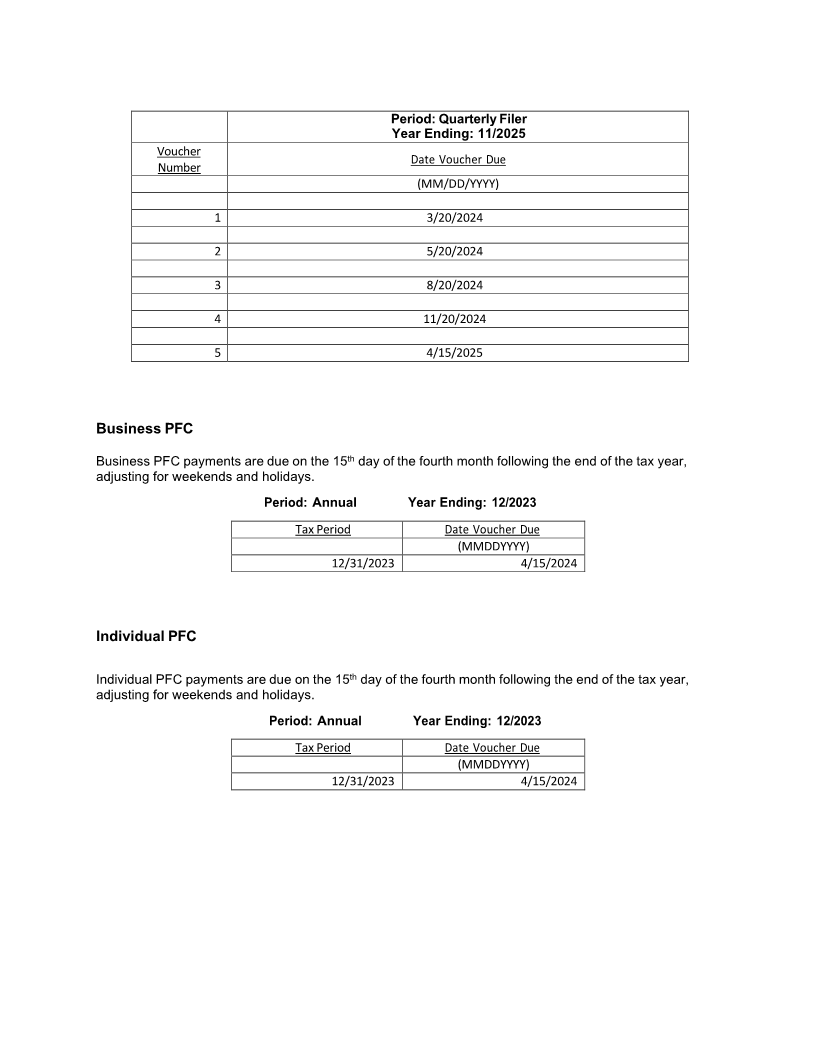

Period: Quarterly Filer

Year Ending: 11/2025

Voucher

Date Voucher Due

Number

(MM/DD/YYYY)

1 3/20/2024

2 5/20/2024

3 8/20/2024

4 11/20/2024

5 4/15/2025

Business PFC

Business PFC payments are due on the 15thday of the fourth month following the end of the tax year,

adjusting for weekends and holidays.

Period: Annual Year Ending: 12/2023

Tax Period Date Voucher Due

(MMDDYYYY)

12/31/2023 4/15/2024

Individual PFC

Individual PFC payments are due on the 15thday of the fourth month following the end of the tax year,

adjusting for weekends and holidays.

Period: Annual Year Ending: 12/2023

Tax Period Date Voucher Due

(MMDDYYYY)

12/31/2023 4/15/2024

|