Enlarge image

Legislative Synopsis 2023 Last revised: July 2023 Indiana Department of Revenue

Enlarge image | Legislative Synopsis 2023 Last revised: July 2023 Indiana Department of Revenue |

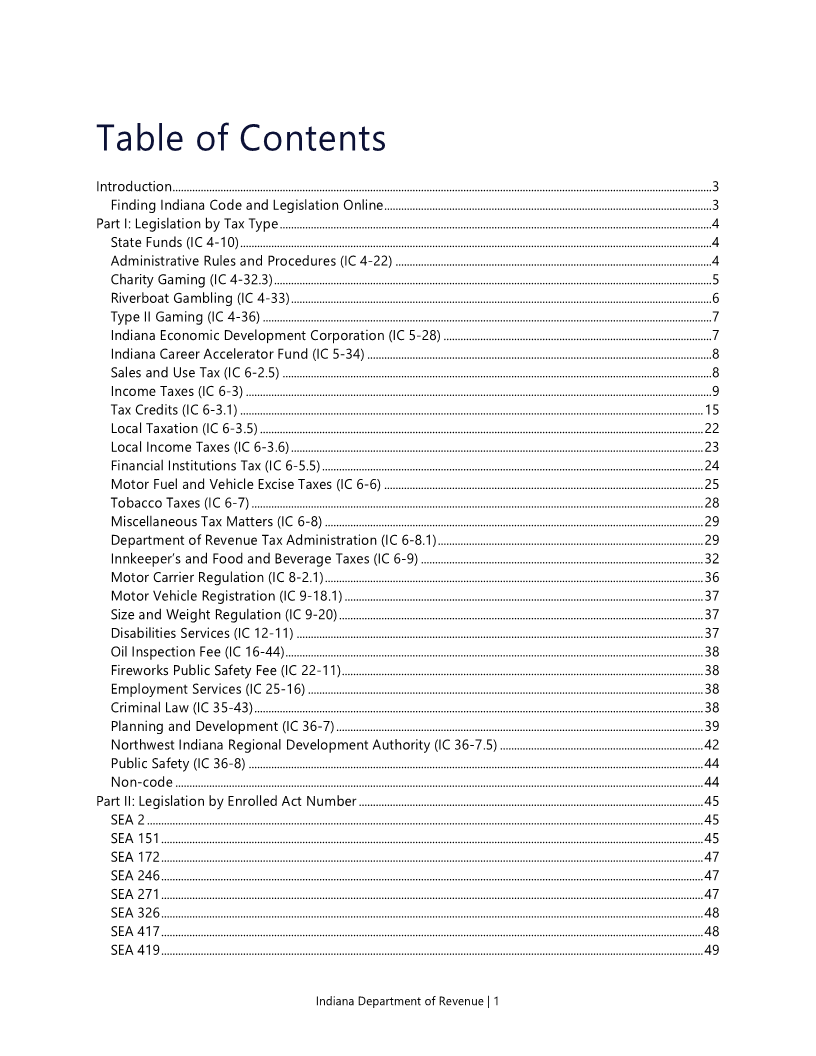

Enlarge image | Table of Contents Introduction............................................................................................................................................................................................... 3 Finding Indiana Code and Legislation Online .................................................................................................................... 3 Part I: Legislation by Tax Type ......................................................................................................................................................... 4 State Funds (IC 4-10) ....................................................................................................................................................................... 4 Administrative Rules and Procedures (IC 4-22) ................................................................................................................ 4 Charity Gaming (IC 4-32.3) ........................................................................................................................................................... 5 Riverboat Gambling (IC 4-33) ..................................................................................................................................................... 6 Type II Gaming (IC 4-36) ............................................................................................................................................................... 7 Indiana Economic Development Corporation (IC 5-28) ............................................................................................... 7 Indiana Career Accelerator Fund (IC 5-34) .......................................................................................................................... 8 Sales and Use Tax (IC 6-2.5) ........................................................................................................................................................ 8 Income Taxes (IC 6-3) ..................................................................................................................................................................... 9 Tax Credits (IC 6-3.1) .................................................................................................................................................................... 15 Local Taxation (IC 6-3.5) ............................................................................................................................................................. 22 Local Income Taxes (IC 6-3.6) .................................................................................................................................................. 23 Financial Institutions Tax (IC 6-5.5) ....................................................................................................................................... 24 Motor Fuel and Vehicle Excise Taxes (IC 6-6) ................................................................................................................. 25 Tobacco Taxes (IC 6-7) ................................................................................................................................................................ 28 Miscellaneous Tax Matters (IC 6-8) ...................................................................................................................................... 29 Department of Revenue Tax Administration (IC 6-8.1) .............................................................................................. 29 Innkeeper’s and Food and Beverage Taxes (IC 6-9) .................................................................................................... 32 Motor Carrier Regulation (IC 8-2.1) ...................................................................................................................................... 36 Motor Vehicle Registration (IC 9-18.1) ............................................................................................................................... 37 Size and Weight Regulation (IC 9-20) ................................................................................................................................. 37 Disabilities Services (IC 12-11) ................................................................................................................................................ 37 Oil Inspection Fee (IC 16-44).................................................................................................................................................... 38 Fireworks Public Safety Fee (IC 22-11)................................................................................................................................ 38 Employment Services (IC 25-16) ............................................................................................................................................ 38 Criminal Law (IC 35-43) ............................................................................................................................................................... 38 Planning and Development (IC 36-7) .................................................................................................................................. 39 Northwest Indiana Regional Development Authority (IC 36-7.5) ........................................................................ 42 Public Safety (IC 36-8) ................................................................................................................................................................. 44 Non-code ........................................................................................................................................................................................... 44 Part II: Legislation by Enrolled Act Number .......................................................................................................................... 45 SEA 2 ..................................................................................................................................................................................................... 45 SEA 151 ................................................................................................................................................................................................ 45 SEA 172 ................................................................................................................................................................................................ 47 SEA 246 ................................................................................................................................................................................................ 47 SEA 271 ................................................................................................................................................................................................ 47 SEA 326 ................................................................................................................................................................................................ 48 SEA 417 ................................................................................................................................................................................................ 48 SEA 419 ................................................................................................................................................................................................ 49 Indiana Department of Revenue | 1 |

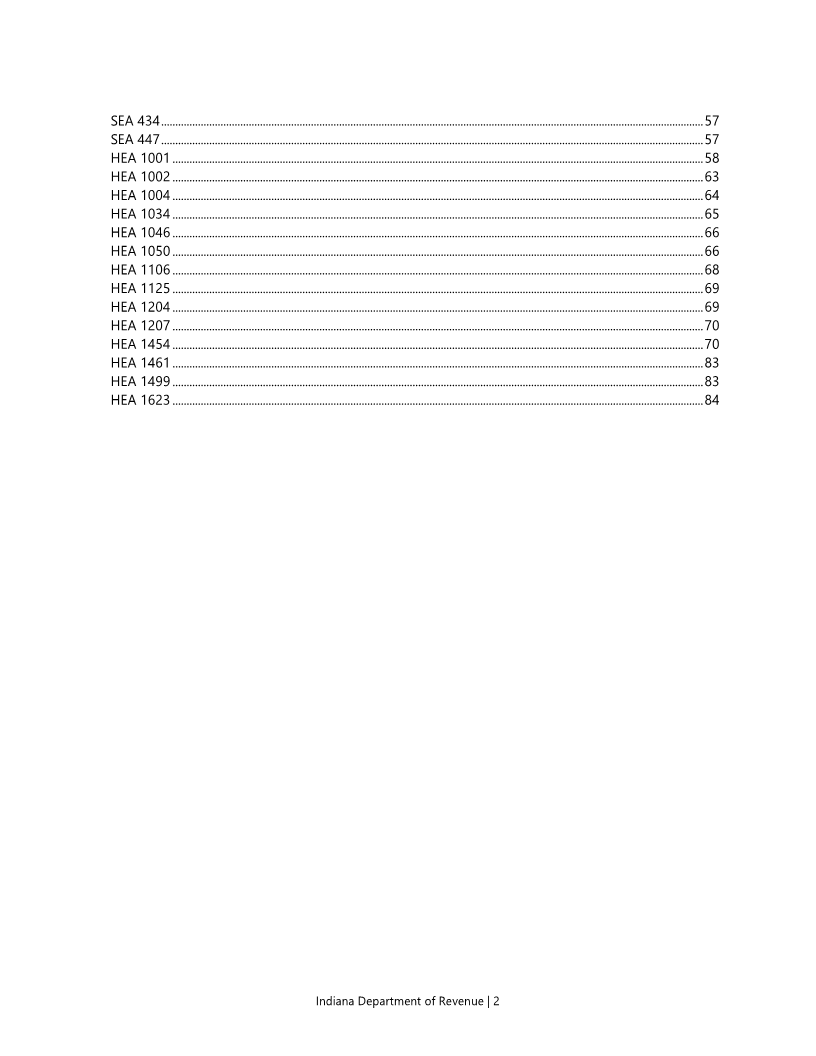

Enlarge image | SEA 434 ................................................................................................................................................................................................ 57 SEA 447 ................................................................................................................................................................................................ 57 HEA 1001 ............................................................................................................................................................................................ 58 HEA 1002 ............................................................................................................................................................................................ 63 HEA 1004 ............................................................................................................................................................................................ 64 HEA 1034 ............................................................................................................................................................................................ 65 HEA 1046 ............................................................................................................................................................................................ 66 HEA 1050 ............................................................................................................................................................................................ 66 HEA 1106 ............................................................................................................................................................................................ 68 HEA 1125 ............................................................................................................................................................................................ 69 HEA 1204 ............................................................................................................................................................................................ 69 HEA 1207 ............................................................................................................................................................................................ 70 HEA 1454 ............................................................................................................................................................................................ 70 HEA 1461 ............................................................................................................................................................................................ 83 HEA 1499 ............................................................................................................................................................................................ 83 HEA 1623 ............................................................................................................................................................................................ 84 Indiana Department of Revenue | 2 |

Enlarge image |

Introduction

The Legislative Synopsis contains a list of legislation passed by the 2023 Indiana General Assembly

affecting the Indiana Department of Revenue (DOR).

DOR’s synopsis has been divided into two parts with each presenting the same information but

organized differently. The first part is organized by tax type and the second by bill number.

For each legislative change, the synopsis includes the heading (the relevant tax type in the first part;

the Enrolled Act number in the second part), short Summary, Effective Date, affected Indiana Code

cites and section of the bill where the language appears.

Finding Indiana Code and Legislation Online

To find laws contained in Indiana Code, acquire more information about recently passed legislation,

or to read the bills in their entirety, visit the Indiana General Assembly’s website.

Indiana Code is arranged by Title, Article, Chapter and Section. Follow the steps below to find

information contained in Indiana Code on the Indiana General Assembly’s website:

• At the top of the webpage, click “Laws” and then click “Indiana Code.” Every Title of the

Indiana Code appears on this page.

• Click the Title you want to review.

• Next, choose the Article you want to review. All the Chapters in the Article are listed on the

left side of the page.

• Click the Chapter you want to review. All Sections of the Chapter will appear, including the

Section of the Indiana Code you want to examine.

To view the bill containing the specific language, follow these steps:

1. Click the “Legislation” link on the top of the Indiana General Assembly’s webpage.

2. From there, click “Bills” and scroll to the bill number you want. Bills which failed to pass will

be displayed in a gray font.

3. When you find the bill, click “Latest Version” to pull up the most recent version of the bill

which, if passed, will be titled as an Enrolled Act.

4. Click “Download” to open a PDF of the bill to find the relevant piece of legislation by looking

for its SECTION number.

Disclaimer

Legislative synopses are intended to provide nontechnical assistance to the general public. Every

attempt is made to provide information that is consistent with the appropriate Enrolled Acts. Any

information or guidance not consistent with the appropriate Enrolled Acts is not binding on the

department. The information provided herein should serve only as a foundation for further

investigation and study of the current law and procedures related to the subject matter covered

herein. This document does not meet the definition of a “statement” required to be published in the

Indiana Register under IC 4-22-2-7.

Indiana Department of Revenue | 3

|

Enlarge image |

Part I: Legislation by Tax Type

State Funds (IC 4-10)

Code: IC 4-10-22-3

Enrolled Act: HEA 1001, Sec. 66

Effective Date: July 1, 2023

• Precludes the possibility of an automatic taxpayer refund being declared in 2025.

Administrative Rules and Procedures (IC 4-22)

Code: IC 4-22-2-17

Enrolled Act: HEA 1623, Sec. 11

Effective Date: July 1, 2023

• Requires agencies to webcast public hearings and allow remote comments.

Code: IC 4-22-2-22.7

Enrolled Act: HEA 1623, Sec. 18

Effective Date: July 1, 2023

• Requires an agency to conduct a regulatory analysis for any proposed rule.

• Provides standards for the regulatory analysis and what information the analysis must contain.

Code: IC 4-22-2-22.8

Enrolled Act: HEA 1623, Sec. 19

Effective Date: July 1, 2023

• Requires an agency to submit a request to the budget agency and the Office of Management

and Budget to authorize commencement of the public comment period.

Code: IC 4-22-2-23

Enrolled Act: HEA 1623, Sec. 20

Effective Date: July 1, 2023

• Requires an agency to provide notice in the Indiana Register of the first public comment

period and detailing the information to be submitted to the publisher of the Indiana Register.

Code: IC 4-22-2-26

Enrolled Act: HEA 1623, Sec. 24

Effective Date: July 1, 2023

• Requires an agency convening a public hearing to include an option for remote attendance.

Indiana Department of Revenue | 4

|

Enlarge image |

Code: IC 4-22-2-26

Enrolled Act: HEA 1623, Sec. 25

Effective Date: July 1, 2023

• Requires those who adopt a rule to fully consider comments received by the agency during

each public comment period and comments received at public hearings.

Code: IC 4-22-2-27.5

Enrolled Act: HEA 1623, Sec. 26

Effective Date: July 1, 2023

• Requires an agency to submit a summary of the comments received and the responses given

by the agency during each public comment period and public hearing to the attorney

general, the governor, and the publisher.

• Directs the publisher to publish the summaries with the final adopted and approved rule.

Code: IC 4-22-2-37.2

Enrolled Act: HEA 1623, Sec. 34

Effective Date: July 1, 2023

• Establishes the process for implementing interim rules that are accepted for filing by the

Indiana Register after June 30, 2023.

Code: IC 4-22-2.3

Enrolled Act: HEA 1623, Sec. 43

Effective Date: July 1, 2023

• Establishes the expiration dates for rules adopted under IC 4-22-2-37.1.

Code: IC 4-22-2.6

Enrolled Act: HEA 1623, Sec. 45

Effective Date: July 1, 2023

• Establishes new rules for the expiration and readoption of administrative rules.

• Reduces the time in which rules need to be readopted to remain effective from seven to five years.

• Sets out the readoption rulemaking actions that must be undertaken to readopt the agency’s rules.

Charity Gaming (IC 4-32.3)

Code: IC 4-32.3-2-25.5

Enrolled Act: SEA 447, Sec. 1

Effective Date: July 1, 2023

• Defines the term "professional sports team foundation" for purposes of the charity gaming law.

Indiana Department of Revenue | 5

|

Enlarge image |

Code: IC 4-32.3-2-31

Enrolled Act: SEA 447, Sec. 2

Effective Date: July 1, 2023

• Specifies that a professional sports team foundation is a qualified organization.

Code: IC 4-32.3-4-3

Enrolled Act: SEA 447, Sec. 3

Effective Date: July 1, 2023

• Specifies that qualified organizations may conduct unlicensed, allowable events at facilities

leased or owned by the capital improvement board of managers of Marion County CIB.

(Current law allows qualified organizations to conduct charity gaming events without a

license if the value of all prizes awarded is less than $2,500 for a single event and $7,500 for

all unlicensed events conducted during a calendar year.)

Code: IC 4-32.3-5-16

Enrolled Act: SEA 172, Sec. 1

Effective Date: July 1, 2023

• Increases the maximum price of a charity gaming ticket for a pull tab, punchboard, or tip

board game from $1 to $5.

Code: IC 4-32.3-5-23

Enrolled Act: SEA 447, Sec. 4

Effective Date: July 1, 2023

• Authorizes payment by credit card for a chance to enter a raffle or water race at an allowable

event conducted by a qualified organization or at a facility leased or owned by the CIB.

Riverboat Gambling (IC 4-33)

Code: IC 4-33-13-2.5

Enrolled Act: HEA 434, Sec. 1

Effective Date: July 1, 2023

• Changes the distribution of revenue remitted by an inland Gary casino after June 30, 2025.

New funds in which this revenue shall be deposited include the city of Gary in the blighted

property demolition fund, the Lake County economic development and convention fund and

the Gary Metro Center station revitalization fund.

• Requires the northwest Indiana regional development authority to provide DOR with any

information that is necessary for DOR to carry out this distribution.

Indiana Department of Revenue | 6

|

Enlarge image |

Code: IC 6-9-2-1.5

Enrolled Act: HEA 434, Sec. 4

Effective Date: July 1, 2023

• Authorizes Lake County to increase its County Innkeeper’s tax by up to 5%.

• Directs that the amounts received from the rate increase adopted shall be deposited in the

Lake County convention and event center reserve fund established by IC 36-7.5-7-10.

Type II Gaming (IC 4-36)

Code: IC 4-36-5-5

Enrolled Act: SEA 172, Sec. 2

Effective Date: July 1, 2023

• Increases the maximum selling price for one ticket for type II gaming from $1 to $5.

Code: IC 4-36-5-6

Enrolled Act: SEA 172, Sec. 3

Effective Date: July 1, 2023

• Requires that for type II gaming in which tickets are sold for at least $1 but not more than $5,

the payout must be at least 75% and not more than 100% of the amount wagered.

Indiana Economic Development Corporation (IC 5-28)

Code: IC 5-28-2-1.5

Enrolled Act: HEA 1106, Sec. 1

Effective Date: January 1, 2023 (Retroactive)

• Adds the Mine Reclamation Tax Credit to the definition of “applicable tax credit” for purposes

of the $250 million aggregate limit of applicable tax credits that the Indiana Economic

Development Corporation may award for a state fiscal year.

Code: IC 5-28-6-9

Enrolled Act: HEA 1001, Sec. 85

Effective Date: July 1, 2023

• Reduces the aggregate amount of applicable tax credits in IC 5-28-2-1.5 that the corporation

may certify for a state fiscal year for all taxpayers to $250 million from $300 million.

Indiana Department of Revenue | 7

|

Enlarge image |

Indiana Career Accelerator Fund (IC 5-34)

Code: IC 5-34-1-7

Enrolled Act: HEA 1002, Sec. 6

Effective Date: July 1, 2023

• Changes the requirements for certification of a qualified education program for INvestED

Indiana.

• Allows an individual to earn a credential in no more than two years instead of six months,

and for graduates to earn an average wage that is at least 150% of the statewide per capita

income within two years of graduation instead of the previous 200%.

Sales and Use Tax (IC 6-2.5)

Code: IC 6-2.5-5-2

Enrolled Act: SEA 419, Sec. 1

Effective Date: July 1, 2023

• Expands the sales tax exemption for agricultural machinery, tools, or equipment (the

property) to a full exemption if the property is predominately used for agricultural

production.

• To qualify for this full exemption, the property must be included on a business personal

property tax return.

• The preexisting prorated sales tax exemption remains for property used for agricultural

production, but not predominately used for agricultural production.

Code: IC 6-2.5-5-8.5

Enrolled Act: SEA 419, Sec. 2

Effective Date: Upon passage

• Clarifies that the sales tax exemption for the provision, installation, or construction of

tangible personal property by a public utility in furtherance of providing utility services

applies to all such tangible personal property and not just the utility services utilized in such

transactions.

Code: IC 6-2.5-10-1

Enrolled Act: HEA 1001, Sec. 93

Effective Date: July 1, 2023

• Changes the distribution of collections from the gasoline use tax beginning in fiscal year

2024, reducing to zero distribution to the general fund and increasing to 64.285%

distribution to the state highway fund.

Indiana Department of Revenue | 8

|

Enlarge image |

Code: IC 6-2.5-5-10.7

Enrolled Act: SEA 419, Sec. 3

Effective Date: July 1, 2023

• Creates an exemption for solar and wind energy systems with an originally rated nameplate

production capacity of at least two megawatts.

• Partially codifies a department legal interpretation of the manufacturing exemption as it

applies to such systems.

Code: IC 6-2.5-5-26

Enrolled Act: SEA 417, Sec. 1

Effective Date: July 1, 2023

• Amends the statute providing an exemption for sales by a nonprofit.

• Changes the $20,000 annual threshold to $100,000 in the current or previous calendar year.

• Excepts churches, monasteries, convents, schools that are a part of the Indiana public school

system, and parochial schools regularly maintained by a recognized religious denomination

from the requirement to collect sales tax, regardless of the dollar amount of sales in a year.

• Further provides that a nonprofit that is not one of the excepted types of nonprofits that

reaches the $100,000 threshold must remain registered and collect sales tax on an ongoing

basis and each year thereafter until the nonprofit makes less than the threshold for two

consecutive years.

Income Taxes (IC 6-3)

Code: IC 6-3; IC 6-5.5; IC 6-8.1; non-code

Enrolled Act: SEA 2

Effective Date:Generally, January 1, 2022 (Retroactive); some sections effective as of other dates

• Authorizes, retroactive to 2022, certain pass-through entities to make an election to pay tax

at the entity level based on each owner's aggregate share of adjusted gross income.

• Provides a refundable tax credit equal to the amount of tax paid by the electing entity with

regard to the owner's share.

• Adds a modification for fiduciaries to add back state income taxes and defines adjusted gross

income for pass through entity tax and nonresident withholding purposes for 2023 and later.

• Allows, retroactive to 2019, a credit for pass-through entity taxes that are imposed by and

paid to another state.

• Makes conforming changes to nonresident withholding taxes to permit withholding taxes for

nonresidents to be reduced by their share of pass-through entity tax.

• Makes conforming changes to partnership audit rules and eliminates the election to be taxed

at the partnership level under the partnership audit regime.

• Makes certain changes to provisions that apply to taxpayers who file a combined return for

the financial institutions tax.

• Provides a statute of limitations safe harbor for nonresident individuals who are subject to

composite tax to not file an individual tax return.

For details regarding SEA 2, please see the Pass Through Entity Tax page on DOR’s website.

Indiana Department of Revenue | 9

|

Enlarge image |

Code: IC 6-3-1-3.5

Enrolled Act: SEA 419, Sec. 7

Effective Date: January 1, 2023 (Retroactive)

• Clarifies the acquisition date for applying the addback for federally tax-exempt state and

local bond interest.

• Decouples from the federal rule in IRC Section 174 requiring taxpayers to amortize the

deduction of qualified research expenditures over a five-year period.

• Allows the complete expenditure to be deducted in the year in which it was incurred.

• Provides direction for calculating the amount of the deduction in IC 6-3-2-29.

• Exempts from Indiana income tax the amount of a federal, state, or local grant received or

discharged indebtedness for providing or expanding broadband service in the state.

• Clarifies the inclusion of adjusted gross income and related modifications for tax-exempt entities.

• Clarifies the application of modifications for estates, trusts, corporations that deduct

dividends, and in the case of certain net operating losses.

Code: IC 6-3-1-3.5

Enrolled Act: HEA 1001, Sec. 94

Effective Date: January 1, 2023 (Retroactive)

• Increases the dependent exemption from $1,500 to $3,000 for the first taxable year in which

a particular exemption is allowed under Section 151(c)(1)(B) of the Internal Revenue Code (as

effective January 1, 2004).

Code: IC 6-3-1-3.5

Enrolled Act: HEA 1002, Sec. 7

Effective Date: July 1, 2023

• Provides an income tax deduction for Career Scholarship Account program grants received

and used towards qualified expenses under IC 20-51.4.

Code: IC 6-3-1-3.5

Enrolled Act: HEA 1454, Sec. 63

Effective Date: January 1, 2022 (retroactive)

• Clarifies the definition of adjusted gross income for pass-through entity tax and tax

withholding purposes and clarifies the adjusted gross income for trusts and estates to reflect

distributions subject to tax for state and federal income tax for beneficiaries.

Code: IC 6-3-1-11

Enrolled Act: SEA 419, Sec. 8

Effective Date: January 1, 2023 (Retroactive)

• Updates Indiana Code definition of the federal Internal Revenue Code (IRC) to that in effect

on January 1, 2023.

Indiana Department of Revenue | 10

|

Enlarge image |

Code: IC 6-3-1-34

Enrolled Act: HEA 1034, Sec. 1

Effective Date: July 1, 2023

• Exempts all military pay for members of a reserve component of the armed forces of the

United States or the National Guard from the income tax for taxable years beginning in 2023

and thereafter.

o Current law provides an exemption only for the period these members are mobilized

or deployed.

• Exempts military pay earned by members of an active component of the armed forces of the

United States from the individual income tax for taxable years beginning in 2024 and

thereafter.

o Current law provides a maximum income tax deduction of $5,000 for members of an

active component of the armed forces of the United States.

Code: IC 6-3-1-39

Enrolled Act: SEA 419, Sec. 9

Effective Date: January 1, 2023 (Retroactive)

• Provides a new definition of preliminary federal net operating loss.

• Provides that the definition includes federal taxable income if a taxpayer does not have a

federal net operating loss.

• Provides that certain net operating losses included in the definition of separately stated net

operating losses are not included in the definition of preliminary federal net operating loss.

Code: IC 6-3-1-40

Enrolled Act: SEA 419, Sec. 10

Effective Date: January 1, 2023 (Retroactive)

• Provides a new definition of separately stated net operating losses.

• Provides that a separately stated net operating loss is a loss that is determined regardless of

whether a taxpayer has federal taxable income.

Code: IC 6-3-2-1

Enrolled Act: HEA 1001, Sec. 95

Effective Date: January 1, 2024

• Reduces the current 3.15% individual income tax rate in stages.

• The rate becomes:

o 3.05% for 2024

o 3.00% for 2025

o 2.95% for 2026

o 2.90% for 2027 and subsequent years.

Indiana Department of Revenue | 11

|

Enlarge image |

Code: IC 6-3-2.1-4

Enrolled Act: HEA 1454, Sec. 64

Effective Date: January 1, 2022 (retroactive)

• Corrects a reference from “entity owner” to “direct owner.”

• Clarifies treatment for when a pass-through entity elects to be subject to pass through entity

tax and is an owner of another pass-through entity that is passing through pass through

entity tax.

Code: IC 6-3-2-1.9

Enrolled Act: SEA 419, Sec.11

Effective Date:July 1, 2021 (Retroactive)

• Clarifies the definition of federal taxable income for the application of net operating losses

for taxable years ending after June 30, 2021, and beginning before January 1, 2023.

Code: IC 6-3-2-2.5

Enrolled Act: SEA 419, Sec. 12

Effective Date: January 1, 2023 (Retroactive)

• Clarifies application of modifications to net operating losses and disallowance of double

counting of modifications.

• Makes various modifications to Indiana net operating losses to more closely reflect federal

net operating losses.

• Clarifies net operating application for tax-exempt entities.

• Clarifies treatment of net operating losses when certain debt discharges occur.

• This provision only applies to resident individuals, trusts, and estates.

Code: IC 6-3-2-2.6

Enrolled Act: SEA 419, Sec. 13

Effective Date: January 1, 2023 (Retroactive)

• Clarifies application of modifications to net operating losses and disallowance of double

counting of modifications.

• Makes various modifications to Indiana net operating losses to more closely reflect federal

net operating losses.

• Clarifies net operating loss application for tax-exempt entities and S corporations.

• Clarifies treatment of net operating losses when certain debt discharges.

• Clarifies the treatment of net operating loss when certain corporate reorganizations and

ownership changes occur.

• Clarifies the treatment of apportionment and allocation provisions when applied to

discharged debt and corporate ownership changes.

• This provision applies to nonresident individuals, trusts and estates, and corporations.

Indiana Department of Revenue | 12

|

Enlarge image |

Code: IC 6-3-2-2.8

Enrolled Act: SEA 419, Sec. 14

Effective Date: January 1, 2023 (Retroactive)

• Permits organizations offering nonprofit agricultural organization insurance coverage to elect

to be subject to the adjusted gross income tax instead of the insurance premiums tax.

Code: IC 6-3-2-21.7

Enrolled Act: SEA 419, Sec. 15

Effective Date: January 1, 2023 (Retroactive)

• Clarifies the rules regarding claiming the exemption for certain income derived from patents.

• Clarifies that an S corporation is eligible for the exemption.

• Clarifies that in the case of an S corporation, the domicile and employee requirements are

determined at the S corporation level.

• Clarifies that:

1. A taxpayer is not required to claim the exemption in the first year after which the

patent was issued.

2. The years in which the exemption is claimed are not required to be consecutive

taxable years.

3. If a qualified taxpayer claims an exemption on the taxpayer's return for a taxable year,

the taxpayer may not file an amended return to reverse the claimed exemption

unless the correct amount of the claimed exemption would have been zero.

4. If a qualified taxpayer does not claim an exemption on the taxpayer's return for a

taxable year, the taxpayer may not file an amended return to claim an exemption.

5. If a qualified taxpayer files returns claiming an exemption with regard to a particular

qualified patent for more than ten years, the statute of limitations for assessment of

the qualified taxpayer and any entities claiming an exemption through a qualified

taxpayer for taxable years after the tenth taxable year for which the exemption is

claimed for the qualified patent shall not expire with regard to any claimed

exemption.

• Clarifies that for an S corporation, the maximum allowable deduction and ten-year deduction

period is determined at the S corporation level.

Code: IC 6-3-2-27.5

Enrolled Act: SEA 419, Sec. 16

Effective Date: January 1, 2024

• Exempts most non-resident workers from Indiana income tax if they work no more than 30

days in a calendar year in Indiana.

o The exemption does not apply to professional athletes, professional entertainers, or

public figures.

• Provides extensive details regarding the employee eligibility for this exemption and the

requirements on the employer for an employee to receive this exempt treatment.

Indiana Department of Revenue | 13

|

Enlarge image |

Code: IC 6-3-2-28

Enrolled Act: SEA 419, Sec. 17

Effective Date: January 1, 2024

• Provides a qualified individual an income tax deduction for the total amount of qualified

health care sharing expenses paid by the qualified individual during the taxable year.

• Establishes rules by which a taxpayer must claim this deduction.

Code: IC 6-3-2-29

Enrolled Act: SEA 419, Sec. 18

Effective Date: January 1, 2022 (Retroactive)

• Provides direction for computing the amount a taxpayer may deduct under IC 6-3-1-3.5 and

IC 6-5.5-1-2 for qualified research expenditures the taxpayer is required to amortize over a

five-year period for federal tax purposes under IRC Section 174.

Code: IC 6-3-2.1-2

Enrolled Act: SEA 419, Sec. 19

Effective Date: January 1, 2022 (Retroactive)

• Clarifies that an S corporation shareholder that is an IRC section 501(c)(3) corporation not

domiciled in Indiana is considered a nonresident for pass through entity tax purposes.

• Clarifies that bank holding companies that are S corporations are eligible entities for pass

through entity tax purposes.

• Clarifies the definition of resident.

Code: IC 6-3-3-12

Enrolled Act: HEA 1454, Sec. 65

Effective Date: January 1, 2024

• Allows a taxpayer to treat a contribution to a 529 college savings account made after

December 31 as having been made during the preceding taxable year if:

o the contribution is made before the original tax filing deadline, and

o an irrevocable election is made with the Indiana Education Savings Authority.

Code: IC 6-3-3-12.1

Enrolled Act: HEA 1454, Sec. 66

Effective Date: January 1, 2024

• Allows a taxpayer to treat a contribution to a 529A ABLE account made after December 31 as

having been made during the preceding taxable year if:

o the contribution is made before the original tax filing deadline, and

o an irrevocable election is made with the Indiana ABLE Authority.

Indiana Department of Revenue | 14

|

Enlarge image |

Code: IC 6-3-7-3

Enrolled Act: SEA 419, Sec. 21

Effective Date: July 1, 2023

• Directs that all revenues derived from adjusted gross income tax computed from a

partnership that has made an election to be subject to tax directly at the partnership level

under IC 6-3-4.5 shall be deposited in the state general fund.

Tax Credits (IC 6-3.1)

Code: IC 6-3.1-17.1

Enrolled Act: HEA 1454, Sec. 67

Effective Date: January 1, 2024

• Establishes the Historic Rehabilitation Tax Credit effective for tax years beginning after

December 31, 2023.

• Authorizes the Indiana Economic Development Corporation (IEDC) to award a credit to a

qualified taxpayer against the qualified taxpayer's state tax liability in the taxable year in

which the qualified taxpayer completes restoration and preservation of a qualified historic

structure if the total amount of qualified rehabilitation expenditures incurred by the qualified

taxpayer equals $5,000 or more.

• Provides that the amount of the credit is generally 25% of the qualified rehabilitation

expenditures that the qualified taxpayer makes for the restoration and preservation of a

qualified historic structure. Provides that the amount of the credit is 30% of the qualified

rehabilitation expenditures that the qualified taxpayer makes for the restoration and

preservation of a qualified historic structure if the structure is owned by a taxpayer that is

exempt from federal income taxation under Section 501(c)(3) of the Internal Revenue Code

or is not income producing.

• Directs that if the IEDC awards credits, DOR and the Office of Community and Rural Affairs

shall administer the allowance of the credits.

• Allows the credit to be applied to a shareholder, partner, or member of the pass-through

entity if a pass-through entity does not have state income tax liability against which the tax

credit may be applied. The shareholder, partner, or member is entitled to a tax credit equal to

the tax credit determined for the pass-through entity for the taxable year multiplied by the

percentage of the pass-through entity's distributive income to which the shareholder,

partner, or member is entitled.

• Notwithstanding the distributive shares, a pass-through entity and its partners, beneficiaries, or

members may allocate the credit among its partners, beneficiaries, or members of the pass-

through entity as provided by written agreement without regard to their sharing of other tax or

economic attributes. The pass-through entity shall also provide a copy of such agreements, a list

of partners, beneficiaries, or members of the pass-through entity, and their respective shares of

the credit resulting from such agreements in the manner prescribed by DOR.

• Allows credit in excess of a taxpayer’s state tax liability to be carried forward for up to ten years.

• Permits the assignment of a credit. The assignment must be in writing, and both the qualified

taxpayer and assignee shall report the assignment on the qualified taxpayer's and the

assignee's state tax returns for the year in which the assignment is made in the manner

Indiana Department of Revenue | 15

|

Enlarge image |

prescribed by DOR. A qualified taxpayer may not receive value in connection with an

assignment under this section that exceeds the value of the part of the credit assigned.

• Limits the aggregate amount of state tax credits allowed to $10 million for each state fiscal

year beginning after June 30, 2023, and ending before July 1, 2030.

• Includes any credits awarded in the $250 million aggregate amount of applicable tax credits

that the IEDC may certify for a state fiscal year under IC 5-28-6-9.

• Authorizes DOR to adopt rules governing administration of the credit.

Code: IC 6-3.1-21-6

Enrolled Act: HEA 1001, Sec. 100

Effective Date: January 1, 2023 (Retroactive)

• Recouples the Indiana Earned Income Tax Credit (EITC) with the federal EITC as in effect on

January 1, 2023.

Code: IC 6-3.1-30.5-13

Enrolled Act: HEA 1001, Sec. 101

Effective Date: July 1, 2023

• Changes the annual limit of school scholarship tax credit that may be allowed to $18.5

million for any fiscal year beginning after June 30, 2023.

Code: IC 6-3.1-34-18

Enrolled Act: HEA 1001, Sec. 102

Effective Date: July 1, 2023

• Directs that any repayment of the redevelopment tax credit shall be deposited in the general

fund and be counted against the $250 million aggregate amount of available tax credits

under IC 5-28-6-9.

Code: IC 6-3.1-35-2

Enrolled Act: SEA 419, Sec. 22

Effective Date: July 1, 2023

• Changes the start of the five-year period in which the Affordable and Workforce Housing Tax

Credit can be claimed from the taxable year in which any amount of the federal tax credit for

the qualified project is first claimed by a taxpayer to the year a building in the project is

placed into service.

Code: IC 6-3.1-35-3

Enrolled Act: SEA 419, Section 23

Effective Date: July 1, 2023

• Makes changes to the calculation of the Affordable and Workforce Housing Tax Credit.

Indiana Department of Revenue | 16

|

Enlarge image |

Code: IC 6-3.1-35-7

Enrolled Act: SEA 419, Sec. 24

Effective Date: July 1, 2023

• Makes changes to the maximum amount of Affordable and Workforce Housing Tax Credit

allowable for a qualified project.

Code: IC 6-3.1-35.8-1

Enrolled Act: SEA 151, Sec. 1

Effective Date: July 1, 2023

• Defines "qualifying contribution" as a monetary payment made by a person to the insuring

foster youth trust fund established by IC 31-26-4.5-4.

Code: IC 6-3.1-35.8-3

Enrolled Act: SEA 151, Sec. 3

Effective Date: July 1, 2023

• Directs that the Foster Care Donation Tax Credit must be claimed on the annual state tax

return of the contributor in the manner prescribed by DOR.

Code: IC 6-3.1-35.8-4

Enrolled Act: SEA 151, Sec. 4

Effective Date: July 1, 2023

• Eliminates the requirement that a taxpayer wishing to claim the foster care donation tax

credit apply to DOR for approval before making the credit-qualifying contribution.

• Instead, the contributor must file an application with DOR stating the amount of the

contribution or investment that it made that would qualify for a tax credit and proof of

payment of the contribution, the amount sought to be claimed as a credit, and any other

information that DOR determines is necessary to determine whether the business firm or

person is eligible for the credit.

• Requires DOR to notify the applicant no later than 45 days after DOR receives an application

for a tax credit that the applicant has been approved for the tax or denied.

• Requires the Department of Child Services to annually provide DOR a list of each approved

organization before January 1 of each year instead of July 1.

Code: IC 6-3.1-35.8-5

Enrolled Act: SEA 151, Sec. 5

Effective Date: July 1, 2023

• Changes the period for applying the global credit limit from a fiscal year to a calendar year

beginning with calendar year 2024.

• Before 2024, the total amount of tax credits allowed may not exceed $2,000,000 for the

period beginning July 1, 2021, through December 31, 2023.

Indiana Department of Revenue | 17

|

Enlarge image |

Code: IC 6-3.1-35.8-6.1

Enrolled Act: SEA 151, Sec. 6

Effective Date: July 1, 2023

• Requires DOR to provide the following information on DOR’s website:

o the application for the tax credit

o a timeline for receiving the credit; and

o the total amount of credits awarded during the current calendar year.

Code: IC 6-3.1-35.8-8

Enrolled Act: SEA 151, Sec. 7

Effective Date: July 1, 2023

• Extends the duration of the credit through 2027 instead of 2024.

Code: IC 6-3.1-37.2

Enrolled Act: HEA 1106, Sec. 2

Effective Date: January 1, 2023 (Retroactive)

• Provides a Mine Reclamation Tax Credit for a taxpayer that enters into an agreement with the

Indiana Economic Development Corporation for a qualified investment for development of

property located on reclaimed coal mining land.

• Limits the credit to the lesser of the qualified investment made by the taxpayer during the

taxable year multiplied by 30% or $5,000,000.

• Permits a taxpayer to assign any part of the credit to which the taxpayer is entitled to a lessee

of the mine reclamation site. An assignment must be in writing, and both the taxpayer and

the lessee must report the assignment on their state tax returns for the year in which the

assignment is made in the manner prescribed by DOR.

• Limits the amount the taxpayer may receive value in connection with the assignment to the

value of the part of the credit assigned.

• Allows any amount of the credit in excess of the taxpayer’s tax liability to be carried forward

for up to ten taxable years following the taxable year in which the taxpayer is first entitled to

claim the credit.

• Establishes that the credit shall be applied against taxes owed by the taxpayer in the

following order:

1. Against the taxpayer's adjusted gross income tax liability (IC 6-3-1 through IC 6-3-7)

for the taxable year.

2. Against the taxpayer's insurance premiums tax liability (IC 27-1-18-2) for the taxable year.

3. Against the taxpayer's financial institutions tax (IC 6-5.5) for the taxable year.

• Provides that a taxpayer must claim the credit on the taxpayer's annual state tax return or

returns in the manner prescribed by DOR. The taxpayer shall submit to DOR the certification

letter from the Indiana Economic Development Corporation to DOR stating the percentage

of credit allowable and all other necessary information for the calculation of the credit and

whether an expenditure is for a qualified investment.

• Allows the credit to be applied to a shareholder, partner, or member of the pass-through

entity if a pass-through entity does not have state income tax liability against which the tax

credit may be applied. The shareholder, partner, or member is entitled to a tax credit equal to

Indiana Department of Revenue | 18

|

Enlarge image |

the tax credit determined for the pass-through entity for the taxable year multiplied by the

percentage of the pass-through entity's distributive income to which the shareholder,

partner, or member is entitled.

• Notwithstanding the distributive shares, a pass-through entity and its partners, beneficiaries,

or members may allocate the credit among its partners, beneficiaries, or members of the

pass-through entity as provided by written agreement without regard to their sharing of

other tax or economic attributes. Such agreement shall be filed with the Indiana Economic

Development Corporation not later than 15 days after execution. The pass-through entity

shall also provide a copy of such agreements, a list of partners, beneficiaries, or members of

the pass-through entity and their respective shares of the credit resulting from such

agreements in the manner prescribed by DOR.

• Limits the aggregate amount of mine reclamation tax credits to $25,000,000 from January 1,

2023, to December 31, 2027.

Code: IC 6-3.1-38

Enrolled Act: HEA 1004, Sec. 2

Effective Date: January 1, 2024

• Establishes the health reimbursement arrangement credit beginning in tax year 2024.

• Defines "qualified taxpayer" as an employer that is a corporation, a limited liability company,

a partnership, or another entity that has any state tax liability and has adopted a health

reimbursement arrangement (as described in Section 9831(d) of the Internal Revenue Code)

in lieu of a traditional employer provided health insurance plan.

• Allows a qualified taxpayer with less than 50 employees to claim a credit against their state

tax liability for an eligible contribution for up to $400 per covered employee in the first year if

the amount provided toward the health reimbursement arrangement is equal to or greater

than the level of benefits provided in the previous benefit year, or if the amount the

employer contributes toward the health reimbursement arrangement equals the same

amount contributed per covered individual toward the employer provided health insurance

plan during the previous benefit year. The credit under this section decreases to $200 per

covered employee in the second year.

• Limits the amount of total tax credits granted to $10 million in any taxable year.

• Directs DOR to record the time of filing of each return claiming a credit and approve the

claims if they otherwise qualify for a tax credit in the chronological order in which the claims

are filed in the state fiscal year.

• Permits a taxpayer to carry over the amount of a credit that exceeds the qualified taxpayer's

state tax liability for that taxable year to the immediately succeeding taxable years.

• Restricts the credit carryover from being used for any taxable year that begins more than ten

years after the date on which the donation from which the credit results is made.

• Directs the department to adopt rules for implementing the credit.

Indiana Department of Revenue | 19

|

Enlarge image |

Code: IC 6-3.1-38.3

Enrolled Act: HEA 1454, Sec. 68

Effective Date: January 1, 2024

• Establishes the employment of individuals with disability tax credit.

• Allows a credit, except in certain circumstances, to a taxpayer that employs an individual who

is referred to the employer for employment through a vocational rehabilitation services

program for individuals with a disability and was initially hired by the taxpayer after

December 31, 2023. The amount of the credit is based on the wages paid to the particular

employee during the taxable year.

• Requires that the employee must work at least an average of 20 hours per week for the

employer in a similar setting and at a rate that is comparable to other employees of the

taxpayer who perform the same or similar tasks.

• Establishes the amount of the credit based on the attributes of the employer.

• If the taxpayer is a benefit corporation (as defined in IC 23-1.3-2-3); the taxpayer employs no

more than 50 individuals; and the majority of the taxpayer's employees are eligible

individuals the amount of the tax credit is determined according to the following:

o In the first taxable year for which the credit is claimed with respect to wages paid to a

particular employee, 30% of the wages paid to the employee during the taxable year.

o In the second taxable year for which the credit is claimed with respect to wages paid to

a particular employee, 40% of the wages paid to the employee during the taxable year.

o In the third and each subsequent taxable year for which the credit is claimed with

respect to wages paid to a particular employee, 50% of the wages paid to the

employee during the taxable year.

• If the taxpayer does not meet the requirements above and employs 500 or fewer employees,

the amount of the tax credit is determined according to the following:

o In the first taxable year for which the credit is claimed with respect to wages paid to a

particular employee, 20% of the wages paid to the employee during the taxable year.

o In the second taxable year for which the credit is claimed with respect to wages paid to a

particular employee, 30% of the wages paid to the employee during the taxable year.

o In the third and each subsequent taxable year for which the credit is claimed with

respect to wages paid to a particular employee, 40% of the wages paid to the

employee during the taxable year.

• Allows the credit to be applied to a shareholder, partner, or member of the pass-through

entity if a pass-through entity does not have state income tax liability against which the tax

credit may be applied. The shareholder, partner, or member is entitled to a tax credit equal to

the tax credit determined for the pass-through entity for the taxable year multiplied by the

percentage of the pass-through entity's distributive income to which the shareholder,

partner, or member is entitled.

• Allows any amount of the credit in excess of the taxpayer’s tax liability to be carried forward

for up to five taxable years following the taxable year in which the taxpayer is first entitled to

claim the credit.

• Disallows assignment of the credit.

• Expires the credit after December 31, 2028.

Indiana Department of Revenue | 20

|

Enlarge image |

Code: IC 6-3.1-39.5

Enrolled Act: HEA 1001, Sec.103

Effective Date: January 1, 2024

• Allows a credit for qualified childcare expenditures by an employer.

• Limits the maximum amount of the credit to the lesser of 50% of the employer’s qualified

expenditures in the taxable year or $100,000.

• If a pass-through entity does not have state tax liability against which to apply the credit, the

credit flows through on a pro rata basis to the shareholders, partners or beneficiaries.

• Allows credit in excess of a taxpayer’s state tax liability to be carried forward for up to three years.

• Directs that the credit must be claimed in a manner prescribed by DOR.

• Provides a recapture schedule for the credit in the event of a “recapture event.”

• Limits the total amount of the credit allowed to $2.5 million in a fiscal year.

• Directs DOR to record the time of returns filed claiming the credit and award the credit in

chronological order.

• Expires the credit on July 1, 2025.

Code: IC 6-3.1-40

Enrolled Act: HEA 1004, Sec. 3

Effective Date: July 1, 2023

• Establishes the physician practice ownership tax credit beginning in tax year 2024.

• Defines "primary care physician" as a physician practicing in one or more of the following:

o family medicine;

o general pediatric medicine;

o general internal medicine; or

o the general practice of medicine.

• Defines "taxpayer" for purposes of the credit to mean an individual who:

o is a physician practicing as a primary care physician;

o has an ownership interest in a corporation, limited liability company, partnership, or

other legal entity organized to provide primary health care services as a physician

owned entity;

o is not employed by a health system (as defined in IC 16-18-2-168.5); and

o has any state income tax liability.

• Allows a taxpayer to claim a credit if a taxpayer has an ownership interest in a physician-

owned medical practice described in IC 6-3.1-40-5(2) that:

o is established as a legal entity under Indiana law after December 31, 2023;

o opens and begins to provide primary health care services to patients in a particular

taxable year beginning after December 31, 2023; and

o has billed for primary health care services for at least six months of that taxable year.

• Limits the amount of the credit for a particular taxable year to $20,000.

• Allows any amount of the credit in excess of the taxpayer’s tax liability to be carried forward

for up to ten taxable years following the taxable year in which the taxpayer is first entitled to

claim the credit.

• Prohibits the credit from being assigned.

Indiana Department of Revenue | 21

|

Enlarge image |

• Requires a taxpayer to claim the credit on the taxpayer's annual state income tax return in

the manner prescribed by DOR. The taxpayer shall submit all necessary information to DOR

to verify the taxpayer's eligibility for the credit.

• Directs DOR to recapture the credit if DOR determines within five years of a taxpayer's

receipt of a tax credit that the taxpayer has sold, transferred, granted, or otherwise

relinquished the taxpayer's ownership interest in an entity described IC 6-3.1-40-5(2) and is

employed by a health system or another non-physician owned medical practice.

• Directs that any recaptured credit amount be deposited in the general fund.

Code: IC 6-3.1-40.9

Enrolled Act: HEA, Sec. 104

Effective Date: January 1, 2024

• Allows a credit to a taxpayer that makes a contribution to an affordable housing organization

approved by the Indiana Economic Development Corporation.

• Limits the amount of the credit to the lesser of 50% of the qualified contribution or $10,000.

• If a pass-through entity does not have state tax liability against which to apply the credit, the

credit flows through on a pro rata basis to the shareholders, partners, or beneficiaries.

• Allows credit in excess of a taxpayer’s state tax liability to be carried forward for up to five

years.

• Directs that the credit must be claimed in a manner prescribed by DOR.

• Limits the total amount of the credit allowed to $2.5 million in a fiscal year.

o Any amounts carried forward shall first be deducted from the total amount of tax

credits that may be awarded for the succeeding state fiscal year.

• Directs DOR to record the time of returns filed claiming the credit and award the credit in

chronological order.

• Directs DOR to provide the following information on its website:

o the application for the credit provided in this chapter;

o a timeline for receiving the credit provided in this chapter; and

o the total amount of credits awarded during the current state fiscal year.

• Authorizes DOR to adopt rules under IC 4-22-2 to implement this new credit.

• Expires the credit January 1, 2030.

Local Taxation (IC 6-3.5)

Code: IC 6-3.5-4-7.5

Enrolled Act: HEA 1454, Sec. 71

Effective Date: July 1, 2023

• Provides that any county motor vehicle registration surtax for permanent registration of

trailers with a gross declared weight of 3,000 pounds or less does not apply after December

31, 2023.

Indiana Department of Revenue | 22

|

Enlarge image |

Code: IC 6-3.5-10-8.5

Enrolled Act: HEA 1454, Sec. 74

Effective Date: July 1, 2023

• Provides that any municipal motor vehicle registration surtax for permanent registration of

trailers with a gross declared weight of 3,000 pounds or less does not apply after December

31, 2023.

Local Income Taxes (IC 6-3.6)

Code: IC 6-3.6-6-2.9

Enrolled Act: SEA 419, Sec. 2

Effective Date: July 1, 2023

• Authorizes a county to impose a local income tax (LIT) rate in increments of 0.01% up to a

maximum of 0.2% to pay for county staff expenses of the state judicial system in the county.

• Provides that the expenses paid from the LIT revenue may not comprise more than 50% of

the county's total budgeted operational staffing expenses related to the state judicial system

in any given year.

• Requires certain reporting requirements related to the use of the LIT revenue.

Code: IC 6-3.6-3-3

Enrolled Act: HEA 1454, Sec. 75

Effective Date: July 1, 2023

• Establishes that if a county or local income tax (LIT) council does not provide the required

notice to underlying units of a tax rate change, the change does not take effect.

Code: IC 6-3.6-3-7

Enrolled Act: HEA 1454, Sec. 77

Effective Date: July 1, 2023

• Establishes notice requirements for a change in LIT when the county adopting body is the

local income tax council.

o If a county adopting body makes any fiscal decision that has a financial impact to an

underlying local taxing unit, the decision must be made, and notice must be given to

the affected local taxing unit by August 1.

o If a county adopting-body passes an ordinance changing the allocation of local

income tax revenue to a local taxing unit, the county adopting-body must provide

direct notice to the affected local taxing unit within 15 days of the passage of the

ordinance.

o The county adopting-body must provide confirmation to DOR and the Department of

Local Government Finance that direct notice was provided to the affected local taxing

units within 15 days of the passage of the ordinance.

Indiana Department of Revenue | 23

|

Enlarge image |

Code: IC 6-3.6-3-7.5

Enrolled Act: HEA 1454, Sec. 78

Effective Date: July 1, 2023

• Establishes notice requirements for a change in LIT when the county adopting body is the

county council.

o If a county adopting-body makes any fiscal decision that has a financial impact to an

underlying local taxing unit, the decision must be made, and notice must be given to

the affected local taxing unit by August 1.

o If a county adopting-body passes an ordinance changing the allocation of local

income tax revenue to a local taxing unit, the county adopting-body must provide

direct notice to the affected local taxing unit within 15 days of the passage of the

ordinance.

o The county adopting-body must provide confirmation to DOR and the Department of

Local Government Finance that direct notice was provided to the affected local taxing

units within 15 days of the passage of the ordinance.

Code: IC 6-3.6-6-2.7

Enrolled Act: HEA 1454, Sec. 79

Effective Date: July 1, 2023

• Raises the maximum tax rate a county fiscal body may impose for correctional facilities and

rehabilitation facilities from 0.2% to 0.3% in the case of a county with bonds or lease

agreements outstanding on July 1, 2023, backed by revenue from this tax.

• Restricts the amount of revenue that may be used for operating expenses for correctional

facilities and rehabilitation facilities in the county to 0.2% of this tax.

Financial Institutions Tax (IC 6-5.5)

Code: IC 6-5.5-1-2

Enrolled Act: SEA 419, Sec. 25

Effective Date:January 1, 2023 (Retroactive)

• Decouples from the federal rule in IRC Section 174 requiring taxpayers to amortize the

deduction of qualified research expenditures over a five-year period.

• Allows the complete expenditure to be deducted in the year in which it was incurred.

• Provides direction for calculating the amount of the deduction in IC 6-3-2-29.

Code: IC 6-5.5-2-1

Enrolled Act: SEA 419, Sec. 26

Effective Date:January 1, 2023 (Retroactive)

• Clarifies the application of certain debt discharges for net operating loss purposes.

• Clarifies that the application of debt discharges is to be consistent with the application of

regular income for the year of discharge.

Indiana Department of Revenue | 24

|

Enlarge image |

Code: IC 6-5.5-2-7

Enrolled Act: SEA 419, Sec. 27

Effective Date:January 1, 2023 (Retroactive)

• Exempts an organization offering nonprofit agricultural insurance coverage from the financial

institutions tax if it elects to pay the Nonprofit Agricultural Organization Health Coverage

Tax.

Motor Fuel and Vehicle Excise Taxes (IC 6-6)

Code: IC 6-6-1.1-201

Enrolled Act: HEA 1001, Sec. 106

Effective Date: July 1, 2023

• Extends the requirement that DOR calculate the gasoline excise tax through July 1, 2027.

Code: IC 6-6-1.6-3

Enrolled Act: HEA 1001, Sec. 107

Effective Date: July 1, 2023

• Extends the requirement that DOR calculate the fuel tax index factors through July 1, 2027.

Code: IC 6-6-2.5-1

Enrolled Act: HEA 1050, Sec. 2

Effective Date: January 1, 2024

• Adds hydrogen, hythane, electricity, or any other fuel used to propel a motor vehicle on a

highway that is not subject to the special fuel tax or gasoline tax to the definition of

“alternative fuel” for purposes of the special fuel tax.

Code: IC 6-6-2.5-6.5

Enrolled Act: HEA 1454, Sec. 83

Effective Date: July 1, 2023

• Defines "compressed natural gas product fuel station" as a fuel station that purchases special

fuel, converts it into compressed natural gas product, and sells the compressed natural gas

product from a metered pump at the same location.

Code: IC 6-6-2.5-28

Enrolled Act: HEA, Sec. 108

Effective Date: July 1, 2023

• Extends the requirement that DOR calculate special fuel tax rate through July 1, 2027.

Indiana Department of Revenue | 25

|

Enlarge image |

Code: IC 6-6-2.5-30

Enrolled Act: HEA 1454, Sec. 84

Effective Date: July 1, 2023

• Exempts the difference between the amount of special fuel purchased by a compressed

natural gas product fuel station and the amount of compressed natural gas product

produced and sold by the compressed natural gas product fuel station from the special fuel

tax.

• Provides that this exemption shall be applied for through the refund procedures established

in section IC 6-6-2.5-32.7.

Code: IC 6-6-2.5-32

Enrolled Act: HEA 1454, Sec. 85

Effective Date: July 1, 2023

• Clarifies that a refund for special fuel tax collected on compressed natural gas product may

not be claimed under both IC 6-6-2.5-32 and IC 6-6-2.5-32.7 9 for the same special fuel tax.

Code: IC 6-6-2.5-32.7

Enrolled Act: HEA 1454, Sec. 86

Effective Date: July 1, 2023

• Creates a quarterly refund process of special fuel tax for compressed natural gas product fuel

stations on the difference between the amount of special fuel purchased by a station and the

amount of compressed natural gas product produced and sold by the station.

• Requires the station to submit a statement to DOR that lists such information, which is

subject to penalties pertaining to perjury, as well as any information reasonably requested on

a form prescribed by DOR.

o The claim must be filed not later than the end of the third month following the end

of the calendar quarter the compressed natural gas qualified for a special fuel tax

refund.

o No interest may be paid on this refund.

• Allows DOR to make any necessary investigations before refunding the tax.

Code: IC 6-6-2.5-37

Enrolled Act: HEA 1454, Sec. 87

Effective Date: July 1, 2023

• Clarifies that the special fuel tax collection allowance is in addition to any amount refunded

under IC 6-6-2.5-32.7.

Indiana Department of Revenue | 26

|

Enlarge image |

Code: IC 6-6-4.1-2

Enrolled Act: HEA 1050, Sec. 3

Effective Date: January 1, 2024

• Adds qualified motor vehicles that are subject to the tax reporting requirements of the

International Fuel Tax Agreement to the types of vehicles subject to the motor carrier fuel

tax.

Code: IC 6-6-4.1-4

Enrolled Act: HEA 1050, Sec. 4

Effective Date: January 1, 2024

• Adds a new motor carrier fuel tax calculation method for alternative fuels that are not

propane or butane, depending on whether the carrier’s fleet has both gas or special fuel

consuming vehicles in addition to vehicles consuming such types of alternative fuel, or

whether the carrier’s fleet only has vehicles that consume such types of alternative fuel.

• Requires DOR to publish MPG data on its website so the latter types of carriers can calculate

the tax owed.

Code: IC 6-6-4.1-4.8

Enrolled Act: HEA 1050, Sec. 5

Effective Date: July 1, 2023

• Provides that a carrier that is exempt from the quarterly reporting requirements under 6-6-

4.1-10 must continue to file a quarterly return in order to obtain a proportional use credit.

• Provides that a carrier that purchased alternative fuel does not have to pay the taxes ahead

of time in order to claim a proportional use credit.

Code: IC 6-6-4.1-9

Enrolled Act: HEA 1050, Sec. 6

Effective Date: January 1, 2024

• Provides that the rule pertaining to applying a standard mileage rate in cases where the

carrier did not maintain proper recordkeeping does not apply to alternative fuels that are not

propane or butane.

Code: IC 6-6-4.1-10

Enrolled Act: HEA 1050, Sec. 7

Effective Date: July 1, 2023

• Removes the requirement that a carrier must apply for an exemption from filing their

quarterly Motor Carrier Fuel Tax return.

• Replaces this requirement with an automatic exemption qualification for carriers that have

purchased all or substantially all of their fuel in Indiana upon which the carrier paid gasoline

or special fuel tax, and all or substantially all of their mileage was in Indiana.

• Requires carriers to file a quarterly return and pay the Motor Carrier Fuel Tax only on

alternative fuel if all or substantially all of the quarterly mileage of the carrier is the result of

Indiana Department of Revenue | 27

|

Enlarge image |

operations in Indiana, and the motor fuel used for operations during the quarter was

purchased in Indiana, some of which was alternative fuel.

• A carrier that meets the exemption or meets the requirements for alternative fuel previously

mentioned still must keep books and records as required by IC 6-8.1-5.

Code: IC 6-6-4.1-12

Enrolled Act: HEA 1050, Sec. 8

Effective Date: July 1, 2023

• Creates an exemption for carriers that meet the exemption from filing quarterly reports as

provided in IC 6-6-4.1-10 from the requirement to pay the $25 annual fee and to put decals

on their vehicles.

• A carrier that meets the alternative fuel requirements in IC 6-6-4.1-10(c) only has to put

decals on their vehicles that consume alternative fuel.

Code: IC 6-6-5-0.5

Enrolled Act: HEA 1454, Sec. 88

Effective Date: July 1, 2023

• Exempts trailers with a declared gross vehicle weight of 3,000 pounds or less that are

registered or renewed under IC 9-18.1-5-13 from the Motor Vehicle Excise Tax.

Tobacco Taxes (IC 6-7)

Code: IC 6-7-1-17

Enrolled Act: HEA 1001, Sec. 109

Effective Date: July 1, 2023

• Raises the cigarette tax collection allowance from 1.3 to 2.0 cents/package.

Code: IC 6-7-1-28.1

Enrolled Act: HEA 1001, Sec. 110

Effective Date: July 1, 2023

• Changes the distribution of cigarette tax collections.

• Eliminates the distribution to the mental health centers fund.

• Increases the distribution to the general fund from 56.24% to 56.84%.

Code: IC 6-7-2-7

Enrolled Act: HEA 1454, Sec. 91

Effective Date: January 1, 2024

• Caps the 24% tobacco products tax for cigars at $1 per cigar.

Indiana Department of Revenue | 28

|

Enlarge image |

Code: IC 6-7-4-8

Enrolled Act: SEA 419, Sec. 29

Effective Date: July 1, 2023

• Amends the definition of “vapor product” by removing “disposable vapor product devices

that are attached to a closed system cartridge and intended for single use” from the list of

items that fall under this term.

Code: IC 6-7-4-10

Enrolled Act: SEA 419, Sec. 30

Effective Date: July 1, 2023

• Renames the “electronic cigarette retail dealer's certificate” the “open system electronic

cigarette retail dealer's certificate.”

Miscellaneous Tax Matters (IC 6-8)

Code: IC 6-8-15-5

Enrolled Act: SEA 419, Sec. 31

Effective Date:January 1, 2023 (Retroactive)

• Establishes that in order for an organization providing nonprofit agricultural organization

coverage in Indiana to be subject to the adjusted gross income tax instead of the nonprofit

agricultural organization health coverage tax, the organization must:

1. file a notice of election with the insurance commissioner and the commissioner of DOR

on or before November 30 of a taxable year; and

2. state in the notice of election that the organization elects to be subject to the adjusted

gross income for the taxable year.

Department of Revenue Tax Administration (IC 6-8.1)

Code: IC 6-8.1-3-29

Enrolled Act: HEA 1499, Sec. 17

Effective Date: July 1, 2023

• Requires DOR (for tax receipts for adjusted gross income taxes due and owing for a taxable

year beginning after December 31, 2023) to annually provide a taxpayer receipt to an

individual who has an individual INTIME account with DOR and filed a resident individual

income tax return with DOR. The taxpayer receipt shall be posted on the taxpayer's individual

INTIME account.

• Prohibits DOR from providing a taxpayer with a copy of the taxpayer receipt by mail.

• Directs DOR, in consultation with the budget agency, to create and administer a web page on

which individual taxpayers may access an estimate of the allocation of their adjusted gross

income taxes to various expenditure categories for the most recent state fiscal year based on

the adjusted gross income taxes paid by the taxpayer. The web page must contain the

following elements:

Indiana Department of Revenue | 29

|

Enlarge image |

1. The web page must be conveniently and easily accessible.

2. A link to the web page must be prominently displayed on the department’s main

website.

3. The web page must provide an estimate of the allocation of the statewide spending

of adjusted gross income tax revenue broken down under the following categories:

• public education

• higher education

• social services

• infrastructure

• criminal justice

• economic development

• environment and natural resources

• elected officials

• general government

• The estimate must include the amount and the percentage of adjusted gross income tax

revenue allocated to each category and provide an estimate of an individual taxpayer's

contribution based on the individual's input of their adjusted gross income tax payments.

• Requires DOR to include a link to the web page on the Indiana individual income tax return,

Form IT-40.

Code: IC 6-8.1-6-3

Enrolled Act: SEA 419, Sec. 3

Effective Date: July 1, 2023

• Directs DOR to consider a document received after the deadline as on time if the postmark

date is up to three business days (not including a day falling on Saturday, Sunday, a national,

legal holiday recognized by the federal government, or a statewide holiday) after the date of

the deadline.

Code: IC 6-8.1-7-1

Enrolled Act: SEA 419, Sec. 32

Effective Date: Upon passage

• Authorizes DOR to publish a list of persons, corporations, or other entities that qualify for a

sales tax exemption under IC 6-2.5-5-16 (state and local governments), IC 6-2.5-5-25

(nonprofit purchases), or IC 6-2.5-5-26 (nonprofit sales). Information that may be disclosed

includes:

1. any federal identification number or other identification number for the entity

assigned by DOR;

2. any expiration date of an exemption under IC 6-2.5-5-25;

3. whether any sales tax exemption has expired or has been revoked by DOR; and

4. any other information reasonably necessary for a recipient of an exemption certificate

to determine if an exemption certificate is valid.

Indiana Department of Revenue | 30

|

Enlarge image |

Code: IC 6-8.1-9.5-10

Enrolled Act: HEA 1454, Sec. 92

Effective Date: July 1, 2023

• Reduces the collection fee charged to a debtor for any debts collected under DOR’s debt

offset program from 15% to 10%.

Code: IC 6-8.1-10-9.5

Enrolled Act: SEA 419, Sec. 33

Effective Date: January 1, 2024

• Requires that a purchaser or seller notify DOR at least 45 days prior to transferring more than

50% of the tangible personal property of a business.

• Failure to provide such notice will result in the purchaser becoming liable for any tax due

under IC 6-2.5 (retail sales and use tax), or IC 6-9 (county innkeepers and food and beverage

tax), including penalties and interest, of the transferring business up to the amount of the

purchase price or value of the tangible personal property.

• After timely notice, the purchaser remains liable for any of the above taxes that are due from

the seller if DOR mails a summary of such taxes due to the purchaser at least 20 days prior to

the closing date of the transaction.

Code: IC 6-8.1-10-14

Enrolled Act: SEA 419, Sec. 34

Effective Date: July 1, 2023

• Directs how penalties and interest resulting from a listed tax shall be deposited.

• Generally, penalties and interest are deposited in the same place as the underlying tax to

which the penalty and interest are associated. Dishonored payment penalties are deposited