Enlarge image

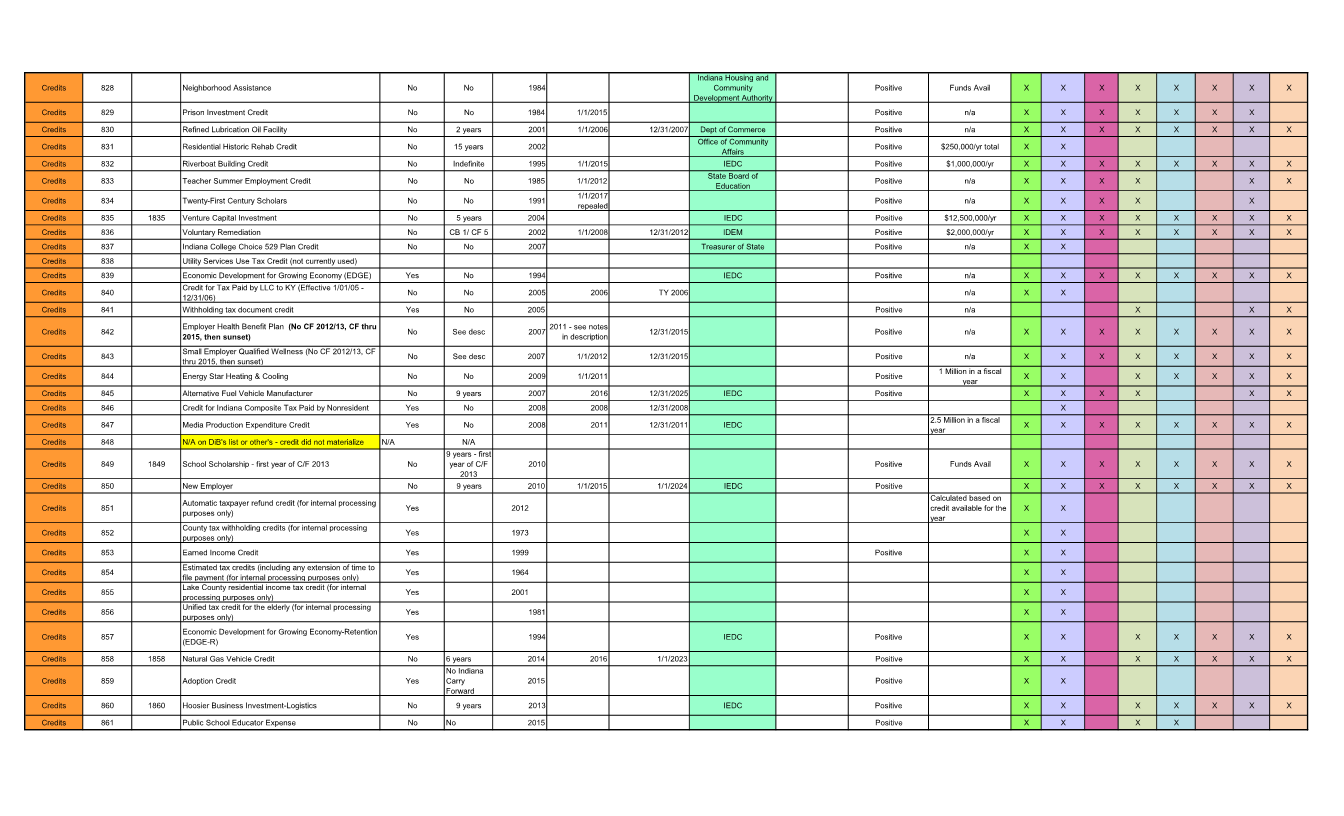

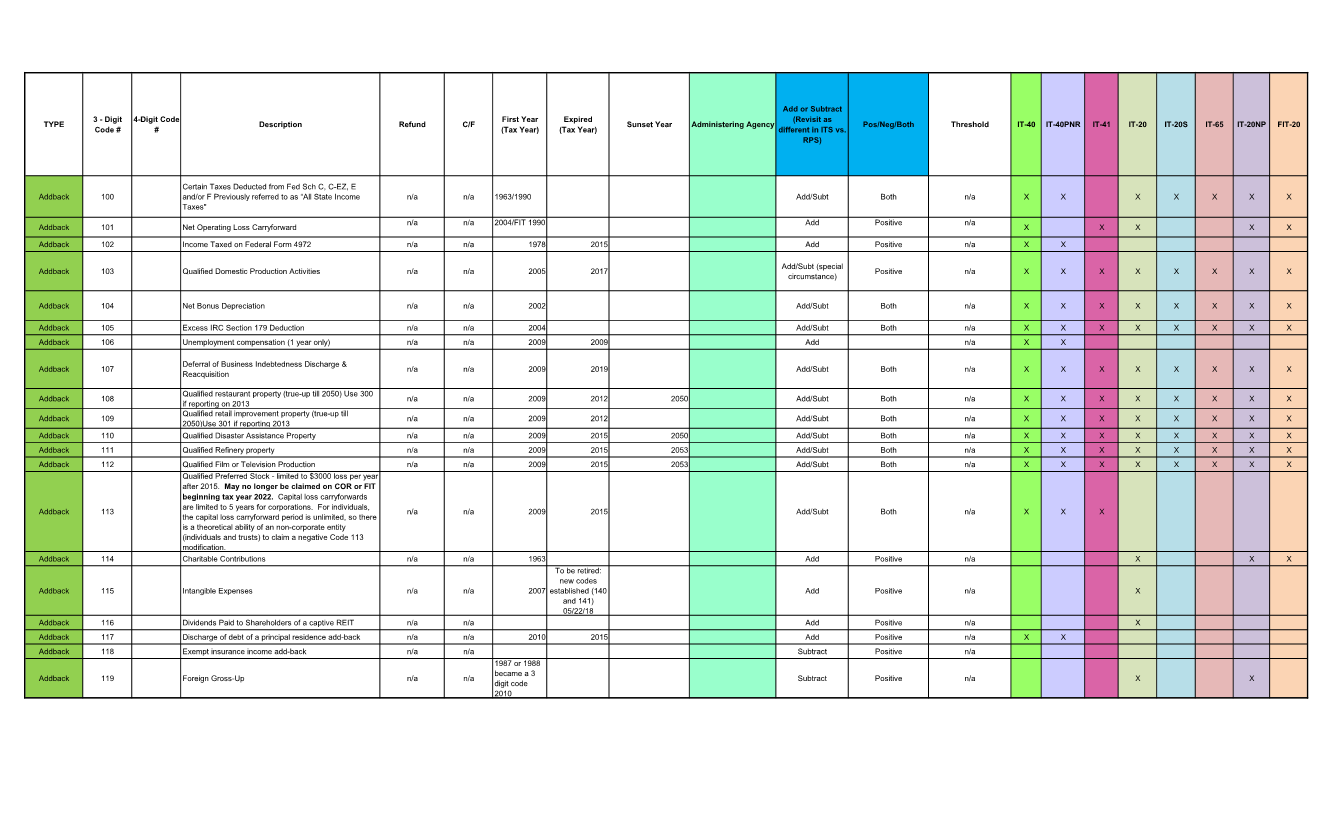

Add or Subtract

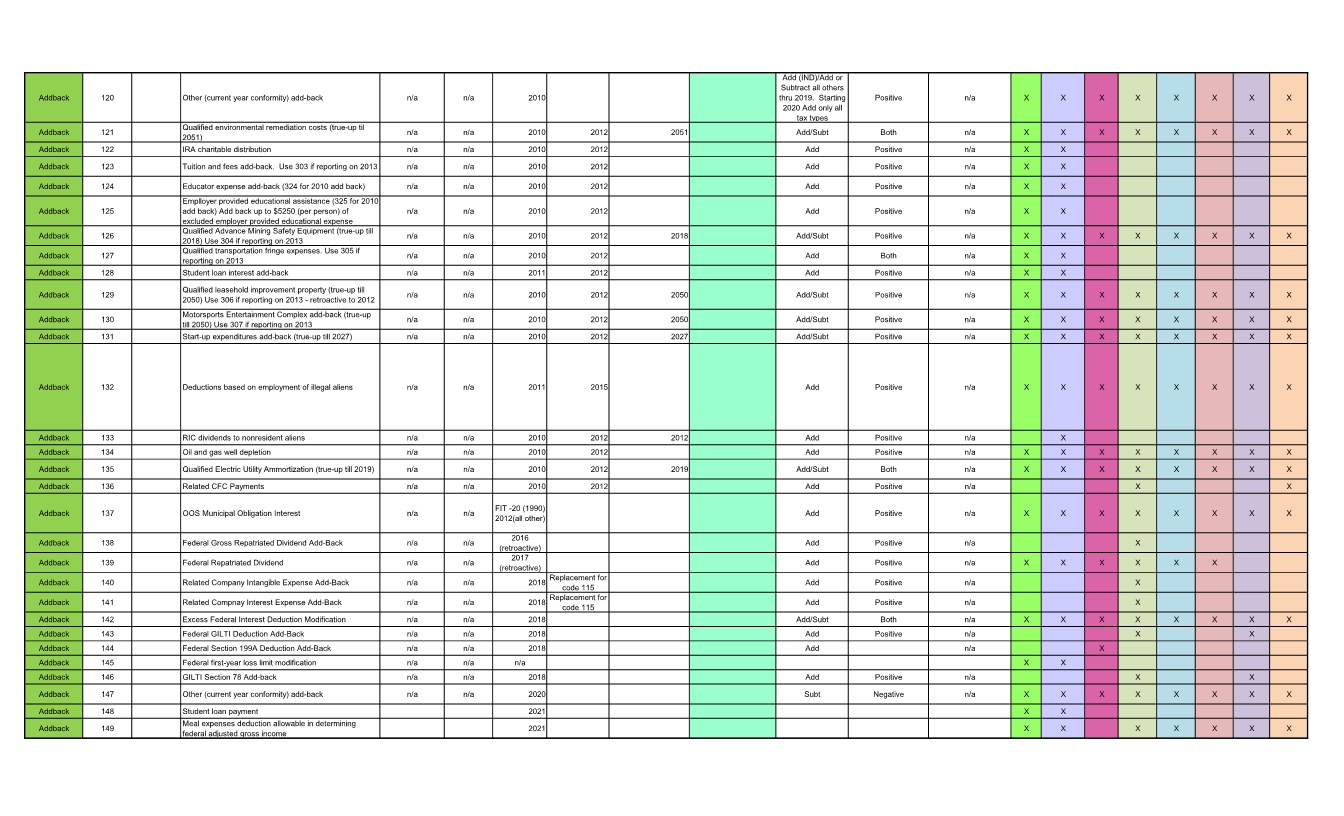

TYPE 3 - Digit 4-Digit Code Description Refund C/F First Year Expired Sunset Year Administering Agency (Revisit as Pos/Neg/Both Threshold IT-40 IT-40PNR IT-41 IT-20 IT-20S IT-65 IT-20NP FIT-20

Code # # (Tax Year) (Tax Year) different in ITS vs.

RPS)

Certain Taxes Deducted from Fed Sch C, C-EZ, E

Addback 100 and/or F Previously referred to as “All State Income n/a n/a 1963/1990 Add/Subt Both n/a X X X X X X X

Taxes"

Addback 101 Net Operating Loss Carryforward n/a n/a 2004/FIT 1990 Add Positive n/a X X X X X

Addback 102 Income Taxed on Federal Form 4972 n/a n/a 1978 2015 Add Positive n/a X X

Addback 103 Qualified Domestic Production Activities n/a n/a 2005 2017 Add/Subt (special Positive n/a X X X X X X X X

circumstance)

Addback 104 Net Bonus Depreciation n/a n/a 2002 Add/Subt Both n/a X X X X X X X X

Addback 105 Excess IRC Section 179 Deduction n/a n/a 2004 Add/Subt Both n/a X X X X X X X X

Addback 106 Unemployment compensation (1 year only) n/a n/a 2009 2009 Add n/a X X

Addback 107 Deferral of Business Indebtedness Discharge & n/a n/a 2009 2019 Add/Subt Both n/a X X X X X X X X

Reacquisition

Addback 108 Qualified restaurant property (true-up till 2050) Use 300 n/a n/a 2009 2012 2050 Add/Subt Both n/a X X X X X X X X

if reporting on 2013

Addback 109 Qualified retail improvement property (true-up till n/a n/a 2009 2012 Add/Subt Both n/a X X X X X X X X

2050)Use 301 if reporting 2013

Addback 110 Qualified Disaster Assistance Property n/a n/a 2009 2015 2050 Add/Subt Both n/a X X X X X X X X

Addback 111 Qualified Refinery property n/a n/a 2009 2015 2053 Add/Subt Both n/a X X X X X X X X

Addback 112 Qualified Film or Television Production n/a n/a 2009 2015 2053 Add/Subt Both n/a X X X X X X X X

Qualified Preferred Stock - limited to $3000 loss per year

after 2015. May no longer be claimed on COR or FIT

beginning tax year 2022. Capital loss carryforwards

Addback 113 are limited to 5 years for corporations. For individuals, n/a n/a 2009 2015 Add/Subt Both n/a X X X

the capital loss carryforward period is unlimited, so there

is a theoretical ability of an non-corporate entity

(individuals and trusts) to claim a negative Code 113

modification.

Addback 114 Charitable Contributions n/a n/a 1963 Add Positive n/a X X X

To be retired:

new codes

Addback 115 Intangible Expenses n/a n/a 2007 established (140 Add Positive n/a X

and 141)

05/22/18

Addback 116 Dividends Paid to Shareholders of a captive REIT n/a n/a Add Positive n/a X

Addback 117 Discharge of debt of a principal residence add-back n/a n/a 2010 2015 Add Positive n/a X X

Addback 118 Exempt insurance income add-back n/a n/a Subtract Positive n/a

1987 or 1988

Addback 119 Foreign Gross-Up n/a n/a became a 3 Subtract Positive n/a X X

digit code

2010