Enlarge image

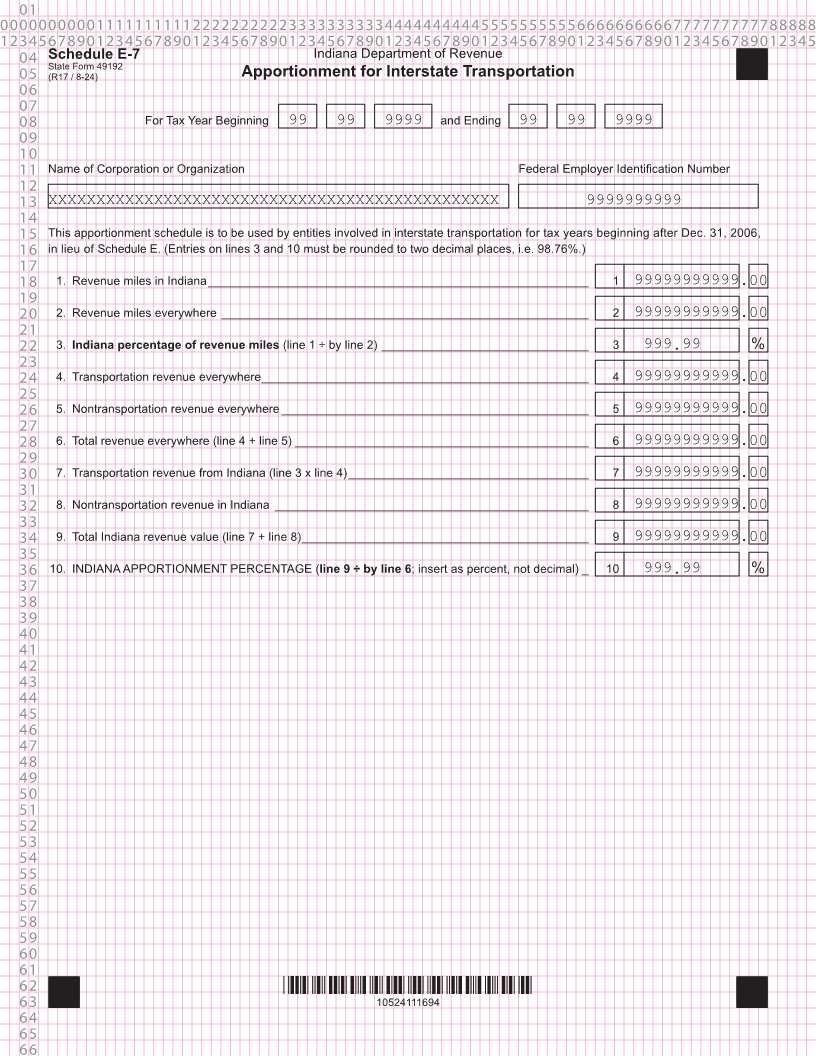

01 0000000000111111111122222222223333333333444444444455555555556666666666777777777788888 1234567890123456789012345678901234567890123456789012345678901234567890123456789012345 04 Schedule E-7 Indiana Department of Revenue State Form 49192 05 (R17 / 8-24) Apportionment for Interstate Transportation 06 07 08 For Tax Year Beginning 99 99 9999 and Ending 99 99 9999 09 10 11 Name of Corporation or Organization Federal Employer Identification Number 12 13 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 9999999999 14 15 This apportionment schedule is to be used by entities involved in interstate transportation for tax years beginning after Dec. 31, 2006, 16 in lieu of Schedule E. (Entries on lines 3 and 10 must be rounded to two decimal places, i.e. 98.76%.) 17 18 1. Revenue miles in Indiana _________________________________________________________ 1 99999999999.00 19 20 2. Revenue miles everywhere _______________________________________________________ 2 99999999999.00 21 22 3. Indiana percentage of revenue miles (line 1 ÷ by line 2) _______________________________ 3 999.99 % 23 24 4. Transportation revenue everywhere _________________________________________________ 4 99999999999.00 25 26 5. Nontransportation revenue everywhere ______________________________________________ 5 99999999999.00 27 28 6. Total revenue everywhere (line 4 + line 5) ____________________________________________ 6 99999999999.00 29 30 7. Transportation revenue from Indiana (line 3 x line 4) ____________________________________ 7 99999999999.00 31 32 8. Nontransportation revenue in Indiana _______________________________________________ 8 99999999999.00 33 34 9. Total Indiana revenue value (line 7 + line 8) ___________________________________________ 9 99999999999.00 35 36 10. INDIANA APPORTIONMENT PERCENTAGE (line 9 ÷ by line 6; insert as percent, not decimal) _ 10 999.99 % 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 *10524111694* 63 10524111694 64 65 66