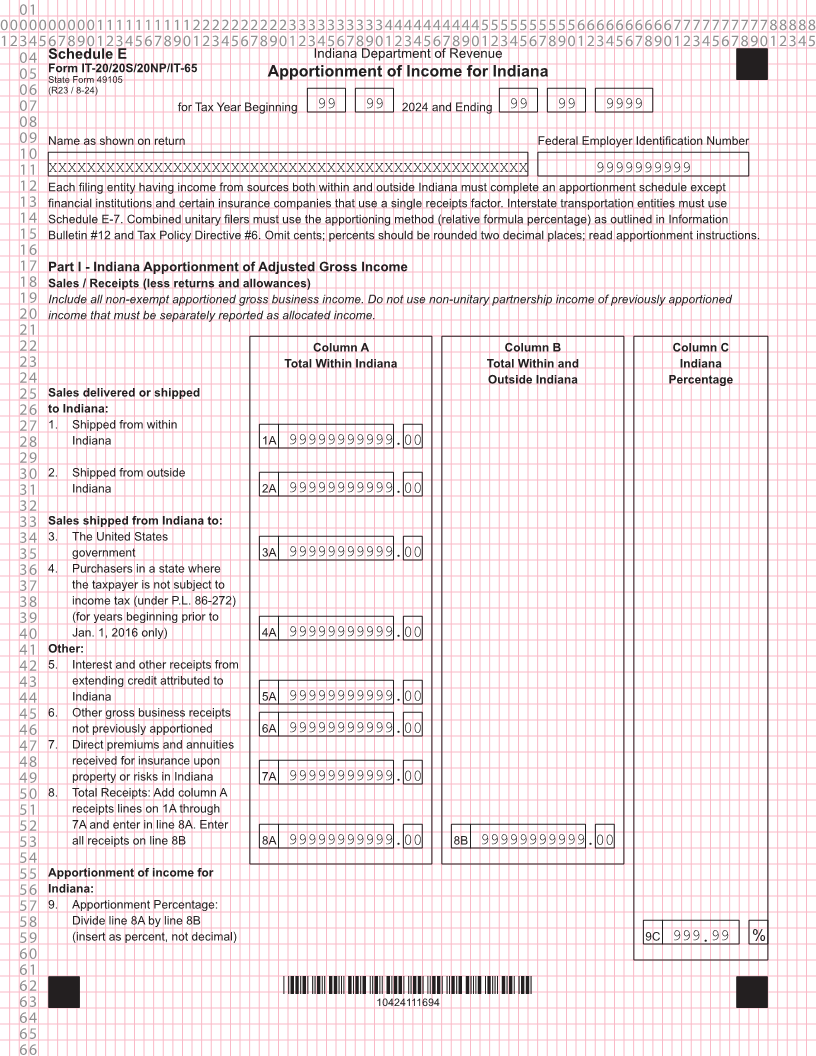

Enlarge image

01 0000000000111111111122222222223333333333444444444455555555556666666666777777777788888 1234567890123456789012345678901234567890123456789012345678901234567890123456789012345 04 Schedule E Indiana Department of Revenue 05 Form IT-20/20S/20NP/IT-65 Apportionment of Income for Indiana State Form 49105 06 (R23 / 8-24) 07 for Tax Year Beginning 99 99 2024 and Ending 99 99 9999 08 09 Name as shown on return Federal Employer Identification Number 10 11 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 9999999999 12 Each filing entity having income from sources both within and outside Indiana must complete an apportionment schedule except 13 financial institutions and certain insurance companies that use a single receipts factor. Interstate transportation entities must use 14 Schedule E-7. Combined unitary filers must use the apportioning method (relative formula percentage) as outlined in Information 15 Bulletin #12 and Tax Policy Directive #6. Omit cents; percents should be rounded two decimal places; read apportionment instructions. 16 17 Part I - Indiana Apportionment of Adjusted Gross Income 18 Sales / Receipts (less returns and allowances) 19 Include all non-exempt apportioned gross business income. Do not use non-unitary partnership income of previously apportioned 20 income that must be separately reported as allocated income. 21 22 Column A Column B Column C 23 Total Within Indiana Total Within and Indiana 24 Outside Indiana Percentage 25 Sales delivered or shipped 26 to Indiana: 27 1. Shipped from within 28 Indiana 1A 99999999999.00 29 30 2. Shipped from outside 31 Indiana 2A 99999999999.00 32 33 Sales shipped from Indiana to: 34 3. The United States 35 government 3A 99999999999.00 36 4. Purchasers in a state where 37 the taxpayer is not subject to 38 income tax (under P.L. 86-272) 39 (for years beginning prior to 40 Jan. 1, 2016 only) 4A 99999999999.00 41 Other: 42 5. Interest and other receipts from 43 extending credit attributed to 44 Indiana 5A 99999999999.00 45 6. Other gross business receipts 46 not previously apportioned 6A 99999999999.00 47 7. Direct premiums and annuities 48 received for insurance upon 49 property or risks in Indiana 7A 99999999999.00 50 8. Total Receipts: Add column A 51 receipts lines on 1A through 52 7A and enter in line 8A. Enter 53 all receipts on line 8B 8A 99999999999.00 8B 99999999999.00 54 55 Apportionment of income for 56 Indiana: 57 9. Apportionment Percentage: 58 Divide line 8A by line 8B 59 (insert as percent, not decimal) 9C 999.99 % 60 61 62 *10424111694* 63 10424111694 64 65 66