Enlarge image

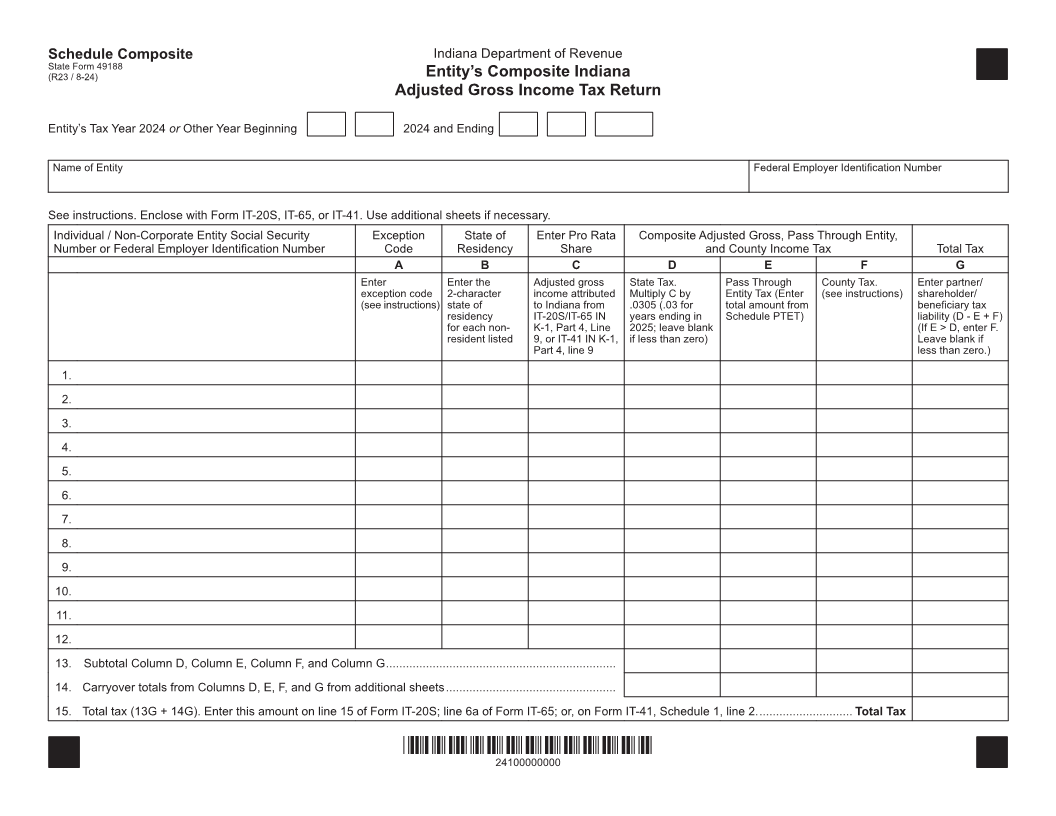

Schedule Composite Indiana Department of Revenue

State Form 49188

(R23 / 8-24) Entity’s Composite Indiana

Adjusted Gross Income Tax Return

Entity’s Tax Year 2024 or Other Year Beginning 2024 and Ending

Name of Entity Federal Employer Identification Number

See instructions. Enclose with Form IT-20S, IT-65, or IT-41. Use additional sheets if necessary.

Individual / Non-Corporate Entity Social Security Exception State of Enter Pro Rata Composite Adjusted Gross, Pass Through Entity,

Number or Federal Employer Identification Number Code Residency Share and County Income Tax Total Tax

A B C D E F G

Enter Enter the Adjusted gross State Tax. Pass Through County Tax. Enter partner/

exception code 2-character income attributed Multiply C by Entity Tax (Enter (see instructions) shareholder/

(see instructions) state of to Indiana from .0305 (.03 for total amount from beneficiary tax

residency IT-20S/IT-65 IN years ending in Schedule PTET) liability (D - E + F)

for each non- K-1, Part 4, Line 2025; leave blank (If E > D, enter F.

resident listed 9, or IT-41 IN K-1, if less than zero) Leave blank if

Part 4, line 9 less than zero.)

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13. Subtotal Column D, Column E, Column F, and Column G .....................................................................

14. Carryover totals from Columns D, E, F, and G from additional sheets ...................................................

15. Total tax (13G + 14G). Enter this amount on line 15 of Form IT-20S; line 6a of Form IT-65; or, on Form IT-41, Schedule 1, line 2. ............................ Total Tax

*24100000000*

24100000000