Enlarge image

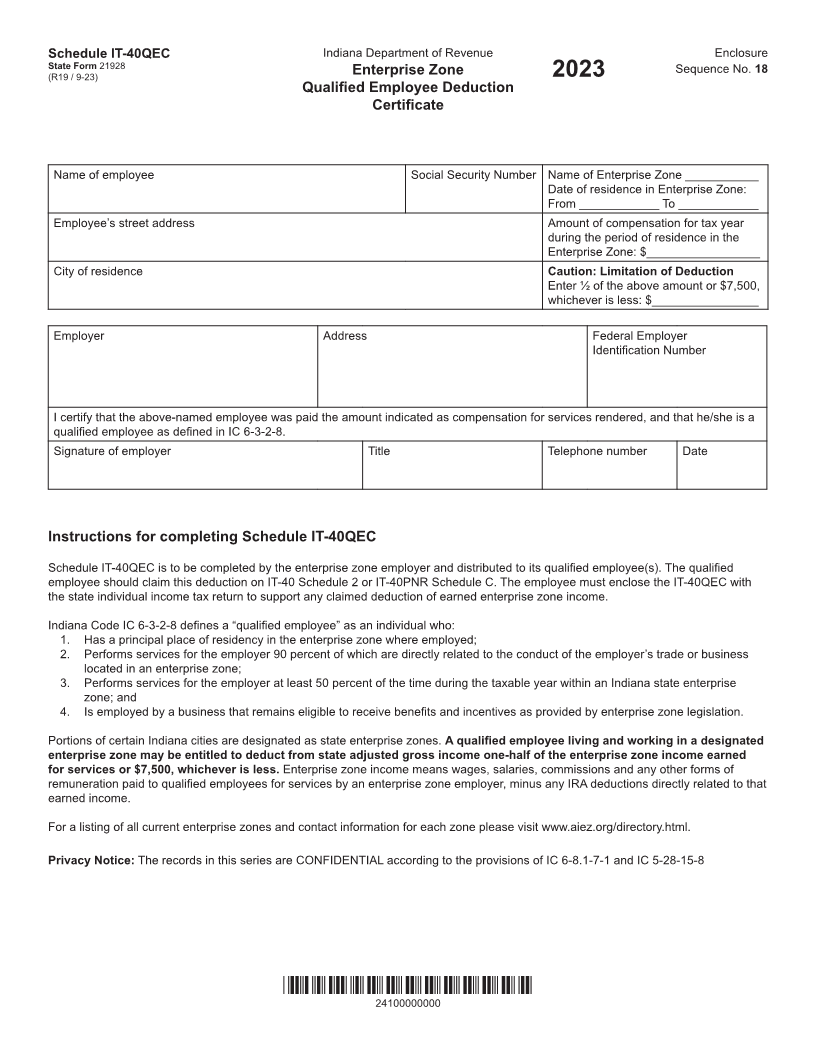

Schedule IT-40QEC Indiana Department of Revenue Enclosure

State Form 21928

(R19 / 9-23) Enterprise Zone Sequence No. 18

2023

Qualified Employee Deduction

Certificate

Name of employee Social Security Number Name of Enterprise Zone ___________

Date of residence in Enterprise Zone:

From ____________ To ____________

Employee’s street address Amount of compensation for tax year

during the period of residence in the

Enterprise Zone: $_________________

City of residence Caution: Limitation of Deduction

Enter ½ of the above amount or $7,500,

whichever is less: $________________

Employer Address Federal Employer

Identification Number

I certify that the above-named employee was paid the amount indicated as compensation for services rendered, and that he/she is a

qualified employee as defined in IC 6-3-2-8.

Signature of employer Title Telephone number Date

Instructions for completing Schedule IT-40QEC

Schedule IT-40QEC is to be completed by the enterprise zone employer and distributed to its qualified employee(s). The qualified

employee should claim this deduction on IT-40 Schedule 2 or IT-40PNR Schedule C. The employee must enclose the IT-40QEC with

the state individual income tax return to support any claimed deduction of earned enterprise zone income.

Indiana Code IC 6-3-2-8 defines a “qualified employee” as an individual who:

1. Has a principal place of residency in the enterprise zone where employed;

2. Performs services for the employer 90 percent of which are directly related to the conduct of the employer’s trade or business

located in an enterprise zone;

3. Performs services for the employer at least 50 percent of the time during the taxable year within an Indiana state enterprise

zone; and

4. Is employed by a business that remains eligible to receive benefits and incentives as provided by enterprise zone legislation.

Portions of certain Indiana cities are designated as state enterprise zones. A qualified employee living and working in a designated

enterprise zone may be entitled to deduct from state adjusted gross income one-half of the enterprise zone income earned

for services or $7,500, whichever is less. Enterprise zone income means wages, salaries, commissions and any other forms of

remuneration paid to qualified employees for services by an enterprise zone employer, minus any IRA deductions directly related to that

earned income.

For a listing of all current enterprise zones and contact information for each zone please visit www.aiez.org/directory.html.

Privacy Notice: The records in this series are CONFIDENTIAL according to the provisions of IC 6-8.1-7-1 and IC 5-28-15-8

*24100000000*

24100000000