Enlarge image

Schedule Enclosure

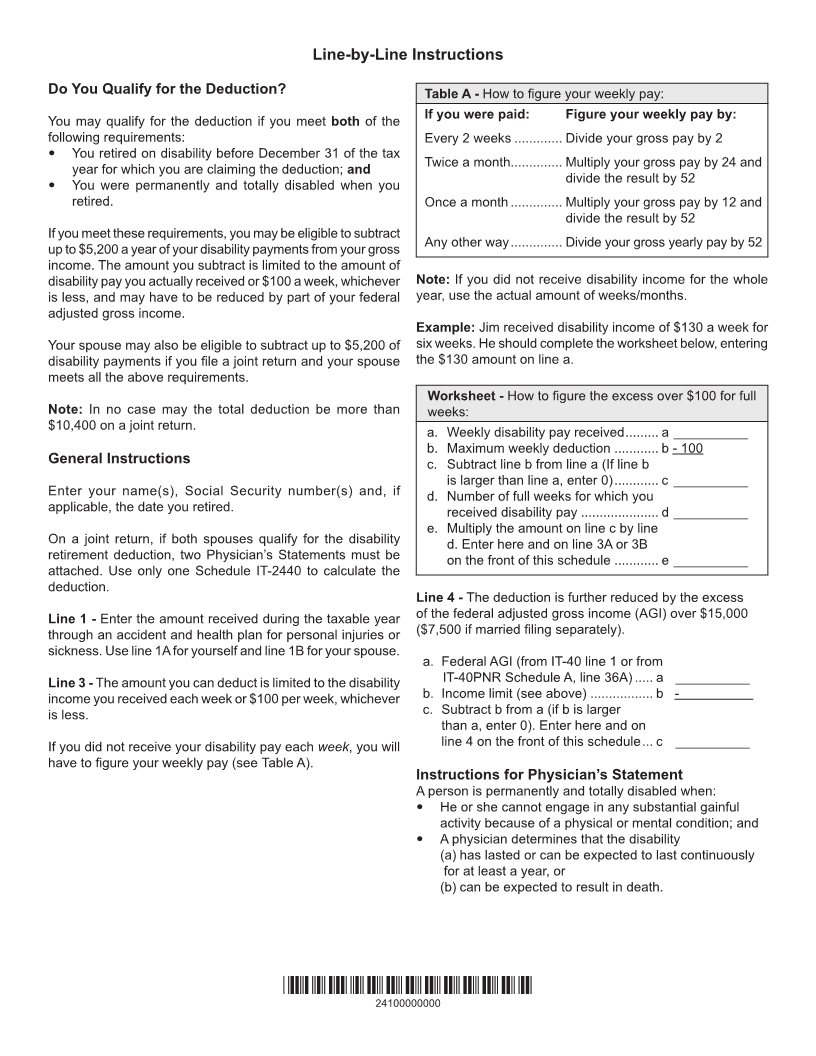

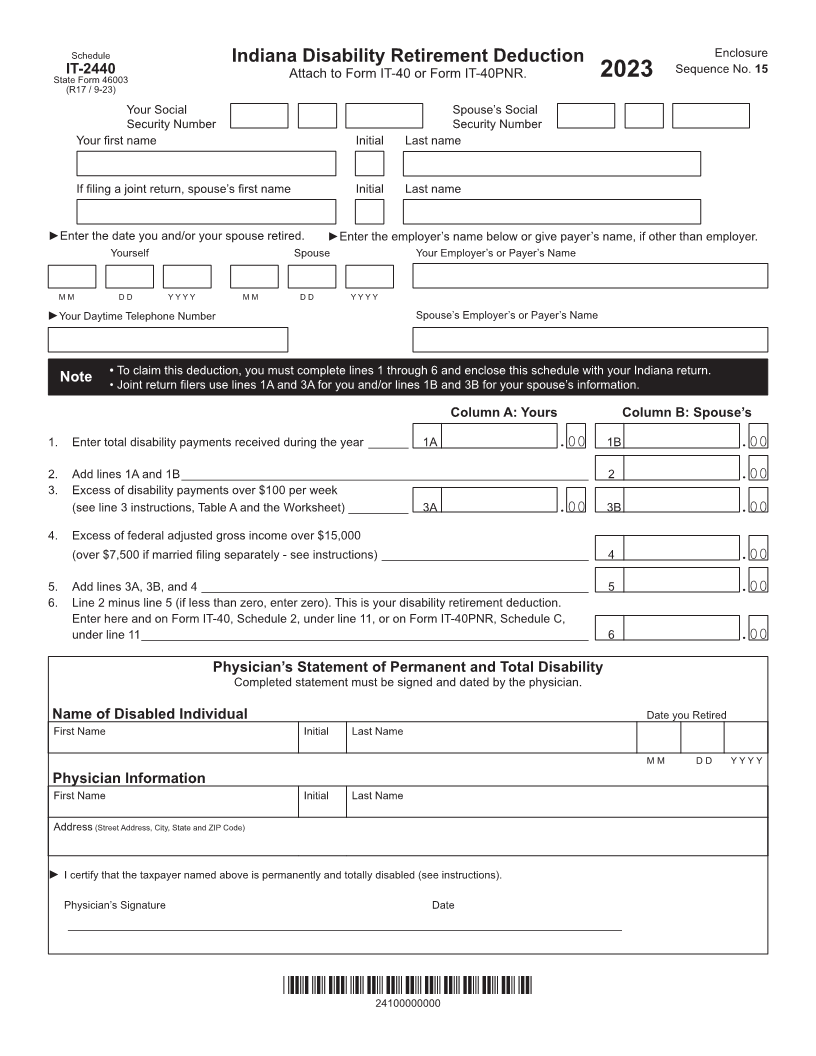

Indiana Disability Retirement Deduction

IT-2440 Attach to Form IT-40 or Form IT-40PNR. Sequence No. 15

State Form 46003 2023

(R17 / 9-23)

Your Social Spouse’s Social

Security Number Security Number

Your first name Initial Last name

If filing a joint return, spouse’s first name Initial Last name

►Enter the date you and/or your spouse retired. ►Enter the employer’s name below or give payer’s name, if other than employer.

Yourself Spouse Your Employer’s or Payer’s Name

M M D D Y Y Y Y M M D D Y Y Y Y

►Your Daytime Telephone Number Spouse’s Employer’s or Payer’s Name

• To claim this deduction, you must complete lines 1 through 6 and enclose this schedule with your Indiana return.

Note • Joint return filers use lines 1A and 3A for you and/or lines 1B and 3B for your spouse’s information.

Column A: Yours Column B: Spouse’s

1. Enter total disability payments received during the year ______ 1A .00 1B .00

2. Add lines 1A and 1B _____________________________________________________________ 2 .00

3. Excess of disability payments over $100 per week

(see line 3 instructions, Table A and the Worksheet) _________ 3A .00 3B .00

4. Excess of federal adjusted gross income over $15,000

(over $7,500 if married filing separately - see instructions) _______________________________ 4 .00

5. Add lines 3A, 3B, and 4 __________________________________________________________ 5 .00

6. Line 2 minus line 5 (if less than zero, enter zero). This is your disability retirement deduction.

Enter here and on Form IT-40, Schedule 2, under line 11, or on Form IT-40PNR, Schedule C,

under line 11 ___________________________________________________________________ 6 .00

Physician’s Statement of Permanent and Total Disability

Completed statement must be signed and dated by the physician.

Name of Disabled Individual Date you Retired

First Name Initial Last Name

M M D D Y Y Y Y

Physician Information

First Name Initial Last Name

Address (Street Address, City, State and ZIP Code)

► I certify that the taxpayer named above is permanently and totally disabled (see instructions).

Physician’s Signature Date

___________________________________________________________________________________

*24100000000*

24100000000