Enlarge image

01

0000000000111111111122222222223333333333444444444455555555556666666666777777777788888

1234567890123456789012345678901234567890123456789012345678901234567890123456789012345

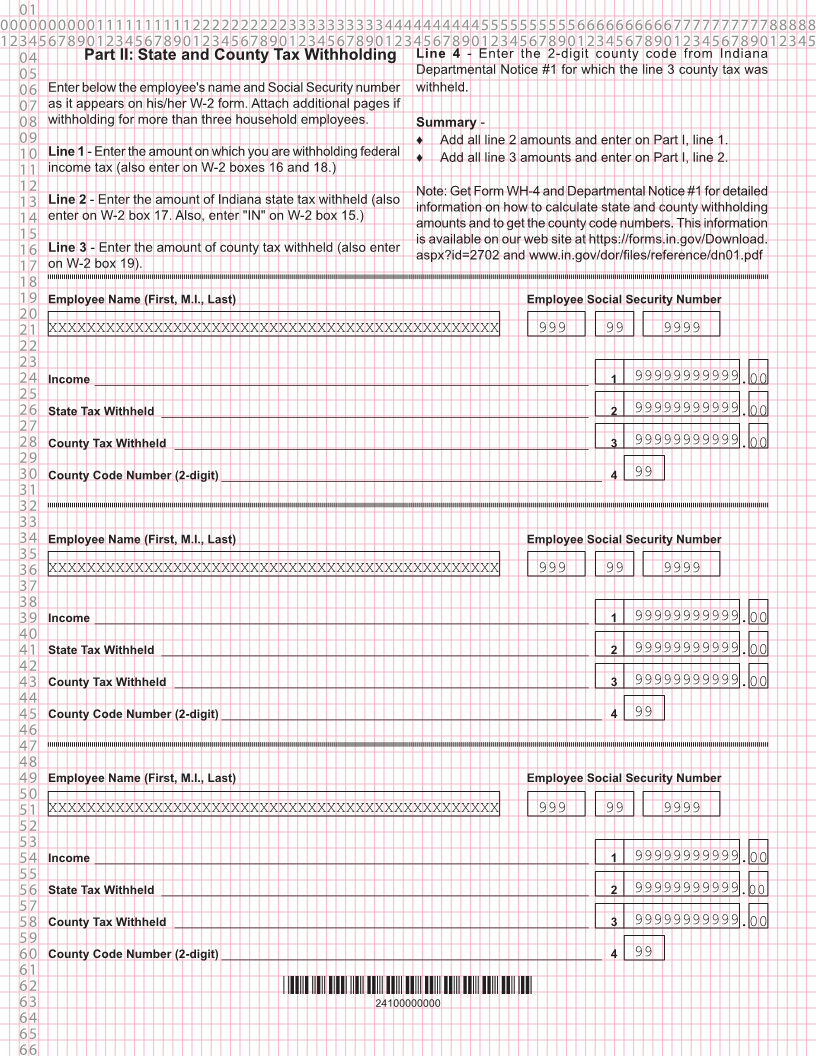

04 Schedule IN-H Indiana Household Employment Taxes Enclosure

State Form 48684

05 (R17 / 9-23) Attach to Form IT-40 or Form IT-40PNR. Sequence No. 12

06 2023

07

08 This schedule should be filed by an individual who:

09 • withholds state and county (if applicable) tax on household employees, AND

10 • pays those withholding taxes with the filing of his/her individual income tax return.

11

12 Name of employer (as shown on individual income tax return) Employer Social Security Number

13

14 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 999 99 9999

15

16 Federal Employer Identification Number

17 A Did you file federal Schedule H for the tax year shown above?

18 99 9999999

19 X Yes. Go to question B.

20

21 X No. Stop. Do not file this schedule.

22

23 B Did you withhold state and/or county income tax for any household employee?

24

25 X Yes. Complete Part II on the back of this schedule.

26

27 X No. Stop. Do not file this schedule.

28

29 C Make sure you enclose the state copy of your employee's W-2 forms.

30

31

Complete Part II (on page 2) first. Carry those totals to the Part I Summary below.

32

33

34 Part 1: Summary of Household Employment Taxes

35

36 1. Enter the total State Tax withheld from Part II, line 2 __________________________ 1 99999999999.00

37

38 2. Enter the total County Tax withheld from Part II, line 3 ________________________ 2 99999999999.00

39

40 3. Add lines 1 and 2. Enter the total here _____________________________________ 3 99999999999.00

41 Enter this amount on your Indiana individual income tax return on the following lines:

42 • Form IT-40 Schedule 4, line 2,

43 • Form IT-40PNR Schedule E, line 2.

44

45

46 Under penalties of perjury, I declare that I have examined this schedule, including accompanying statements and W-2 forms,

47 and to the best of my knowledge and belief it is true, correct and complete.

48

49

50

___________________________________ ______________________ ___________

51 Employer's signature Daytime telephone number Date

52

53

54

55

56

57

58

59

60

61

62 *24100000000*

63 24100000000

64

65

66