Enlarge image

01

00000000001111111111222222222233333333334444444444555555555566666666667777777777888888888899999999990000000000

12345678901234567890123456789012345678901234567890123456789012345678901234567890123456789012345678901234567890

Enclosure

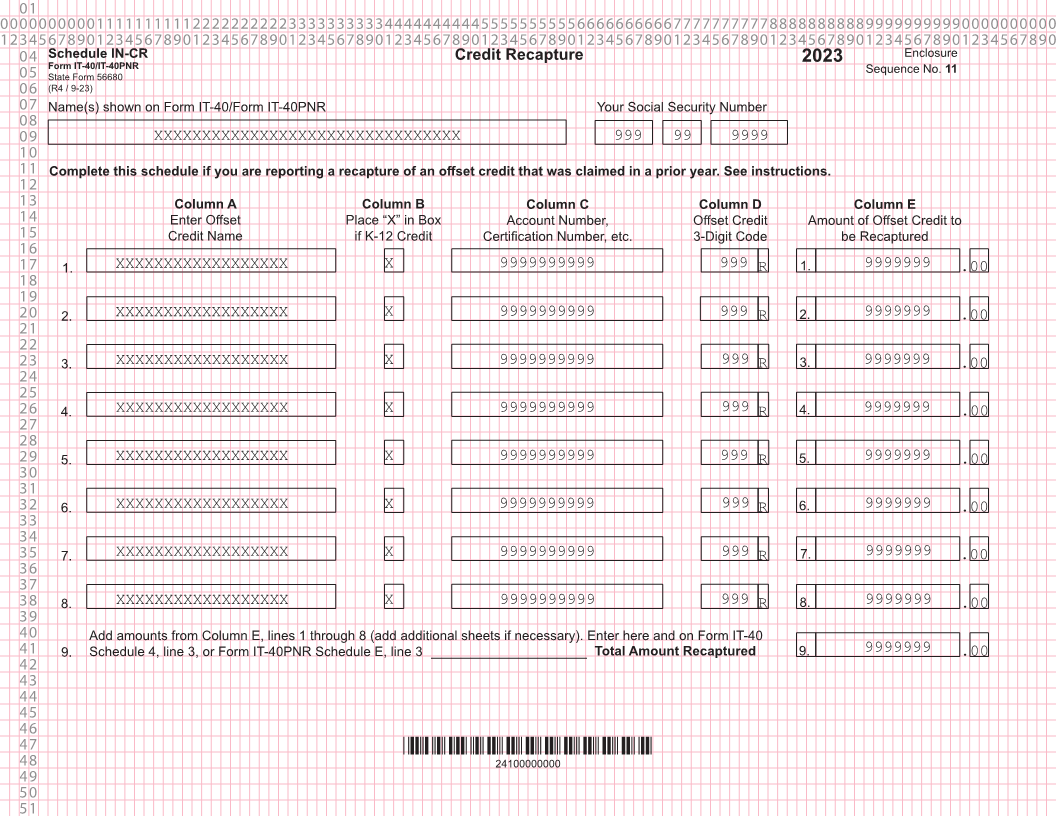

04 Schedule IN-CR Credit Recapture 2023

Form IT-40/IT-40PNR

05 State Form 56680 Sequence No. 11

06 (R4 / 9-23)

07 Name(s) shown on Form IT-40/Form IT-40PNR Your Social Security Number

08

09 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 999 99 9999

10

11 Complete this schedule if you are reporting a recapture of an offset credit that was claimed in a prior year. See instructions.

12

13 Column A Column B Column C Column D Column E

14 Enter Offset Place “X” in Box Account Number, Offset Credit Amount of Offset Credit to

15 Credit Name if K-12 Credit Certification Number, etc. 3-Digit Code be Recaptured

16

17 1. XXXXXXXXXXXXXXXXXX X 9999999999 999 R 1. 9999999 .00

18

19

20 2. XXXXXXXXXXXXXXXXXX X 9999999999 999 R 2. 9999999 .00

21

22

23 3. XXXXXXXXXXXXXXXXXX X 9999999999 999 R 3. 9999999 .00

24

25

26 4. XXXXXXXXXXXXXXXXXX X 9999999999 999 R 4. 9999999 .00

27

28

29 5. XXXXXXXXXXXXXXXXXX X 9999999999 999 R 5. 9999999 .00

30

31

32 6. XXXXXXXXXXXXXXXXXX X 9999999999 999 R 6. 9999999 .00

33

34

35 7. XXXXXXXXXXXXXXXXXX X 9999999999 999 R 7. 9999999 .00

36

37

38 8. XXXXXXXXXXXXXXXXXX X 9999999999 999 R 8. 9999999 .00

39

40 Add amounts from Column E, lines 1 through 8 (add additional sheets if necessary). Enter here and on Form IT-40

41 9. Schedule 4, line 3, or Form IT-40PNR Schedule E, line 3 _____________________ Total Amount Recaptured 9. 9999999 .00

42

43

44

45

46

47 *24100000000*

48 24100000000

49

50

51