Enlarge image

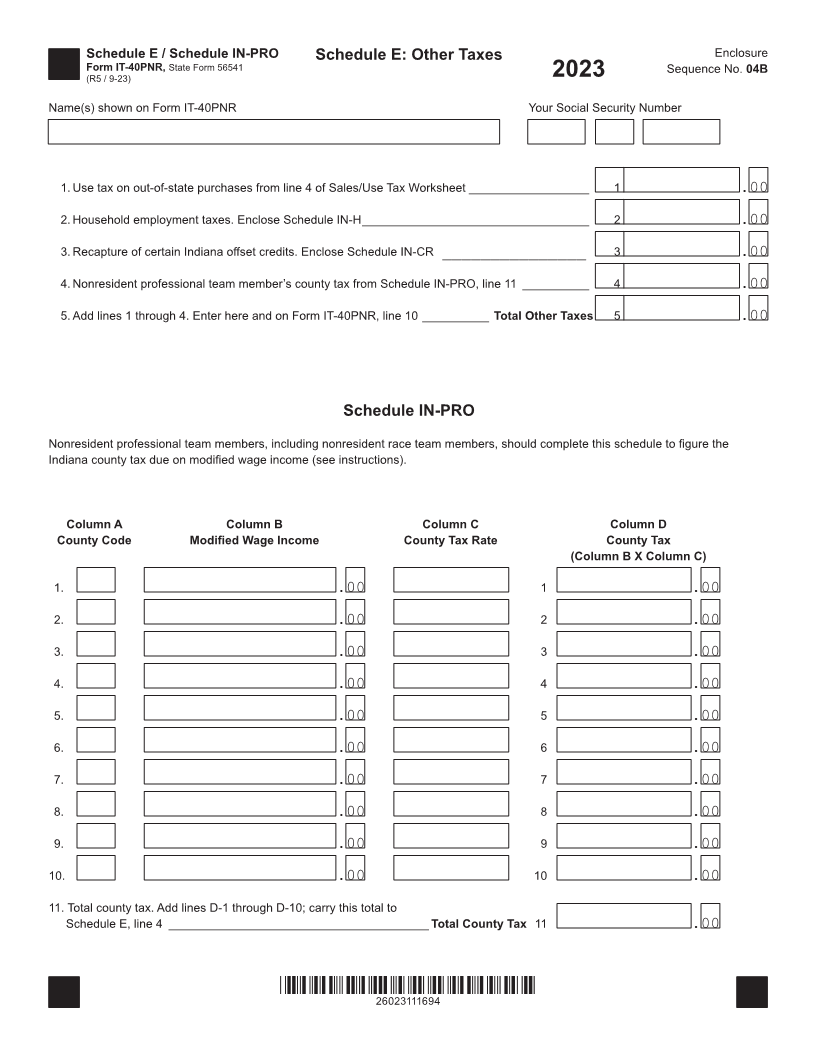

Schedule E / Schedule IN-PRO Schedule E: Other Taxes Enclosure

Form IT-40PNR, State Form 56541 Sequence No. 04B

(R5 / 9-23) 2023

Name(s) shown on Form IT-40PNR Your Social Security Number

1. Use tax on out-of-state purchases from line 4 of Sales/Use Tax Worksheet __________________ 1 .00

2. Household employment taxes. Enclose Schedule IN-H __________________________________ 2 .00

3. Recapture of certain Indiana offset credits. Enclose Schedule IN-CR _______________ 3 .00

4. Nonresident professional team member’s county tax from Schedule IN-PRO, line 11 __________ 4 .00

5. Add lines 1 through 4. Enter here and on Form IT-40PNR, line 10 __________ Total Other Taxes 5 .00

Schedule IN-PRO

Nonresident professional team members, including nonresident race team members, should complete this schedule to figure the

Indiana county tax due on modified wage income (see instructions).

Column A Column B Column C Column D

County Code Modified Wage Income County Tax Rate County Tax

(Column B X Column C)

1. .00 1 .00

2. .00 2 .00

3. .00 3 .00

4. .00 4 .00

5. .00 5 .00

6. .00 6 .00

7. .00 7 .00

8. .00 8 .00

9. .00 9 .00

10. .00 10 .00

11. Total county tax. Add lines D-1 through D-10; carry this total to

Schedule E, line 4 _______________________________________ Total County Tax 11 .00

*26023111694*

26023111694