Enlarge image

01

0000000000111111111122222222223333333333444444444455555555556666666666777777777788888

1234567890123456789012345678901234567890123456789012345678901234567890123456789012345

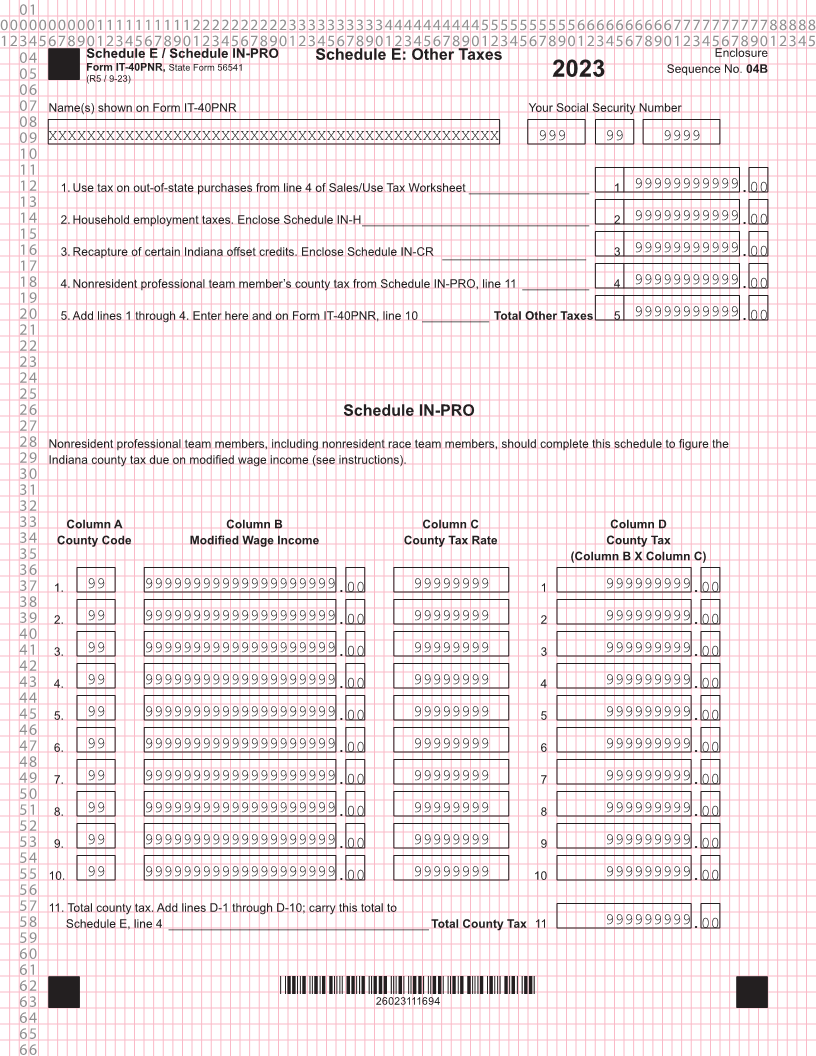

04 Schedule E / Schedule IN-PRO Schedule E: Other Taxes Enclosure

05 Form IT-40PNR, State Form 56541 Sequence No. 04B

(R5 / 9-23) 2023

06

07 Name(s) shown on Form IT-40PNR Your Social Security Number

08

09 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 999 99 9999

10

11

12 1. Use tax on out-of-state purchases from line 4 of Sales/Use Tax Worksheet __________________ 1 99999999999.00

13

14 2. Household employment taxes. Enclose Schedule IN-H __________________________________ 2 99999999999.00

15

16 3. Recapture of certain Indiana offset credits. Enclose Schedule IN-CR _______________ 3 99999999999.00

17

18 4. Nonresident professional team member’s county tax from Schedule IN-PRO, line 11 __________ 4 99999999999.00

19

20 5. Add lines 1 through 4. Enter here and on Form IT-40PNR, line 10 __________ Total Other Taxes 5 99999999999.00

21

22

23

24

25

26 Schedule IN-PRO

27

28 Nonresident professional team members, including nonresident race team members, should complete this schedule to figure the

29 Indiana county tax due on modified wage income (see instructions).

30

31

32

33 Column A Column B Column C Column D

34 County Code Modified Wage Income County Tax Rate County Tax

35 (Column B X Column C)

36

37 1. 99 99999999999999999999 .00 99999999 1 999999999.00

38

39 2. 99 99999999999999999999 .00 99999999 2 999999999.00

40

41 3. 99 99999999999999999999 .00 99999999 3 999999999.00

42

43 4. 99 99999999999999999999 .00 99999999 4 999999999.00

44

45 5. 99 99999999999999999999 .00 99999999 5 999999999.00

46

47 6. 99 99999999999999999999 .00 99999999 6 999999999.00

48

49 7. 99 99999999999999999999 .00 99999999 7 999999999.00

50

51 8. 99 99999999999999999999 .00 99999999 8 999999999.00

52

53 9. 99 99999999999999999999 .00 99999999 9 999999999.00

54

55 10. 99 99999999999999999999 .00 99999999 10 999999999.00

56

57 11. Total county tax. Add lines D-1 through D-10; carry this total to

58 Schedule E, line 4 _______________________________________ Total County Tax 11 999999999.00

59

60

61

62 *26023111694*

63 26023111694

64

65

66