Enlarge image

01

0000000000111111111122222222223333333333444444444455555555556666666666777777777788888

1234567890123456789012345678901234567890123456789012345678901234567890123456789012345

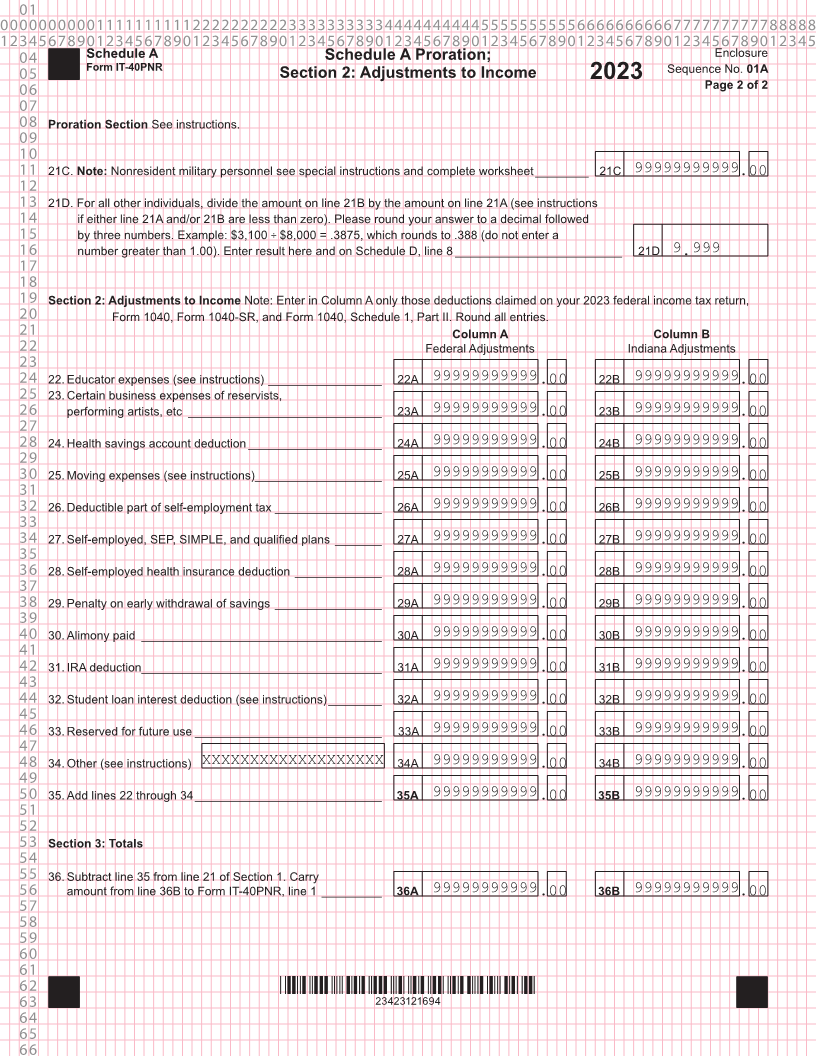

04 Schedule A Schedule A Section 1: Income or Loss Enclosure

Form IT-40PNR (Complete Proration, Section 2 and Section 3 on back) Sequence No.

05 State Form 48719 01

06 (R22 / 9-23) 2023 Page 1 of 2

07 Name(s) shown on Form IT-40PNR Your Social Security Number

08

09 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 999 99 9999

10

Section 1: Income or (Loss) Enter in Column A the same income or loss you reported on your 2023 federal income tax return, Form

11

1040, Form 1040-SR, and Form 1040 Schedule 1 (except for line 19B and/or a net operating loss carryforward on line 20B; see

12 instructions). Round all entries.

13 Column A Column B

14 Income from Federal Return Income Taxed by Indiana

15

16 1. Your wages, salaries, tips, commissions, etc _____________ 1A 99999999999.00 1B 99999999999.00

17

18 2. Spouse’s wages, salaries, tips, commissions, etc _________ 2A 99999999999.00 2B 99999999999.00

19

20 3. Taxable interest income _____________________________ 3A 99999999999.00 3B 99999999999.00

21

22 4. Dividend income __________________________________ 4A 99999999999.00 4B 99999999999.00

23 5. Taxable refunds, credits, or offsets of state

24 and local taxes from your federal return ________________ 5A 99999999999.00 5B 99999999999.00

25

26 6. Alimony received __________________________________ 6A 99999999999.00 6B 99999999999.00

27

28 7. Business income or loss from federal Schedule C ________ 7A 99999999999.00 7B 99999999999.00

29 8. Capital gain or loss from sale or exchange

30 of property from your federal return ____________________ 8A 99999999999.00 8B 99999999999.00

31

32 9. Other gains or (losses) from Form 4797 ________________ 9A 99999999999.00 9B 99999999999.00

33

34 10. Taxable IRA distribution _____________________________ 10A 99999999999.00 10B 99999999999.00

35

36 11. Taxable pensions and annuities _______________________ 11A 99999999999 .00 11B 99999999999.00

37 12. Net rent or royalty income or loss reported on

38 federal Schedule E ________________________________ 12A 99999999999.00 12B 99999999999.00

39

40 13. Income or loss from partnerships _____________________ 13A 99999999999.00 13B 99999999999.00

41

42 14. Income or loss from trusts and estates _________________ 14A 99999999999.00 14B 99999999999.00

43

44 15. Income or loss from S corporations ____________________ 15A 99999999999.00 15B 99999999999.00

45

46 16. Farm income or loss from federal Schedule F ____________ 16A 99999999999.00 16B 99999999999.00

47

48 17. Unemployment compensation ________________________ 17A 99999999999.00 17B 99999999999.00

49

50 18. Taxable Social Security benefits _______________________ 18A 99999999999. 00 18B 99999999999.00

51 19. Indiana apportioned income from

52 Schedule IT-40PNRA ___________________________________________________________ 19B 99999999999.00

53

54 20. Other income reported on your federal return ____________ 20A 99999999999.00 20B 99999999999.00

55 List source(s). (Do not include federal net operating loss in Column B. See instructions.)

56

57 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

58

59 21. Subtotal: add lines 1 through 20 _______________________ 21A 99999999999 .00 21B 99999999999.00

60

61

62 *23423111694*

63 23423111694

64

65

66